Although traditionally, Chinese alcohol consumers have always favored Baijiu, a strong liquor distilled from fermented sorghum, with increased globalization in the past decades, consumers have begun to adopt a variety of imported liquors such as wine. While Chinese wine consumption is still low, only 1.5 liters a person in 2019, over the years, wine has accumulated both status and fandom in the country. Hence, the premium wine market in China has optimistic prospects.

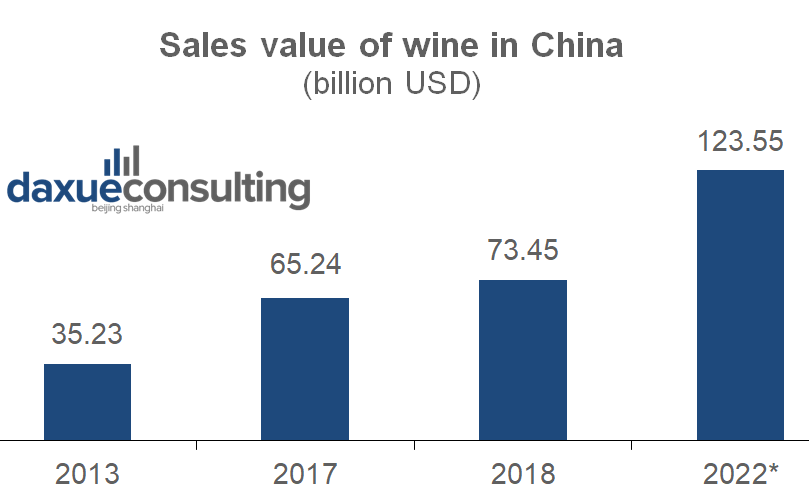

China’s wine market exhibits a drastic increase in total sales value

The sales value of wine in China has increased from $35.23 billion dollars in 2013 to $73.45 billion dollars in 2018, with a forecast of $123.55 billion dollars in 2022.

Data source: Statistia; designed by Daxue Consulting, sales value of wine in China

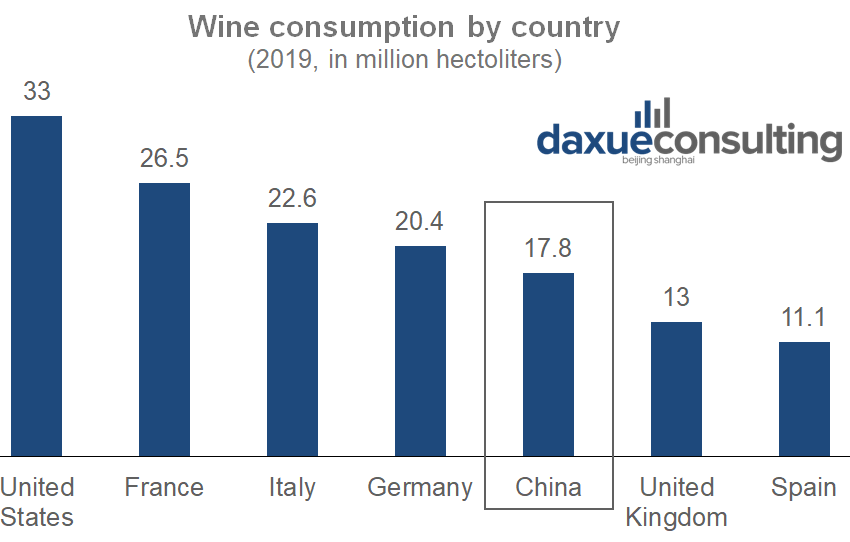

More surprisingly, China has the 5th largest wine consumption in the world, only behind the U.S., France, Italy, and Germany, which all have a rich history of culture and custom associated with wine.

