In 2020, perfumes in China generated RMB 15.6 billion in revenue. Nonetheless, in the last three years, China’s perfume market increased drastically, generating RMB 26.5 billion in revenues in 2024. While luxury brands like Chanel, Hermès, and Dior, continue to dominate the industry, a new wave of niche and local fragrance brands is reshaping consumer preferences. This shift is largely driven by Gen-Z, who unlike previous generations, seek deeper emotional connections, personalization, and cultural relevance.

The diminishing social stigma of perfumes in China

In the past, Chinese people preferred no odor over using perfumes, especially in public spaces. Wearing perfume could be considered disrespectful because some people might dislike the smell or experience headaches. It was also considered harmful for pregnant women and those with allergies. In some cases, wearing perfume was also perceived as “fake” since it covered up one’s natural scent. Moreover, in business occasions, people avoided using strong-scented perfumes to not maintain a humble profile.

However, nowadays, Chinese consumers are increasingly seeking perfumes as they become more individualistic. Amid their fast-paced and stressful lives, people wear perfume to experience a sense of emotional comfort. Moreover, they pay less attention to whether others dislike the smell and instead wear it to express their taste and personality. Nonetheless, many people in China still prefer lighter and “non-artificial” scents. As of 2024, floral scents remain the most popular smell.

Niche and high-end gain popularity in China

Despite the economy slowing down, Chinese consumers continue to show strong interest in niche and high-end perfumes. The demand for these premium fragrances in China is expected to rise significantly, driving an increase in imports. Consumers prioritize perfumes that offer a refined scent, long-lasting wear, and a strong brand story—qualities that many domestic fragrance brands still fall short.

More niche brands have entered the Chinese market, leveraging cross-border e-commerce platforms like Tmall Global, JD Worldwide, and Douyin. For example, brands like Le Labo, Diptyque, and Maison Francis Kurkdjian have expanded their presence in China. Cainiao Network and other logistics providers have further optimized the “perfume route,” reducing delivery times and costs for European and other international brands. This has made it easier for niche brands to meet the growing demand.

The rise of local Chinese perfume brands like To Summer (观夏)

Even though local perfume brands fall behind luxury foreign brands in terms of quality and heritage, they are captivating consumers with their affordability and connection to Chinese traditions. For example, To Summer (观夏) has emerged as a trailblazer, redefining the fragrance landscape with its unique Oriental fragrance (东方香) concept.

A cultural renaissance in fragrance

Unlike Western brands that often focus on European floral or musky scents, To Summer draws inspiration from Chinese botanicals and cultural motifs, such as osmanthus, bamboo, and lotus, to craft fragrances that feel deeply personal to Chinese consumers. For example, its best-selling fragrance, Golden Osmanthus, captures the essence of autumn in Beijing, while Kunlun Snow evokes the crisp, serene air of the Kunlun Mountains.

To Summer’s emergence coincides with a broader Guochao (国潮) trend, where Chinese consumers, particularly Gen-Z and Millennials, are buying local perfume brands for their connection to Chinese heritage.

Additionally, in February 2024, L’Oréal announced a minority investment in To Summer. It aims to grow its market share in the mass and premium segments and introduce Oriental fragrances to the global market.

Gen-Z’s focus on brand story and concept

Gen-Z consumers in China value the “brand story and concept” (品牌故事和概念) behind perfumes. They seek emotional connection and a sense of exclusivity, which is why brands like Le Labo have successfully captured their attention.

On June 1st, 2023, Estée Lauder-owned Le Labo opened its first physical store in mainland China in Shanghai. The store’s design features vintage furniture while the second floor replicates a perfumer’s workspace and displays books on perfumery. The inclusion of OH LE JOURNAL, a newspaper detailing the brand’s culture and perfume stories (香水故事), further enhances the brand’s artistic appeal.

Moreover, Le Labo’s in-store perfume blending service, a hallmark of its brand identity, was introduced in its Shanghai store. This personalized experience allows consumers to witness the creation of their fragrance, reinforcing the brand’s commitment to craftsmanship and individuality. According to Estée Lauder’s Q1 2024 earnings report, the company’s fragrance division, driven largely by Le Labo, achieved a 5% increase in net sales. Notably, Le Labo itself recorded double-digit sales growth, with strong performance particularly in the Asia-Pacific region, including China.

RedNote has a significant influence on young consumers’ purchasing decision

Young consumers rely heavily on digital platforms for perfume recommendations and brand discovery. RedNote (also known as Xiaohongshu in China) is one of the most influential sources. It amassed over 65 million users interested in fragrances in 2024, making it a powerful space for brands to engage with potential customers. Among the platform’s top five most engaging content categories, perfume ranked alongside makeup, daily life and emotions, home decor, and relationship advice in January 2023.

