On April 2, 2020, Luckin Coffee (Ruixin Kaffei瑞幸咖啡) confirmed that its sales numbers were inflated by a total of CNY 2.2 billion (USD 310 million) in 2019. This number represents approximately 45% of its projected final sales.

Suspicions of fraud had already been hanging around for several months after the investment firm Muddy Waters released a report based on 11,260 hours of store traffic video. The report highlights Luckin coffee’s fraud by cross-checking actual orders and customers, and the company’s bottom line.

Source: Luckin Coffee stock price, Luckin’s stock plummeted from $50 to $3.82

As a result, Luckin Coffee stock price plummeted from USD 50 to less than USD 2 in a matter of months. But does this may not mean the end of Luckin. With such a low stock price and a high tech eco-system, there is a possibility to extend the rein of Luckin. Hence, we speculate who could buy the company that once was capturing Starbuck’s share on the coffee market in China?

The fantastic story of an internet company selling coffee

Luckin Coffee is an internet company. Coffee is the product sold by this company which operates more like other Chinese tech startups than a coffee shop. Indeed, Luckin Coffee digitalized and standardized the operation of an offline retail business.

Concretely, Luckin coffee users order through an application and pickup in store, a vast contrast from the large, cushy relaxation areas of its competitor Starbucks. Luckin coffee’s business model is based on new retail in China. This means that the online shopping experience of buying a coffee is supplemented by offline actions of going into a store and being served by a real employee.

Source: Luckin app, Forbes, Luckin Coffee’s business model embodies new retail in China through on app orders needed to be offline picked up

What else defines Luckin coffee as an internet company is the classic cash-burning process to quickly acquire users and scale-up. This method enabled Luckin Coffee to raise the right amount of money to promptly establish thousands of stores across China before going public by a USD 640 million IPO in May 2019 on the Nasdaq. Another interesting finding is that the company’s IPO documents insist on Luckin Coffee’s new retail business model, rather than on its F&B products.

Following the IPO, the company quickly raised USD 1.1 billion in January 2020. The same month, the company made the headlines by becoming the first coffee chain in China. Thanks to its highly praised business model, the company now exceeds the number of Starbucks stores, with more than 6,500 locations.

But the story was too good to be true. Right after the IPO, the company is reported having fabricated financial and operating numbers.

Luckin Coffee’s fraud highlights a fundamentally broken business

On January 31, 2020, short-seller Muddy Waters published an 89-pages anonymous report, claiming that the company had falsified financial and operational figures. Not only claiming that, the report says Luckin Coffee “was a fundamentally broken business that was attempting to instill the culture of drinking coffee into Chinese consumers.”

The report says the number of items sold per store per day was inflated by at least 69% in 2019 3Q and 88% in 2019 4Q. According to the writers, they employed 92 full-time and 1,418 part-time staff to record traffic in 620 Luckin Coffee stores. The data accumulation is impressive, with the collection of thousands of receipts, as displayed below.

Source: Muddy Waters’ anonymous report

Faking in-store order numbers

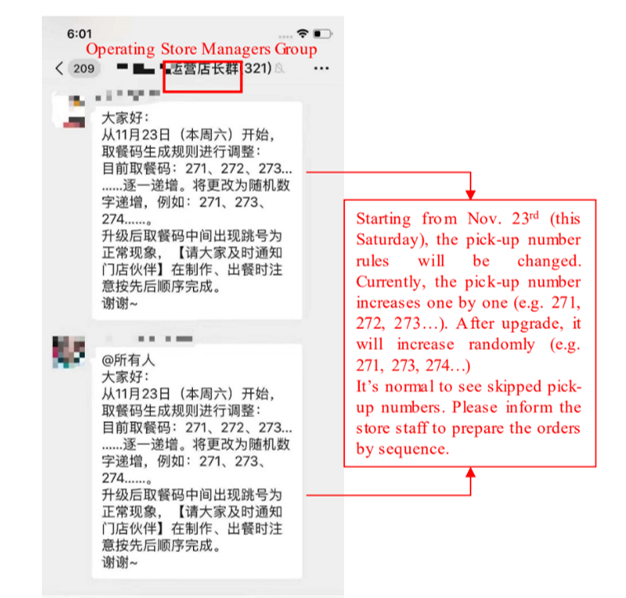

According to the investigation document, Luckin coffee’s fraud would likely have started occurring around November 23, 2019, when the company started to inflate its own app online order volume.

As all orders are placed online and retrieved from the store, a sequential order number appears on the receipt (such as when ordering at McDonald’s). Therefore, paying attention to these numbers could give a clear idea of how many orders have been placed per day for a specific store.

