The outbreak of the COVID-19 pandemic in 2019 and the consequent containment measures have forced consumers to stay at home, as a result, shopping habits significantly shifted. Indeed, the pandemic accelerated health awareness in China: fitness and weight have become some of the hottest topics on social media platforms like Weibo, Douyin, Xiaohongshu, and WeChat, while top-tier cities like Shanghai and Beijing have seen a major trend in detox, juice cleansing, and healthy foods. On the other hand, video games and Livestreaming saw explosive growth.

Download our report about the Zero-COVID lockdown’s long-term impact on Chinese consumption

Differences between the 2020 and 2022 COVID outbreaks in China

When China found itself at the center of a global pandemic that spread like wildfire, from the city of Wuhan to all corners of the country, then gradually all over the world, SARS-CoV-2 was still a mystery. What was known was that the virus attacked the host’s lungs, causing pneumonia and, in the worst case, the patient’s death. The first strain of the virus was deadlier than the current Omicron variant where people were also not vaccinated. According to the official narrative, the 2020 stay-at-home measures were essential in order to prevent the spread of the virus to the rest of the world, with an effective 90% decline in the number of new cases. In contrast, during the recent wave of lockdowns in China, although more contagious but less harmful, 87% of the population in China is fully vaccinated, thus raising some criticism for heavy government intervention since the rest of the world decided to co-exist with the virus instead. Nevertheless, the central government seems determined to go on with the Zero-COVID strategy and converted it into an ideological battlefield.

Zero-COVID’s impact on GDP

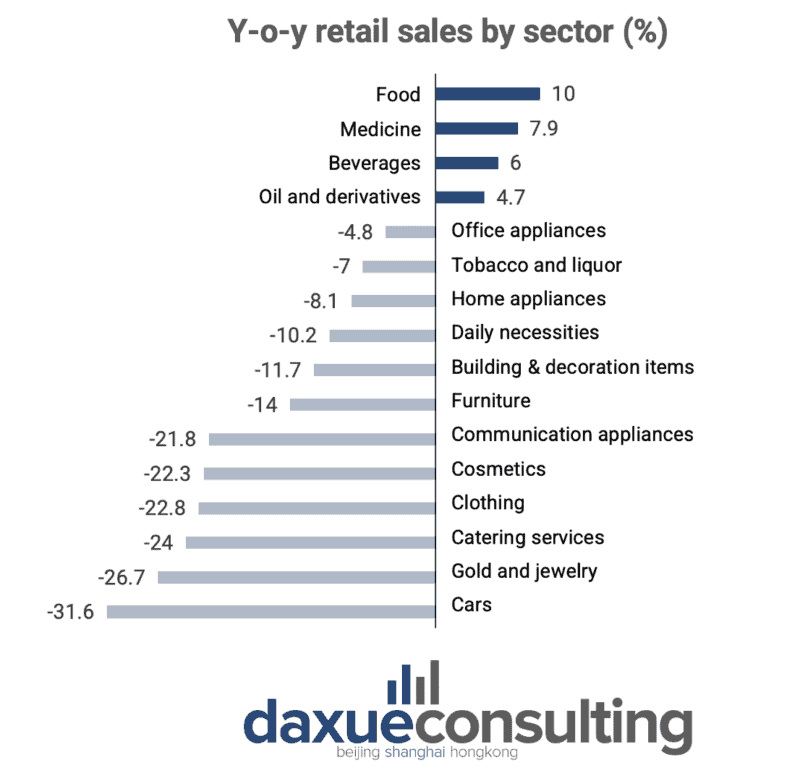

Beyond irritating some of the citizens, the recent wave of lockdowns is putting a strain on the national economy and the 5.5% GDP target growth rate appears to be an increasingly distant goal. As people are asked to stay at home and with factories and stores being shut down, China’s domestic consumption and export are declining, thereby posing a threat to the dual circulation strategy. China’s new economic model aimed at breaking the national dependence on exports. However, despite retail, entertainment, tourism, and hospitality being the most affected industries, netizens have shown clear intent on revenge shopping and traveling once lockdowns lift, thus giving hope for a recovery in consumption.

Our 7 hypotheses on Zero-COVID’s impact on Chinese consumption

As lockdowns continue nationwide, we observe some evolving dynamics and changing consumer habits, from group-buying to online counseling, and less demand for inconspicuous luxury products to growing demand for pet ownership. What should brands be aware of once China returns to normality? Did any industries benefit from the lockdown? Which industries are likely to continue prospering and who is at risk once the pandemic is over? Daxue Consulting investigated seven hypotheses on the impacts of Chinese consumption caused by recent lockdowns, from short to medium to long-term effects.

1. Lockdowns are likely to continue on a city-by-city basis, but there will be differences between high-tier and low-tier cities

Despite the high vaccination rate in China, stay-at-home orders have proven to lower the transmission rate from the 2020 outbreak, as a result, lockdown measures are likely to continue on a city-by-city basis, with different tier systems.

