With more than 140.5 billion RMB of annual sales made by milk tea shops in 2019, the success of bubble tea in China is well proven. If you are lost among all the new entrants to the market, the latest innovations and the dynamics of the sector, this article retraces the history of bubble tea analyzing its success.

The incredible success of bubble tea in China since 1996

Bubble tea is a drink made from tea (usually black tea), milk, syrup, and a special ingredient that captivates the hearts of Chinese people: tapioca pearls. Bubble tea is also known as 珍珠奶茶 (Zhen Zhu Nai Cha) directly translates to pearl milk tea, but is also known as boba tea in parts of the world. Far from healthy, the drink contains a lot of caffeine and sugar, especially due to syrup sweetener.

What is captivating about this drink is that it is both drank and eaten at the same time. Tapioca pearls, which can be different sizes, offer a unique chewy texture and a sweet taste.

Where does such a successful drink in China’s beverage market come from?

Bubble tea originates from Taiwan, in the city of Taichung. It was reportedly created in the 1980s in a tea shop called Chen Shui Tang where the owner, Liu Han-Chieh, was selling oolong tea. With the innovative idea of changing the way Chinese people consumed tea, and a bit of influence from the Japanese way of drinking cold drinks, mixed tea, milk, and ice in a cocktail shaker. Following the popularity of his cold drinks, he experimented with pouring tapioca pearls into the milk tea. This marks the birth of the world-famous Bubble tea beverage in China.

The rest of the story is well known: bubble tea has been a great success, spreading throughout Asia and even gaining popularity throughout North America. Today, bubble tea is an integral part of Taiwanese and Chinese culture.

More and more brands on China’s beverage market

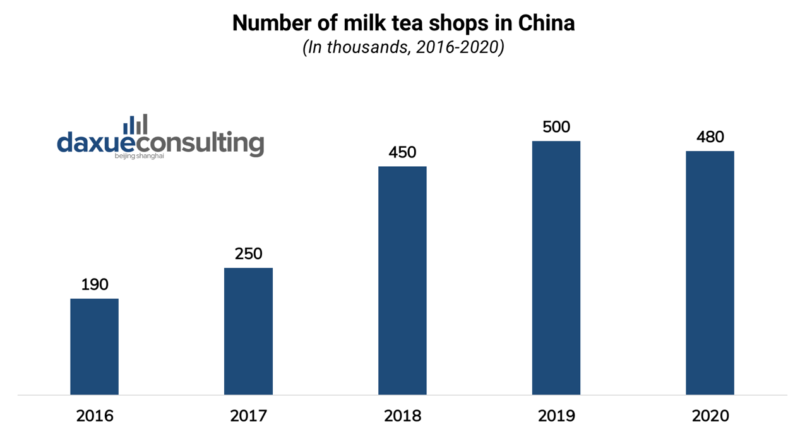

China’s bubble tea market seems almost saturated: at the end of 2019 Qianzhan counted 500,000 milk tea shops offering bubble teas in China. The number of milk tea shops in 2019 increased by 11% from 2018. However, the expansion of new stores was affected due to the impact of the epidemic. By the end of June 2020, the number of tea stores in China is around 480,000. Bubble tea is the best-seller in almost every milk tea shop. There are dozens and dozens of players in the milk tea market in China. Equal Ocean ranked the 19 most powerful brands in 2019 in this sector:

Bubble tea brands in China can be divided into two types: traditional and new style, embodied by the famous Heytea brand (find the Heytea case study here). The differences are mainly in price and design. The new ones attract younger consumers who see them as a way to show a cool and international lifestyle.

Among these bubble tea brands in China, some will catch your attention, either by the pertinence of their marketing strategy or by their product innovation or even their financial power.

Bubble tea brands in China, those who paved the way

- Yi Dian Dian (一点点) is one of the three most powerful bubble tea brands in China, coming directly from Taiwan. It is considered a classic brand, serving traditional bubble tea milk. Yi Dian Dian has more than 600 stores in China and is now conquering Europe and other Asian countries such as Japan. Yi Dian Dian keeps their prices lower than most bubble tea stores.

- Coco or Coco Fresh is also one of the 3 brands mentioned above, with more than 2,000 stores worldwide and 20 years of experience. Coco offers a wide variety of toppings and the adjustment of all recipes, and have entered the coffee market in China.

- THE ALLEY is probably the brand that has focused the most on the aesthetic side of beverages. Known for its brown sugar tapioca pearls, and layered matcha and black tea drink, its drinks are also among the most caloric bubble teas in China. The brand has succeeded in its commitment to be present throughout the world, on all continents.

