China has entered into the top 10 world’s biggest wine-producing countries. The past decade has seen the planting of over 120,000 hectares of vineyards, with eight large-scale regions and more than 200 wineries emerging.

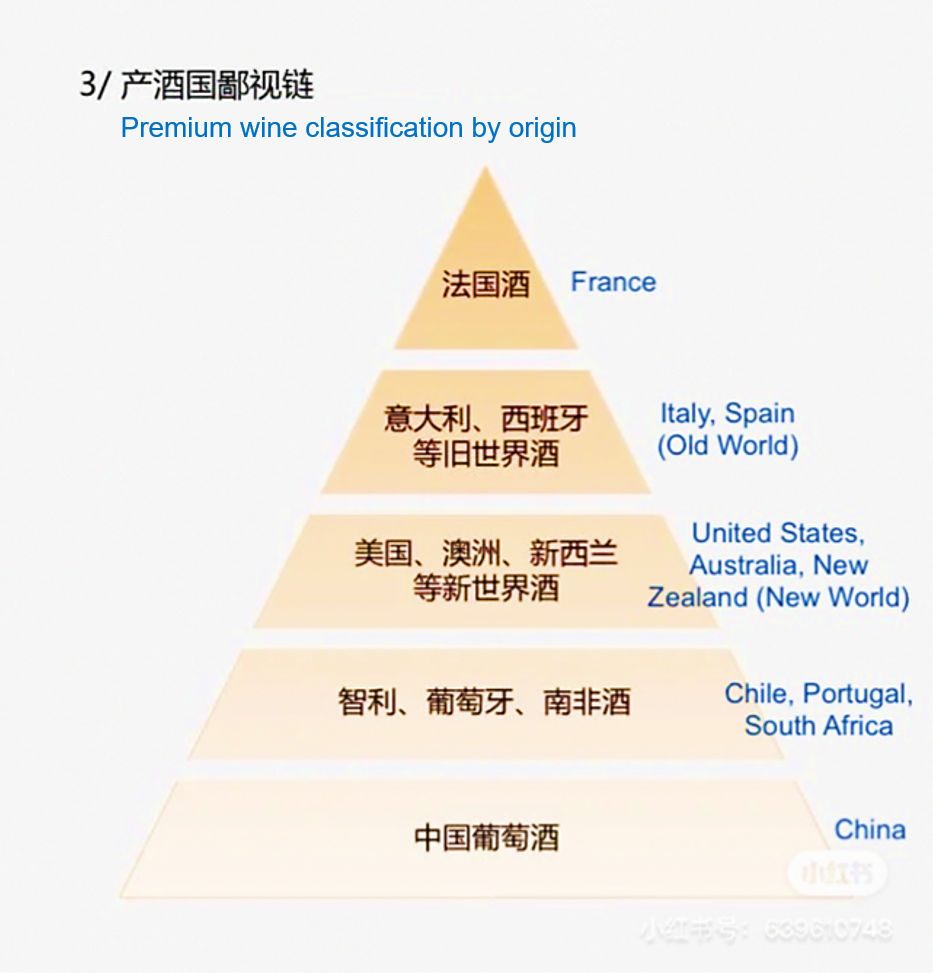

Chinese wines, like Australian wines, are considered new world wines- a term used by sommeliers to describe wines which are not produced in traditional regions such as France or Italy. For most Chinese consumers, Made-in-China wine ranks at the bottom of their wine classification. Especially in the Chinese premium wine market, Made-in-France wines from the Bourgogne or Bordeaux wineries are perceived as the highest-quality by general Chinese consumers and ranked at the very top of the wine hierarchy. Moreover, with the impacts of the pandemic and the Chinese zero-tariff policy on imported wine from Chile and New Zealand, the local market share of Made-in-China wine has been further compressed.

