Clothes distribution in China is shifting from offline to online. Online platforms are increasingly sophisticated, and brands must evaluate which platforms have the highest return on investment. Luxury, fast fashion, foreign and domestic brands all have unique needs which can be met by different distribution channels. Despite consumers turning more to online channels, offline channels are not obsolete. In fact, they still serve as important sales and marketing channel.

Click to jump to sections of the guide on clothes distribution in China

China’s fashion market growth is not slowing anytime soon

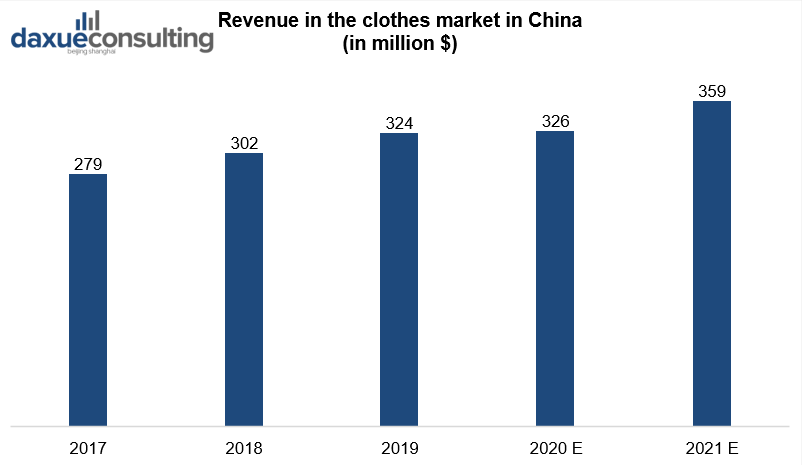

The fashion industry in China has performed well over the past five years. Industry revenue grew at an annualized 5% over the five years through 2019, to total $324 million. Forecast shows that the performance of clothes industry in China will increase to $359 million in 2021.

Data Source: Statista, Revenue in the clothes market in China

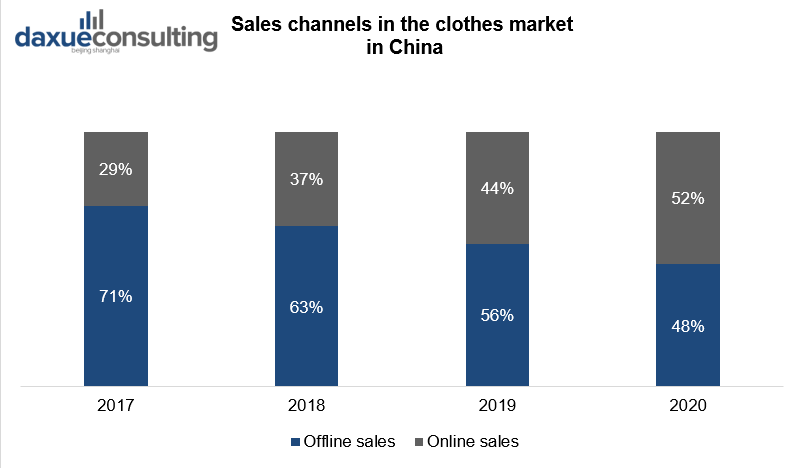

Clothing occupies 1/3 of all online shops. The three most popular e-commerce websites for clothes distribution in China are Taobao, Tmall and JD. Forecasts show that 52% of total revenue will come from online sales in 2020.

Data Source: Statista, Sales channels in the clothes market in China

Though offline channels attract less traffic than online, they play a more important role in the purchase stage, accounting for 60 percent of all transactions. Offline conversion is almost 4.5 times as high as online. Chinese consumers buy 43 percent of unbranded clothes online. However, they tend to buy branded clothes in physical retail stores. When it comes to branded clothes distribution in China, offline channels account for 80 percent of sales.

E-commerce market is an essential channel for clothes retail

Taobao and Tmall – the key e-commerce players for clothes distribution in China

There are three major types of clothes brands sold in Taobao: designer brands, commercial brands, and fast fashion brands. In recent years, international apparel brands have accelerated their expansion into the Chinese market. In general, Taobao targets the fast-fashion category of middle-income consumers seeking diversified fashion. For example, Zara is also developing rapidly in the Chinese e-commerce industry.