Data source: Statista; designed by Daxue Consulting, consumption of wine by country in million hectoliters

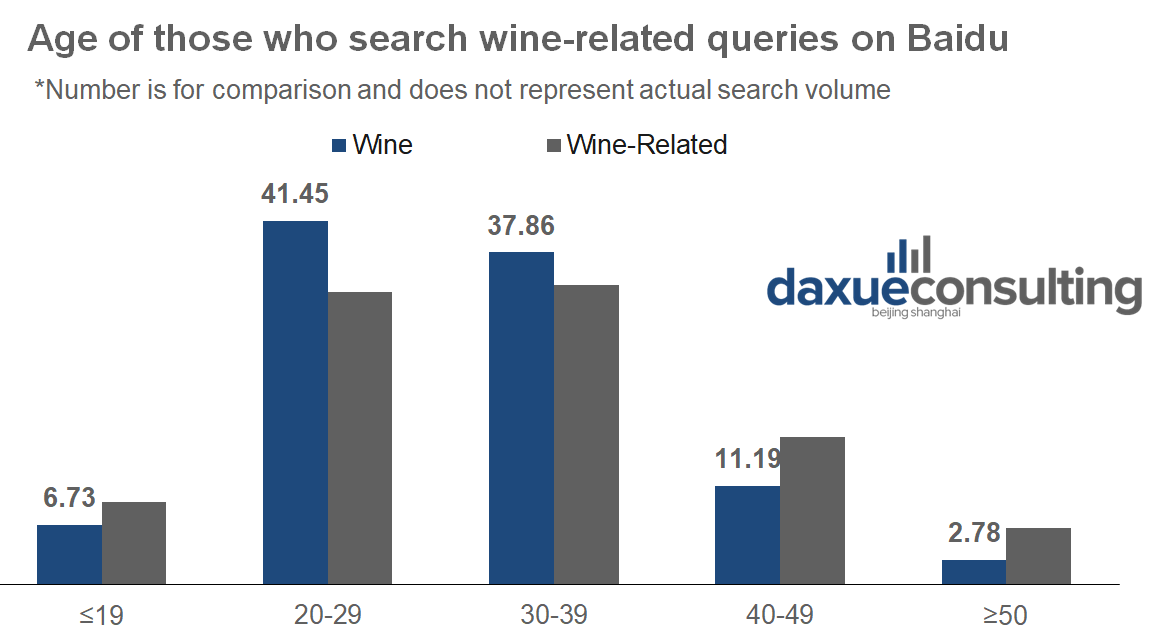

Young adults who have higher standards for life are the most active wine information seekers online

Among all age groups in China, those between twenty to thirty-nine years old are more likely to search for premium wine on Baidu search engine.

Data source: Baidu Index; designed by Daxue Consulting, age distribution of searches about wine on Baidu

While the fact that older people generally use search engines less certainly contributes to the trend, older Chinese alcohol consumers tend to have high loyalty to Chinese traditional alcohol and resist imported liquor due to habit and tradition. On the other hand, younger people, characterized as those younger than nineteen but older than eighteen years old, search for premium wine less despite having technology fluency for a few reasons.

Younger people usually have lower budgets than adults since they are still at school, making little to no income. This means that when it comes to alcohol consumption, younger people would be more likely to select alcohol that is both low in alcohol content and price, making premium wine an unlikely option.

Therefore, mid-aged consumers — who have higher income and standards about lifestyles as well as more years of experience with alcohol — are the most active information seekers and display the greatest interest in premium wine. In other words, these consumers should be considered the target customers for marketers and wine producers interested in the premium wine market in China.

Consumers are more willing to learn about the culture and story behind premium wine

For premium wine producers and marketers, it is important to understand customers’ needs so they can provide products that satisfy those needs. In order to find out the most important attributes that consumers look for in premium wines, professionals need to first learn where consumers stand regarding their knowledge of wine.

Wine experts have inputted their takes on Chinese consumers’ adoption process of wine on Zhihu. As stated by these wine experts, the initial characteristics that attract premium wine consumers the most include price and packaging, which are the two most direct indicators that consumers can use to determine wine quality without having too much knowledge about it. As wine is mostly imported from European countries with rich and long histories, wine consumption was seen as a symbol of royalty and elite status.