However, this method cannot be used if Luckin intentionally jumps and skips numbers during the day to purposely distort the tracking results. This is exactly what happened, as evidenced by this screenshot in the report.

Source: Muddy Waters’ anonymous report, Wechat screenshot evidences the inflation of Luckin Coffee’s order volume as one of the methods to manipulate operation figures

Shortly after the revelations of the report, Luckin published a press release to deny the allegations. The company evoked the strength of its business model, combined with the booming coffee market in China: “Luckin Coffee firmly stands by its business model and is confident in benefiting from the strong growth of China’s coffee market in the future.”

The fact that Luckin Coffee’s stock price didn’t drop after the publication of the report, until Luckin’s own internal audit, shows strong trust from the investors in the company’s business model.

But was the magic business model of Luckin Coffee enough to prove that the business could ever reach profitability?

Were Chinese people even ready to drink more coffee?

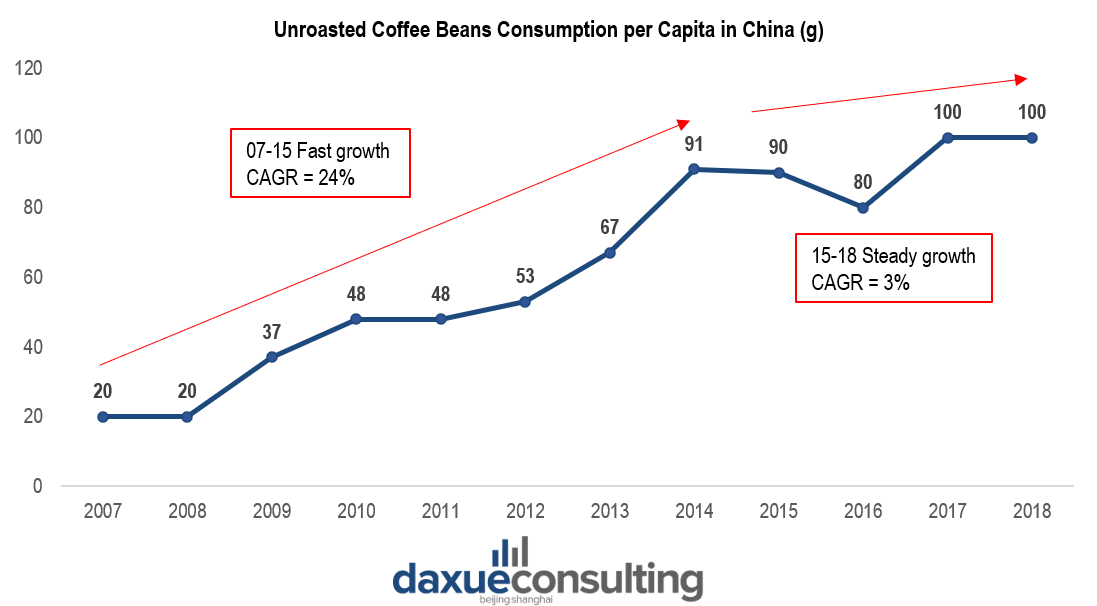

Data from the International Coffee Organization (ICO) show that the coffee market in China experienced strong growth between 2007 and 2015. But for the past few years, growth has stalled, especially since the players which target the core functional coffee demand are well established and more numerous (Starbucks, Costa Coffee, McCafé).

Source: International Coffee Organization (ICO) 2018, Unroasted coffee beans consumption in China

Coffee consumption is driven by culture rather than economic development

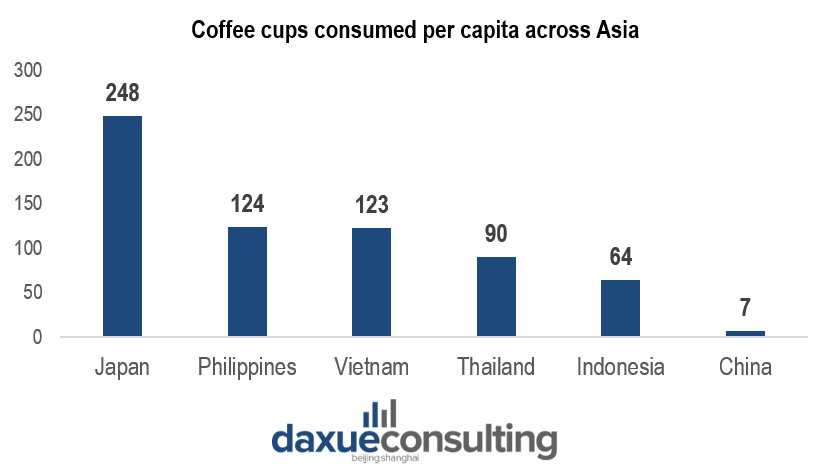

Increasing disposable income does not mean that their small consumption of coffee will explode overnight. Obviously, the coffee market in China was a boon for those who managed to capture the emerging demand in the 2010s (Hello Starbucks). In fact, the global coffee consumption comparison across countries indicates that coffee consumption per capita level is primarily driven by culture rather than economic development.