From the perspective of key brands, in December 2018, the online sales growth of most listed apparel companies continued to decline year-on-year mainly due to the fierce online competition.

Luxury clothing distribution on Tmall and Taobao

Luxury fashion has trouble differentiating from counterfeits on Taobao

There are no official stores of luxury brands on Taobao platform, as it focuses on fast-fashion. Besides, luxury brands worry about counterfeiters, which are hard to regulate on Taobao. In 2015 Gucci, Yves Saint Laurent and other brands filed a suit accusing Alibaba of being a conduit for counterfeiters. Starting in 2016 sellers of luxury products have to upload an invoice or authorization letter from the luxury brands, for examination by Taobao.

Tmall is an ideal alternative for luxury brands

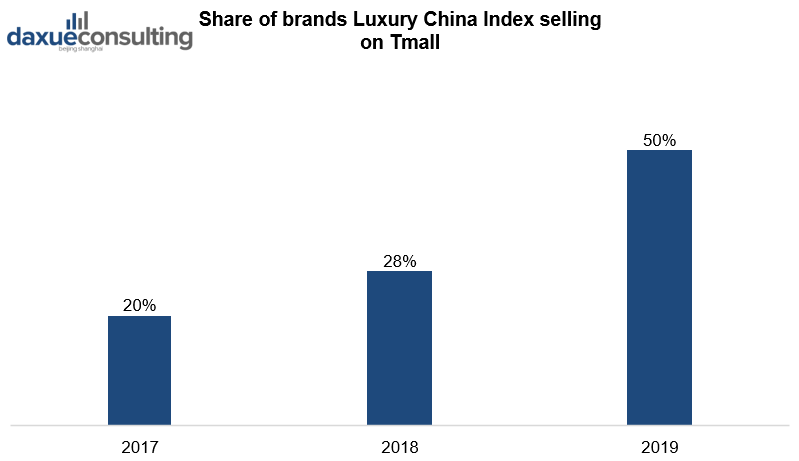

51% of 45 top global fashion brands now have official flagships on Tmall. It’s a big uptick from previous years. Luxury brands that now sell on Tmall include Valentino, Versace, Isabel Marant, Coach, Bottega Veneta, Givenchy, and Burberry. At the end of September 2019, online fashion retailer Net-a-Porter and its men’s site, Mr. Porter, opened a shop on Tmall too. They are offering more than 130 luxury and designer labels. However, luxury’s mega-brands, such as Louis Vuitton and Gucci, haven’t come around to Tmall just yet. But for independent brands and so-called affordable-luxury labels such as Coach and Michael Kors, the reach Tmall provides is particularly beneficial.

Data Source: Quartz, Share of brands Luxury China Index selling on Tmall

Fast fashion distribution on Tmall and Taobao

E-commerce accounted for 20% of Uniqlo’s sales in China accounted in the first half of 2020, an increase of 30% over the same period last year. The brand expects e-commerce to account for more than 30% of sales in the fiscal year of August 2021.

The growing middle class in China are mostly seasoned shoppers who have a long-standing relationship with online retailers like Taobao. If we look at top selling clothes brands on Taobao, Uniqlo occupied the top position in the brand store category. In 2019 on 12.12 they got around 5 million yuan revenue in one day.

Up to now, Tmall has attracted 90% of the world’s fast fashion brands. Taking Uniqlo as an example, the financial report released in 2018 showed that thanks to the strong growth of the Chinese e-commerce market, the performance exceeded expectations. Co-operation with Tmall brought Uniqlo space for lane change and overtaking. In 2019 during 11.11 festival after 16 minutes, the turnover was around 5 hundred million RMB. Uniqlo became the leading Tmall apparel brand.

Data Source: Zhiyi Technology, Top ten brand stores on Taobao

Does Tmall and Taobao have more domestic or foreign brands?

