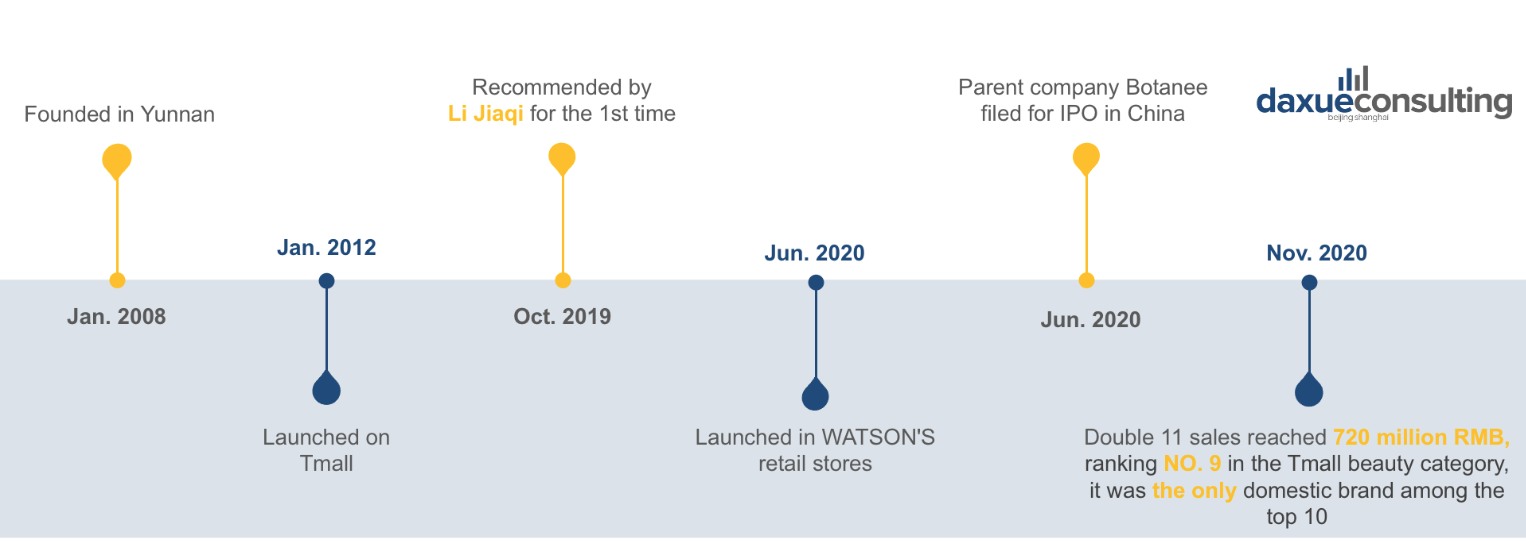

Winona, founded in 2008, is a Chinese skincare brand that specifically targets sensitive skin. Although faced with many strong incumbents in the industry, Winona was able to appeal to customers and rank number one in the sensitive skincare category in 2020. In June 2020, Winona’s parent company Yunnan Botanee Group, a biotechnology manufacturer, filed for IPO in China, validating Winona’s success. Winona’s market strategy is defined by its professional image, including using dermatologists as live-streamers, earning its reputation as a “cosmeceutical” brand.

Source: Daxue consulting and Double V. Training & Consultancy; C-Beauty brands report, timeline of Winona’s major achievements

Winona shows its professional brand image through partnerships and packaging

First, knowing customer concerns with skincare products in China, Winona conveys a professional brand image through its partnerships and packaging. Unlike other skincare brands, Winona has its own R&D team and has been working closely with authoritative organizations and figures including hospitals, dermatologists, and universities. To further strengthen this trustworthy brand image, Winona also carefully chose white and red as their packaging color to resemble the red cross symbol, which is often related to cosmeceutical products.