Source: Zhihu; wine experts introducing consumers’ growing understanding of premium wine

However, as the number of wine consumers increases, people are willing to spend more time and effort to understand the stories and values hidden behind the wine. These consumers, who are often regarded as premium wine consumers, have acquired a great deal of information and expertise about wine via KOLs. These KOLs provide detailed, personal description of different wine varieties and offer tailored recommendations for consumers at each stage of understanding.

Source: xiaohongshu; a KOL who shares information about premium wine via short videos

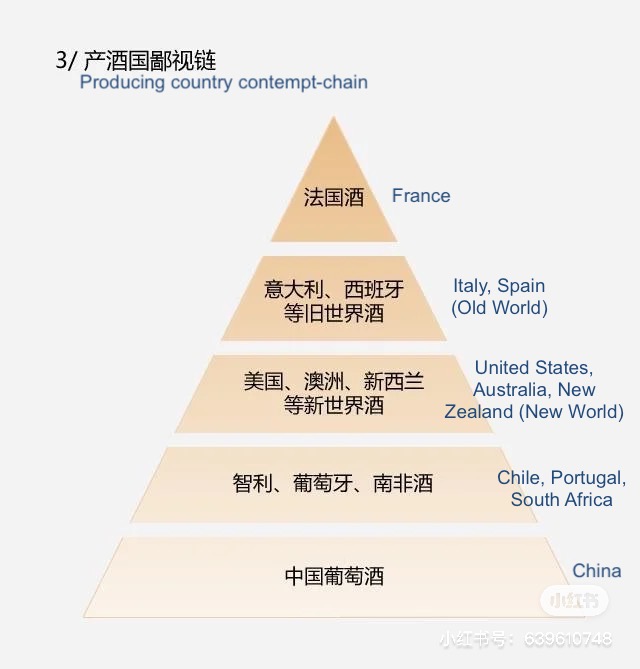

The origin serves as an important indicator of premium wine quality

These premium wine consumers have relatively high expectations for what kind of wine they are drinking and even what kind of glassware they are using for the wine. As a result, they have developed a so-called “鄙视链” (contempt-chain) on Xiaohongshu, in which they rank the quality of the wine based on its origin, winery, and more. This concept of contempt-chain is relatively new, and it conveys sarcasm towards traditional hierarchies. In other words, those who consume French wine are considered “more refined” than those who consume American wines, and this group of consumers in turn “look down” on those who consume domestically produced Chinese wines.

For example, premium wines that are perceived as the highest in quality by general consumers usually satisfy the following criteria. First, the premium wine has to be imported rather than domestically manufactured. Then, the premium wine should be imported from France, and finally, it’s from the Bourgogne winery or Bordeaux winery specifically.

