How to gain market share with China-adapted distribution strategy

How can sports brands optimize distribution in China to gain market share? The sports equipment market in China is booming, and brands and distributors are interdependent. In this piece we evaluate the sports equipment distribution distribution channels in China of market leaders. Lastly, we see how brands responded to two recent disruptions in the sports equipment distribution landscape in China.

Overview of the sports equipment market in China

Sports equipment market size is growing at double digit pace

Promotion from the State and general improvement in quality of life pushed more people to work out

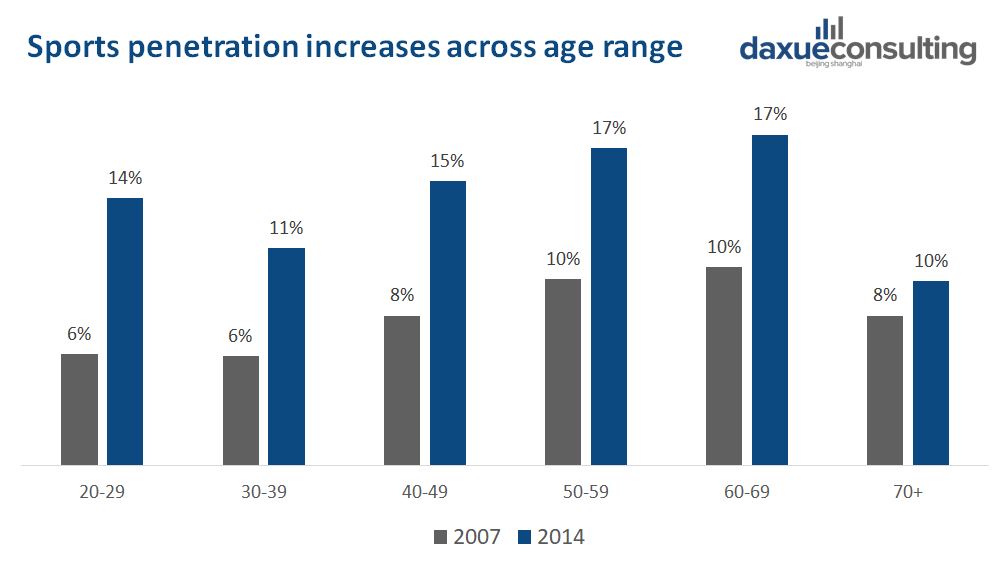

State Council has made the sports industry a top strategy since 2014. Based on statistics from General Administration of Sport of China, the population who regularely exercised grew 48% in urban areas and 148% in rural areas from 2007 to 2014. According to Qianzhan Industry Research Institute, as of 2018, the absolute number of people exercising regularly hit 420 million, almost 32% of the Chinese population. Since it’s still behind 70% of the United States, there is still room for growth. What’s more, this increased interest in sports is manifested across all age groups. According to YiGuan Analysys and China Merchants Securities, the penetration rate of sports has almost doubled from 2007 to 2014.

[Data source: YiGuan Analysys and China Merchants Securities, “Sports penetration improved across age range in China”]

The passion for sports and an increase in disposable income have led people’s attention to a wider range of physical activities

