In China, an estimated 26 million tons of clothes are thrown away every year, whereas less than 1% of that amount is reused or recycled. Due to association with poverty and the concept of mianzi (面子), many Chinese people are unwilling to buy and wear secondhand clothing, leading to mass production and waste accumulation in landfills. However, younger generations are gradually getting rid of that set of prejudices which has for long prevented Chinese consumers from buying and wearing secondhand clothing. In efforts to decrease the impact of its carbon footprints, online clothing rental services in China has also been growing alongside the secondhand clothing market in China.

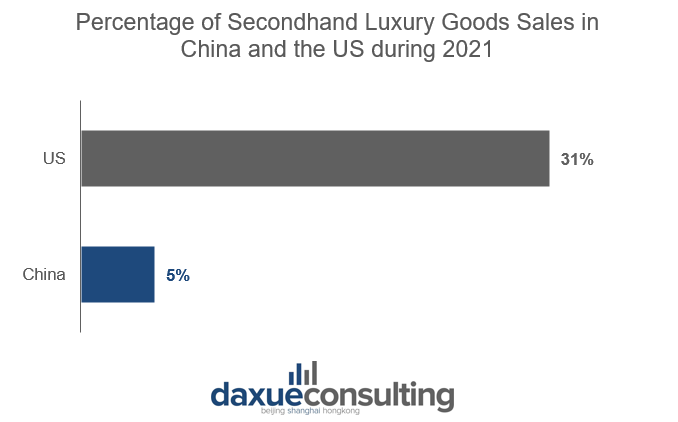

With the COVID-19 outbreak, the decline in performance of the luxury goods industry and the increase in prices due to travel restrictions induced the secondhand luxury market in China to emerge from its niche market into the mainstream. Compared to other countries, China has a lower percentage of sales (5%) from secondhand luxury, which account for 28% in Japan and 31% in the U.S. The rapid growth of the secondhand e-commerce business has fueled the development of the secondhand luxury market in China, however, such market still has a lot of challenges ahead.

Consumers of secondhand clothing market in China

Chinese people used to consider secondhand clothing as unsophisticated, dirty, or as a bad omen. Although some still do, Gen Z consumers have overcome such superstitious beliefs and tend to view secondhand goods beyond its function, as items with a positive emotional value and uniqueness which helps promote the circulation of the secondhand economy. To them, pre-owned goods are synonym for environmental sustainability, personal expression, and cost-effectiveness. As a result of such change in consumer perception, the secondhand clothing market in China is growing as consumers are realizing that they can wear luxury brands at lower prices while helping reduce waste.

In fact, one of the biggest consumers for the secondhand luxury market is Generation Y and Z with more than 50% of second-hand luxury consumers under the age of 30. To Chinese customers, the circular fashion economy in China allows them to present themselves with dignity to keep up with their appearances without spending too much money. Especially for what regards luxury items, it allows Chinese consumers to enjoy secondhand luxury purchases without splurging too much money. Sun Shaqi, a famous Key Opinion Consumer (KOC) in China, advocates for the purchase of secondhand goods and especially luxury bags on her account on Douyin. By using the concept of mianzi (面子), Shaqi is able to connect with her audience by reassuring them that wearing pre-owned goods will not affect the way they are perceived in society.

Distributors of high-end secondhand clothing market in China

Law in China prohibits profiting from recycling clothing in China and bans non-charitable sales on health and safety grounds. The Chinese government has authorized some approved organizations to collect and sort donated secondhand clothes through clothing collection recycling bins, although they have to be in “excellent condition”. Due to the unpopularity of used clothing, 70% of these high-quality garments are sold to overseas secondhand clothing markets, especially Africa. Out of the collected donations, only 15% are given to poorer regions in China, while the other 15% is recycled and used in construction, agriculture, gardening or waste-to-energy incinerators. While the government is assisting in the recycling of waste clothes, a growing number of start-ups in China are looking for new ways to reuse old clothing. In Beijing, Re-Clothing employs migrant women to cut and turn old clothes into patchwork jackets, bags, and carpets.

Online and offline secondhand markets have also become key distributors of the circular economy in China. In 2021, the rise of secondhand luxury market in China has led to million-dollar investments in secondhand luxury e-commerce platforms such as Erluxe, Feiyu, and Explosive Luxury. Explosive Luxury, for instance, hopes to focus on the secondhand luxury goods transaction through AI technology with an innovative customer experience. Even Alibaba, the biggest online e-commerce company in China, launched its own platform known as Idle Fish in 2012. Idle fish has remained popular among Chinese consumers due to its easy usage and credit score which resonates with many users’ mistrusts against counterfeit goods and delivery promises. Other popular Chinese secondhand goods platforms include Plum, Ponhu, Xianyu, and Poizon.

Tackling challenges within the secondhand luxury market in China

Despite recent popularity in secondhand goods, the secondhand luxury market in China has not taken off due to:

- the limited supply of goods

- consumers’ lack of trust due to the spread of counterfeit goods

- lack of after-sales services

By focusing on building an efficient supply chain, gaining users’ trust, and providing after-sales services, secondhand luxury platforms may be more likely to success.

The prospects of the secondhand luxury market in China in the near future remain dim as Secoo, one of the first luxury resale platforms to open and sell secondhand bags in 2008 has been experiencing store closures. Secoo’s B2C business model creates a gap of information between the platform and its users as customers have no way to know anything about the origin, authenticity, and quality of displayed goods. Their decline is mainly due to negative customer feedback, bankruptcy suspicions, debts with suppliers, and opaque transactions which led to freeze their stock shares. In the five years since its listing, Secoo has experienced a fall by more than 90% of its high stock price. Since September 2021, it has been in a state of non-delivery and non-refundable which has caused dissatisfaction and over 6,000 complaints among consumers.

Fighting against counterfeit goods in the secondhand luxury market in China

After the establishment of Secoo, a wave of secondhand luxury platforms emerged such as Fifth Avenue, Zhengpin, Shangpin, but they all were shut down due to harsh competition and limited supply of goods. Above all, most of these platforms could not prove the source of their goods and did little to detect forged items.

In order to limit the spread of counterfeit goods, in recent years the Chinese government has issued new policies and some e-commerce giants have enhanced their anti-counterfeiting efforts. For instance, Alibaba created Yishepai, a Chinese luxury goods authentication service to resolve allegations. Live streaming and broadcasting may also be a good way to exhibit secondhand luxury products and gain consumers’ trust by giving further details about the pre-owned items.

Key Takeaways form China’s secondhand market

- Pre-owned clothing in China have been for long associated with poverty and lack of hygiene.

- However, things are gradually changing and nowadays the secondhand luxury market in China is filled with many potential opportunities that investors are looking to tap into. Nevertheless, with a limited share of sales in the secondhand luxury goods market, Chinese secondhand platforms must be able to understand their target consumers and their concerns, as well as why previous platforms have failed.

- Indeed, Secoo, one of the first luxury resale platforms, has been on a decline leading to frozen stock shares due to suspicions of bankruptcy, poor customer feedback, and not solving the issue of counterfeit goods.

- The secondhand luxury market has not taken off due to the limited supply of goods, consumers’ lack of trust in authentic goods, and lack of after-sales service

- To combat against counterfeit goods, the Chinese government has implemented new regulations in the black market while Alibaba has created a luxury goods authentication service

- Resolving supply chain management and the limited supply of goods can increase the chances of success of luxury resale platforms.

- Live streaming and broadcasting are a way to show secondhand luxury products and gain consumers’ trust by providing them with the same sense of exclusivity in a physical luxury retail store

Author: Daiane Chen