In a country where tea is considered to be the national beverage, coffee had not high hopes to be positively accepted in the market, when it first entered in the 1980s. 30 years later, the situation has drastically changed: although consumption per capita is still low, China’s coffee market sales have skyrocketed in the last couple of years. Coffee is likely to become one of China’s favourite drinks.

When love for a product blooms, many chances come for new brands to get their piece of the cake.

How coffee consumption in China has grown over the years

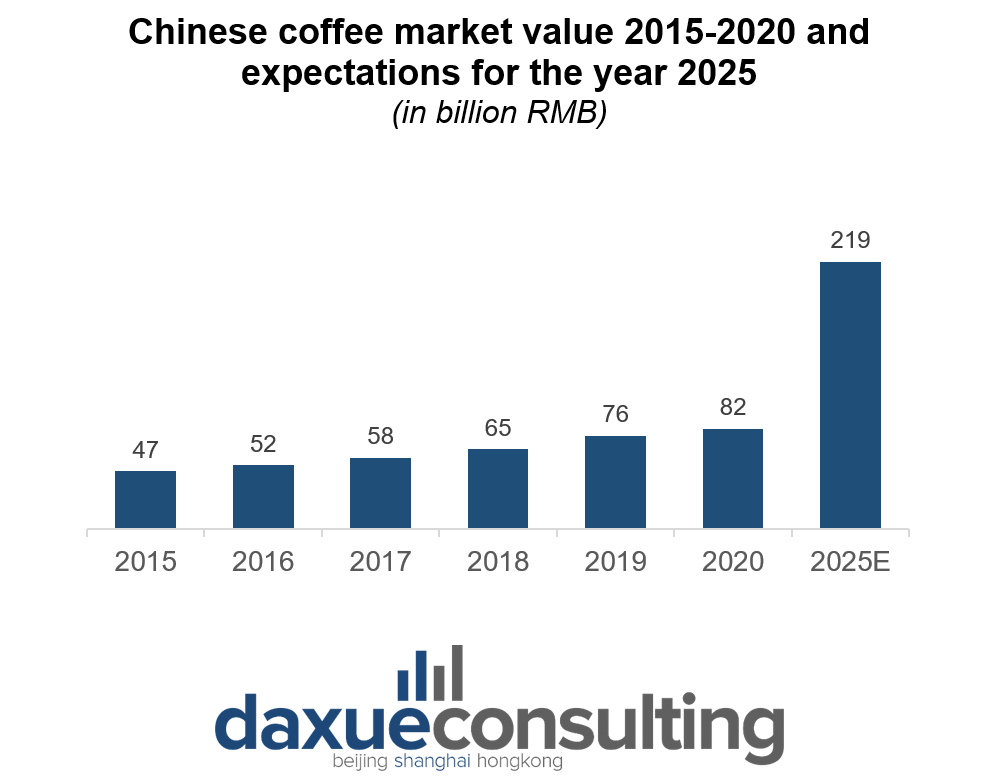

From 2015 to 2020, the Chinese coffee market’s value has almost doubled, going from RMB 47 billion in 2015 (around USD 7 billion) to RMB 82 billion in 2020 (around USD 12 billion). Considering the growth rate in this 5-year window, it is expected that China’s coffee market will reach a compound annual growth rate (CAGR) of 22%, thus rising to RMB 219 billion value (around USD 32 billion) by 2025.

China’s coffee market is vast and made up of different categories. The main ones are fresh ground coffee, ready-to-drink (RTD) coffee, and instant coffee. Instant coffee makes up more than 50% of the market share. Its popularity is owed to its low price and affordability, and increasingly more companies are deciding to launch their own instant coffee brands.