Source: Xiaohongshu; Winona’s product packaging resembles the red cross symbol

Strategy 1: Segmentation for sensitive skincare

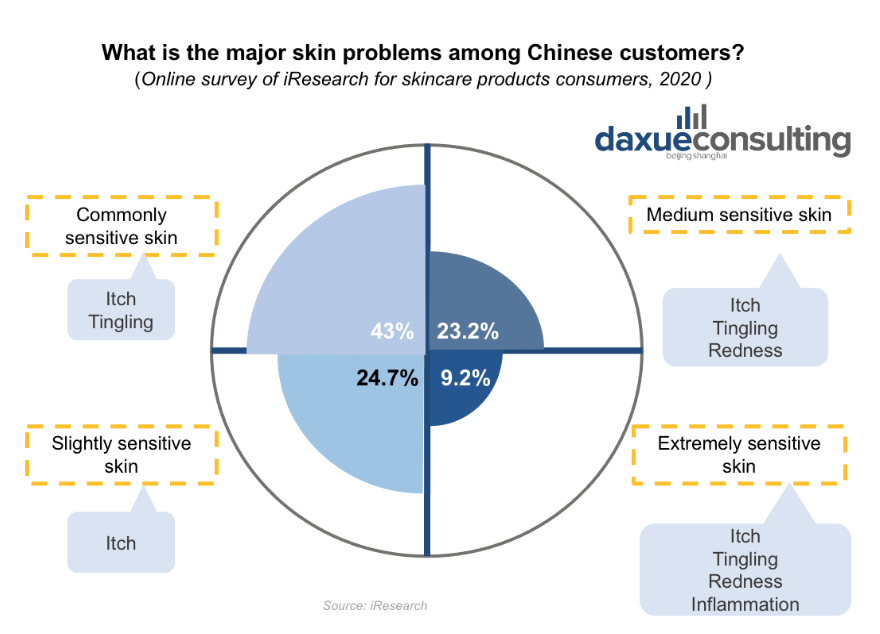

When picking target customers, Winona conducted extensive research to understand current consumer demand. What Winona found is that sensitive skin accounts for a large proportion of skin types in China, ranging from slightly sensitive skin to extremely sensitive skin. What’s more important is that countless consumers are bothered by having sensitive skin problems such as itch and redness. On Xiaohongshu, a Chinese social media app for browsing and sharing posts, over 1.57 million searching results were related to the word “sensitive skin” or “敏感肌.” The topic became even more popular after COVID-19 possibly due to behaviors like mask-wearing that could contribute to skin problems.

Data source: iResearch, designed by Daxue Consulting; C-beauty brands report, major skin problems among customers

Having discovered this mass market, Winona accurately targets the specific group of customers with sensitive skin and provides solutions to their problems. Besides building a professional brand image, Winona also appeals to its target customers by delivering brand concepts that directly point out “this is a kind of product that is effective to solve sensitive skin’s problems.” On Xiaohongshu, 90% of the posts about Winona, regardless of source, are related to sensitive skin problems. The keyword “Winona sensitive skin” also has over 20k search results on the app. These results are consistent with Winona’s positioning as an expert in the sensitive skincare category.