Source: xiaohongshu; a KOL’s post about premium wine contempt-chain

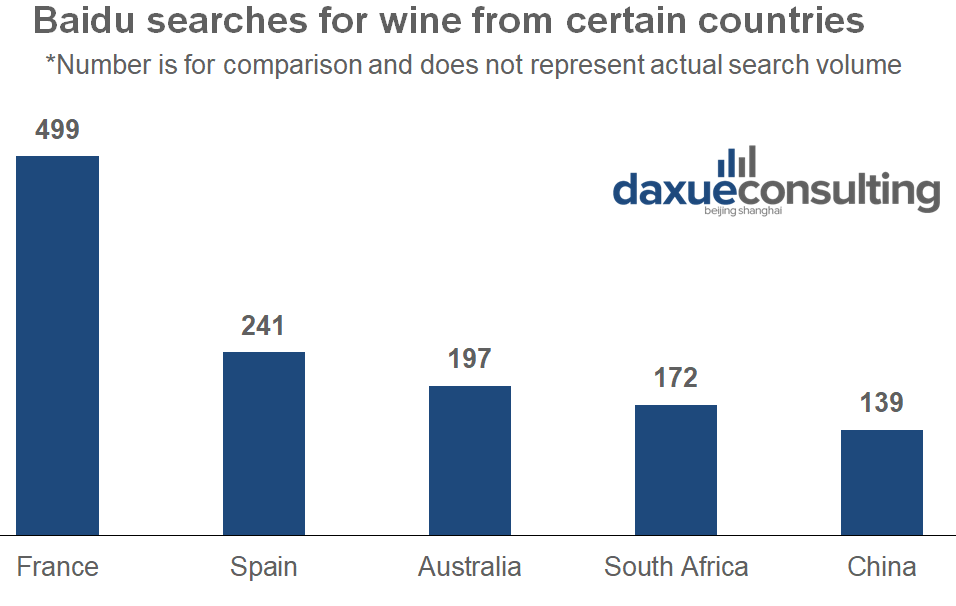

Source: Baidu index; designed by Daxue Consulting, average search index by premium wine producing country

Aligned with the contempt-chain, consumers exhibit the greatest interest in premium wine produced in France, followed by Spain, Australia, South Africa, and finally China. This trend shows how the producing country, France in this case, can be a key quality indicator of wine for premium wine consumers.

See our analysis on Chinese perceptions of wine based on import source

Consumers value taste more than grapevine variety when choosing premium wine in China

Interestingly, instead of paying a lot of attention to the specific grape variety and making a particular wine their default-mode, consumers seem to be shifting to reply more on the flavor of wine as the major determinant of purchase. On Xiaohongshu, premium wine marketers have created detailed graphic profiles to introduce different grapevine varieties based on the wine’s fruitiness, alcoholic content, tannin content, and acidity.

Source: Xiaohongshu; detailed graphics made by premium wine experts to help consumers visualize different grape variety

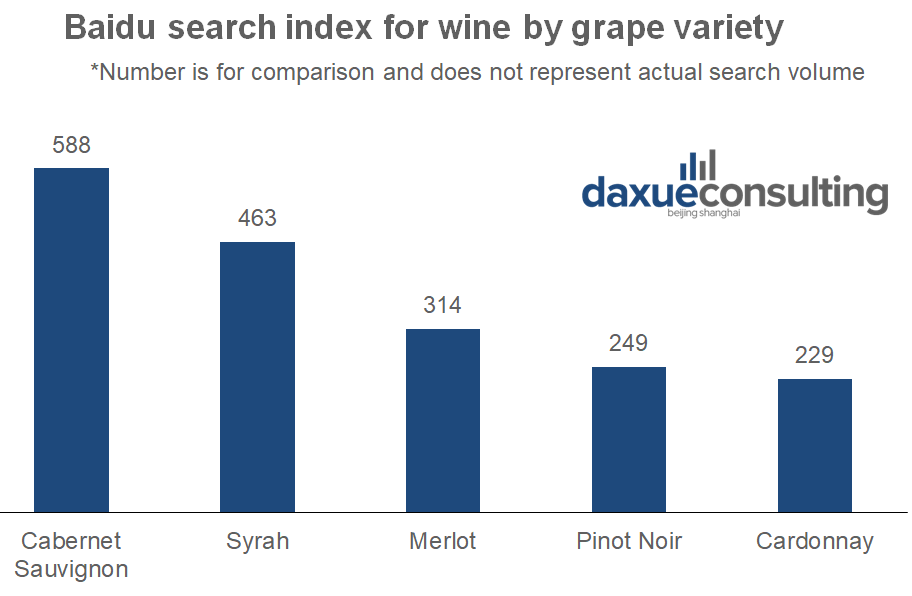

Source: Baidu index; designed by Daxue Consulting, average search index by grape variety

However, certain grape varieties do gather more attention that other kinds in the premium wine market in China. For instance, cabernet sauvignon has significantly more searches on average than chardonnay. According to premium wine experts on Zhihu, cabernet sauvignon is the most commonly consumed wine type by older premium wine consumers due to its strong fruity flavor, as well as high acidity and tannin content. The high content of tannin and acidity makes cabernet sauvignon a perfect match for older consumers’ diet, which is often accompanied by greasy, bulky meat dishes because the tannin will soften the meat fiber and the protein can in turn reduce the sour taste of the wine.