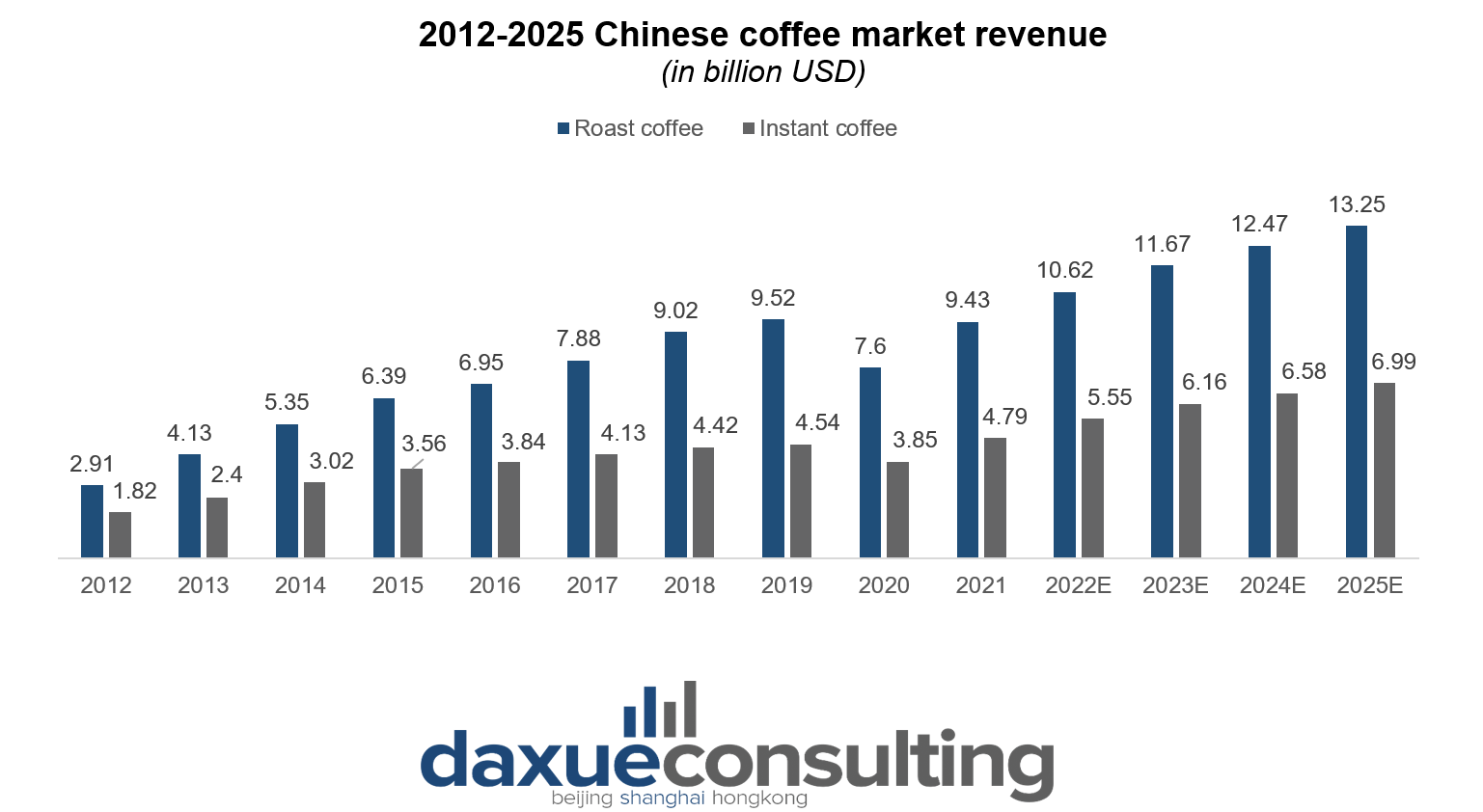

In recent years, coffee sales have skyrocketed. Data show that in 2012 roast coffee revenue was only USD 2.91 billion and instant coffee revenue was USD 1.82 billion. 9 years later, roast coffee revenue reached USD 9.43 billion and instant coffee revenue USD 4.79 billion.