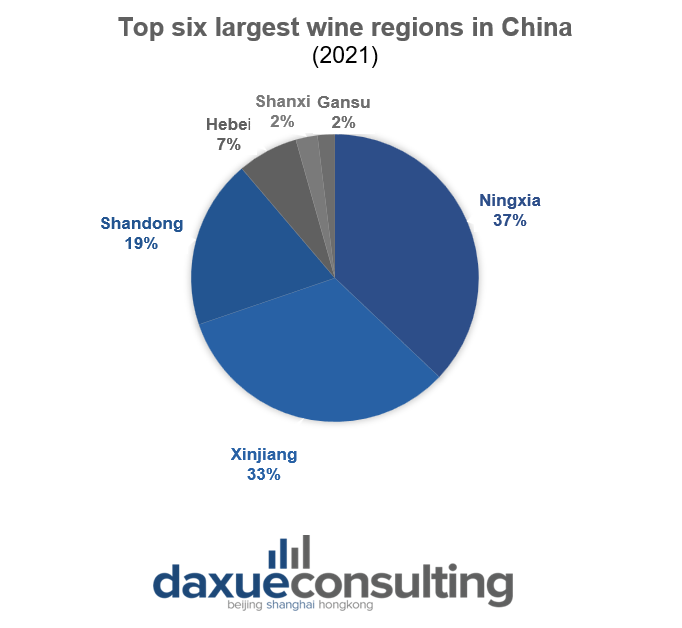

Major wine grape planting and wine production regions in China

China’s wine grape planting and wine production are mainly distributed in 26 provinces (autonomous regions and direct-administered municipalities), including Xinjiang, Ningxia, Shandong, and Hebei, with a planting area of about 800 square kilometres in 2021.

As the earliest place to cultivate grapes and produce wine in China, Xinjiang enjoys favourable natural conditions and boasts excellent grape varieties. Therefore, such area plays a vital role in the development of the Chinese wine industry.

In addition, the Ningxia region is one of the critical areas of wine development due to its superior geographical features and lower cost of production. Ningxia is about 1,000 meters above sea level and lies on the same latitude as Bordeaux. The area’s clay and limestone gravel soil are rich in minerals and polyphenol materials, giving the grapes a distinct taste. Wine grapes from Ningxia have an excellent sugar-acid ratio, layering and body that especially suits Chinese palates.

In recent years, Ningxia’s wine industry has developed rapidly. In 2021, the planting area of wine grapes was 347 square kilometres, the output of wine was about 130 million bottles, and the output value exceeded 30 billion RMB. In addition, Helan Mountain in Ningxia was the region that won the largest number of gold and silver medals in China.

China’s premium wineries cannot be overlooked

With the development of the wine industry in China, domestic wineries have upgraded their quality over the last decade.

The most significant domestic player – Changyu – has started to focus on their own vineyards with the launch of Ningxia Château Changyu-Moser XV into international markets. In 2015, Changyu and Lenz M. Moser decided to work on a joint project: Chateau Changyu Moser XV, a partnership with the big goal of producing China’s best and most important wines. The focus is Cabernet Sauvignon and Blanc de Noir.

Another winery that should be highlighted is the Silver Heights Vineyards which is located at the east foothills of the Helan Mountains. Silver Heights also has the distinction of being one of China’s highest wineries, with an altitude of 1,200 meters which is the same latitude as the world-renowned wine regions of Bordeaux, France, and Napa Valley, California. This region vaunts favourable conditions for growing top-quality wine grapes: dry climates, gravelly soil, little rain and sufficient sunlight. Compared to the temperate wet climates of Bordeaux and Napa Valley, the grapes grown in Ningxia actually have a stronger and richer aroma when ripe. The main varieties grown in such vineyards are Cabernet Sauvignon, Merlot, Chardonnay and Riesling. In addition, Silver Heights The Summit 2013 and Silver Heights Family Reserve 2014 were chosen as the national wines to be drunk on the occasion of the dinner in honour of the then German Chancellor Angela Merkel.

