Every consumer is familiar with having to choose between what’s tempting and what’s good for them. Many terms can be used to describe this conundrum, such as “inspirational vs aspirational” consumption or short-term vs long-term gratification. But the core of these two conflicting forces is the temptation of a dopamine hit vs. the satisfaction of serotonin. Another way to think of this concept is “sprinters” vs “marathoners”. Chinese consumers are currently undergoing a massive shift from being sprinters to marathoners. Brands that market to dopamine-driven “sprinters” can enjoy quick, trend-driven success, but must invest in continuously staying on-trend for long-term success. On the other hand, brands that market to aspirational, serotonin-aligned “marathoners” can enjoy sustainable success by focusing on product quality and a meaningful brand image.

The finish line is moving: Chinese consumers want long-term satisfaction

During the 2000s and early 2010s, when China’s GDP growth maintained well above 5%, and consumption trends were riding on a high of consumer confidence, the blueprint for commercial success in China was clear: target the impulsive, status-hungry consumer. Brands raced to create hype, capitalizing on the fleeting trends of social media. The consumers of this time were enjoying their newfound financial wealth, chasing the immediate rush of a new purchase and the social validation it brought.

But in this new economy with more sophisticated consumers and lower consumer confidence, the race has changed. A more resilient, aspirational, and valuable consumer is emerging: the Marathoner. This segment is not chasing a quick high but pursuing sustained fulfillment, driven by a serotonin-based reward system that values health, stability, and meaning. This shift drives experience-based consumption such as outbound travel, which in the first half of 2025 exceeded 2019’s pre-pandemic levels.

However, while there’s a shift happening from sprinters to marathoners, it’s still important to understand both archetypes. All consumers have been in both their lifetime, brands will interact with both, and lastly, both consumer types can be fruitful. What’s crucial for brands in China is to align who they are targeting and why.

Meet the “sprinter” consumer in China

The Sprinter is characterized by impulsive, image-led consumption. Their purchasing decisions are heavily influenced by the desire for external validation and instant gratification. The sprinter is the stereotype of status-driven Chinese consumers of a decade ago, but seeing all consumers as sprinters now would be outdated.

- Motivation: Social status, trendiness, fear of missing out (FOMO).

- Behavior: Loyal to brands as symbols (e.g., luxury logos, latest edition of smartphone), highly engaged with short-video platforms like Douyin, and primary users of instant delivery services. Fitness, for a Sprinter, is often about aesthetics, such as the “Instagrammable” gym selfie rather than genuine well-being.

- Dopamine-driven: This neurotransmitter is associated with the pleasure of seeking and anticipating a reward. The thrill of the hunt and the quick hit of a new purchase define the Sprinter’s cycle.

Meet the “marathoner” consumer in China

The Marathoner represents a more mature, introspective consumer. They are focused on long-term goals, functional value, and internal fulfillment. Their consumption is an investment in a better life.

- Motivation: Health, longevity, personal growth, quality, and sustainability.

- Behavior: Researches products extensively (ingredients, materials, technology), prefers functional apparel over fast fashion, and engages in activities like hiking, cycling, and meditation for their intrinsic benefits. They are the core audience of deep-dive content on Xiaohongshu (AKA Red Note).

- Serotonin-pursuing: This chemical is linked to feelings of happiness, well-being, and stable mood. It’s not about the chase, but the contentment derived from a wise choice that contributes to a meaningful life.

The macro-drivers fueling the rise of the Marathoner

This is not a fleeting trend, but a deep-rooted movement catalyzed by powerful socio-economic forces.

The “common prosperity” mandate and the following cultural recalibration: The government’s focus on social equity has made overt displays of wealth less socially desirable. Conspicuous consumption is now seen as tactless. It is shifting the definition of aspiration from “showing off” to “showing up”, for one’s family, health, and community.

Increased focus and attention on health: Health is synonymous with the Marathoner consumer’s desired lifestyle, and China’s government initiatives like the Healthy China 2030 are adding force to this shift. The government has an ambition to reach a regular physical exercise participation rate of 38.5% in 2025 and 45% in 2035. Moreover, consumer spending habits are in alignment. In the August 2025 release of the Government’s Total Retail Sales of Consumer Goods report, Sports and Recreational Articles was, once again, one of the fastest growing categories, at 16.9% growth year-on-year.

Economic prudence in an era of uncertainty: With economic headwinds and a volatile job market, Chinese consumers are becoming more cautious with their spending and seeking out products that bring value for money. The Marathoner’s mindset is a natural adaptation: investing in high-quality, durable products that offer long-term value is simply smarter than frequently buying cheap, trendy items.

How to engage the Marathoner consumer in China

To win the loyalty of the Marathoner, brands must move beyond traditional marketing and speak a new language built on the following cultural codes.

