The Chinese e-commerce platform market generated a staggering sales volume of RMB 15.5 trillion in 2024. This makes China the world’s largest e-commerce market. This flourishing market is growing steadily year on year, reaching an annual growth rate of 7.2% in 2024. Chinese consumers are pampered with a myriad of platforms to choose from, such as tech-giants (Alibaba) to the “lesser-known” ones like SMZMD.

Download the report on the She economy in China

Taobao: one of the biggest e-commerce platforms in China

Taobao, owned by Alibaba Group, is the biggest consumer-to-consumer (C2C) e-commerce platform in China. In 2024, the gross merchandise volume (GMV) exceeded RMB 5.2 trillion, an increase of RMB 800 million compared to 2023. Consumers are also extremely active, having an average of 200 million MAUs (Monthly Active Users) as of January 2025.

Since 2023, Taobao has launched the “top store list” (神店榜), a series of online shops that are often praised for their after-sales service, high quality of their products, and good reputation. Shops that receive this label obtain special benefits such as more visibility in the search results and better assistance service. This creates a sustainable ecosystem to maintain consumers’ trust and incentivize shop owners to improve.

How Taobao won over Gen Z with anime collabs

Millennials and Gen Z, born after 2000, are one of the main targets in Taobao’s marketing strategy. Since 2024, the Chinese e-commerce platform has collaborated with several anime and video games to launch a personalized collection.

A standout example is the “pain bag”, or itabag, which Olympian Quan Hongchan carries. The bag became a hot topic on social media platforms like RedNote during the 2024 Olympic Games. The topic registered more than 10.7 million posts as of April 2025. Catching the trend, over 25,000 related products are now available on Taobao.

T-mall: Same “parent”, different purposes

Tmall is the biggest business-to-consumer (B2C) e-commerce platform. Together with Taobao, the e-commerce platform’s sales revenue accounted for 45% of the total market in 2023. Despite being two platforms of the same big tech group (Alibaba), Tmall and Taobao share a few yet fundamental differences. While Taobao concentrates more on the variety of products and C2C commerce, Tmall focuses on official brands selling their products. Thus, the quality perceived by the consumer is higher. The presence of Tmall in the Chinese e-commerce scenario is growing stronger year-on-year, with an increase of 83% in vendors’ subscription to its site in 2024. Furthermore, foreign brands’ presence on Tmall is unmatched. As of 2025, the platform has gathered more than 40,000 brands from more than 90 countries.

From 90s to 00s: Why Tmall is betting big on paid memberships

Tmall wants to attract more post-90s and post-00 (Gen Z) consumers, as they represent the majority of online consumers. This consumer group accounted for 95.1% and 88.5%, respectively, as of June 2024.

Tmall launched special memberships such as VIP88 to attract repeat consumers. Launched on Taobao in 2018 and Tmall in 2024, VIP88 is Tmall’s most popular paid membership that offers personalized discounts and fixed lower prices at specific shops like Tmall Supermarket. As of November 2024, Tmall amassed more than 46 million VIP88 users, with an increase of 533% in post-00s consumers compared to the previous year, due to the price advantages compared to other platforms during popular e-commerce events such as the 618 festival.

Main difference between Taobao and Tmall

| Differences | Taobao | Tmall |

| Type of platform | B2B | C2C |

| Type of e-commerce strategy | Market | Shopping center |

| Strengths | Variety of products and low prices | Quality of products, official flagship stores |

| Weaknesses | A variety of products and low prices | Higher prices |

| Type of consumer | Price-sensitive | Quality-conscious |

| Supports VIP88 | Yes | Yes |

JD.com: Leveraging logistics and fast delivery

Founded in Beijing in 1998 and digitalized in 2004, JD.com (or 京东) is the biggest Chinese e-commerce platform for logistics providers and technology product retail. In 2024, the company’s net revenues accounted for RMB 1.1 trillion, increasing by 6.8% compared to 2023. JD.com can also be placed among the biggest e-commerce platforms in terms of MAUs, boasting more than 91.4 million monthly active users as of January 2025.

One of the core strengths of the platform is the capillary expansion of its logistics and delivery system, called “JINGDONG Logistics” or “JDL”. Established in 2017, the service consists of a wide network of plants and warehouses to facilitate and enhance the delivery time of the goods purchased on the platform. By the end of 2024, JD’s express delivery network employed over 300,000 delivery personnel and operated more than 1,600 warehouses across China and internationally. Its infrastructure enabled 90% of JD’s retail orders to be delivered within 24 hours nationwide.

