Chinese car market is one of the biggest and most developed markets in the world. In 2021, more than 26.7 million vehicles were sold in the country. China contributed to more than 32% of the world car production in 2021. Having a gross output of more than 10 trillion RMB (1.4 trillion USD) in 2021, the automotive industry in China accounts for 10% of the total Chinese GDP. Because of such a big significance in the world economy, Chinese car market is also a field in which both Western and Chinese vehicle manufacturers are bidding for dominance.

Consumers between 31 and 40 years old account for the largest group of car buyers in China

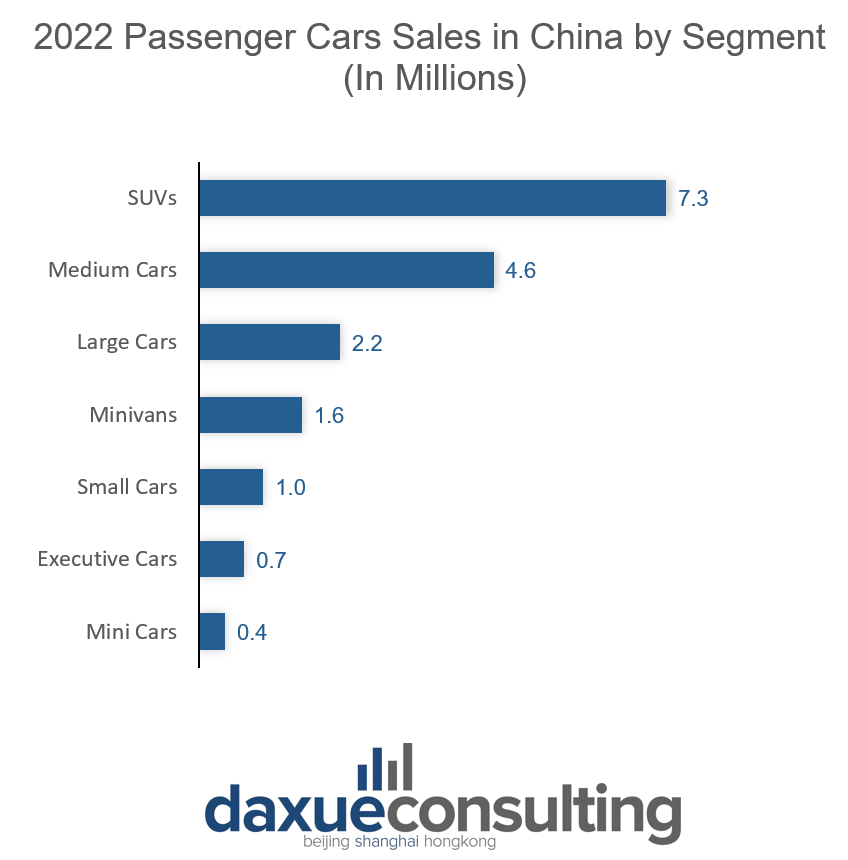

Chinese consumers can choose among a wide range of cars and brands. In 2022, 17.8 million cars produced in the country were passenger vehicles.

Despite the huge number of produced vehicles, the number of Chinese drivers is even bigger. In 2021, mainland China counted over 443 million drivers. The reason of such a mismatch between the demand and the supply can be traced in the Chinese car culture. In the country, the car is seen as a status symbol, so not every people who has a license can afford to buy an actual vehicle. In addition, since 2011, obtaining a car has become more difficult in China, in part due to the implementation of the car plates lottery. Most big cities have implemented this initiative to reduce the number of cars on the streets, releasing a limited amount of license plates per year. In 2022, Beijing offered 100,000 car plates, of which only 30% were for fuel vehicles, while 70,000 were for EV. Moreover, registration fees are extremely high. In 2022, the cost of a car plate in Shanghai was around 92,500 RMB (roughly 14,000 USD). As a result, drivers are usually not very young. In 2022, those aged between 21 and 31 years old accounted for 27% of the total car buyers, whilst the main consumer group is from 31 to 40 years old, representing 40% of the total drivers.