Indeed, China’s coffee bean consumption per capita is not only significantly behind developed countries such as Japan but also way lower than developing countries such as Vietnam.

More Westernized developing countries such as Vietnam (a former colony of France) and the Philippines (a former colony of Spain and the US) have high coffee consumptions. By contrast, in countries with strong tea cultures, such as China, India, and Sri Lanka, coffee consumptions are low.

Therefore, it’s no wonder that Luckin Coffee burned billions of investors’ dollars without meeting the expected success.

Source: International Coffee Organization (ICO) 2018, Per-capita Coffee cups consumed across Asia

Time for a Business turnaround in China

Even if Chinese people only consume 7 coffee cups per year, they do like coffee. Luckin coffee’s scandal does not contradict this. Rather, it highlights the fact that burning billions won’t make people drink coffee even faster. However, if Chinese people won’t drink more coffee, they will drink more tea.

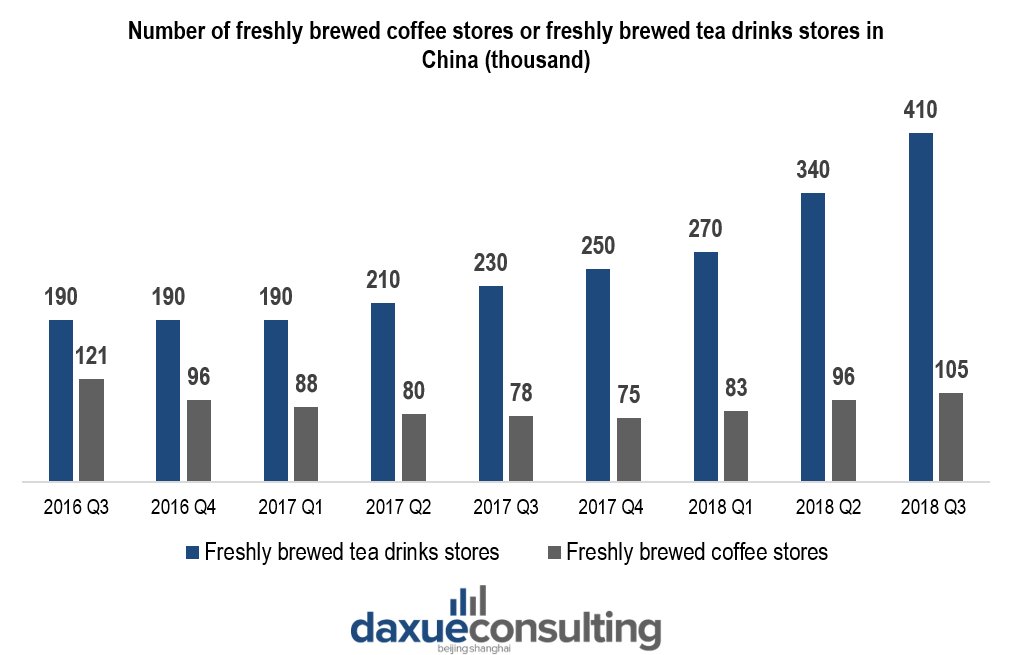

While the number of tea stores demonstrated a continuous growth trend, the number of freshly brewed coffee stores declined from 121,000 stores in 2016 to 105,000 stores in 2018. Hence, the coffee supply network coverage is not the issue. There is just not enough demand yet.

Data source: Meituan, 2019 Chinese Beverage Industry’s Development Trend Report, The growing number of tea stores highlight the strong growth of the tea market in China

Following these observations, Luckin Coffee did try a business turnaround by starting a new type of product called Luckin Tea in May 2019. But business turnaround in China requires more than starting a new range of products.

Daxue Consulting’s China business turnaround expertise

In order to help a client build its business turnaround in China, Daxue Consulting developed a four-step plan, beginning with an audit of the situation. It consists of identifying where the brand had potential improvement and re-orientation needs. It includes distribution screening (data-collection through Store-Checks in China), brand image, and positioning in its competitive frame (through Benchmark). The following steps include consumer research, marketing activation portfolio, and monitoring plan.