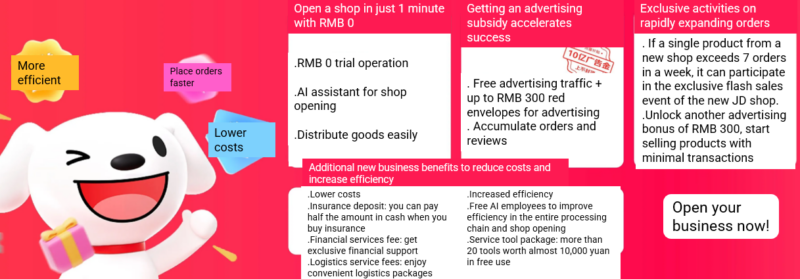

Apart from customer services, in March 2025, the company announced the “spring dawn plan” (春晓计划), allowing vendors to easily open their online shop. The plan consists of 3 phases: open an online shop during the free trial period, obtain subsidies to make products known to consumers, and participate in exclusive activities to boost sales. If a vendor achieves 7 sales in the first 7 days, its products are advertised in JD flash sales.

Taobao vs JD.com: After-sales service plays a key role

In the latest years, consumers have written some “guides” to help other users navigate these two platforms by avoiding scams, especially linked to after-sales services. Both JD.com and Taobao have introduced the option “return without a reason” respectively in 2017 and 2024. Within 7 days after the delivery, consumers can return their product, even if not damaged, and get a complete refund. However, the two platforms differed slightly: on JD.com, there are no strict rules on the refund, whereas on Taobao, the product must be intact.

Furthermore, the refund system is operated by vendors, who can also refuse to send money back to the consumer because the purchase has already been made. This is a hot topic on platforms like Weibo, in which consumers complain about the scarce after-sales service of Taobao. At the end of April 2025, the return without reason came to an end. The e-commerce platforms in China have mutually agreed to deactivate this option on their apps in order to avoid malice among vendors and consumers.

Pinduoduo: The most famous group buying platform

Pinduoduo operates as a group-buying platform, prioritizing bulk sales over individual consumer preferences. In 2024, the Chinese e-commerce giant reported revenue of RMB 108 billion, marking a growth of over 88% from the previous year. The company’s marketing strategy is built on a “consumer-to-manufacturer” model and offers two prices: a standard price for solo purchases and a lower group-buying price. This Chinese e-commerce platform is especially popular in rural China due to its low-priced products, which, thanks to its group-buying feature, are accessible even to low-budget consumers. In June 2024, the platform registered 695 million MAUs, and almost 307 million of them were young people and middle-aged men living in lower-tier cities.

Pinduoduo’s rural expansion

In 2024, Pinduoduo expressed the objective of enhancing this rural trend by launching the project “ e-commerce moving west” (电商西进). The mission consists of creating a wide logistics network to bring goods and items to Western, underserved regions like Tibet and Qinghai, and the service will be 100% free shipping. This is part of the strategy to focus on the sinking markets.

Going global: Temu’s rise in international markets

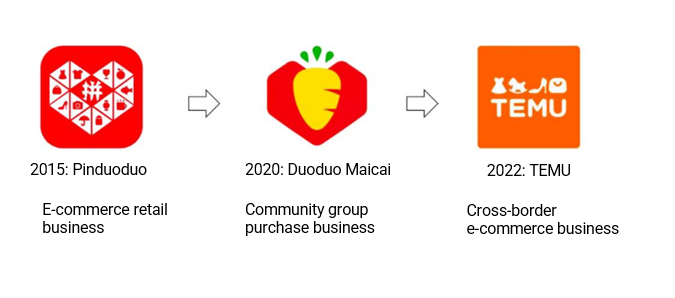

In September 2022, Pinduoduo Holding released Temu, an e-commerce platform for the foreign market. In 2024, Pinduoduo’s foreign counterpart, Temu, registered roughly RMB 515 billion in GMV, and 292 million MAUs worldwide. Apart from inland and foreign e-commerce platform, there is also another “Pinduoduo”: launched in 2020, the app is called “多多买菜” (Duoduo grocery shop).

However, despite the huge success, the app is struggling to keep up with other e-commerce platforms. In 2024, indeed, the GMV of Duoduo Maicai didn’t reach the expectation of RMB 400 billion and stagnated between RMB 300-350 billion.

