Perfect Diary (完美日记), a Chinese cosmetics brand, achieved early success through KOL (Key Opinion Leader) marketing, co-branding, and private traffic pools. However, despite being recognized as one of the leading makeup brands in China, Perfect Diary’s success has waned over time. To recover, it has been focusing more on product quality, integrating skincare functionalities into its makeup products – though without generating the same marketing buzz it once did.

Download our report on Chinese beauty consumer pain points

Perfect Diary’s rise between 2017 and 2020

Founded in 2017, Perfect Diary is a young Chinese makeup brand under beauty giant Yatsen Holding. It targets women aged 20 to 35, with relatively high spending power. In March 2017, it set up flagship stores on Taobao and Tmall. Just six months later, it opened an official account on RedNote (known as Xiaohongshu in China), launched its own WeChat store, and inaugurated three pop-up stores in Shanghai. During the 2018 Double 11 festival, the brand generated over RMB 100 million in sales in just 90 minutes.

In 2020, this C-beauty brand was recognized for its outstanding performance, receiving an award at the Tmall Golden Makeup Awards, known as the “Oscars of the beauty industry”. It won three awards: Best Lipstick, Best Foundation, and Best Product for its 12-color animal shadow palettes. Since then, Perfect Diary has become one of China’s top beauty brands.

Moreover, during the Double 11 promotion in 2020, the brand sold over 600 million products during the promotion, imposing as the highest-selling makeup brand on Tmall. The company’s annual net income exceeded RMB 7.23 billion in 2020.

Perfect Diary’s strategies driving its early success

1. Co-branding collaborations with popular IPs

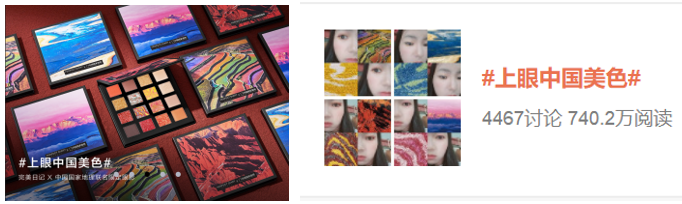

Co-branding in China is a valuable tool to create buzz and boost sales in the beauty industry. According to the CEO of Perfect Diary in China, Huang Jinfeng, a new brand can get more exposure by co-branding with other popular intellectual properties (IPs). The brand leveraged Chinese breathtaking natural landscapes to inspire the color combinations in the eyeshadow palette. This unique approach to makeup design captured the interest and excitement of a large number of consumers, resulting in the product winning the prestigious 2021 Top 10 Annual National IP Crossover Collaboration Award.

Another successful collaboration was the one with Oreo in 2020. Inspired by the shape of Oreo cookies, the Chinese makeup brand launched two limited-edition air cushion creams, Classic Black and Cherry Blossom Pink. This partnership not only provided consumers with a unique shopping experience but also generated significant buzz, expanded the brand’s influence, and empowered the brand to stand out in the competitive beauty market.

2. Effective KOL strategy

Celebrity endorsement and KOL marketing played a key role in Perfect Diary’s strategy in China and abroad. By collaborating with celebrities, the C-beauty brand capitalized on the Chinese idol economy. In October 2020, the brand declared Zhou Xun, a renowned actress in China, as its first global spokesperson. Zhou Xun was the first Chinese actress to win the most important national cinema awards (Golden Horse Awards, Golden Academy Awards, Golden Rooster Awards). The brand chose Zhou Xun as its global spokesperson to convey the message of “beauty has no limits” to young women worldwide, as she is regarded as a symbol of beauty and accomplishment by the Chinese audience. This collaboration between the brand and Zhou Xun sparked lively discussion on social media platforms such as Weibo, attracting a significant number of audiences.

Moreover, KOL marketing helped the brand create momentum on the internet in China. Perfect Diary collaborated with Li Jiaqi, one of the most famous Chinese live-streamers. During the 2019 Double 11 festival, this collaboration helped the brand garner the most attention among all Chinese cosmetics products and brought its brand awareness to new heights. In February 2020, Perfect Diary and Li Jiaqi’s pet dog Never jointly launched a collection of animal-themed eyeshadows, which sold 160,000 units in just 10 seconds. By leveraging the bandwagon effect, this C-beauty brand was able to reach a wider audience of potential consumers.

3. Leveraging intensive promotions on social media

This Chinese makeup brand relied on intensive promotions on social media to accumulate high-quality user reviews, improve its brand reputation and reach younger users. For instance, it leveraged the community advantages of Xiaohongshu and Bilibili, which have a significant user base consisting of individuals born in the 1990s and 2000s. The brand’s official account on Xiaohongshu boasted over 2 million followers as of August 2023, and a search for the brand on Bilibili yielded dozens of positive reviews and titles, such as “best value products” and “high-quality domestic cosmetics”.

Falling from the top in 2021

The turning point for the brand came in 2021. It fell from its top spot and ranked fourth on the Tmall makeup sales list during the 2021 Double 11 festival. Moreover, during the 2022 Double 11, it dropped out of the top 20 brand list.

Overemphasizing marketing over quality

Yatsen Holding’s net revenue has been falling since 2021, dropping to RMB 3.4 billion in 2024 — a 41.2% decrease from RMB 5.84 billion in 2021. While the pandemic contributed to the downturn, a more significant factor is the brand’s tendency to overemphasize marketing at the expense of quality.