Domestic brands are key on Taobao

Despite that foreign brands started actively participating in selling on Taobao, domestic brands still play a key role. In 2019 among top 5 best-selling brands on Taobao during 12.12. festival four brands were Chinese. For example, Semir brand established in 1996, has become a leading brand in China’s casual clothing industry. It made around 600,000-yuan revenue during the 12.12 festival.

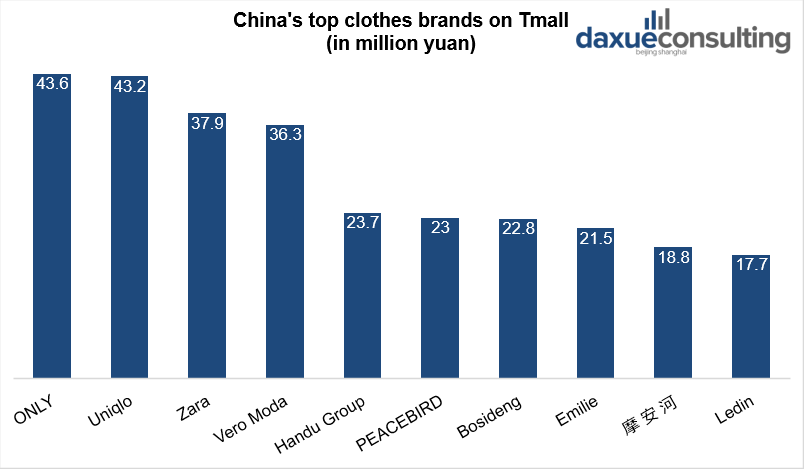

Unlike Taobao, Tmall’s top brands in terms of sales are mostly foreign brands. Good performance shows Handu Group. In April 2019, the number of followers of the HSTYLE Tmall Flagship Store exceeded 20 million.

Foreign brands turn to Tmall

Foreign brands like Levi’s, GAP and Uniqlo actively distribute through Taobao and Tmall. Adidas also established an online store on Taobao and Tmall. Adidas claimed while most of its sales still come from offline stores, the company’s online sales in the country has seen rapid growth.

Tmall has become the core position of global brands in the Chinese market. According to Tmall data, the number of global brands that have entered Tmall has exceeded 50,000. Such foreign brands as Uniqlo, ZARA and Monki participated in Spring/Summer Tmall Fashion show, bringing nearly one million new products to the Chinese clothes market.

Data Source: Yunguan data, China’s top clothes brands on Tmall

Clothing distribution on JD.com

The data shows that JD.com clothes industry went online in 2011. It became the second largest occupant of clothes categories in China’s B2C market in 2014. It has now become one of JD.com’s fastest-growing categories. JD.com’s key brand layout has attracted many well-known international and domestic brands to settle in.

Luxury fashion: JD can help with brand awareness, but not all brands use it

Louis Vuitton Group has no official store on JD platform. However, other luxury brands in China actively cooperate with this e-commerce giant. In 2017 JD.com and Farfetch announced a strategic partnership that created the premier platform for luxury e-commerce across China. Farfetch has well-established operations in China and is already the partner of choice for 200 luxury brands. JD will help drive further brand awareness, traffic and sales for Farfetch in the market. Such brands as Armani, Swarovski and Zenith have their official stores on JD platform.

Fast fashion is not a focus of JD

As JD.com initially specialized in tech, there are not so many fast-fashion brands on the platform. The key players are Vero Moda and Only. From the brand lineup, JD.com bags, watches and jewelry account for a higher proportion, while Tmall focuses on clothing and beauty.

Domestic vs. foreign brands on JD

According to JD’s clothing brand ranking, domestic brands prevail in different categories of clothing. Taking the category of “women’s dresses” as an example, we can see that the top 5 products are Chinese brands.

Source: JD.com, Top 5 products in “women’s dress” category

Pinduoduo – discounted clothing with group buying

Founded in 2015, the Chinese e-commerce platform Pinduoduo offers a wide range of products from daily groceries to home appliances. Counting 536.3 million active buyers and 7 billion products sold in the first half of 2019, the platform is essential for retailers and brands. When looking at a product, users have two price options, a standard price to buy directly and a discounted price. Discounted prices are unlocked when users form ‘teams’ of at least two buyers.