Tamburins leverages co-branding in China’s perfume market

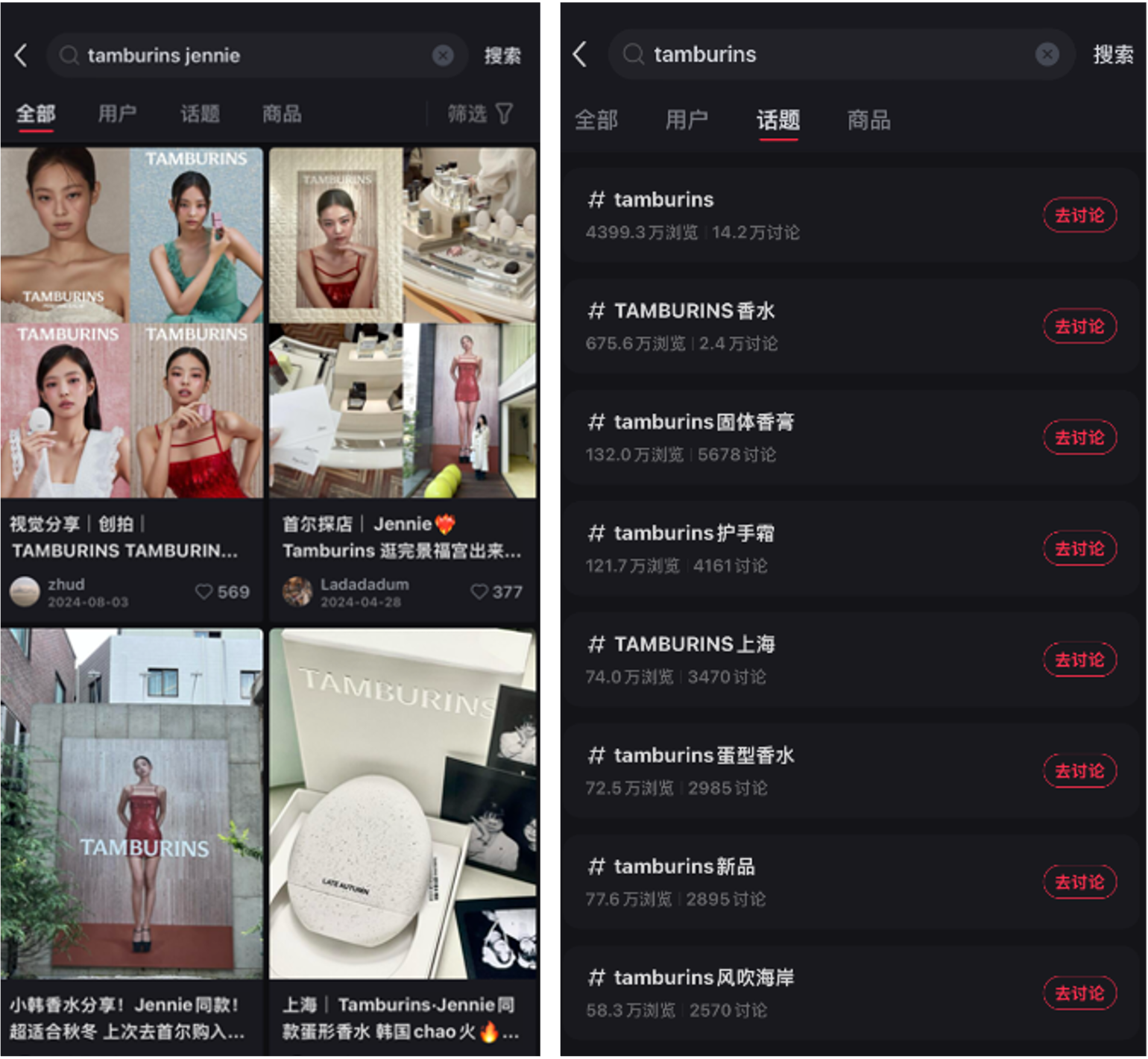

Tamburins, a beauty and fragrance brand under the parent company of Gentle Monster, stood out on Xiaohongshu with almost 44,000,000 views as of February 2025. It is known for its minimalist design, unique scents, and premium pricing.

However, what sets Tamburins apart is its co-branding in China, leveraging celebrity endorsements that tap into the idol culture in China. It appointed Jennie from Blackpink as the face of its perfume series. Jennie, who has a massive following in China, particularly among Gen-Z and Millennial women, not only boosts Tamburins’ brand visibility but also aligns it with youthful, trendy, and aspirational values.

The untapped potential of China’s perfume market

- Despite the beauty market slowing down in China, the perfume segment has seen rapid growth. It doubled in revenue from 2020 to 2024, generating a value of RMB 26.5 billion in 2024.

- Social stigma around perfumes in China is disappearing. Perfumes are perceived as tool for self-expression and emotional comfort and not considered impolite to wear.

- Gen-Z is driving demand for niche, gender-neutral perfumes, personalization and brand storytelling.

- The Guochao movement has fueled the rise of domestic brands like To Summer (观夏). These brands embrace Chinese cultural heritage through fragrances inspired by traditional botanicals. This shift challenges the dominance of established international luxury brands.

- RedNote (also known as Xiaohongshu in China) has solidified its role as the go-to platform for perfume recommendations. Chinese consumers rely heavily on influencer and peer reviews before making their purchase.

- Celebrity influence has become a powerful marketing tool, as seen in Tamburins’ collaboration with Blackpink’s Jennie.

Contact us for in-depth beauty market research in China

The cosmetics market in China is a rapidly evolving landscape, driven by the rising demand for high-quality products, innovative ingredients, and sustainable practices. Daxue Consulting offers specialized market research in China, providing a comprehensive understanding of the preferences, behaviors, and emerging trends shaping the cosmetics market.

Our Chinese consumer insights empower businesses to tailor their products and marketing strategies to resonate with local tastes and expectations. We offer consulting services that help you stay ahead of industry developments and achieve sustainable growth. Connect with us today to discover how our expertise can support your brand’s success in China’s thriving cosmetics market.