Following economic growth and increasing willingness to pay (WTP) has given rise to higher health awareness in China with a growing need that accelerates a paradigm shift from being a reactive consumer to a proactive consumer.

China is rapidly becoming the world’s largest market for healthy eating. A report by Boston Consulting group had estimated that the health and wellness market was worth around $70 billion in 2020. This is a result of rising disposable incomes that signals growing opportunities for both western and Chinese companies to redefine health and awareness in the world’s largest consumer market.

The consumer shift from reactive to proactive consumption

Reactive consumers are generally not as curious about health awareness and rely on traditional lifestyles until told otherwise by their doctors. Today’s Chinese consumers are connected to the internet, socially active, curious and combine knowledge from the internet, friends to incorporate their own healthy habits into their lifestyles. The advent of advanced technology has also allowed Chinese consumers to keep track of their health and progress through the usage of wearables.

Low health awareness makes consumers vulnerable to scams in the digital age

For senior citizens who are retired and have lot of spare time, health related articles WeChat are the main learning source for improving health awareness. However, some misconceptions and even frauds may emerge in those articles, misleading elderly and even sometimes causing them financial loss.

For instance, an article on WeChat suggested that eggs and sweet potatoes or carrots and certain mushrooms cannot be eaten together. Sometimes the products recommended in articles are ones that entice or wrongly convince senior citizens to purchase certain products without delivering its promised value. Sometimes this can lead to senior citizens losing money. WeChat has since paid strict attention to these rising problems and deactivate WeChat official accounts that spread misinformation.

Source: WeChat shut down a WeChat official account which promoted health-scams

Healthy China 2030

On October 2016, President Xi Jinping announced the Healthy China plan stating that a health-conscious China will be a prerequisite for the all-round development of people linking its importance directly to the country’s future social and economic development.

According to an official report published by the Chinese government in 2019, data showed that health awareness among Chinese citizens has been improving over recent years. 17% of Chinese people had a good knowledge about health in 2018. This figure was obtained from a national wide survey that tests the health awareness, lifestyles and basic skills among citizens aged between 15 and 69.

An official report states that 22.4% of urban residents had basic health awareness and skills to make right decisions for their health whereas 13.7% residents in rural cities had basic knowledge to make the right decisions for their health.

This continuing trend of health awareness has led to Chinese consumers pursuing a healthy lifestyle and some are even investing their disposable income in organic foods. Even before Covid-19, Chinese consumers were shifting their behaviour to be proactive. In turn, this has positively impacted the health food market which include local and international food brands, supplement brands and premium dairy brands. Simultaneously, low nutrition food products such as instant noodles have been on the decline in recent years.

The health and wellness market can be divided into two segments: Consumers from top tier and lower tier cities

Top tier cities like Shanghai and Beijing have seen a major trend in detox, juice cleansing and healthy foods in the last few years. A report from Mintel indicated that plant protein drinks rose to popularity with almost 87% of Chinese consumers now drinking plant-based protein drinks.

These products are predominantly soy, grain based and natural juices signalling a huge opportunity in the drinks segment. Natural juices and drinks have also seen rise in consumption with coconut water consumption notably experiencing a rise by 30% from 2019.

Lower tier cities in China also provide huge market opportunities for brands to scale. The cheaper living costs and less hectic working schedules have allowed people to have more disposable income. While, people in lower tier cities currently have less health awareness the trend of healthy eating, exercising has been growing rapidly.

COVID-19 accelerated the already existing growing health awareness trend

A May 2020 survey by BCG showed that 33% of Chinese indicated they intended to purchase more fresh and organic food after COVID-19, which 27% indicated they would purchase more vitamin and health supplements.

While Covid-19 may have accelerated the growth of health awareness in China data reveals that consumers were already relatively health conscious well before COVID-19. After Healthy China 2030 was launched the key goals were to increase health awareness among topics such as obesity and the need to increase overall physical activity.