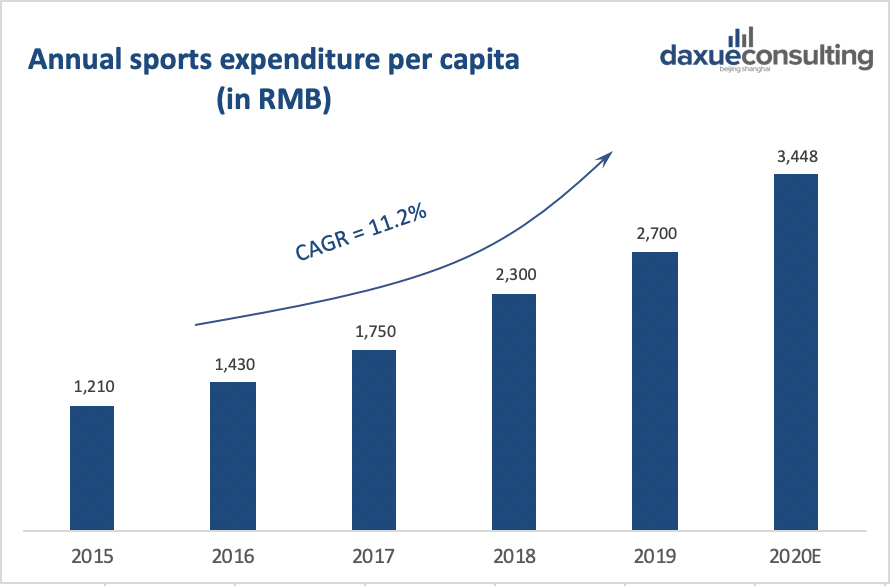

More and more people are not satisfied simply with running, football, basketball, but also participated in skiing, diving, yoga, hiking and other specialized sports. According to Official Website of Chinese Athletics Association, the number of people who run marathons grew 8 times from 900 thousand to over 7 million over 2014 and 2018, and the sport clubs almost doubled from 45,465 to 80,106 in the same period. According to Wind and China Merchants Securities, the average expenditure on sports equipment is growing at a CAGR at 11.2% and is expected to attain 3,448 RMB by 2020.

[Data source: wind and China Merchants Securities, “Annual per capita sports expenditure is rising in China”]

The two important factors of sports equipment market size are both on the rise, making the sport market size bigger than ever. The State Council issued a program called Fitness for All which predicted that by 2020, the market size for sports consumption will be 1.5 trillion RMB, 58% more compared to 910 billion in 2018.

In this growth context, the Covid-19 pandemic caught everyone off guard. Many department stores were forced to temporarily shut down, and economic slowdown curbed consumer expenditure in the short term. In the medium to long term, we can expect a shuffle in the industry with weak sports equipment brands being squeezed out and leaders self-upgrading. This is likely to consolidate the growing internal demand and make the leaders even stronger in the market position.

Profile and segmentation of Chinese sports equipment customers

It is to be acknowledged that sports equipment market encompasses a wide variety of equipment and accessories. They could be consumer facing (2C) or gym facing (2B), suitable indoors or outdoors, for leisure or for competition. Also, each category requires a distinct set of marketing and distribution strategy to best target their specific market segment.

A humble categorization of this vast Chinese sports equipment market can be defined into 3 parts:

- Sports shoes and sports protection equipment like running shoes and yoga clothes,

- Special sports equipment and accessories like treadmill and dumbbells,

- All the rest that does not fit into the first two subcategories.

The first category, the sportswear market is mostly consumer facing. This requires the sports equipment brands to incorporate brand image, comfort and performance into the product design. Likewise, the sportswear distributors have to first emphasize on in-store experience and second develop the distribution channel that covers the most potential customers with the help of e-commerce and management information systems.

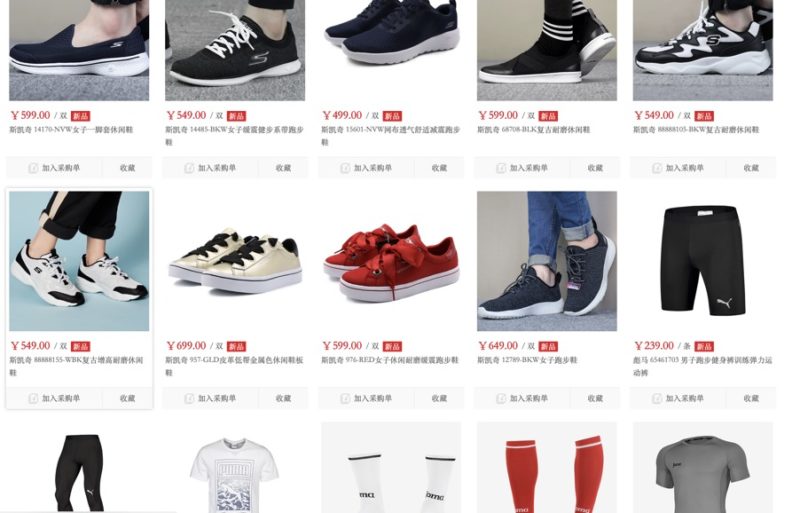

[Source: heiyd.com, “Example of special sports equipment in China”]

The second category of special sports equipment and accessories usually has final clients like schools, businesses, gyms, communities, and governments. Consequently, it’s important for sports equipment brands and manufacturers to have several trustworthy wholesalers. The distribution channel doesn’t necessarily need to be as widespread and stretched as the sportswear market, but it has to ensure big quantity supplied to viable clients.