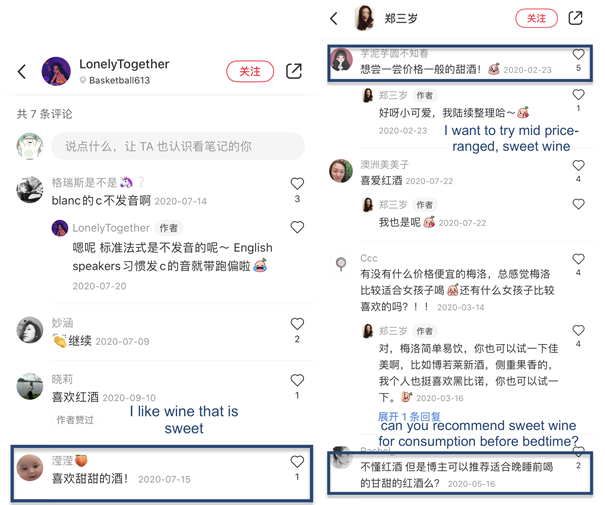

What is surprising is that although the Chinese have a tradition of consuming strong liquor that can have an ABV (alcohol by volume) as high as 60%, most premium wine consumers nowadays prefer wines that are low in alcoholic content as well as tannin content because a high tannin content in wine usually produces a more bitter and astringent taste. The new trend among younger consumers in the premium wine market in China is favoring wine that is sweeter and lighter; something like a complement for desserts and steak.

Source: xiaohongshu; users demonstrating interest and favor towards sweet, light premium wine