Luxury fashion slowly join Pinduoduo

For most brands, Pinduoduo is not going to be as good of a fit as a platform like Tmall or JD.com. This is particularly true for premium or luxury brands, which after years of resistance have turned in droves to Tmall’s Luxury Pavilion but are as resistant to discounting and promotions in China as they are elsewhere. However, in 2018 such luxury brands as Armani and Givenchy joined the platform. It can give other luxury brands in China an impulse to cooperate with Pinduoduo.

Brand owned channels

Brand.com is key for luxury

With higher platform fees and increasing user acquisition costs, only 10-20% brands are making profits on Tmall. Thus, building brand-owned ecommerce channels may be more worthy of investment. Besides, the issue of fake goods sold on public marketplace is a common concern of Chinese ecommerce consumers. Brand-independent ecommerce platforms in China can ensure brands full control on the whole retail process.

Louis Vuitton in China – like Gucci and Hermes – has ventured online but on its own terms. In 2017 it launched a standalone e-commerce site. The site will let customers buy Louis Vuitton leather goods, shoes, accessories, watches, jewelry, luggage and perfume. Vuitton is fiercely protective of its distribution as a means of controlling prices and supply.

Many fast-fashion brands using their own website for clothes distribution. For example, UNIQLO has its own web-based store in China. Customers can also receive the latest information including the weekly mail magazine and the latest UNIQLO campaigns. Customers will be able to choose from approximately 500 different items of UNIQLO mainstay products.

Using own website is more common for foreign than domestic brands

Most of global foreign websites such as Zara, Uniqlo, H&M, Nike, etc. have their brand-owned websites in China. For example, Zara in China launched an online store back in 2012. The website offers online shoppers the same full range of merchandise for women, men and kids as the one found in physical stores.

As Chinese companies are aware of rising costs of e-commerce in China, they actively distribute clothes using brand-owned websites. For example, Chinese company Peacebird launched a variety of sales models during Spring Festival, such as discounts and live broadcasts on its online shopping platform. It invited fans to “cloud shop”.

Social commerce in clothes distribution in China

Xiaohongshu- the fastest growing social media platform for shopping review

Xiaohongshu is a startup that’s part e-commerce portal and part social media platform. It also has its own e-commerce mall to which the posts on its site can link. The company is backed by Alibaba and Tencent, and has 220 million users. The top 10 content are the categories of “clothes”, “hairstyle”, “skincare”.

With the rising of Xiaohongshu many domestic brands started using it to achieve sales breakthroughs. For example, in June 2020 the domestic women’s clothing brand Zhizhi and the Orange Desire held a brand day event in Xiaohongshu. 12 different fashion bloggers shared live broadcast, promoting clothes of these brands. After this event, both brands saw rapid growth in sales.

Using hashtag “fitting room” on Xiaohongshu, most of results will show popular fashion bloggers taking photos of themselves trying on clothing in a store changing room. Zara, H&M, Uniqlo and COS are the most mentioned brands with fitting room hashtags. The article will give a description of the items, what the KOL did or didn’t like about them (such as material and fit), the prices, and which items the Chinese KOL suggests buying.

Source: Media Production, A typical ZARA fitting room try-on post

Luxury fashion use Xiaohongshu for brand awareness

Luxury brands like Dior and Chanel actively use Xiaohongshu to increase awareness. The number of mentions of luxury labels such as Hugo Boss and Max Mara by users has increased quickly on the platform. In 2017, users mentioned Chanel 2.24 million times, with Dior following after at 2.14 million mentions. Meanwhile, Hugo Boss recorded a 271 percent jump in mentions, with Bally and Max Mara both achieving growth of 133 percent.

Xiaohongshu shows fast growth in Fast-fashion

In 2019 the search volume of brand specific information on Double 11’s Eve brand has skyrocketed. In recent years, Uniqlo, a clothing brand that repeatedly created sales campaigns during the Double Eleven period, has also increased its search volume by 148% during this period.

Clothes brands embrace WeChat e-commerce

WeChat is a key channel for Luxury fashion

Since Louis Vuitton became the first luxury brand to open a WeChat public account in November 2012, other luxury brands have also rushed to open service numbers.