2. The economic situation launches luxury spending into a new phase focused on value and inconspicuousness.

The launch of the common prosperity campaign, along with growing social inequalities due to the pandemic, is discouraging Chinese high-income people from flaunting their wealth, thus pushing them to favor discreet luxury brands. Furthermore, recent lockdowns are mainly disrupting Tier-1 cities, therefore, brands are likely to expand into lower-tier cities in the near future.

3. Lockdowns are going to accelerate the China+1 strategy while providing the opportunity to move up the value chain

As lockdowns have disrupted the production and manufacturing of goods, Southeast Asian countries are going to be the most popular destinations for Foreign Direct Investments diverted from China, with over 180 global companies being affected in the first quarter of 2022.

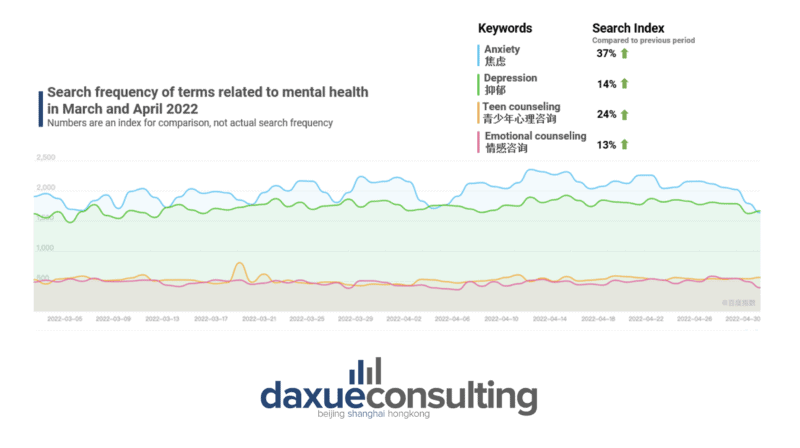

4. Rising mental health issues due to prolonged lockdowns are pushing China’s mental health industry to mature

Due to recent lockdowns, more and more people downloaded mental health apps on their smartphones. Meanwhile, searches frequency of terms relating to mental health throughout March and April 2022 recorded an increase as well, thus creating opportunities in the mindfulness economy, such as meditation and yoga classes.

5. Group-buying will continue to rise in the long run even when the pandemic is over

Once confined in lower-tier cities and rural areas, group-buying has now landed in higher-tier cities as well. Due to its cost-effectiveness, community-building effect, and better quality of products, group-buying is likely to stay even when all restrictions have been lifted.

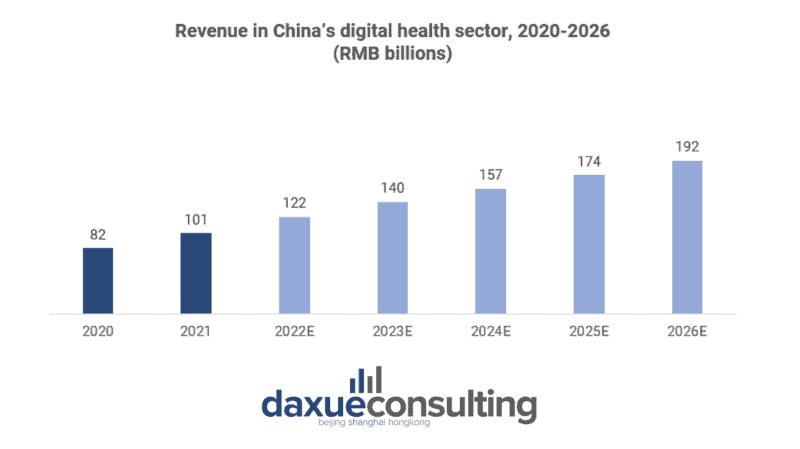

6. Digitization will reach new heights as consumers seek experiences from the comfort of their homes

Gaming, livestreaming, and ecommerce were not the only winning industries during the lockdown. In fact, healthcare, fitness, and food recipe apps also saw an increase in demand. However, some sectors may lose newly acquired users once people return to normalcy.

7. The single economy is reshaping China’s consumption landscape as lockdowns extend

COVID-19 led to a decline in marriage rate and a spike in divorce rate, triggering a rise in the single population. Isolation and health concerns are boosting pet ownership and solo traveling, as well as untapping opportunities for single-oriented industries.

Takeaways from the impact of the Zero-COVID strategy on Chinese consumer habits

As Chinese consumers are forced to stay at home and consumption moves online, this creates opportunities for foreign brands to explore new ways to engage with consumers and enhance their digitization efforts. Investing time and resources to show empathy toward Chinese consumers may also generate great returns in the long run.