The third category should adopt a distribution depending on the specific characteristics of the sports equipment. As there are no distinct commonalities, the distribution strategy might be a mixture of the two models mentioned above.

Sportswear takes up a big part of total sports equipment market and has most visibility in the distribution issues. According to the State Council, the leisure exercise industry is an important subcategory to the general sports industry and could take 60% of the total market size (3 trillion out of 5 trillion RMB) in the market projection for 2025. In order to better illustrate the supply chain for sports equipment distribution in China, the following report focuses mainly on the sportswear market.

[Source: heiyd.com, “Examples of sportswear sold in China”]

Sports equipment brands, sports equipment distributors and their interdependencies

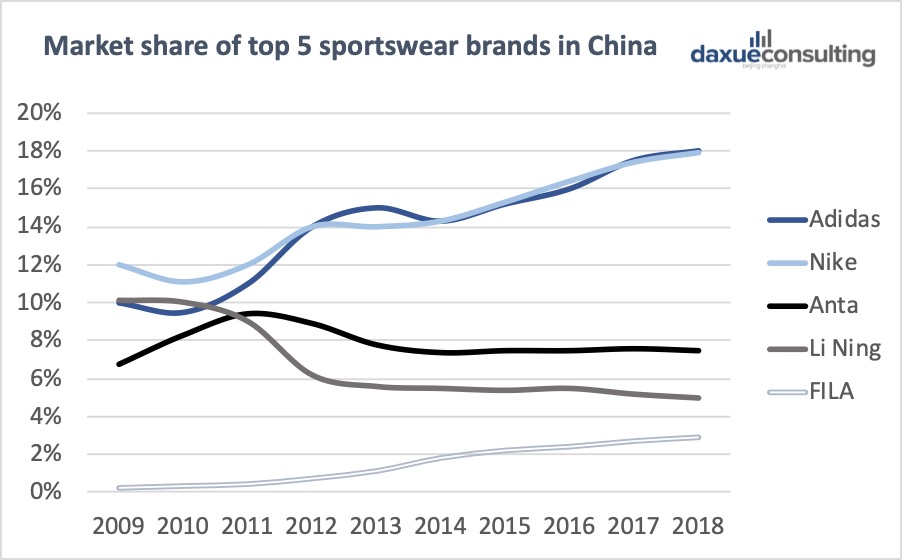

The sports clothes and sports shoes industry has seen several major brands fighting for market share in China. According to Euromonitor and China Merchants Securities, Nike and Adidas each claim 18%, followed by Anta with 7%, Li-Ning 5%, and FILA 3% in 2018.

[Data source: Euromonitor and China Merchants Securities, “Market share of top 5 sportswear brands in China”]

The major sports equipment distributors operating in china include international-level distributors such as Baili International (holding company of Top Sports) and Paosheng international (holding company of YY Sports) as well as regional distributors like Really Sports in Shanghai, High wave Sports in Chengdu, Sanfo Outdoors in Beijing, Sanse in Guangzhou. There are also international players such as Intersport and Decathlon. The fact that the manufacturers of sports equipment are mostly in the southern provinces like Zhejiang, Fujian, Guangdong, Jiangsu and Shanghai in some way explains the prosperity of distributors in those regions.

Sports equipment brands and sports equipment distributors are both important business partners but also partially competitors. For example, when the sports equipment brands adopt self-owned distribution channels through digital means, the distributors lose some of its market competitiveness to the brands. Inversely, when the distributor collects a big number of sports equipment brands and consolidates the local demand, they gain bargaining power.

The intricate relationship between sports equipment brands and sports equipment distributors imply different strategies for getting ahead. For distributors, their success relies on securing vast retail points through M&A, regional networks, and their own sports equipment R&D. A beautiful example is the French Intersport’s strategic partnership with Chinese distribution conglomerate Suning. On the other hand, brands benefit from developing proprietary distribution channels, enhancing brand identity, and cutting-edge R&D in sportswear innovation.

Sports equipment brands have more bargaining power than sports equipment distributors in China

Unlike the home appliance market in China where Gome and Suning, two famous appliance distributors have taken the lead in the distribution landscape, the sports equipment market seldom sees distributors build up their own brand name or decorate their own boutique, even though they own thousands of chain stores. Additionally, this phenomenon is also in contrast with the sports equipment market in the West where retailers like Foot Locker or Decathlon have total authority in the interior decoration of their stores.