For example, on Chinese Valentine’s Day 2016, Dior launched an online customization campaign for its Lady Dior handbag. Users could choose the accessories for a small Lady Dior bag and directly purchase it using WeChat’s payment system or Alipay.

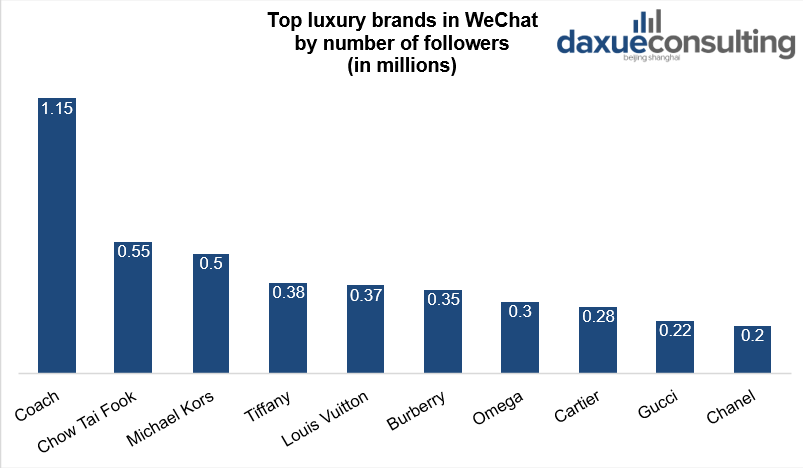

Data Source: LadyMax, Top luxury brands in WeChat by number of followers

Uniqlo set the pace of WeChat for Fast fashion

UNIQLO was the first brand to test the WeChat mini-program store in China. At the same time, it introduced smart shopping guides Xiaoyou and Xiaoyou Zongsha to provide consumers with a better-quality experience and make its omni-channel closed loop more complete, thereby targeting more consumers. Uniqlo has taken the lead in WeChat, a traffic pool with 1 billion users, and has introduced offline self-promotion and LED digitization in all e-commerce channels and physical stores.

Domestic brands

Domestic brands use WeChat to increase awareness and communicate with customers. According to statistics, such brands as Eichitoo and Li Ning have the best results in WeChat promotion of their clothes.

Data Source: Sino-Fashion, Top domestic clothes brands in WeChat

Foreign brands

Nike, Adidas, Tiffany&Co, H&M and many other foreign brands launched WeChat accounts in China in order to expand clothes distribution. Users are staying on WeChat more frequently and longer, but for domestic brands, it is easier to attract traffic, gain customers, and convert sales on WeChat. For foreign brands, wanting to enter the Chinese market towards it requires a lot of capital investment and months of account opening.

Offline stores still make 60% of the total transaction volume

Despite the enthusiasm of Chinese consumers for online shopping, most still prefer purchasing luxury products at bricks-and-mortar stores. These enable them to see, touch, feel and try out products. Besides, it helps to enjoy high-end customer experiences such as refreshments, invitations to private lounges, and other customized services.

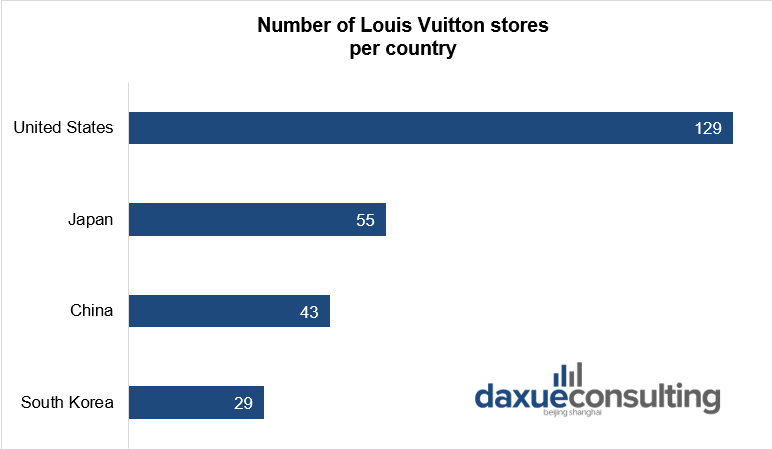

Particularly in the luxury sector, offline stores are still an important marketing and sales channel, where consumers are engaged in a highly experiential way through activities and events that reflect the brand image of the retailer. According to a report by Tencent, in 2017, 95% of luxury purchases were made offline versus merely 5% of luxury purchases done online. Taking Louis Vuitton as an example, China has the third place in the ranking of countries with the biggest number of LV physical stores. It shows the importance of physical clothes distribution in the Chinese luxury sector.