A recent survey conducted by Ipsos revealed that 84% of 3,000 survey respondents aged 18-65 from tier 1-3 cities reported that they are paying more attention to their health now. Particularly people aged 25 or above showed an increasing awareness and satisfaction with their current health condition.

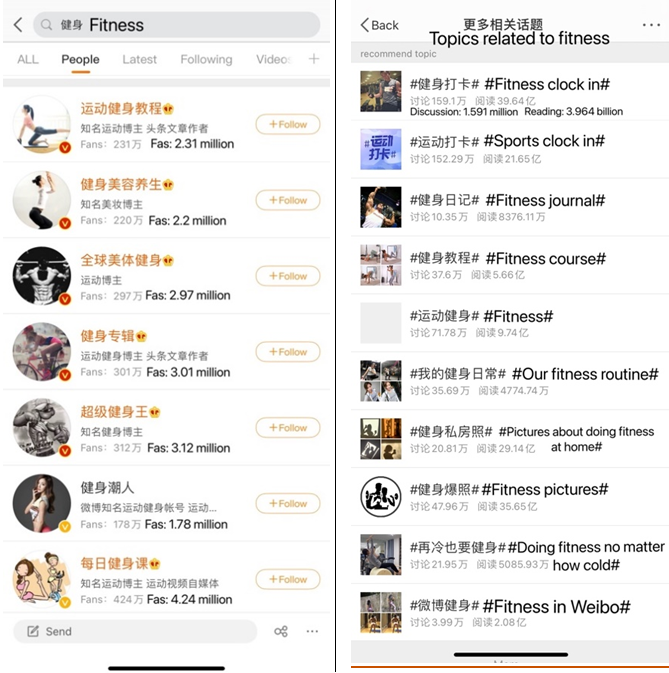

Fitness and weight have become some of the hottest topics on social media platforms like Weibo, Xiaohongshu and WeChat.