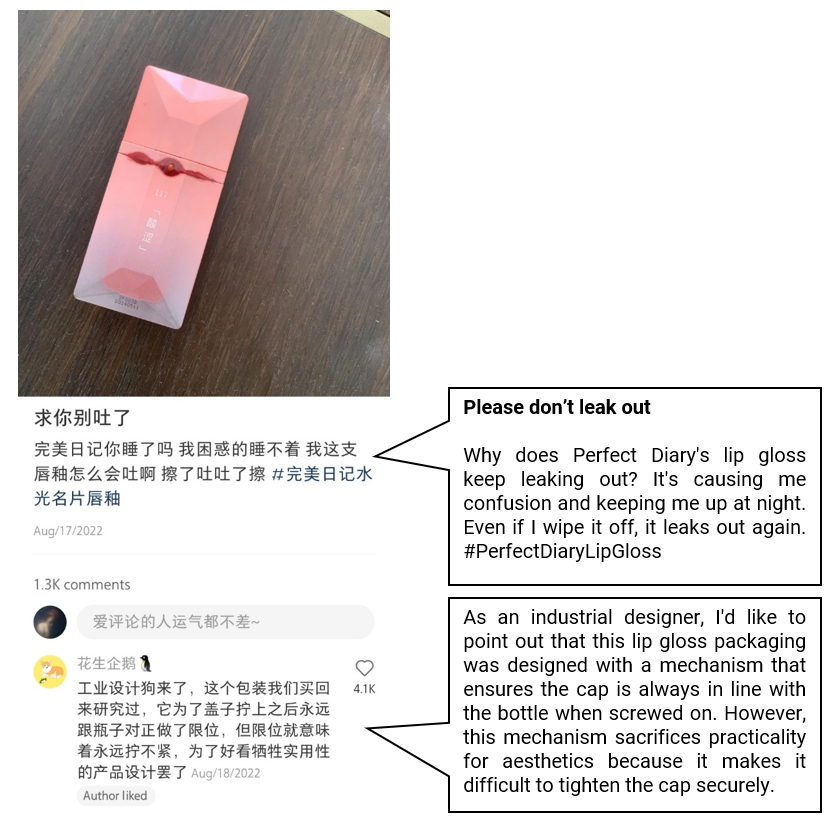

For example, in 2020, the brand’s marketing expense amounted to RMB 3.41 billion, accounting for 65% of the total revenue. To put this into perspective, if one Perfect Diary lipstick was RMB 100, then the marketing cost of it was 65 RMB. In contrast with the heavy marketing investment, the product research and development costs were lacking. According to its financial statement from 2018 to 2020, its research and development expenditure rate was 0.4%, 0.8% and 1.3%, respectively. Such low research and development expenditure generated quality issues, then sparking consumers’ outrage.

In addition, in 2021, the live commerce industry faced a “big reshuffle” following a crackdown on tax inspections. This posed significant challenges for brands that relied heavily on KOL marketing in China. The impact of this challenge is evident in the company’s performance, with revenue growth dropping sharply from 337% in 2019 to 11.6% in 2021.

Shifting towards a makeup-skincare hybrid brand

Perfect Diary is shifting away from its overreliance on marketing at the expense of its products and focusing on its products. As Chinese consumers seek products that have both aesthetic and functional benefits, it is developing makeup-skincare hybrid products (妆养一体).

This strategic pivot began in September 2023, when it launched the first Biolip essence lipstick, marking the brand’s entry into makeup-skincare hybrid innovation. This product combines features of a lipstick, serum, and mask, powered by the proprietary Biolip™ technology that uses biotech ingredients with a patented pomegranate peptide complex. Building on this, in September 2024, it launched the Second-Generation, an upgraded version that uses Biotec™ technology. This version includes anti-aging and regeneration benefits, beyond just hydration and nourishment.

“Perfect Diary’s second-gen Biolip Essence Lipstick – powered by biomimetic technology – racked up over 13 million views on RedNote. It combines rich pigment with advanced anti-aging benefits and intense hydration.”

– Lisa Zhang, Project Leader at Daxue Consulting

The Biolip Essence Lipsticks have experienced a cumulative sales of 3.8 million as of November 2024 and ranked number one on eight major bestseller lists, including Tmall Lipstick New Releases, Douyin Double 11 Beauty Hot-Selling Gold List, and JD.com’s Rising Domestic Lipstick Bestseller List.

To sustain the momentum, the company continues to invest in research and development, working with scientists and clinic institutions – like it did for the development of its Biolip Essence Lipsticks. However, skincare-infused makeup is not unique to Perfect Diary. In fact, local brands such as FunnyElves (方里) and foreign ones like Bobbi Brown (芭比波朗) are already doing it. Therefore, whether Perfect Diary can reignite the consumer excitement similar to its early years – without overrelying on heavy marketing – remains uncertain.

Lessons from Perfect Diary’s decline

- Perfect Diary leveraged KOL marketing, co-branding, and digital marketing to get to the top of the cosmetics market in China.

- However, this Guangzhou-based beauty brand put too much emphasis on marketing but not enough on quality. As a result, it started losing ground and hasn’t recovered yet.

- Perfect Diary is focusing on its products, developing skincare-infused makeup products through collaboration with scientists and clinical institutions. While its makeup-skincare hybrid lipsticks have received a warm response, standing out in a saturated market remains a challenge.

Contact us for in-depth beauty market research in China

The cosmetics market in China is a rapidly evolving landscape, driven by the rising demand for high-quality products, innovative ingredients, and sustainable practices. Daxue Consulting offers specialized market research in China, providing a comprehensive understanding of the preferences, behaviors, and emerging trends shaping the cosmetics market.

Our Chinese consumer insights empower businesses to tailor their products and marketing strategies to resonate with local tastes and expectations. We offer consulting services that help you stay ahead of industry developments and achieve sustainable growth. Connect with us today to discover how our expertise can support your brand’s success in China’s thriving cosmetics market.