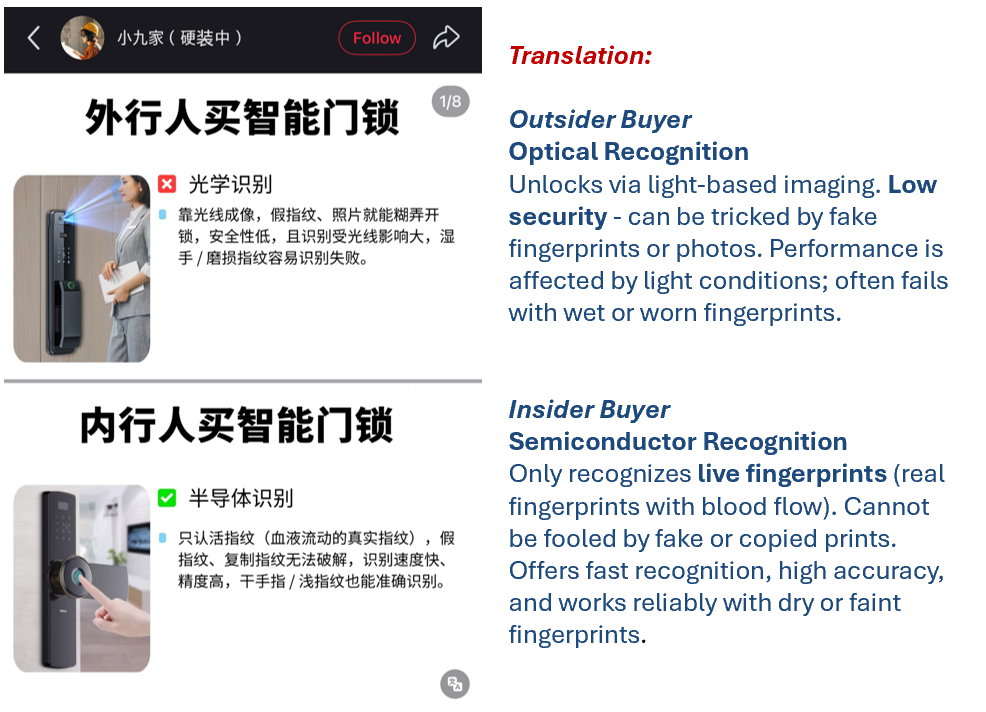

“内行” (Nèiháng) – The Informed Insider

The Marathoner trusts their own research above all. When it comes to the products they love, they see themselves as “Insiders” who delve into product specs, material science, and brand heritage. On their journey to becoming insiders, they only listen to those who have proven to be true insiders and flock to Xiaohongshu for detailed reviews and value technical transparency. The desire to be an insider is also what drives the interest in “niche” (小众) brands in China across a range of product categories.

The “skintellectuals” (成分党) in China’s skincare market were an early example of informed insiders. Now this way of thinking has spread to all industries, especially those related to health and longevity, such as China’s sports market.

Brands in China can reach the informed insider consumer by shifting from selling an image to educating on why their product is superior. Showcase technology, craftsmanship, and innovation. The bottom line is that the product must perform. A sports brand should explain the biomechanics of its sole (which is the tactic of Hoka). A food brand should highlight its sourcing and nutritional science.

“踏实” (Tāshi) – Grounded Substance

In a world of noise, the Marathoner seeks stability and reliability. “Tashi” embodies a sense of grounded, substantial quality. It’s the antithesis of flashy trends and represents something genuinely good, trustworthy, and built to last.

Brands can reach the grounded, practical consumers in China by positioning their brand as a reliable partner in the consumer’s long-term journey. Emphasize durability, timeless design, and consistent performance. A brand that embodies “Tashi” becomes a staple, not a novelty, earning deep trust and repeat purchases. While the fast-fashion industry is the perfect example of “sprinter” or trend-chasing consumption, Uniqlo stands out in China for its reliability and consistent quality.

“圈层认同” (Quāncéng Rèntóng) – Tribal Affinity

Marathoners find motivation and identity through niche communities, their “tribes”. This could be a local running club, a dedicated hiking group, or an online community for sustainable living. Their purchasing decisions are heavily influenced by these circles of trust.

Brands can reach marathoner consumers through tribe marketing in China. It’s increasingly important for brands to invest in building and nurturing authentic communities. Partner with expert Key Opinion Leaders (KOLs), sponsor local events, and create platforms for customers to connect.

Chinese consumers are changing; it’s time for brands to adapt

The brands that dominated China’s consumer boom by catering to the Sprinter now face a pivotal choice: adapt or decline. Adapting to the long-term focused Marathoner consumers is not the right choice for all brands, as there will always be a consumer base for novelty and trend chasing. However, the future of consumption belongs to the consumer who values substance over status, longevity over novelty, and meaning over momentary hype.

Is your brand’s strategy built for a sprint or a marathon? Contact Daxue Consulting at dx@daxueconsulting.com to gain the deep, actionable insights needed to connect with the evolving Chinese consumer and build a legacy brand for the decade ahead.