Source: Weibo screenshot, accounts and topics about fitness in Weibo

Unhealthy products are seeing sales decline in China

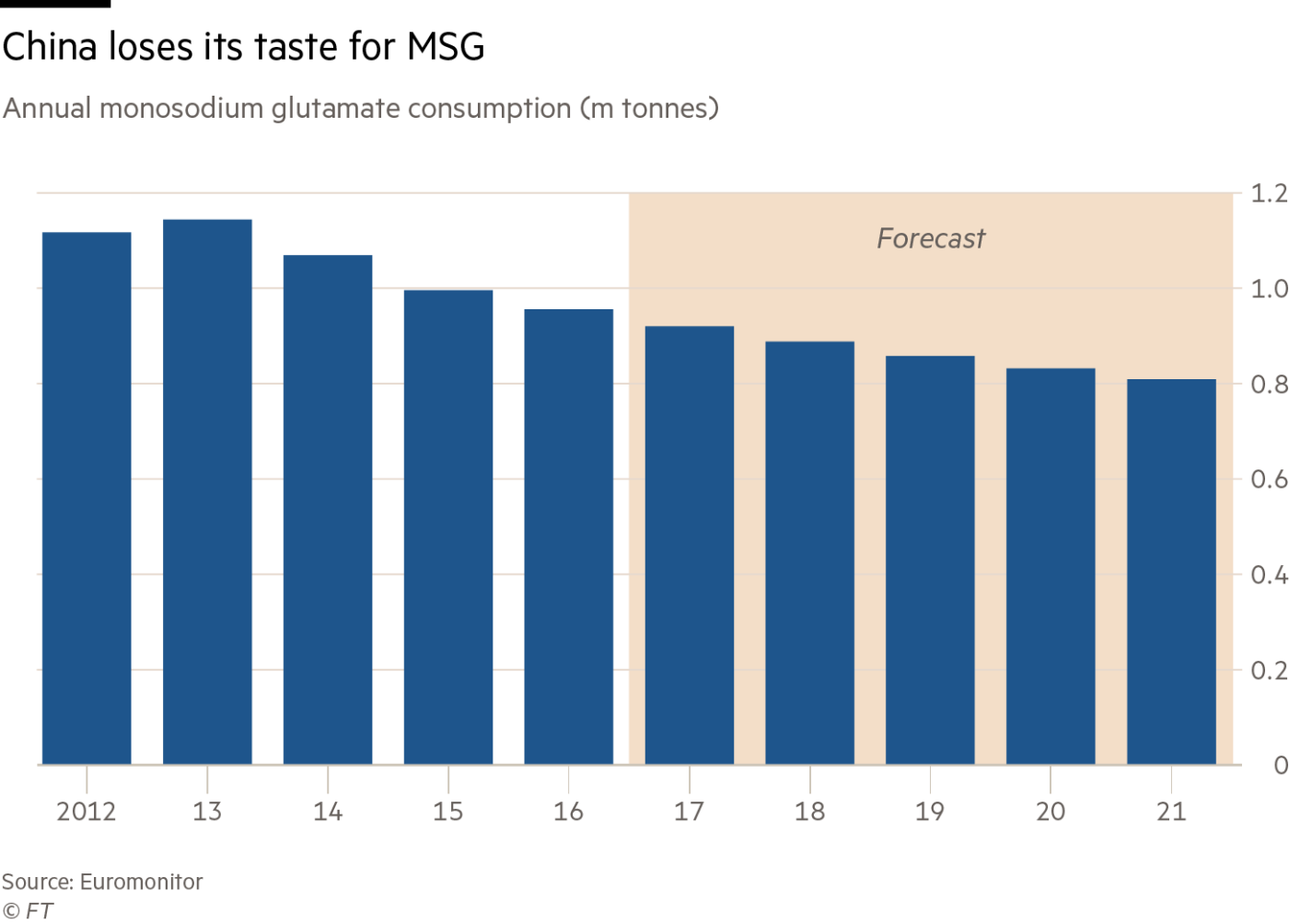

A decade ago, a Chinese company called Henan Lotus was the world’s largest producer of monosodium glutamate (MSG), a controversial flavour-enhancing ingredient which has been said to cause health problems. At the time, China became the largest consumer of MSG.

Fast forward to present times Henan Lotus faces monumental challenges as a rapid decline in MSG consumption could force them to miss out on a fast-moving consumer market seeking healthy products worth $180 billion US. Coco-Cola is among one of the world’s famous companies where their centralized strategy has stagnated their growth amidst a growing health awareness amongst Chinese consumers.

Euromonitor revealed that approximately more than half a billion Chinese consumers made conscious efforts to limit MSG in their diet. Their concerns shifted more towards nutrition and the positive perception associated with healthy eating drove purchases.

Source: Euromonitor, Declining rates of MSG consumption signals the growing health awareness in China

It was not just MSG that felt the decline, a host of products sales have been on the decline in China. Sales of chewing gums have seen a decline by 14% in the last two years, chocolates and confectionaries experienced a decline by 6% and 4% respectively based on survey results published by Bain and Kantar Worldpanel.

Healthy food replaces unhealthy food

The shift to healthy eating resonates with President Xi Jinping’s call for Healthy China 2030 as China has rising obesity levels and related diseases like diabetes linked with poor eating habits. Meituan Dianping a prominent food delivery platform in China reported in 2018 that orders for salads on their platform grew by 160%.

Consumers seem to ride the wave of healthy eating trends in China and local and international brands are looking to cash in on this opportunity. Domestic soda brand Genki Forest advertises its products as 0 sugar, 0 calories, 0 fat, a message that may not have meant much to consumers a decade ago.

For instance, Coca-Cola introduced a Sprite Zero in 2018 followed by Sprite Fiber+ which is said to contain the same amount of a fiber as that of two apples.

Coca-cola also invested in a Chinese yoghurt brand LePur. LePur has been growing rapidly in China selling more than 1m units of Greek-style yoghurt a month. The founder was quoted as saying “Coke made the deal because “their theme is going healthier”. In the dairy market in China natural fruit juices, coconut, aloe waters, oat milk, soybean milk, almond milks have gained popularity amongst Chinese consumers.