Yihong Chen, the president of DX Sport, a Hong Kong-listed sportswear company in charge of all the equity of Kappa in China observed this too: “in the international market, sports distributors and sports brands are equally competent when it comes to branding or sponsoring. But in China no, in China it’s the brand that nurtures the distributors.”

One explanation is that, compared to home appliances, sports equipment has a shorter life cycle and emphasizes more on personal experience

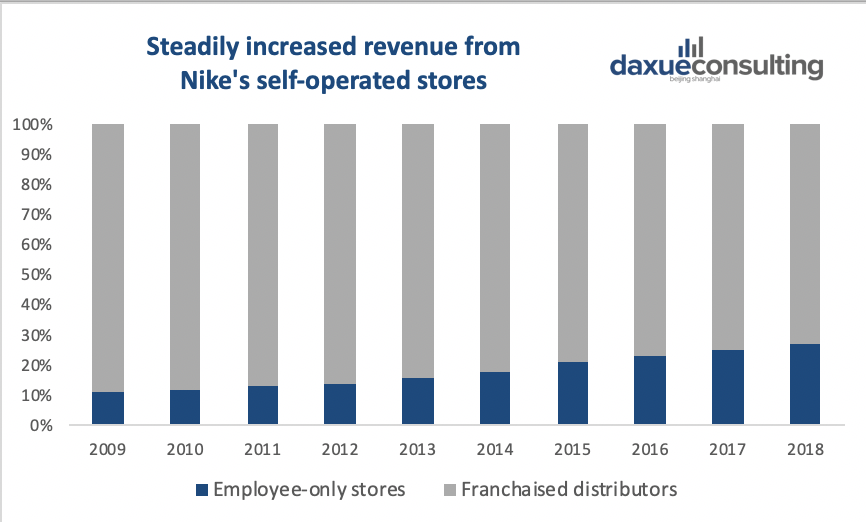

This gives more power to sports brands rather than the channel. As sports equipment poses a greater need for direct feedback between brands and end consumers, there is less need for the existence of distributors. Nike for example, disclosed in its annual reports that sales revenue coming from self-owned channels has increased to 30% of total sales revenue in 2018, a big jump from 13% in 2009. What’s more, according to China Merchants Securities, while the Year-on-Year growth rate of self-owned channels kept at remarkable double digits from 2010 onwards, that of Nike’s distributor only fluctuated around 5%.

[Data source: Nike, China Merchants Securities, “Self-operated stores increased for sports equipment brand Nike”]

A second reason is related to the timing

The sports equipment market in China only started developing in the late 20th century, while in the United States the sports equipment market was already growing at an annual 10%. Consequently, China entered into digital era so quickly that the traditional distribution pyramid had not fully matured compared to the Western countries. This enables sports equipment brands to further take power away from the distributors by setting up direct online sales channels. Take Nike again for example, its e-commerce sales revenue has risen from 12% (2013) to 27% (2018) out of the total revenue from self-owned channels, making the e-commerce a major driver for self-operated growth.

A third reason is the lack of brand sense and brand awareness in the reasoning of Chinese sports equipment distributors

Having a strong distributor brand is not yet appreciated by consumers from 2nd or 3rd tier cities, therefore not a strategic asset for distributors. Also, brands seldom choose only one distributor, as exclusive rights to sell can feed into complacency and under-exploitation of market. Having multiple dealers give brands more bargaining power but puts distributors under pressure. Naturally, the primary concern of distributors is to cut down cost and not build up own brand equity. In order to outcompete other distributors and have more customer, they have to offer a bigger variety of sports equipment in the store, which, unfortunately, resulted in even thinner branding.

A chronological review of sports equipment industry in China

In the 80s in 20th century, the budding sports equipment industry in China developed elementary retail outlets scattered mostly around department stores and gymnasiums. The retail stores were small, under decorated, selling a collection of products manufactured by various factories and enjoyed minimum brand awareness.

From the 90s on, Chinese sports equipment brands such as Li Ning and KangWei started to roll out their distribution network though a combination of franchised retailers and self-operated outlets. The characteristics of this decade include:

- A traditional pyramidal distribution chain with multiple intermediaries,

- A strong bargaining power on the side of manufacturers for the convenience of downstream logistics,

- Wholesalers were of small scale and only influential in a limited geography.