Strategy 2: Academic marketing

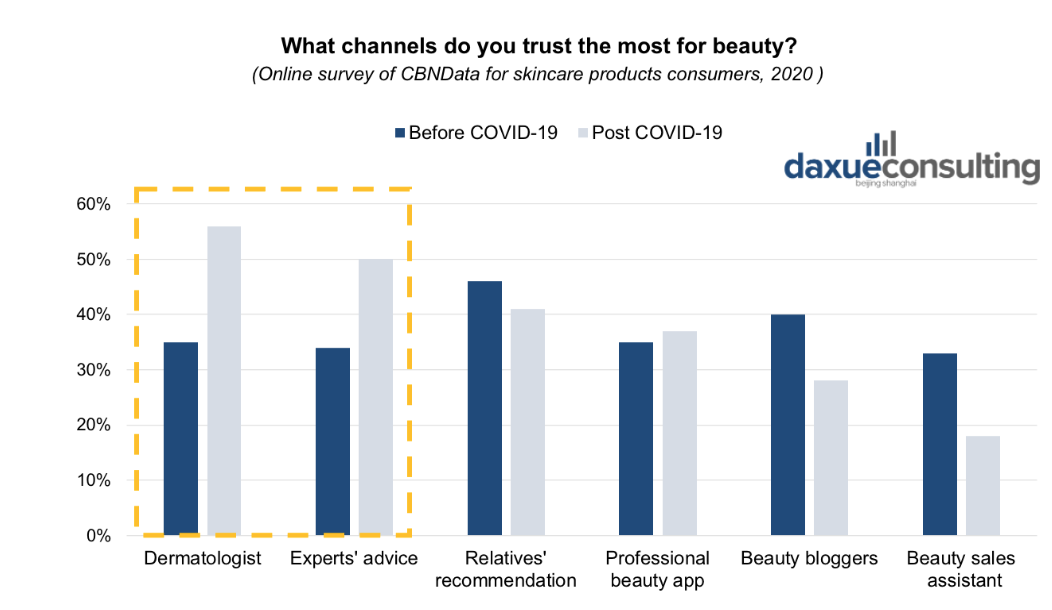

Customers today are smarter than ever. Rather than relying on word-of-mouth, consumers today seek information from valid sources. This trend is observed more clearly after COVID-19. For instance, consumers were more likely to be influenced by relatives’ recommendations and beauty bloggers who post content like “annual favorite product recommendation” before COVID-19. However, they are now more influenced by dermatologists and experts who create educational posts about products they use or recommend.

Source: CBNData; designed by Daxue Consulting, channels that consumers trust pre- vs post-COVID-19

Knowing that many potential buyers have questions relating to skincare, Winona uses academic marketing as a way to inform consumers of different skin types, common skin problems, and how Winona’s products can serve as a solution. Besides having a founder who’s a doctor in the industry with a strong academic backgrounds, most KOLs and KOCs of Winona are also professional dermatologists. Winona also occasionally invites skincare experts to give professional advice on different skin problems.

Leveraging the impact of social media marketing channels, Winona utilizes live stream as a way to connect and communicate directly with its customers. In these live stream sessions, Winona often invites dermatologists as speakers and uses keywords such as “#Online Q&A from dermatologists” to increase views. Such a strategy converts hesitant consumers by helping them to first realize what kind of skin problems they are experiencing and then provide them with a convenient, authority-certified Winona solution.

Source: Winona; live stream advertising posters, Winona’s China market strategy

Strategy 3: Strategic selections for live stream hosts

As mentioned previously, Winona holds live streams not only for selling products but also for teaching customers about the science of skin and skin sensitivity. Although dermatologists are the major live stream hosts, top KOLs like Viya and Li Jiaqi are also featured since they exert a strong influence on converting consumers. For instance, Li Jiaqi recommended a Winona product on Double 11 in 2019, and within 10 seconds, 25k sets of that product were sold out. The data again proves the scale of influence these top KOLs have and why Winona chose to build valuable partnerships with them.

Source: Tik Tok; Li Jiaqi live streaming with Winona’s product

Problems: High price & single concept of “sensitive skin”