- With its first boutique opened in Shanghai in 2006, Happy Lemon is also an interesting bubble tea brand in China because its identity differs slightly from that of its main competitors with design and values more focused on freshness and fruits.

From 2015, new style tea brands emerged

- Heytea, whose success has made a lot of headlines in Chinese media, the Starbucks of Bubble Tea, is one of these new styles brands and has easily competed with Coco and Yi Dian Dian (一点点). Attracting mainly Chinese millennials, they are an example of innovation in a standardized sector and successful brand launch. With their first boutique opened in Shanghai in 2017, they are now also present in Singapore and Hong Kong, and with higher prices, they are positioned towards the premium end of the bubble tea market in China.

- Nayuki is founded in 2015 in Shenzhen. To target young women aged 20-25, Nayuki builds an innovative business format as “tea +soft French bread”. Through its innovation and strict quality control, Nayuki expands its stores quickly in China: now it has 349 stores in 50 cities (find Nayuki case study here).

- Lelecha, with a similar business format as Nayuki, it is famous for its chocolate-covered croissant and Dirty Matcha (Brown sugar milk tea). Lelecha mainly distributed in tier-1 cities such as Shanghai (50%) and Beijing (25%).

In search of innovation for tea beverages in China: format is constantly evolving

Although most tea shops offer two main options (milk teas and fruit-flavored teas), harsh competition boosted the number of innovations. Non-fruit flavors such as avocado, ginger, mango green tea, taro or mocha are very often available and toppings such as tropical fruits, lychee, coco cubes, aloe jelly, coffee jelly, coconut jelly, pudding or chia seeds can be chosen as well.

The segment of cheese teas, also known as milk cap, is also new: Heytea is very well known for adding salty, creamy cheese to its beverages. The idea is to add creamy cheese to the tea. This helps to compensate for the bitterness of tea, which is less popular with younger generations of Chinese people. This salty cheese balances the sweet taste of the tea and fruits that are added to the drink. Surprisingly, cheese tea seems to appeal to people who care about their health thanks to the low-fat options available.

Happy Lemon has also developed Oreo Milk Tea which consists of adding oreo pieces to a milk-cap tea. But innovations do not stop at taste, design, and format. Shops try to offer the best customer experience. This is the case of Happy Lemon. They went viral on social media thanks to their robotic arm present in some of their shops, which embodies their desire to embrace the trend of new retail.

A report from Mintel recently showed that Chinese people prefer to buy their tea in physical stores. That is why many bubble tea brands in China try to innovate offline. The owner of the boutique explained that it was a pure marketing initiative, to attract consumers in a very competitive landscape.

Instant milk tea in China: different marketing, different codes

China’s tea market is by far the biggest in the world with a retail value of US$78.7 billion with a 9.3% growth rate in 2020. Where it becomes particularly interesting is that 38% of its value comes from the instant tea category. One of the top segments of the instant beverage market in China is milk tea and bubble tea.

China’s instant teas imitate the flavors of bubble teas that can be bought in shops and sometimes even add real tapioca pearls to drinks. How does it work? In a cup, often made of plastic, you can find a sealed pouch of instant tea, a straw and another small pocket with tapioca pearls. Then add hot water, mix and in two minutes, bubble tea to take away is ready. Consumers’ favorite instant bubble tea brands in China are U-loveit and Xiangpiaopiao.

Packaging plays an important role in this market: on-the-go packaging is perfectly adapted to the fast-paced lifestyle of urban and overbooked Chinese millennials. Although more limited than what can be found in the shops, the choice remains quite wide: Xiangpiaopiao offers milk tea with green tea, chocolate, caramel, strawberry, sweet potato, etc.

The brand U-loveit has even worked with celebrities and KOLs in China to promote its bubble teas, collaborating with the world-renowned actor, singer-songwriter, Jay Chou.

The conclusions that can be drawn from the success of bubble tea in China

Drinking bubble tea is something you need to show on social media, that you share with your followers to show your very cool lifestyle, especially with the increasingly aesthetic drinks

On Chinese social media, the bubble tea trend is definitely huge and several pictures of milk teas are posted every single minute. Indeed, bubble tea is fashionable, fun and the most beautiful drink in China’s beverage market. The tapioca pearls and the colors of the tea mixed with milk make very shareable pictures. On Xiao hong shu or Weibo, there are thousands of photos of all brands. The Alley has particularly succeeded in making drinks beautiful enough for social media.