New generations are the main coffee consumers in China

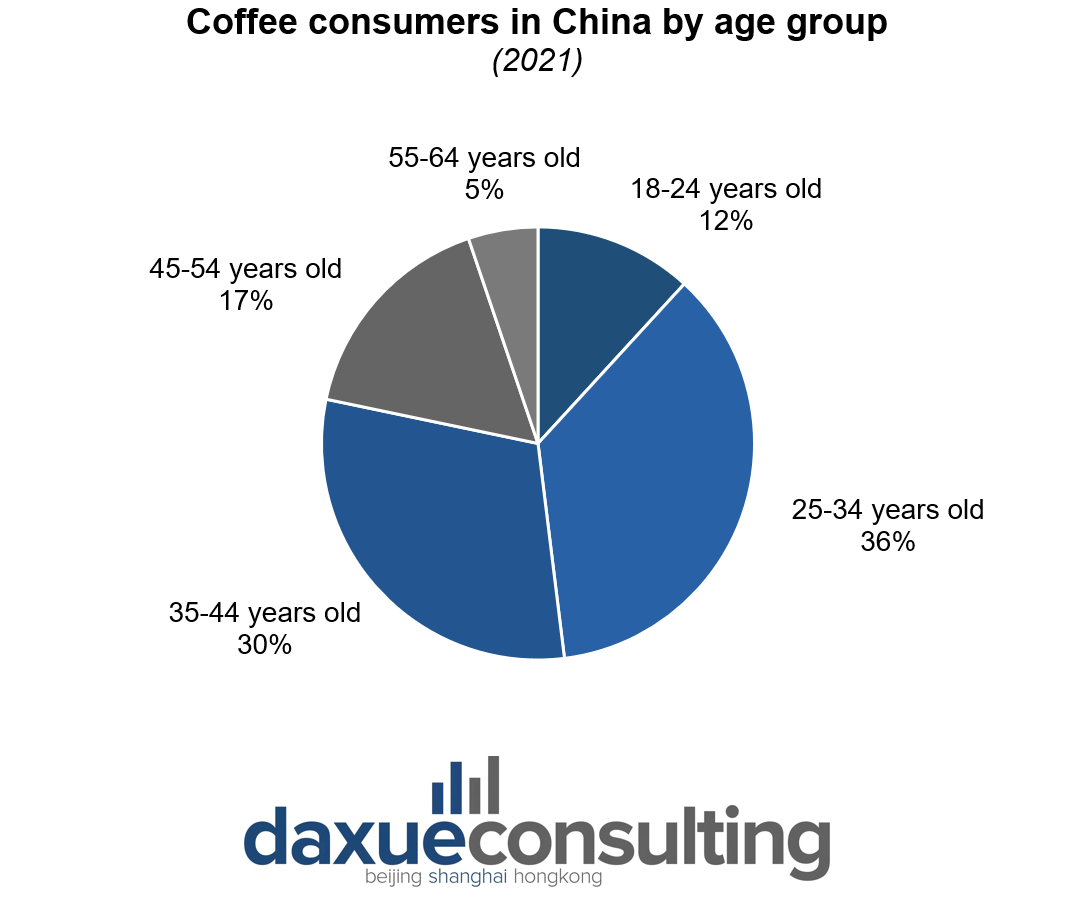

The coffee consumption per capita in China is still well behind European countries’ and the US’ standards. In 2021, it was only 9 cups a year, but it is expected to reach 10 cups by 2023. New generations are in fact growing fonder of the Western beverage: 36.2% of coffee consumers belong to the age range 25-34 years old, and 30.2% of coffee drinkers are between 35-44 years old.

Health awareness and social expectations influence coffee consumption in China

Following the COVID-19 epidemic, Chinese people give more importance to health issues. According to an iiMedia Research, 56.3% of the interviewed consumers are concerned about the fat percentage contained in coffee, while 55.3% of them drink it to relieve fatigue and 54.6% of them because it is good for metabolism.

Alongside the above-mentioned functional factors, other reasons for drinking coffee are the taste (54.4%), the refreshing and invigorating feeling you get after consuming it (46.7%), the coffee shop service and atmosphere (45.2%), and demonstrating to have a refined taste (38.4%).

In order to succeed in the Chinese context, it is important to combine functional and social factors and to take into account the dualistic dimension of the Chinese’s interests towards health and social activities.

The fierce competition brands have to face

China’s coffee market is extremely competitive. Even well-established brands like Nestlé and Starbucks need to fear the competition and cannot allow themselves to slack off in innovating their marketing tactics.

Fresh ground coffee

When talking about fresh ground coffee, Starbucks is the first one to come to mind.

As of February 2022, the American colossal had opened over 5,400 coffee shops in more than 200 cities, guaranteeing China’s position as its second-largest market after the US. In September 2022, Starbucks declared its intention to open 3,000 more shops in mainland China by 2025, bringing its presence across the country up to 9,000 shops. As of 2020, Starbucks had 36.4% of the fresh ground coffee market share, followed by the local brand Luckin Café (瑞幸咖啡), with 6.8%.

Luckin Café is Starbucks’s direct competitor: founded in 2017, within a few years it has rapidly increased its presence in the country and it has now surpassed the American multinational. As in the first period of 2022, Luckin Café counted 6,580 outlets in mainland China, against Starbucks’ 5,650.

In the third quarter of 2022, Starbucks registered a net revenue of almost USD 3 billion, an 18% decrease compared to the previous year, while Luckin Coffee, in the second quarter of the same year, recorded an increase of 72%, reaching USD 493.2 million. Although there is still a big gap between the two enterprises, it looks like Luckin coffee is giving it all to catch up.

Instant coffee

The leading company in the instant coffee market is the Swiss Nestlé, which was the first coffee company to enter China in the 1980s. With targeted campaigns and advertisements, Nestlé’s objective was to persuade Chinese consumers that instant coffee was a valuable alternative to tea. For years, it had ruled almost uncontested in the instant coffee market, but due to a lack of innovation, new local companies like Yongpu (永璞), Saturnbird (三顿半) and Tasgear (隅田川) emerged and are now catching up. In 2019, Saturnbird even surpassed Nestlé in sales on TMall.