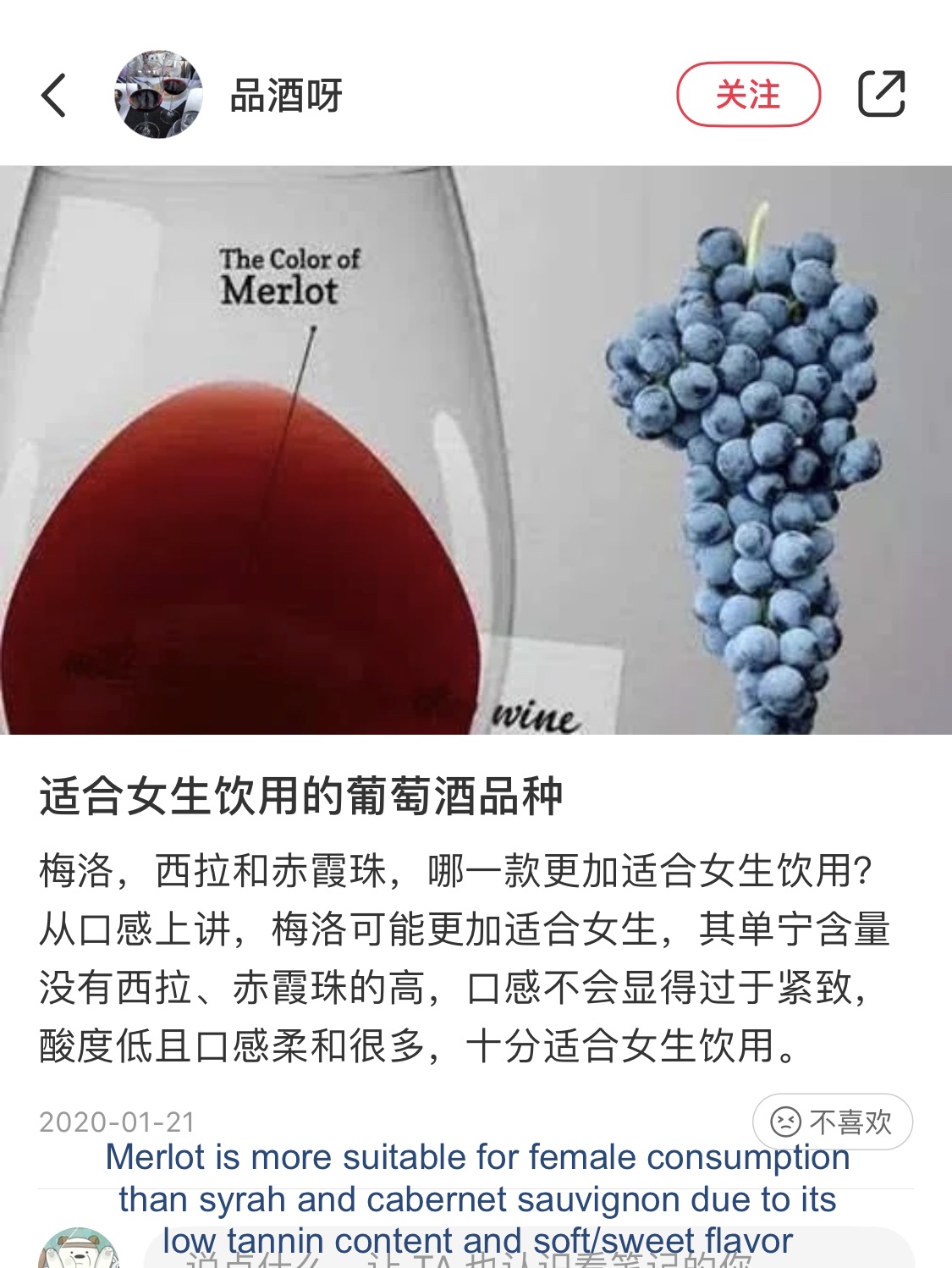

A particular grape variety that stands out to younger premium wine consumers is merlot. Merlot’s biggest attraction to this segment of premium consumers is its flavor, which contains cherry, plum, blackberry, chocolate, vanilla, and black pepper, making it sweeter than most other varieties. KOLs often mention merlot as a premium wine suggestion for female consumers.

Source: xiaohongshu; a premium wine KOL suggesting merlot to female consumers

Challenges in altering premium wine consumers’ drinking habit

Interestingly, while wine is almost an essential for the dining table in many western countries, wine is rarely a go-to pair for traditional Chinese food. Chinese food is known for its heavy use of flavor and spice; thus, in order to be able to taste the liquor, the liquor itself has to be strong like baijiu. Such drinking habits can hardly be changed just to create demand for wine but other solutions can be taken into consideration.

For example, the phrase “仪式感” or “sense of ritual” has been going viral among consumers as more people want to live more meaningfully. People began to appreciate what they have and want to enjoy the moment and treat themselves better. Novelty commodities like candles and bath bombs were once considered a waste by the older generation are now hot picks among younger consumers. Since premium wine has an image of “royalty” and “elegance,” focusing on the ceremonial purpose of wine may be a new direction for marketers.

Health benefits of wine maybe the next marketing focus to acquire consumers

Other than marketing the wine itself, spreading awareness about the health benefits that wine can potentially bring may acquire a whole new segment of customers who were never considered by wine producers. As people become increasingly conscious about what they consume, a light-tasting, low-alcohol content liquor sounds like a perfect match for both healthy living and a fun lifestyle.

It is no secret that Chinese people put a lot of emphasis on health. A large reason why consumers prefer baijiu and other stronger alcohol over milder imported alcohol is because alcohol like baijiu is distilled from grains only. When alcohol is made of all-natural ingredients, or in other words, nothing artificial, it usually won’t lead to a bad hangover.