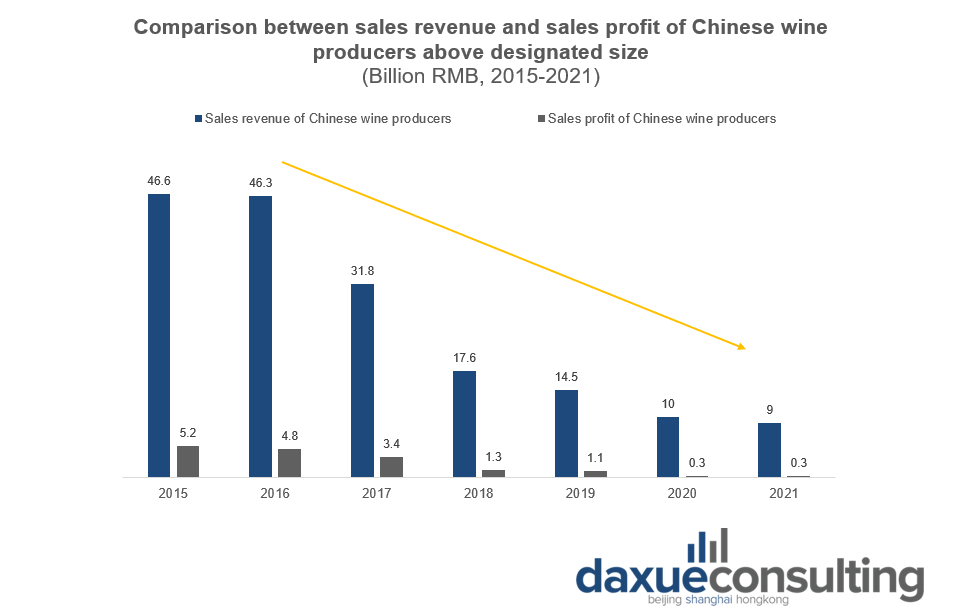

Chinese wine has lost ground in the last 6 years

After 2017, domestic wine production and demand in China decreased YoY. Instead, the market share of imported wine in China has been constantly increasing, from 32% in 2015 to about 60% in 2020, seriously threatening the survival of Made-in-China wine. According to the National Bureau of Statistics, the output of domestic wine enterprises above the designated size was 205 million litres in 2021, recording a 34.7% drop compared to 2020, when the pandemic was more severe. In 2021, the revenue and the net profits were 6.74 billion RMB and 215 million RMB, thus recording a drop of 12.6% and 5.5%, respectively, compared to 2020.

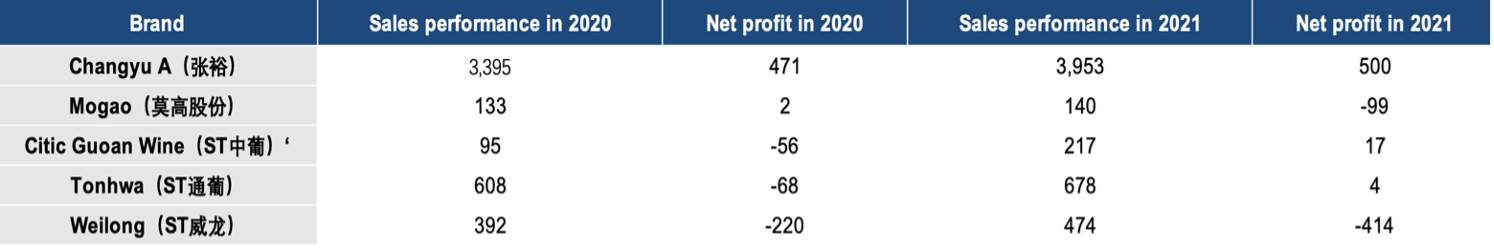

Competition in China’s wine industry is fierce. There are about 600 enterprises operating in the Chinese wine market, among which more than 10 are listed, are mainly distributed in Xinjiang, Ningxia, Shandong, and other regions with relatively developed wine manufacturing. In 2021, Changyu accounted for 28.7% of the Chinese market, while Weilong held a market share of 4.5%. Among the top 5 listed Chinese wine enterprises, only Changyu and Mogao closed 2020 with positive net profits. Some of the wineries posted positive net profits in 2021 because of the recovery from the pandemic. However, Weilong and Mogao’s net profits have been a huge loss.

Sales performance and net profit of the Top 5 listed wine enterprises in China

(Million RMB)

Why Made-in-China wine doesn’t take off

Although the wine market in China has grown in the past decade, wine is still not the drink of choice during meals. Chinese consumers prefer baijiu, beer, and rice wine because of local drinking habits. Both red and white wines account for 4-5% of China’s alcoholic beverage consumption. In China, wine is perceived as a gift and a common alcoholic beverage in a social context. However, due to frequent lockdowns and restrictions, sales of wine in China have dropped in the last few years. Once drinking occasions such as parties and banquets were restricted, wine suffered much more than baijiu, beer, and rice wine in China. In 2020, the sales revenue of wine only accounted for 1.7% of the total sales revenue of Baijiu. In 2021, the percentage of wine production in China dropped dramatically: the profit’s YoY growth rate of wine was -74.5% that year.

Among the Chinese selection criteria for wine, Chinese consumers give priority to the origin over the label and the colour of the beverage, which favours Bordeaux and Champagne in particular. Price comes second, followed by taste and designation of origin.

In addition, extreme winter temperatures and dryness are common in northerly wine regions such as Liaoning, Ningxia and Xinjiang, and vines are required to be buried until spring to survive under extreme conditions. This drives up production costs and makes viticulture a challenge overall. Ningxia wineries have produced high-quality wines in recent years, mostly positioned as premium wines with a high price and low output on the market.

