The beauty industry covers a wide variety of categories such as personal products (cosmetics, skincare, hair care, fragrances), beauty appliances (hair dryers, brushes, combs), and services (salons, day spas, medical aesthetics).

On a global stage, China’s beauty industry is a force to be reckoned with. The country ranked second in terms of cosmetics market revenue in 2021, just behind the United States. Additionally, in 2022, China’s disposable income grew by 2.9% compared to the previous year, making it more important to understand the trend and market situation of its beauty industry.

What beauty companies need to know about China’s beauty standards

Understanding Chinese beauty standards is essential for beauty companies willing to enter the local skincare and makeup market, as they influence Chinese consumer behavior. Beauty standards in China are starkly different from Western countries, and they reflect historical and cultural factors.

Download our report on Chinese beauty consumer pain points

One of the most notable standards is pale skin. Porcelain complexion is often associated with a higher class. This social class division concept can be dated back to the dynasty era, when people who worked outdoors had darker skin than those who stayed indoors. To look as white as possible, local beauty consumers put significant effort to protect their skin from UV rays and buy products or undergo treatment aimed to brighten their skin tone.

Another beauty standard in China is big eyes, which is influenced by the Western world. Most Chinese naturally have slim, single-fold eyelids, while Westerners, on the other hand, often have large eyes with double lids, also known as double-eyelids. Mono-lid eyes look smaller when compared to double-eyelids, and therefore, are perceived as less attractive. Many people in China use makeup to create the illusion of a double-eyelids and bigger eyes. Double-eyelid plastic surgery is also one of the most common operations in China.

A small waist, a slim body, and a short height are considered desirable traits for women in China. The thinner a woman is, the better looking she is. As a result, this led to a high demand in weight control supplement market. Many “challenges” to demonstrate one’s thinness, such as the A4 challenge, popped up and became viral online.

Gen-Z is the main driver of China’s beauty industry

With a value of US$80 billion in 2021, China’s beauty and personal care industry is projected to grow by 5.41% annually from 2023 to 2027.

As of September 2022, Gen-Z accounted for the largest beauty consumer group and is demanding more skincare compared to other demographics. Moreover, the male segment in China is growing rapidly, outpacing the global average, with retail sales growing at a rate of 13.5% annually from 2016 to 2019, compared to the global average of 5.8%. In 2021, the male beauty market in China amounted to RMB9.9 billion (US$1.44 billion).

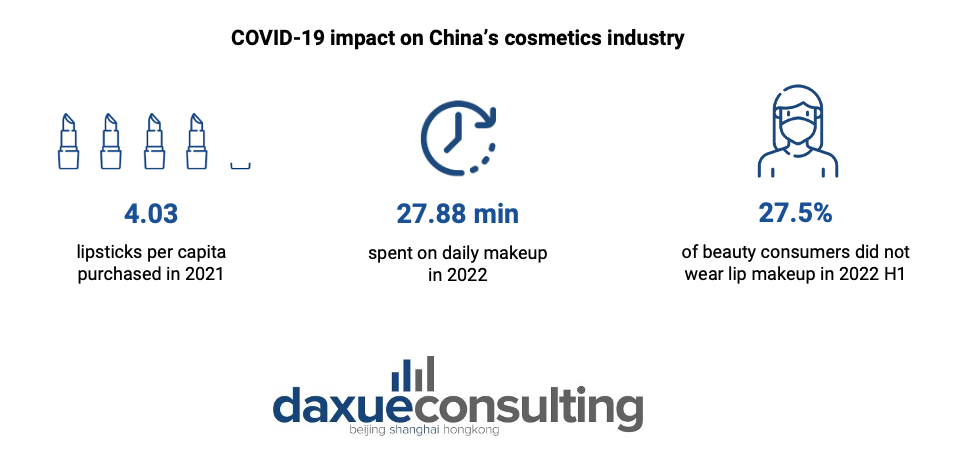

COVID-19 is changing China’s beauty industry’s landscape

COVID-19 affected the beauty industry in different ways depending on the category. The pandemic had a greater detrimental effect on cosmetics, while skincare and personal care products saw an increase in popularity during this time. In August 2022, facial masks, skincare sets, serums, lotions/creams, and electronic beauty devices represented the top five categories of beauty product sales on Douyin.