Half social media, half e-commerce platforms: RedNote and Douyin

Born as social media platforms, RedNote and Douyin are competing among the biggest e-commerce platforms. RedNote (or Xiaohongshu) is a lifestyle-focused social media and e-commerce platform that is widely popular among young consumers in China. Indeed, as of February 2024, users under 24 years old accounted for 40% of the total base.

Livestreams are one of RedNote’s keys to popularity. Livestream shops were first launched on RedNote in mid-2019 and immediately reached immense success. In 2023, the transaction volume on these livestreams exceeded RMB 100 million. Other than livestreams, the platform heavily relies on consumers’ honest product reviews, so that others feel safer knowing what they are buying. Just as JD.com, the app introduced a support plan in 4 phases for new vendors. Firstly, vendors can freely open their “shop”, then they receive subsidies, free trials, and formation courses to enhance their activity. At the end of 2024, RedNote hosted more than 140,000 brands, both domestic and foreign.

Douyin: TikTok’s Chinese counterpart relies on algorithms and livestreams

Launched by Bytedance in 2016, Douyin rapidly gained popularity and became one of the most popular applications in China. As of September 2024, the platform had an average of 766 million MAUs. Like RedNote, Douyin consumers’ base is extremely young, with Gen Z representing the biggest user group. In total, users aged between 18 and 35 account for roughly 60% of the total app’s users.

The main strength of Douyin lies in its powerful algorithm that connects the social and the commercial parts. The last upgrade was launched at the beginning of 2025 and does not rely on hashtags and visuals of content. Instead, the algorithm uses neural network calculations, such as the probability of liking, to make predictions on what the user will watch, with the aid of artificial intelligence. In this way, the algorithm calculates a correlation between the user’s behaviour and type of content, without analysing the content itself, so that the pattern recognition process is faster. Douyin’s numerous e-commerce features granted huge popularity among users. The online purchase services became so popular that in 2024, they boasted RMB 3.5 trillion in gross margin value (GMV), an increase of 30% compared to the previous year. Livestreams are another crucial part of Douyin’s market positioning, whose sales accounted for RMB 659 billion in 2024. The livestream shopping not only benefits consumers, who can easily buy goods directly from the app without third parties, but also merchants, whose deposit costs and commissions have been reduced significantly.

Using AI for shopping: SMZMD

Apart from the usual e-commerce platforms in China, there are also many “underdogs” that are rapidly positioning themselves as important players. SMZDM (什么值得买) or “What’s worth buying” is an outstanding example. The e-commerce platform was launched in 2010 by “Beijing Worth Buy Co. Ltd”. Despite the slow rise at first, this e-commerce platform is consistently gaining popularity. In 2023, SMZDM registered RMB 950 million in revenue, increasing the previous year’s number by 7.5%. Consumers are increasing their presence on the app too, as in June 2024, the number of users reached roughly 30 million, with a year-on-year increase of 7%. One of the most innovative aspects brought by SMZMD lies in its unique way of doing shopping. In May 2024, What’s Worth Buying launched the AI Agent shopping assistant called “Xiaozhi“. The AI feature came with a wide variety of features, such as real-time price tracking, product advice, and a chatbot to which the consumer can communicate.

E-commerce platforms in China: An app for every need

- Taobao dominates China’s C2C e-commerce market by combining massive product variety, low prices, and fast delivery. Its strategy consists of focusing on customer service and a young customer base.

- Tmall is the biggest B2C e-commerce platform in China. Tmall differentiates itself with brand authenticity, premium product quality, and a growing focus on Gen Z consumers, enhanced by launching premium subscriptions such as VIP88.

- JD.com leads in logistics and tech-driven retail in China, offering rapid deliveries through its vast JDL network and supporting new merchants with its Spring Dawn Plan.

- Pinduoduo is particularly known for its “consumer-to-manufacturer”. In recent years, Pinduoduo has wanted to strengthen its rural base and enhance its delivery network to the remote parts of China.

- The lifestyle platform RedNote (Xiaohongshu) blends social media with e-commerce by leveraging peer reviews and livestreams to appeal to young consumers.

- Douyin integrates short video content with advanced algorithms and e-commerce services, especially through livestream shopping.

- SMZDM is carving out a niche in e-commerce platforms in China by combining consumer guidance and innovative AI tools like its “Xiaozhi” shopping assistant.