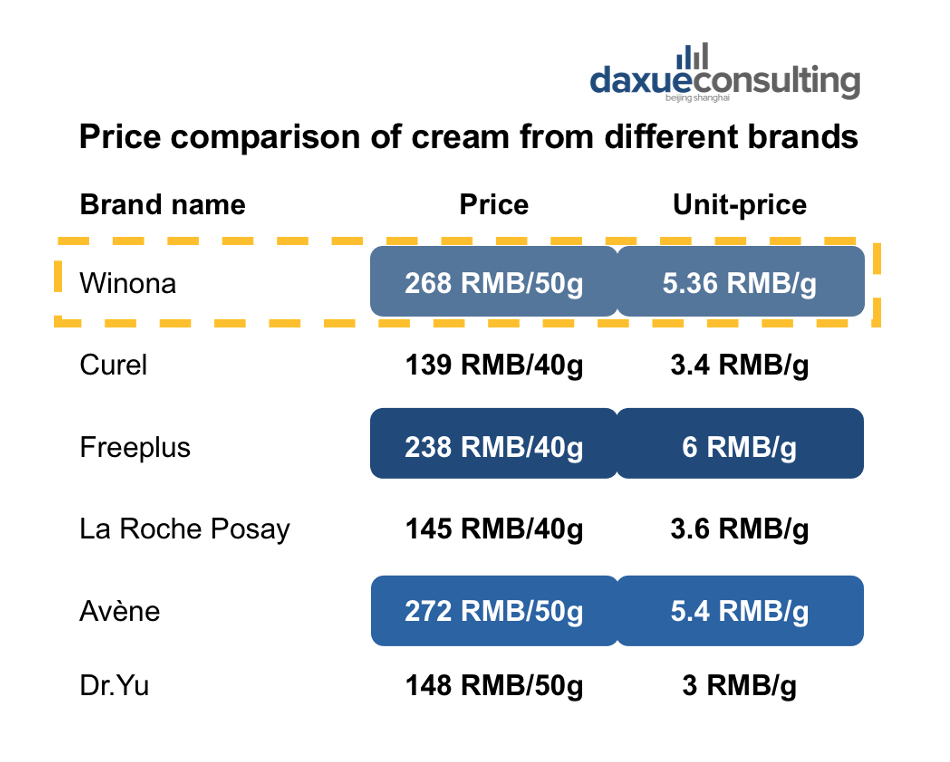

Among all the advantages that Winona is equipped with, there are still a few potential threats. Compared to other cosmeceutical skincare brands that also focus on treating sensitive skin, Winona has a relatively higher price. For instance, the average unit price for the cream product from other brands is around 3RMB/g while Winona’s unit price is over 5RMB/g. This pricing may be problematic since customers with a higher willingness to pay usually prefer products from bigger, more luxurious brands. Therefore, if Winona wants to target all consumers with sensitive skin issues, they could add additional benefits to create more value. Finally, a few questions that are crucial in shaping Winona’s future directions are worth digging into. How can Winona further develop with the concept of “sensitive skin repair” or “cosmeceuticals” and when “sensitive skincare” is no longer popular, how can Winona change the brand concept.

Data source: Double V. Training & Consultancy; daxue consulting, rising C-beauty brands report, price comparison of cream from different brands

What brands can learn from Winona’s China market strategy

- Brand concept and product packaging are straight-forward ways to build and convey a brand image. When many brands utilize complex and colorful marketing strategies like Guochao in their packaging, Winona’s packaging is plain and straightforward, contributing to its professional image.

- Businesses should always conduct customer and market research first before launching a product/service. Key point is to understand consumer need and provide products/services that can satisfy the need. Winona’s China market strategy includes narrowing down on one specific consumer niche, sensitive skin. However, this could also limit their market potential.

- When marketing products that are beyond average consumer knowledge, it is important to inform customers with more information about the product, including its components, functions, etc.

- Consumers are getting smarter and regard authoritative sources as more convincing. Therefore, businesses can leverage the impact of authoritative organizations or figures to increase consumer trust in the brand.

- Digital marketing is huge in today’s marketing world. Channels such as live stream can convert hesitant consumers and create enormous profits. Brands should consider building valuable partnerships with social media KOLs to achieve maximum influence.

The current state of the C-beauty market | Daxue Talks interview with Miro Li

Subscribe now!

Learn something new? Stay updated on the Chinese market by following our WeChat, scan the QR code below, or subscribe to our newsletter

See our report on the market strategies of C-beauty brands

Listen to over 100 China entrepreneur stories on China Paradigms, the China business podcast

Listen to China Paradigm on Apple Podcast