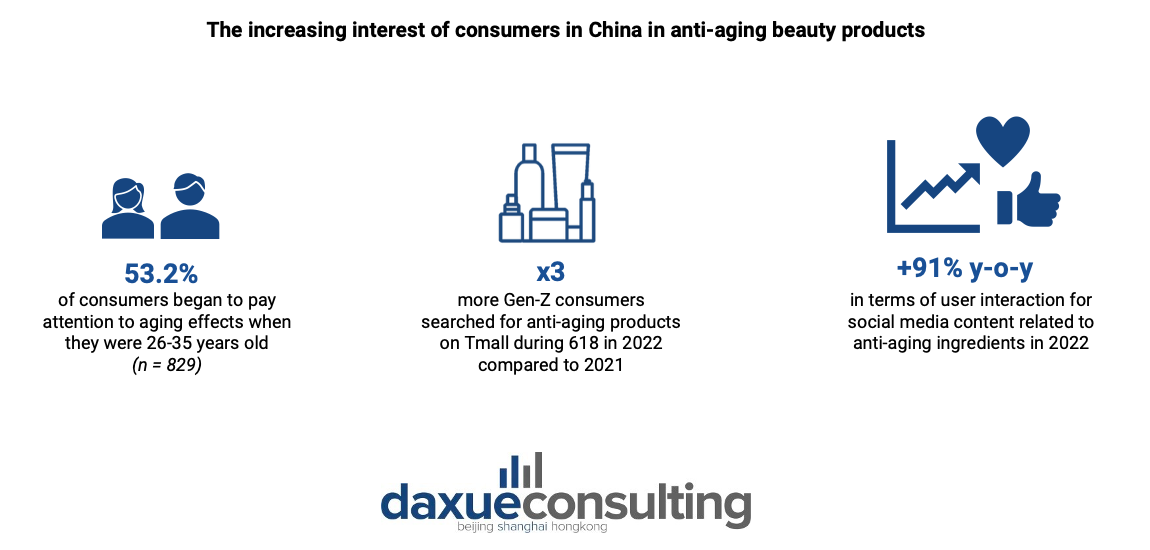

Products that feature “skin repair”, “basic skincare” and “first-aid care” have become more popular due to the damage caused by prolonged use of face masks. Gen-Z, particularly those born after 2005, have demonstrated a strong demand for eye essence, eye cream, and face masks, compared to other age groups.

During the pandemic, beauty and skincare also gained a strong psychological value. The search volume of emotional healing beauty and skincare videos on China’s famous video platform, Bilibili, increased by 8.4 times in 2021. Beauty brands have capitalized on this trend to attract younger consumers.

An in-depth look into China’s beauty industry’s segments

China’s cosmetics and skincare segment is becoming less price-sensitive

People in China are decreasing their number of makeup steps due to the pandemic. According to a survey by iiMedia, 50.7% of respondents simplified their makeup routines. Videos related to “mask makeup” also became popular. Lipsticks lost ground in the last two years due to the mask mandate. However, they still ranked within the top 3 most sold beauty products by Gen-Y and -Z on Douyin in 2021. Consumers are now paying an increasing amount of interest to eye makeup, including eye shadows.

Furthermore, the skincare segment in China became more quality-driven rather than price-driven. Chinese consumers are also paying greater attention to the product ingredients, which resulted in beauty marketers coining the term “skintellectuals”. There has also been a rising phenomenon of using terms like “anti-EMO”, “streamlined skincare”, and “mask makeup”, which has positively impacted the growth and consumption of the skincare industry in China. Moreover, the demand for anti-aging products has seen a significant rise in the last few years.

While there were no significant changes in the top 10 most successful domestic beauty brands during 11.11 2022, more local companies have reached the top 100 rankings for both skincare and cosmetics. The fact that professional cosmetics businesses made up the whole list of the top 10 makeup brands by revenue illustrate how important quality is to Chinese customers.

The role of Gen-Z in reshaping China’s perfume preferences

Gen-Z, is playing a significant role in transforming China’s fragrance market as well. Despite the low perfume penetration in the nation, it is anticipated that China will encounter an increase in demand for niche fragrances. This is largely due to the boost in sales rates facilitated by social media platforms.

Some of the most significant changes in the Chinese perfume market include the rise of domestic perfumeries, an increased focus on natural ingredients, and a greater emphasis on the emotional and psychological benefits of perfumes. Floral, citrusy, and woodsy are the fan-favorite fragrances among Chinese consumers.

Rising hair loss among young Chinese spurs the demand for hair care products

More and more young people in China are affected by hair loss. The average age of those experiencing hair loss is 30.1 years old, 20 years younger than the age at which those in the generation before them first noticed hair loss. Combined with the increasing per capita spending on personal care products, the demand for hair care products jumped.

Anti-hair loss shampoo is the most popular treatment in China as it is the first line of defense for young people with thinning hair. Meanwhile, people in the primary and mid-stage of hair loss use topical medication as a cost-effective and convenient solution. Medications featuring finasteride, spironolactone, and minoxidil becoming more prevalent.

Digitalization is playing a significant role in China’s beauty industry

Having a strong online presence is crucial for beauty brands. Combined with Chinese consumers’ appetite for technology and personalized recommendations, as well as the rapid growth of the lazy economy and the emergence of Gen-Z, investing in e-commerce solutions and at-home beauty devices is essential for beauty companies. The pandemic has led to a significant shift in consumer behavior, with more people turning to social media platforms for entertainment and shopping. This has increased the importance of incorporating live streams and KOLs into beauty brands’ marketing strategies to effectively reach their target audience.

Timage: blending Chinese and international makeup aesthetics for beauty in China

Timage is a Hangzhou-based cosmetic brand that combines both Chinese and international makeup aesthetics and focuses on offering cosmetics that meet the needs and standards for beauty in China.

Timage’s success in the Chinese market can be attributed to its strong omnichannel strategy, which includes a significant online presence via social media platforms Weibo and Douyin. Moreover, the company has collaborated with Key Opinion Leaders (KOLs) and TV shows to enhance its reach. In 2020, its products appeared about 77 times in Li Jiaqi’s live-streaming sessions and became the brand with the highest live sales volume between June and December of that same year. This strong online presence and its products specifically designed to cater to Chinese beauty consumers are the keys to Timage’s success in China.

Changing consumer habits: trends in the Chinese beauty market

- China’s beauty industry is growing fast and diversifying, as Gen-Z and male customers demand more skincare solutions.

- COVID-19 reshaped the local beauty industry: skincare enjoyed higher popularity while cosmetics were negatively influenced. Moreover, the pandemic boosted the psychological value of beauty and skincare and induced consumers to simplify their makeup routines.

- Young Chinese consumers pay greater attention to the functional power of cosmetics and skincare products, and therefore also to their ingredients and their role in the formulation.

- Chinese people are experiencing hair loss at a younger age, resulting in an increasing demand for hair-loss treatments.

- Local consumers crave customized recommendations and tailor-made products. Technology can help provide Chinese customers with a highly personalized experience, while at the same time offering a new purpose to offline beauty stores.

Author: Regina Sukwanto

Download our white paper on China’s beauty industry