The Covid-19 outbreak and the consequent restrictions had a huge impact on the Chinese car production

Covid-19 restrictions had a huge impact on the Chinese car market. According to the statements of the China Passenger Car Association, in April 2022, the Covid-19 outbreak resulted in a 20-40% loss. Due to the zero-Covid policy, the supply chains of the automotive industry in China were disrupted. The containment measures also forced some of the biggest companies to temporary shut down their factories. For instance, Tesla had to close their Gigafactory in Shanghai for 22 days. At the end of 2022, the problem persisted and more than 41% of the Chinese car dealerships remained closed for weeks before the loosening of restrictions.

Local carmakers are gaining ground on Western manufacturers

In 2021, the Shanghai Automotive Industry Corporation (SAIC) was the biggest company in China in terms of revenue, with a total income of more than 779 billion RMB (113 billion USD). On the next year, it was also the biggest car maker in China, producing more than 5.3 million vehicles and topping all the competitors for the 17th year in a row. Moreover, with more than 500,000 vehicles shipped, SAIC was the largest Chinese vehicles exporter in 2021, accounting for 24% of the China’s total auto exports.

BYD is another important player in China’s automotive industry. In 2022, the group produced more than 1.45 million vehicles and had a revenue of more than 457 billion RMB (66.5 billion USD). It was also a year full of innovation for the company because of the launch of its “BLUE plan” aimed to reach carbon neutrality by 2050. As far as the EV market in China is concerned, BYD is the undisputed leader of the sector. The Shenzhen company sold roughly 600,000 plug-in electric cars in 2021. In April 2022, BYD stopped the production of fuel cars to focus more on producing electric vehicles. In 2022, the Chinese manufacturer sold more than 1.85 million plug-in electric cars, almost tripling the previous year’s sales.

Homegrown players in the Chinese EV market can compete with leading foreign companies

The EV market in China is extremely developed. In 2021, it generated a revenue of more than 854 billion RMB (142.2 billion USD). Despite being impacted by the zero-Covid policy, EVs have continued to experience non-stop development. Several Chinese brands are among the main players in this sector. In H1 2022, BYD was at the top of the electric car market, holding 27.9% of the market share.

Tesla is the only real Western competitor of Shenzhen-based brand. Its success in China is partly due to the construction of the Shanghai Gigafactory. As of May 2022, the US company accounted for 6.6% of the total Chinese plug-in cars market share.

Western players in China struggle to keep up with Chinese automakers

Since the beginning of 2022, the Chinese government has allowed full foreign ownership car makers in China. Previously, foreign automakers were only allowed to own up to 50% of a vehicle manufacturer, forcing them to create joint ventures with local partners, such as SAIC Volkswagen.

Western companies are increasingly investing in the production of electric vehicles in China. In 2022, BMW invested 10 billion RMB (1.38 billion USD) to expand its battery production center in Shenyang. Similarly, Volkswagen announced an investment of 17 billion RMB (2.5 billion USD) in R&D and plans to collaborate with the Chinese chip manufacturer Horizon Robotics. Despite the significant investments of international brands, Western automakers’ market share shrank by 45.6% in 2021.

Meanwhile, Chinese automakers are giving international manufacturers a run for their money: in 2021, 3.3 million hybrid and full electric Chinese cars were registered in the country, while, European EV registrations were around 1.1 million units, highlighting the gap between foreign manufacturers and local giants such as BYD.

Giving a second life to vehicles: Chinese secondhand car market

The secondhand vehicles sector is a flourishing market segment in China. In 2021, more than 17.5 million used cars were sold in China. Since 2022, the government has been supporting the used car market through a series of measures to enhance the purchase of pre-owned cars and reduce costs for consumers. For instance, companies that sell used cars can now directly apply for transfer registration of a secondhand vehicle to the Ministry of Public Security, which simplifies the process of transferring ownership. Furthermore, restrictions on the relocation of pre-owned vehicles have been loosened, enabling buyers to have broader access to used cars nationwide. The prices have also been reduced; on average, a consumer can save around 7,000 RMB (1,000 USD) by purchasing a pre-owned vehicle instead of a new one. Despite the significant investment, the Chinese secondhand car market faced a slowdown in 2022 due to a new wave of Covid-19 cases across the country. Sales dropped by 8.5% to 14.6 million units from January to November, compared to the same period the previous year.