Moreover, China’s zero-tariff agreement on imported wine from New Zealand and Chile has further poised a threat to Chinese winemakers-

Opportunities for Made-in-China wine to bounce back

Since the pandemic outbreak, Chinese customs inspections of containers have also increased and become more time-consuming. In the past, customs clearance used to take about 1 day, but now imported goods must be stored up at the port for at least 14 days, and importers will be charged for storage after the deadline.

In 2021, the Chinese government announced that imported wine from Australia violated the anti-dumping and countervailing law and damaging the domestic wine industry. Consequently, China’s Ministry of Commerce imposed anti-dumping duties on imported Australian wine ranging from 116.2% to 218.4%.

Domestically, the Chinese government has also launched supportive policies and subsidies aimed to foster wine production and wine grape planting. In 2022, winemakers above the designated size that set up sales companies in Ningxia wine-producing area shall be given a 5% reward according to the sales volume (the maximum compensation is 5 million RMB). The wineries in the producing regions with wine exports of more than 100,000 RMB in a year will be rewarded with 10% of the export value, with a maximum reward of 1 million RMB for each winery.

Moreover, a subsidy has been introduced to encourage the output of wine grapes with over 3.75 RMB per square meter for vineyards. To sum up, the main competitors of Chinese wine producers are suffering from higher costs, and local producers are benefiting from the supportive policy and subsidy from the Chinese government. Therefore, Made-in-China wine can seize an excellent opportunity to take back the market shares in the domestic market.

Notable “Chinese” wines

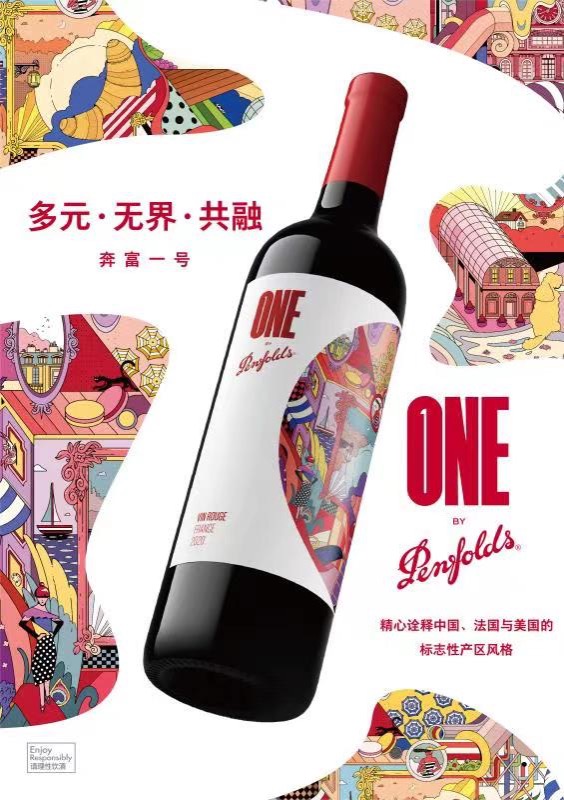

In recent years, many famous international wineries have been producing wine in China to bypass tariffs, including the well-known Penfolds and Château Lafite Rothschild.

In line with its multi-country of origin winemaking approach, the “One by Penfolds” series features wine sourced and made in California, France, and for the first time, China. To be more specific, the red blend for Chinese Penfolds was all planted and harvested in the northwestern Ningxia region.

Moreover, the legendary Château Lafite Rothschild released its first vintage from grapes grown at Domaine de Long Dai, its estate in Shandong Province in 2019. With 74 acres of vineyards, production at the new estate is modest. Only 2,500 cases of the 2017 vintage will be sold, mainly in China. In addition, bottles of the 2017 Long Dai are priced at 2,388 RMB. That is comparable to a bottle of high-end baijiu in the Chinese market.

However, a series of challenges stop other foreign wineries from emulating them. On the one side, international winemakers had to find a balance between the heavy monsoon rains in the summer and the dry spring seasons. On the other side, as is often the case for foreign companies in China, managing relations with the government was tricky at times.

The future of Made-in-China wine

- China’s wine grape planting and wine production are mainly distributed in Ningxia, Xinjiang, Hebei, and Shandong.

- Most of the Chinese wine producers lost ground in the last years because of the pandemic and free trade agreements allowing to import wine from Chile and New Zealand duty-free.

- Chinese people prefer drinking baijiu, rice wine and beer. At the same price level, Chinese consumers tend to purchase imported wines.

- The Chinese government has launched supportive policies and subsidies to boost the grape planting and wine-producing industry.

- Famous wineries like Penfolds and Château Lafite Rothschild have been producing wine in China to bypass tariffs.