Social media is a showcase opportunity for Chinese consumers

This success of bubble tea in China shows us once again how much social networks are an integral part of Chinese life and that sharing with friends is the daily activity of millennials.

However, social media are also used by brands to advertise. Thirst marketing is thus leveraged by a large amount of bubble tea brands in China, such as Heytea which success relies heavily on its smart use of social media. The brand used the ‘network effect’ of social media and is mainly famous for the extremely long waiting time to get its products.

It uses a controversial technic: scarcity marketing. Heytea posted several pictures of lines in front of their stores explaining that waiting time could reach 6 hours! This went viral online and encouraged customers to share a picture when they finally got the precious beverage. Heytea’s famously long waiting time actually became a selling point.

China’s tea market, an invincible market

One of the first conclusions that can be drawn from the success of bubble tea in China is that the Chinese are still tea drinkers. It should be recalled that tea was discovered in 2737 BC by the Chinese Emperor Shen Nong. An emperor that became mythical precisely because he taught agriculture, medicine and the art of using plants to the population. Since the Tang dynasty, tea has become the main drink in China’s beverage market. Despite the growing success of coffee and the arrival of new coffee brands, tea remains a staple among Chinese. Moreover, the consumption of milk tea in China has exceeded the consumption of coffee. According to Ibzuo, Chinese people consume five times more milk tea than coffee.

The increasing popularity of the new style tea market

As aforementioned, the new style tea market is growing rapidly from 2015, attracting new competitors and more than 1 billion investment. By emphasizing healthy ingredients and high-quality tea, new style tea satisfies customers’ demands for health. To solidify their market position, top players of the new style tea market such as Heytea and Nayuki start to focus on brand building. For example, Heytea designs concept stores to offer a different experience and adopts co-branding strategies actively (explore a brand resilience concept of Heytea brand).

Starbucks trend going to an end?

The success of bubble tea in China also leads us to question Starbucks’ supremacy in China. With existing 3,300 stores in over 90 Chinese cities and around 2,700 new stores expected to open by the end of the 2022, Starbucks’ success in China is undeniable. The American and international way of life promoted by these coffee chains has pleased Chinese people for years. Costa Coffee used the same sales argument, with nearly 350 stores in mainland China.

However, the atmosphere of these coffee shops and the values they convey still appeal to the Chinese.

What a tea entrepreneur says about the threat of coffee consumption

In an expert interview with tea entrepreneur Martin Papp, he shared his experience conducting market research in Starbucks in China.

“China is still a tea-drinking country. I did some market research in 2014 when I was planning on starting this company. So I went to multiple Starbuck stores in China and surveyed customers in the store on whether they prefer drinking tea of coffee. I found that about 50% of Starbucks’ customers prefer tea over coffee. ”

Papp’s research suggests that people who prefer tea still went to Starbucks because tea shops did not offer the desired atmosphere in 2014. However, now things are changing, and milk tea chains have begun to adopt the same codes. People no longer have to go to Starbucks to find a hip place to socialize over a drink. Whether in the names of the drinks, the aesthetics of the drinks, the decoration of the shops and the values conveyed in the advertisements, everything reflects the enviable codes of Starbucks. Recently, HeyTea and Nayuki have even created tea rooms which are comfortable spaces for their customers to relax. So going to Heytea has become just as cool, even cooler given the long queues in front of the shops in Shanghai.

Healthy or unhealthy: a still difficult choice?

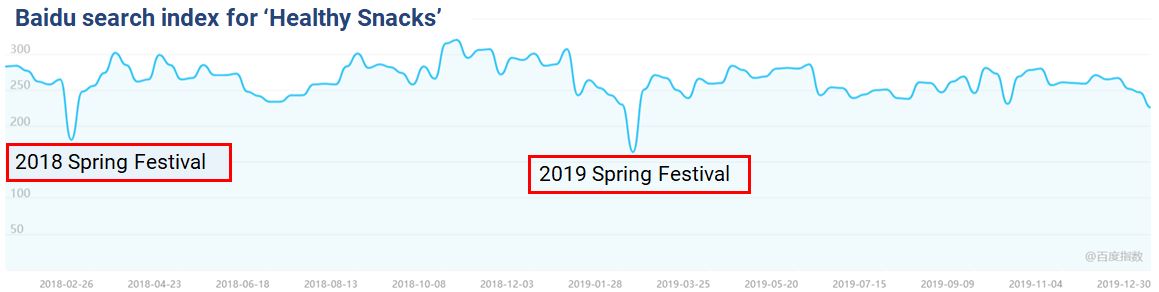

Finally, bubble tea drinks with a lot of sugar, raise the issue of healthy drinks in China’s beverage market. According to the Daxue Consulting report on healthy snacks in China, Chinese people, and especially women, have been paying attention to what they buy, the composition of products and the origins of ingredients. Baidu Index demonstrates searches on healthy products has been stable throughout the past year, showing a real interest in better products. Although, searches for healthy products takes a dive during the spring festival when Chinese people tend to eat more sweet things and other family dishes.