These three new local companies identify young people as their target consumers. Their objective is to offer a healthy and high-quality instant coffee, in response to the new generation’s increasing attention towards health.

Innovative brands

In the saturated Chinese market, it is not unusual to stumble upon totally new and unconventional products. This is how the “fruit coffee” was first discovered, and since summer 2022 it has become more and more popular. On the popular platform Xiaohongshu (小红书), there are now roughly 700 thousand posts on the topic.

A well-received brand specialising in fresh fruit coffee is “There was no coffee” (本来不该有). Launched in September 2021. The company now has more than 600 stores in mainland China and expanded to Singapore. The founders of the brand wanted to fulfil young people’s requests of a healthy yet sweet coffee – and what better natural sweetener is there than fruit itself?

Are the tea and coffee market colliding?

Tea is known to be China’s national drink. As any product in the Chinese market, though, tea needs innovation too. Many brands that specialised in tea are now facing towards the coffee industry to offer new varieties of products. I am talking about CoCo, Nayuki’s Tea(奈雪的茶) and Hey Tea (喜茶).

For instance, Nayuki’s Tea launched its first mix of tea and coffee at the end of 2018 and then continued on the coffee track with fruit coffee products. At the end of 2020, it opened a new store called “Nayuki PRO” (奈雪PRO), offering even more coffee options.

The tea market meddling in the coffee business is no news: it is very common for tea companies to invest in coffee brands.

The quality of Yunnan’s coffee is likely to further improve in the next years

Domestic coffee production is located mainly in the south-western Yunnan region.

In 2020, the coffee beans plantation area in the Yunnan province was around 15 billion hectares, with a production of around 131 thousand kilos of coffee. 95% of the locally produced coffee comes from the Yunnan region, the rest 5% is from the Hainan and Fujian provinces.

When coffee production in China started in the late 1980s, the quality expectations for the beans were low. The aim of the financing was to produce cheap coffee to be mainly exported by foreign multinationals like Nestlé and Starbucks. However, in the 1990s Chinese farmers grew more interested in the specialised coffee market, and started cultivating the Catimor coffee kind, a hybrid of Caturra and Timor. Slowly, but steadily, the Yunnan coffee gained a new reputation for itself, and is now regarded as a good quality coffee, with a unique flavour.

Now, Yunnan coffee is especially popular in mainland China. When Luckin Coffee launched its “Yunnan Red Honey series”, millions of users shared photos and comments about it on Weibo, going viral.

The Chinese government measures to stimulate an expansion of the Coffee market

The Chinese government wants to bring the Yunnan high-quality coffee production up to 30% and to introduce new varieties of coffee. For this reason, it is investing and encouraging foreign investment on local plantations, as well as promoting new measures for a sustainable coffee production.

What you need to keep in mind about the Chinese coffee market

- Despite a difficult start in the 1980s, the coffee market in China is now stable and growing at a quick rate.

- China’s coffee market is expected to reach RMB 219 billion value by 2025 and will produce a USD 20 billion revenue, with a CAGR of 22%. Coffee consumption per capita is likely to reach 10 cups a year in 2023.

- New generations are the main consumers of the beverage. The highest percentage (66%) of coffee drinkers is between 25 to 44 years old.

- Health and sociality are influential factors in China’s coffee market: Chinese people drink coffee mainly because it relieves from fatigue, it is good for metabolism, and it shows they have a refined taste.

- The competition in the Chinese coffee market is extremely fierce. Although Nestlé and Starbucks have had a privileged position for years, the local company Luckin Coffee has now opened more shops than Starbucks in mainland China, while Nestlé was surpassed in sales by Saturnbird on TMall in 2019.

- New brands are emerging proposing original and unconventional ideas of coffee drinks. Since summer 2022, fresh fruit coffee has become extremely popular. Other tea brands like CoCo, Nayuki’s Tea and Hey Tea have also started to face towards the coffee industry to expand their market.

- China is both a producer and an exporter of coffee. Yunnan province accounts for 95% of the domestic demand of coffee and it exports mainly to Japan and Germany. The government is taking measures to improve the sustainability of local production and it is investing in an increase of specialised coffee plantations.

Author: Chiara M. Barbera

Learn about China’s Wine and Spirits

Listen to over 100 China entrepreneur stories on China Paradigms, the China business podcast

Listen to China Paradigm on Apple Podcast