Chinese secondhand car market is going digital: the case of Uxin

The secondhand car market in China is vast and highly developed, with some companies like Uxin specializing in digitizing sales. Since 2018, the company has been offering used cars and services to customers through their online platform. In September 2021, the group collaborated with Changfeng County Government of Hefei, investing up to 2.5 billion RMB (360 million USD) to create an Inspection and Reconditioning Centre (IRC). The IRC is expected to produce from 60,000 to 100,000 reconditioned vehicles annually.

Uxin also has offline stores where consumers can purchase pre-owned vehicles. In 2022, the company upgraded another ICR and reconditioned car shop in Xi’an. The superstore has a floor area of more than 150,000 square meters and can accommodate more than 3,000 vehicles, catering to the demand for used cars in Xi’an and its surrounding areas.

Sustainability is reshaping the automotive industry in China

In recent years, environmental protection became a matter of concern in China’s automotive industry. In June 2022, the Beijing-based BAIC group held an online conference entitled “BLUE plan” to showcase its sustainability strategy. The brand’s main objective is to invest more in new energy and smart networking technologies, including the production of a new line of low-carbon cars both for passengers and commercial purposes. BAIC aims to reach peak emissions by 2025 and become carbon neutral by 2050. The company also plans to create a circular economy by reusing and recycling car wastes.

Similarly, BYD is also striving to increase the sustainability of their vehicles. On September 9, 2022, the EV giant started working on the production of newer and more efficient batteries. The project involves the creation of a new 5 GWh full-electric battery and a 10 GWh hybrid battery, along with the construction of a new energy vehicles industrial park. They also plan to use existing factories for R&D purposes.

Audi and Mercedes are targeting young Chinese women

As for some luxury cars such as Porsche, passenger car brands have launched promotional campaign specifically targeting female consumers. In 2020, Audi collaborated with “Sisters Who Make Waves”, a TV show created to eliminate the Chinese stereotype of “leftover women”. This term refers to all single women in their late twenties and beyond. The show was so popular that the official hashtag of the program (#乘风破浪的姐姐#), garnered over 55 billion views on Weibo as of December 2022. Prior to the final episode of the series, Audi launched the campaign “There is no need to define her beauty,” featuring three of the contestants. That same year, to support women’s empowerment on social media and debunk stereotypes, the company launched the hashtag “Ms. Audi”. Audi still uses the hashtag today and boasts more than 7 million views on Weibo.

The German automaker Mercedes launched a similar initiative as well. In 2021, the Stuttgart-based brand announced the “She is Mercedes” campaign for the International Women’s Day. Mercedes launched the project on Xiaohongshu, a social media that gained immense popularity among young Chinese women. As of 2022, the official hashtag of the campaign ( #奔驰的她们# ) had gained more than 6.4 million views on the platform.

The automotive industry in China: a flourishing market full of opportunities and innovation

- China is a major player in the global automotive industry, accounting for over 32% of global car production in 2021.

- Despite the high number of vehicles produced, obtaining a car in China can be difficult due to factors like high registration fees and the car plates lottery.

- Chinese consumers tend to be older, with those aged 31-40 accounting for the largest share of drivers.

- The COVID-19 pandemic has had a significant impact on the Chinese car market, with disruptions to supply chains and factory closures.

- Chinese carmakers like SAIC and BYD are gaining ground on established Western car companies, with BYD being the undisputed leader in the Chinese EV market.

- Tesla is the only Western car company with significant market share in China, accounting for 6.6% of the Chinese plug-in car market.

- Western car companies are struggling to keep up with Chinese brands in the EV market, but are increasing investments in EV production in China. Sustainability is imposing as a key topic in China’s automotive industry.

- European car brands in China are targeting young Chinese women. Audi collaborated with the popular TV show “Sisters Who Make Waves”, whilst Mercedes announced the hashtag “she is Mercedes” to promote its products on Xiaohongshu.

Author: Lorenzo Linguerri