These attributes on the one hand laid out a solid ground for rapid development in the coming decade, on the other hand resulted in a lack of understanding of the end customers due to the long distribution chain for products, information and cashflow.

The first decade in the 21st century witnessed a big stride in the development of sports equipment distribution in China

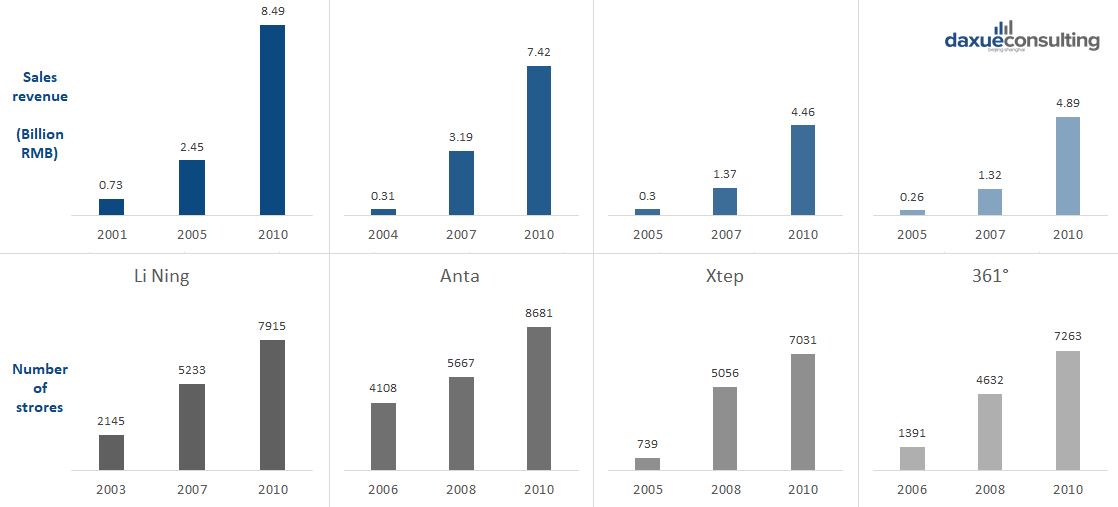

The 2008 Beijing Olympics boosted not only a general passion for sports, but also a fierce growth and competition in the sports industry. According to China Merchants Securities, the industry annual growth rate was at an amazing 20%. Internationally, Nike and Adidas entered the Chinese market by working with top national distributors such as BaiLi (who owns Top Sports) and PaoSheng (who owns YY Sports) in the top tier cities, and Puma, Kappa, Misuno followed suit. Domestically, new brands such as 361, Anta, ERKE appeared and also further developed their distribution foothold, mostly in 2nd and 3rd tier cities.

Distributors were working hard to expand and consolidate, and brands needed that partnership, but brands were also exploring self-owned distribution channels to bypass all the intermediaries. Li Ning for example, had almost 90% of its retail stores franchised to distributors who were selected rigorously. While the self-managed stores grew 30% from 2004 to 2006, the franchised stores grew 70%, showing Li Ning’s determination to obtain deeper grip in the distribution.

The distributors had similar logic. Naifeng Cai, CEO of YY Sports said in an interview with Sina: “We lifted our original goal of 1000 retail stores up to 4000 by end of 2009, because we’ve reached the 1000 target 3 years ahead of schedule.”

In fact, everyone knew that distribution depth and width is the key strategic advantage, so everyone did just that. By end of 2010, according to China Merchants Securities, the 5 top brands of Nike, Adidas, Li Ning, Anta and 361 together claimed 44.7% of total sportswear market share, largely thanks to the increase in retail stores.

[Data source: China Merchants Securities, Sales revenue soared for sports equipment in China]

The 3-year inventory crisis from 2011 to 2014 had forced both brands and distributors to rethink about their strategy

