Chinese new retail

Alibaba, JD and Tencent are well-known Chinese tech giants. They’re also Chinese New Retail giants

What is New Retail? It’s a consumer-centric, data-driven approach that merges online and offline interactions as well as elements of traditional retail, social media and entertainment in the shopping experience. It not only improves shopping for customers but also saves retailers time and money as logistics and supply chains behind the scenes are also optimized.

All three companies are rapidly expanding their reach with internationalization plans, setting their sights on serving consumers and businesses globally. They’ve gone into other countries under their own banner, through acquisitions of local enterprises and also as a technical support provider.

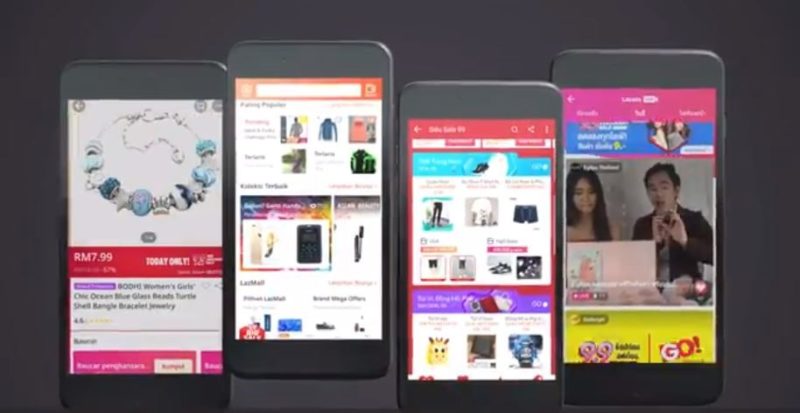

For example, after its acquisition of Lazada, a Southeast Asian e-commerce retailer, Alibaba integrated its China-based products and services into Lazada’s ecosystem, as well as its Cainiao logistics network.

In addition to going outside of China themselves, they’re also increasingly welcoming foreign brands to their platforms in China. On June 26th, Tmall Global launched an English portal to simplify the process for foreign brands to join their Chinese language platform that sells international brands within China. Within a week, according to Tmall Global statistics, they received over 300 applications from all over the world.

“As the global market merges, each country’s e-commerce will increase its acquisition and expansion speeds. Buying from global companies and selling to global companies will eventually become normal.” — Qian Fangli, director of the Ministry of Commerce’s Department of Electronic Commerce and Information Technology

Why are international brands cooperating with China’s tech giants?

It’s nearly impossible to go it alone when doing New Retail in China. Data and its collection, which New Retail depends on, is mainly in the hands of technology giants such as Alibaba, JD.com, Tencent and some smaller e-commerce platforms such as RED, Pinduoduo and others.

Ella Kidron, International Communications Senior Manager at JD.com, says that the Chinese New Retail giant “has a vast amount of insight into consumer behavior and consumer preferences. We open up these resources to our brand partners. Brands can have access to a range of marketing resources.”

These marketing resources enable brands to analyze their customers’ preferences and customize products to boost their sales. This is one of the reasons why more and more brands are joining Chinese commerce platforms and embracing China’s tech giants.

What does a New Retail partnership between an international brand and a local player in China look like? Uniqlo’s partnership with Taobao provides an example.

Since 2016’s 11.11 Shopping Festival, Uniqlo’s “Buy online, Pick up in store” policy has been integrated into both its Tmall e-commerce and brick-and-mortar operations, making things much more convenient for shoppers.

Uniqlo’s offline stock data is connected with its online Tmall shop allowing accurate stock numbers across both platforms. Over 500 Uniqlo brick and mortar stores in more than 100 cities keep their stock changes in sync with their Tmall shop in real-time.

By cooperating with Tmall, Uniqlo provides a seamless shopping experience for their customers and avoid issues of insufficient or surplus stock.

“New Retail is a very broad concept. In different industries and enterprises, it has different business models. You will only do well in New Retail when you understand what your customers want. ” — Jalin Wu, the CMO of Uniqlo in Greater China

What role does social media play in Chinese New Retail?

When Jack Ma introduced the term New Retail in 2016, he envisioned a consumer-centered model that somewhat reversed traditional B2C business models. But many brands aren’t prepared for these changes.

A customer-oriented model needs constant user feedback and comprehensive data to help brands make decisions and update their products and services. Social media and other communities can also be a good source for this feedback and help brands understand and engage with their customers.

One Zone is a new Chinese retailer that specializes in home and lifestyle items, health and beauty products, digital accessories, snack foods and a variety of other consumer goods. It’s famous for its New Retail strategies. Let’s take a look at some of them.

In its physical store in Shanghai, there’s a QR code at the cashier and people are encouraged to scan it and join the store’s WeChat member group to get coupons and other benefits.

They also have a WeChat mini program that provides a service called “No.1 House Manager”. It’s similar to Amazon’s now discontinued Dash service and helps customers to refill their One Zone products like towels, toothbrushes and slippers regularly. Once subscribed to the service, One Zone periodically sends products to the subscriber’s home. Customers not only enjoy the service but also build a relationship with and a loyalty to the brand.

Social media is one of the keys to winning in the New Retail era. It’s also clear that social media and e-commerce will become ever more intertwined in the future. Social New Retail is already here and set to grow.

Author: Ashley Galina Dudarenok

Additional research: Amy Cheung.

About the author

This article was authored by Ashley Galina Dudarenok an entrepreneur, professional speaker, bestselling author, vlogger, podcaster, media contributor and female entrepreneurship spokesperson. She is the founder of several startups, including social media agency Alarice and training company ChoZan. She runs the world’s largest vlog about China market, consumers and social media on YouTube and AshleyTalks.com.

Ashley’s third book New Retail: Born in China Going Global co-authored with Michael Zakkour is available on Amazon now.

Learn more about Ashley

Learn more about Ashley’s entrepreneurial journey on China Paradigm episode 28: How to use thought leadership and social media to accelerate your business in China. Listen on Spotify, SoundCloud, Apple Podcast or watch on Youtube.

Let China Paradigm have a positive economic impact on your business!

Listen to China Paradigm in iTunes