Thus, although other imported spirits such as vodka and tequila are also strong in flavor, consumers are hesitant to switch over due to the alcohol’s high ethanol content. However, wine shares many similarities as baijiu that may appeal to many customers. For instance, wine is typically made of all-natural ingredients: grapes. More importantly, the consumption of wine can, indeed, lead to many health benefits such as “significant reductions in all-cause and particularly cardiovascular mortality” as stated in a published journal on PubMed.

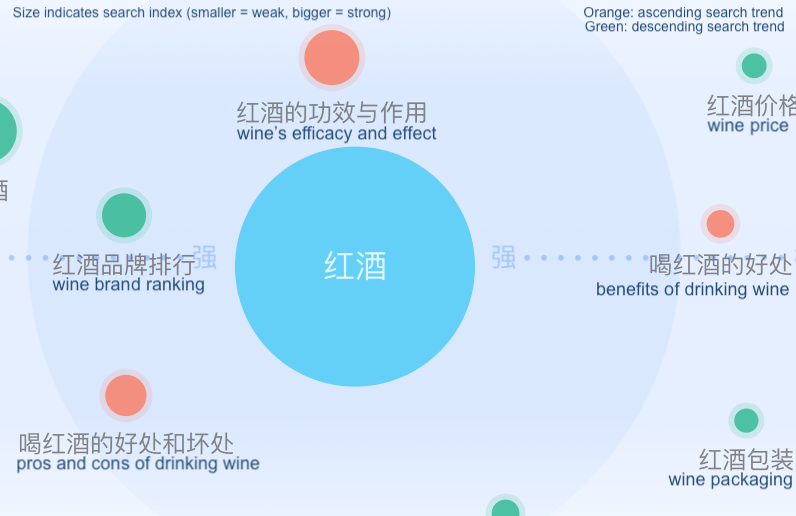

Moreover, for the segment of customers who abstain from drinking due to concerns around health, wine can be a better alternative to provide them with some new options. In other words, there is a huge opportunity to discover a once unopened market. In fact, users have been entering keywords such as “benefits (好处),” “effect (作用),” “pros and cons (好处和坏处)” when generating their searches regarding wine.

Source: Baidu Index; top keyword searches related to wine

The index demonstrates that premium wine consumers are focusing more and more on the health benefits of wine rather than the brand or packaging (for example).

Female consumers exhibit growing interest in using premium wine as a beauty enhancer

Such a trend is also observed on Xiaohongshu as female consumers begin to notice the beauty maintenance function associated with wine. Premium wine KOLs and marketers are putting more efforts into emphasizing the beauty benefits that wine can offer. For instance, in one of the posts below, a KOL introduces how wine can enhance beauty by preventing aging.

Source: Xiaohongshu; users posting about health benefits of wine

Key takeaways of the premium wine market in China

- The premium wine market in China is growing fast

- Those between twenty and thirty-nine are the most active premium wine information seekers on Baidu search engine.

- Unlike in the past when consumers mostly focused on external attributes of the wine, Chinese premium wine consumers now are more willing to learn about the culture and story behind it.

- Certain key terms, such as France and Bourgogne, are crucial for premium wine consumers to determine the quality of wine. Based on these key terms, a contempt chain has emerged, pricing of the wine should reflect the position in the contempt chain.

- Within the last ten years, cabernet sauvignon is the most popular grape variety in premium wine market in China.

- Instead of focusing on specific grape variety like many western wine consumers do, premium wine consumers nowadays focus more on the taste of wine and prefer sweeter and lighter flavor.

- Wine is still mostly consumed as a complementary product for desserts. Ways that marketers can increase demand for wine is through emphasizing wine’s ceremonial uses, as well as French or western cuisine (which is often consumed with wine).

- The health benefit of wine is an area for interest for many premium wine consumers.

- Female consumers are increasingly investing in premium wine for its beauty maintenance function.

Learn something new? Stay updated on the Chinese market by following our WeChat, scan the QR code below, or subscribe to our newsletter

Listen to over 100 China entrepreneur stories on China Paradigms, the China business podcast

Listen to China Paradigm on Apple Podcast