While western companies still hold a slight edge in the minds of Chinese consumers as their products are positioned being more nutritional, local Chinese companies are catching up with engaging digital marketing strategies.

Health awareness movement in China

Chinese consumers are increasing their spending on categories related to health and lifestyle. This was already the trend before Covid-19. According to consumers buying behaviours they have been intentionally purchasing healthy foods. This was more prominent across first tier cities.

Change in actual spending by category (2018 vs 2017)

% of respondents (N=1,325), ranked by % of consumers increased spending

Source: McKinsey China Consumer Survey 2020

In 2020, the growing trend of Chinese consumer’s health awareness had shown progress in the top tier cities a whopping 60% of consumers stated that checking ingredient labels on packaged foods was the most important factor while purchasing a product. Consumers also revealed that if the ingredient labels did not seem convincing, they would not purchase the product. Transparency and information sharing have become a deciding factor for Chinese consumers regardless of local or foreign brands. With a wide array of options in the market the power has shifted in the hands of the consumer and companies must make sure they play their cards right.

According to McKinsey’s consumer report, around 25 categories or product purchases were closely tracked, and consumers mentioned that they had spent the most on fresh milk in 2018 compared to 2017. Yogurt featuring natural ingredients was the most popular product among millennials and Gen Z.

Despite the gradual shift to healthy eating in China, a small divide remained between the health awareness of top tier cities with that of lower tier cities. Data from McKinsey suggested that the top sales in lower tier cities remained amongst carbonated soft drinks and juices.

Source: China Daily 2020, A consumer in Guangdong province searching for snacks at a store.

The life of millennials and Gen Z in top tier cities can be hectic and tiring. These groups normally have a long tiring day and unwind by consuming social media or streaming their favourite TV show.

A typical top tier working professional normally spends about 500 yuan ($71.5) a month on snacks. These consumers mentioned that they consciously eat healthy snacks such as nuts and dried fruits which are both delicious and healthy. It was important to them that the snacks they consumed were high in protein, clean and sanitary.

Source: Chozan, Screenshot of mini Oreos, assorted nuts from WeChat

Covid-19 accelerated a stay at home economy early in the year for Chinese consumers and a business research report by a Beijing based think tank EO intelligence revealed that sales volume for China’s healthy snack market would peak to 3 trillion yuan in 2020 and surpass the 4 trillion yuan mark by 2025. There was an increased attention and awareness around the quality, freshness and nutritional value of snacks.

Data from Alibaba Group’s TMall platform revealed that in February 2020, sales of nuts, fresh vegetables and fruits on the platform increased by 122% and a 72% year on year respectively. This shows that during the pandemic Chinese consumers were still health conscience.

Growing customer segments conscious about their health

Rookie White Collars are educated and mostly live in tier 1-3 cities. They have just begun their careers and are looking to grow personally and professionally by living a fast pace life. They represent a higher per-capita spending on Taobao and TMall and are increasingly becoming passionate about self- improvement. This is accelerating their spending habits into products that benefit them mentally and physically.

Supermoms are women living in tier 1-3 cities with children mostly under the age of 12. Their top priority is to raise healthy families while still maintaining their careers. This means that they are ready to pay a premium for healthy products, their own health and want these services at their convenience.

Key takeaways for health-focused brands in the Chinese market

There is a growing health awareness in China which is creating huge market opportunities for both foreign and local Chinese brands.

While top tier cities remain the key markets the lower tier cities in China are an untapped market which is rapidly growing, and brands should be paying attention on the buying potential of these consumers.

The healthy snack market and dairy market in China are the fastest growing segments in China’s FMCG sector.

Learn something new? Stay updated on the Chinese market by following our WeChat, scan the QR code below, or subscribe to our newsletter

Learn more about the healthy snacks market in China

Listen to over 100 China entrepreneur stories on China Paradigms, the China business podcast

Listen to China Paradigm on Apple Podcast