Source: Baidu Index, Daxue Consulting report – The search frequency of “healthy snacks” in 2018 and 2019

How does bubble tea adapt to this trend?

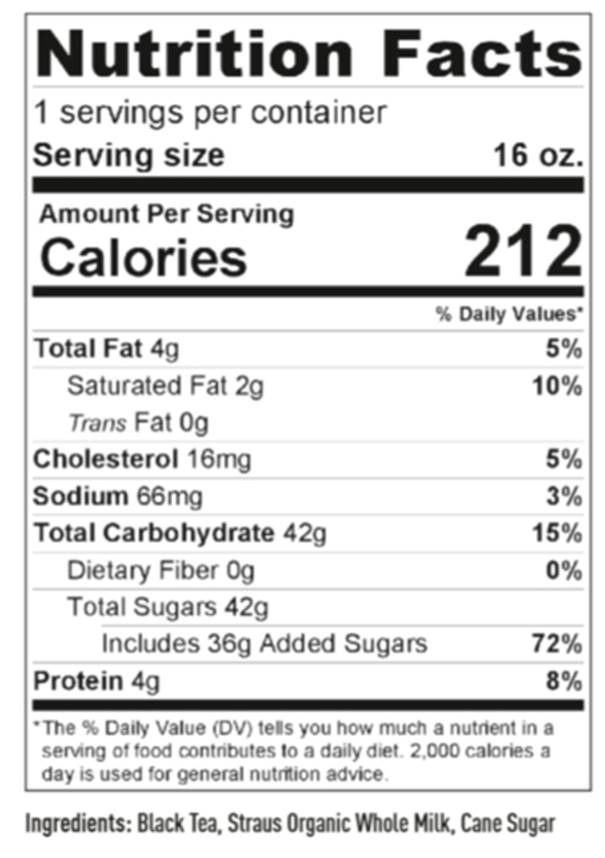

A mix of milk and tea seems not caloric but because of the added sugar and tapioca pearls, bubble tea is a very caloric drink, heavy in carbohydrates. The typical glass contains more than 200 calories and 33 grams of carbohydrates.

According to Meituan, who delivered more than 210 million orders of milk tea last year, Chinese women are the largest consumers of milk tea and bubble tea, far ahead of men. 95% of women under 26 who use the Meituan app typically order milk tea every week. This means that bubble tea brands in China have had to adapt to new health concerns by offering more healthy alternatives and being more flexible on the amount of sugar. It is anyway a trend that is going to reshape the whole F&B industry in China.

Thus, in a highly competitive market, there is no shortage of innovations. Bubble tea brands in China are working hard to keep their current customers and attract new ones. Despite the growing trend of a healthy lifestyle, bubble teas in China still have a bright future ahead of them. The craze for bubble tea is so huge that we are even starting to find bubble sushis, bubble sandwiches, bubble noodles, and bubble pizzas…

Forecast for China’s bubble tea market

According to Grace Yu, a project manager at Daxue Consulting, who is a real fan of bubble tea and a regular, with the increasing competition of the Chinese milk tea market, currently bubble tea brands are seeking a new business model and offering innovative products to attract customers.

First, brands are gradually moving from low-end to high-end positioning. Milk tea brands are not limited as beverages but a promoting channel for the Chinese tea culture. Moreover, consumers start to link their brand’s image with lifestyle and pay more attention to the quality of the tea.

Second, market maturity implies the need for innovation. Customers may be willing to try interesting substitutes of milk tea, for example, milk tea with alcohol or “well-being” tea drink such as mung bean soup.

For the offline milk tea market, Grace Yu believes there will be more milk tea boutique and niche stores rather than chain stores, complying with the increasing consumer’s needs for higher quality products and spaces to socialize.

Author: Steffi Noël

Make the new economic China Paradigm positive leverage for your business

Listen in China Paradigm in iTunes