It turns out this article briefly tackles step 1 of daxue’s business turnaround consulting service in China. We identified where Luckin has potential improvement – in tea – but we still need to assess its tea competitive frame.

Could Luckin Coffee’s future be with tea products?

Tea is an entirely different market from coffee. Nowadays, the tea market in China is made up of ‘new style tea 新式茶饮’ which is made of fresh tea leaves and concentrated liquid, such as milk or cream. It also includes topping like jellies, tapioca pearls, and fruit. Hence, while demand is not the limiting factor for the tea market in China, the main challenges lie in supply chain management and in-store production.

Source: Daxue Consulting report, The Tea Market in China

Could Luckin Coffee’s future be with Luckin Tea?

Part of a more aggressive turnaround strategy, Luckin Tea was separated from Luckin Coffee as an independently operated brand in September 2019. However, Luckin Tea in-store production and supply chain management is designed for Coffee products, which are fundamentally different from the new-style tea products.

In a China Paradigm podcast interview, Martin Papp, co-founder of PAPP’S TEA told Daxue Consulting young Chinese are going to Starbucks because they can’t find a tea location that fits their lifestyle. They want a more modern, fashionable, and cool tea brand. And while Luckin Coffee and its spin-off brand Luckin Tea are focusing on digital and financial engineering, HEYTEA appears to be focusing on thrilling their customers via its product development.

This new-style tea brand has lines out of doors in China and proven demand for their fresh flavored elaborated teas. While Luckin Tea products are basically made of blended NFC juice, frozen fruits, and artificial pigment, HEYTEA’s products have an uneven texture with distinct layers of tea, fruits, and hand-made cheese milk topping.

Source: Luckin Coffee, HEYTEA, could Luckin Coffee’s future be with Luckin Tea?

HEYTEA also has extensive capabilities in continually refreshing the menu with new product introduction. It is something quite far from Luckin Tea, whose in-store standardization process leaves little room for product customization.

Could Luckin Coffee’s future be with HEYTEA?

Let’s summarize. Luckin Coffee grew up like a tech company using investors’ money to open more than 6,000 outlets – more than Starbucks – without ever reaching profitability. The company has been accused of faking its financial and operational figures, which turned out to be true. As a result, Luckin Coffee’s stock price plunged and will soon be delisted from the NASDAQ stock exchange. In a last attempt, Luckin Coffee created Luckin Tea, which turns out to be no more than a desperate move to capture new-style tea lovers with a tea that cannot fall in this category of products.

On the other hand, HEYTEA is thrilling Chinese customers. The brand is growing based on its traffic, not investor capital, just like Starbucks did in China. The brand has 400 stores, regularly taken by storm by tea lovers. In fact, HEYTEA is Starbucks’ most interesting competitor now. Simply because we saw that it has a tailwind that neither Starbucks nor Luckin Coffee has – a significant, proven and enthusiastic demand.

Should HEYTEA buy Luckin Coffee?

Moreover, HEYTEA is recently moving into coffee. They quickly adopted a Chinese new-retail business model as Luckin did, merging pickup stores and their ordering app called “HEYTEA GO.” The brand is now growing on Luckin Coffe’s field, which previously tried to grow on HEYTEA’s one. The strong difference between the two is that HEYTEA succeeded in its ‘home’ market while Luckin Coffee is slowly dying on its.

Source: EqualOcean, HEYTEA GO pickup stores, could Luckin Coffe’s future be with HEYTEA?

Then the question comes naturally: Should HEYTEA buy Luckin Coffee?

HEYTEA is already doing great at creating popular products that thrill Chinese consumers. But unlike Starbucks, it still doesn’t have a quality footprint of good locations across China. Therefore, according to Jeff Towson, “The next logical move is for HEYTEA is to find a partner to scale up on the real estate aspects.”

Could the tea brand buy Luckin? It could. It could get HEYTEA +6,000 locations in a snap. However, according to Mike Vinkenborg, project leader at Daxue Consulting: “Part of HEYTEA’s mystery is their lines. If the brand becomes too mass, it may lose its level of mystery.”

Still, we could easily imagine HEYTEA buying Luckin Coffee. The new-style tea brand could use it as a strong asset to develop its coffee branch by only selecting a few thousand premium quality Luckin Coffee stores to further threaten its biggest rival, Starbucks.

If Luckin Coffee’s future is uncertain, HEYTEA could be interested in buying the broken business. If not, possibilities are endless for other hot drink businesses to take over the brand. And if not again, let’s see if Luckin Coffee’s business turnaround in China can strengthen its capabilities to turn off rumors of bankruptcy.

Author: Maxime Bennehard

Curious to learn more about China’s tea market?

Check out our official report on the tea market in China!