Data Source: Louis Vuitton, Number of Louis Vuitton stores per country

However, between 2015 and 2017, 138 new leading luxury brand stores were open in China, yet 144 stores were closed, therefore the aggregated number of the leading 20 luxury brand retail stores fell slightly down to 1,119 in 2017, compared to 1,125 shops in 2015. It can reflect the growing importance of the e-commerce in China, as more and more consumers choose to shop online.

Fast fashion brands continue to open offline stores

Companies with ambitious expansion plans include European company C&A Mode, which has more than 40 stores and plans to have 150. The Japanese brand Uniqlo, one of the first entrants into the scene of the fast fashion industry in China, plans to open 100 new fashion stores in China and already holds 2.4% of all apparel and retail footwear values.

Foreign fashion brands focus on offline ‘flagship stores’ in China

A number of players have expanded local store networks and launched their first/ largest global flagship store in the country. For example, in June 2019, Spanish fast fashion brand Mango signed a cooperation agreement with Hangzhou Jingzhe Clothing Co., Ltd. to accelerate its development in Asia, especially in the China market. Under this cooperation agreement, the brand will further develop both online and offline channels – it plans to open 16 physical stores in China.

Brand stores in China dominate in terms of clothes distribution in China

At the moment, in Asia – and in China in particular –mono-brands dominate the market. More precisely, 95% of the market in China is mono-brand retail stores. Adidas alone has 11,281 stores in China. The only exception in Asia is Japan, which already has a mature market. Nevertheless, the multi-brand trend is constantly evolving.

Multi-brand stores are rising in China

Department stores in China are still an important channel for clothing sales. According to the statistics, in 2005, the monthly sales of clothing in the top 100 shopping malls were 4.9 billion yuan. 44% of the total amount, with an average sale of 100 million yuan, indicating that despite the rapid development of the apparel wholesale markets in various regions, large department stores is still the main channel for clothes distribution.

COVID-19 impact on clothes distribution in China

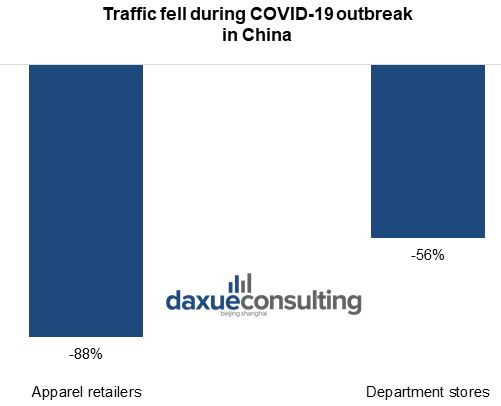

Data Source: McKinsey, Traffic fell during COVID-19 outbreak in China

COVID-19 outbreak in China influenced the clothes industry in China. Discretionary categories, such as food service outlets, apparel stores, and department stores were hit hard during the crisis and their recovery has been slow. Absolute traffic levels fell dramatically in all categories. Some 80 percent of apparel stores have reopened, but footfall in discretionary categories is still 40-50 percent below pre-COVID-19 levels. To engage with these dynamics, hard-hit categories such as apparel have ramped up their digital activities. In February, when coronavirus struck China hard, Taobao saw the number of livestream sessions on its app double. It is a sign to the e-commerce platform that brands are relying more on livestreaming to get customers.

Distribute through brand-owned channels – our Brand Independence in China report

Listen to 100 China entrepreneur stories on China Paradigms, the China business podcast

Listen to China Paradigm on Apple Podcast