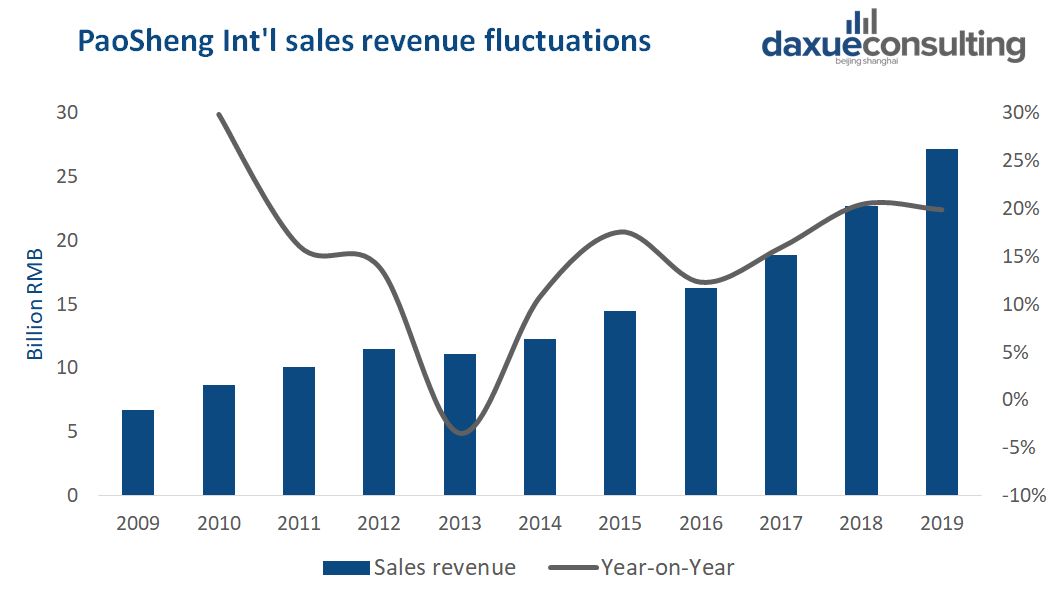

The huge increase of distribution veins seemingly strategically important, however, led to three years of inventory crisis and sector-wide slowdown from 2011 to 2014. The revenue of PaoSheng international, the biggest sports equipment distributor in China even hit negative growth rate in 2013, according to its annual reports.

[Data source: PaoSheng International annual reports, “Negative growth for biggest sports equipment distributor in China in 2013”]

There were several reasons contributing to the downturn

Firstly, consumers’ needs turned slowly from leisure equipment to high-performance sports equipment, and their shopping habits were moving from street stores to online shops or shopping malls. Secondly, brands had focused too much on distribution development that product R&D and innovation were neglected, then marketing problems such as unclear brand positioning and low differentiation followed. Third and most importantly, the competition among distributors were fierce and they were under pressure of getting rid of a surplus of inventory. They did so by cutting margins for market, to the point where many shut down and the rest reduced order amount and delayed payments to brands.

This crisis eliminated the brands who didn’t differentiate in product features and the distributors who harbored too much inventory from overestimating the demand. It also tested the strength of partnership between brands and their dealers.

Everyone knew that it was only by working together, could the industry restore prosperity

Li Ning took out 2 billion RMB to reform its distribution channels by better locating and decorating its stores, as well as opening experience boutiques in shopping malls. Anta did a very good job turning around. It took several effective measures all with the end goal of clearing excessive inventory and upgrading brand position in the turbulent time:

- Bought back the inventory excess at a very low price

- Set up its e-commerce and channeled all these stocks

- Introduced an ERP system to have full transparency in retailers’ KPIs such as stock-to-sales ratio

- Finally made organizational changes to flatten out the distribution pyramid.

Thanks to Anta’s distributors who were exclusively serving Anta, and therefore better mobilized and teamed up with the brand, Anta surpassed Li Ning in market share by 2012.

The recent years witnessed integration of digital solutions in the sports equipment distribution chain

E-commerce has been an indispensable part of sports equipment brands’ self-operated sales channel

Brands can either build up its own e-commerce site or open an official account on third-party B2C e-commerce platforms such as Tmall, JD and VIP Shop. The benefits of e-commerce are as follows:

- Its real-time feedback and big data generation offer invaluable insights into customers psychology and segmentation, which in turn better instructs distribution.

- It shortens and flattens the supply chain, cutting down costs and margins of errors all along the distribution channel.

- E-commerce also transcends the geographical and time limits, making the most recent product launches immediately available at the fingertips of consumers across the country.

- It offers the possibility of drop shipping and pre-ordering, thus mitigating the make-to-stock pressure from the distribution chain.

Those benefits clearly attracted sports equipment brands. According to a sportswear industry full report by China Merchants Securities, Adidas has achieved 2 billion Euro in e-commerce in 2018, up from 55 million in 2010, which puts its CAGR at a startling 57%. Amer Sports had appeared on 100 e-commerce sites in 2018, 80% more than in 2012. Li Ning also hit a remarkable 61% of CAGR of its e-commerce sales.

However, it is to be warned that e-commerce in China might imply counterfeits, so sports equipment brands have to be careful and monitor the e-commerce outlets that are not entitled to sell their branded sports equipment.

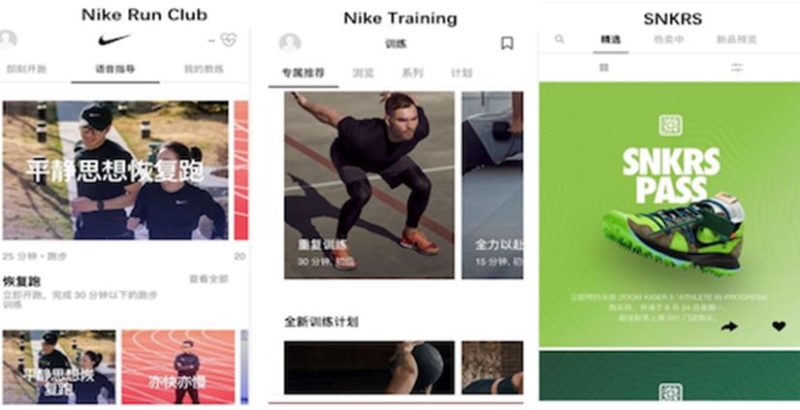

Another important digital transformation for sports equipment brands is their self-developed APP

For example, Nike China has developed Nike+Run Club, Nike+Training Club, and Nike SNKRS. These applications not only empower the end consumer to produce user generated contents and build up a digital community, but also integrate digital marketing, e-commerce and offline distribution into a comprehensive whole.

[Source: Nike self-developed apps, “The digital transformation of Nike”]

Information system also plays an important role in upgrading sports equipment distribution in China

Nike has put in place an information system that shares the real-time inventory data of 90% of retailer stores across China to its HQ, which enables better decision in stock order quantity and replenishment frequencies. Anta, being the first to recover from the inventory crisis, also understood the importance of information transparency. Its ERP system coverage rate improved from 43% in 2008 to 98% in 2017, and maintained at 100% at present.

The future of sports equipment distribution in China

Newcomers never stops disrupting the traditional sports equipment distribution in China

Hey Sports (Hei Yun Dong in Chinese), a B2B e-commerce platform for sports equipment founded in 2016, is a product of Internet+, the Chinese way of saying digital transformation. It provides integrated supply chain services of lead generation, logistics, payment and information to help manufacturers quickly establish a flat retail channel to their end clients, in the hope to downsize the supply chain cost by 30%.

Xusheng Wang, its founder mentioned in an interview with Sohu Sports: “The sports equipment distribution in China is a fragmented business represented by local wholesale markets, each fighting its own battle. Other than the professional and high-end sportswear brands such as Nike, Adidas, Anta, most brands with limited annual sales cannot afford a nationwide sales network, and that’s how the idea of a B2B e-commerce for sports equipment came into being.”

The brands listed on the website of Hey Sports are mostly manufacturers for physical training in schools and gymnasiums. Thanks to years of experience in the sports equipment distribution in China and a solid network of over 30 thousand retailers in 22 capital cities, Hey Sports became the first digital disruption in the B2B sports equipment distribution domain, making the B2B sector more visible.

[Source: heiyd.com, “Examples of sports equipment brands listed on Hey Sports”]

Another disruption comes from the fitness industry in China

Keep, China’s largest social sports APP, was founded in 2015 and reached 14 million monthly active users in January 2020. Its first genius is to implant the sales of sports equipment in the context of digital course offerings, naturally and precisely grapping the target customer. Its second genius, is to build its proprietary e-shop inside the mobile APP. It fully understands that the package delivery industry is so mature in China that consumers can order a treadmill on this app.

[Source: Keep, “E-commerce is embedded in the social fitness app Keep”]

These 2 disruptions constantly remind players in the Chinese sports equipment industry that new opportunities never cease to germinate, and that no one is ever too safe in a competitive landscape.

Author: Della Wang

Listen to 100 China entrepreneur stories on China Paradigms, the China business podcast

Listen to China Paradigm on Apple Podcast