The Chinese alcohol market continues to lead globally, reaffirming its position as the world’s largest by market value. According to the latest report from the Chinese Alcoholic Beverage Industry Association (中国酒业协会), China’s brewing industry achieved sales revenue of RMB 1.08 trillion (approximately USD 148 billion) in 2024, reflecting a robust 9.3% year-on-year growth. Concurrently, total profits rose 7.6%, reaching RMB 262.8 billion (USD 36 billion), underscoring significant economic vitality despite global uncertainties.

Baijiu still dominates, but the Chinese alcoholic beverage market is diversifying

China dominates the global alcohol market, primarily through its spirits sector, notably baijiu (白酒), which constitutes the bulk of national consumption. Baijiu alone accounts for a significant share of the Chinese alcoholic beverage market revenue, with beer trailing as the second-largest category. Despite a 4 to 5% contraction in the Chinese beer market in 2024, consumption is projected to rebound, expected to reach over 53 billion liters by 2025. Wine and ready-to-drink (RTD) cocktails and other flavored beverages occupy smaller market segments in the Chinese alcoholic beverage market.

Premiumization of baijiu as a status symbol coupled with sophisticated consumption

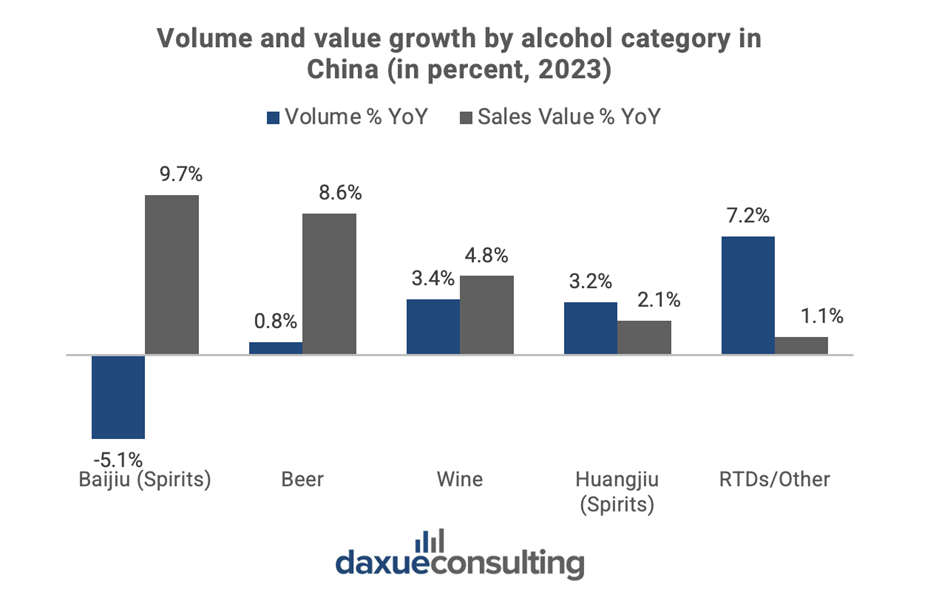

The major Chinese liquor firms reinforced their dominance in the premium alcohol market during 2023, while other categories experienced sectoral growth compared to previous years. Based on the data released by the China Wine Industry Association, Baijiu saw a 5.1% decrease in volume consumption yet achieved a remarkable 9.6% increase in total sales between 2022 and 2023. This indicates a preference transition towards high-end products. This premiumization trend in Baijiu has indicated excess household savings accumulated during the pandemic, which drove up the premium alcohol prices. Moreover, premium baijiu is often treated as a status symbol for prestige-driven occasions such as business banquets, weddings, and gift-giving, where ‘face’ (面子) is paramount. As a result, high-end baijiu was driven by the demand for luxury bottles being displayed rather than a daily beverge

Baijiu bifurcation: Chinese liquor market is splitting between luxury and value

However, since 2024, major Chinese liquor firms have expanded their presence into the RMB 100 to 500 (approximately USD 14 to 71) price range for retail spirits products. According to Beijing Business News, by 2024, this pricing segment will have become the most active, reflecting a more cautious consumer approach amid ongoing economic pressures. In response, leading brands such as Guizhou Maotai (贵州茅台), Wuliangye (五粮液), and Luzhou Laojiao (泸州老窖) have introduced new products specifically targeting the RMB 100 (around USD 14) price point. For example, the Tmall (天猫) platform recently listed “Taiyuan Wine” (台源酒) from the Moutai Group at RMB 148.2 (around USD 21) per bottle after discounts. The pivot towards lower-priced baijiu signals an attempt to compete in the daily drink category.

Premiumization and value growth in urban cities

In addition to the trends above, consumers in major urban centers, including Tier 1 (Beijing, Shanghai, Shenzhen) and Tier 2 cities (Chengdu, Wuhan, etc.,) also increasingly favor premium, imported, and craft alcoholic beverages. For instance, beer similarly showed minimal volume growth (+0.8%) as Baijiu but achieved an 8.6% increase in sales, driven primarily by high-end and craft beer demand. Imported wines saw stable growth in total sales(+4.8%), particularly favored by consumers in first-tier cities such as Beijing and Shanghai.

Young consumers are redefining the alcohol market

Among younger consumers, there is a marked departure from traditional notions of alcohol consumption. Rather than formal or ceremonial occasions, alcohol is increasingly integrated into casual and social settings—weekend gatherings, music festivals, and solo leisure time. The rise of “微醺” (tipsy) culture on social media reflects a growing trend where young adults seek to unwind and express individuality through light, mood-enhancing drinks like craft beer, wine, and RTDs. Festivals that combine alcoholic beverages with music, art, and food have become powerful platforms for engaging Gen Z consumers.

The 5th TaiKoo Hui Craft Beer Festival in Guangzhou highlights how China’s youth are reshaping drinking culture toward lighter, fruitier, and more social alcohol experiences. Featuring low-ABV brews like strawberry milkshake cider and guava gose (mostly 3 to 5% ABV), the event blended craft beer with lifestyle branding and music, attracting young consumers who prioritize flavor, aesthetics, and shared moments over heavy drinking. Social media users on RedNote praised the “小甜水” (little sweet water) beers for their balance of taste and drinkability, signaling a clear shift in market preferences towards low ABV (alcohol-by-volume) beverages. Young adults aged 18 to 24 generally prefer lighter, diverse beverages such as beer, RTD, and ciders compared to traditional high-alcohol Baijiu (35 to 60% ABV). Growing health awareness among younger consumers significantly shapes alcohol consumption behaviors. Demand for lighter, lower-alcohol, and healthier options, such as sugar substitutes and low-calorie beverages, are rising. More importantly, these drinks are meant for sharing, discussing, and experiencing together, rather than solo consumption or traditional banquet-style drinking.

Emerging e-commerce of alcoholic beverages in China

The rapid expansion of digital platforms like Tmall (天猫) and JD.com (京东) has revolutionized alcohol distribution, particularly for premium and imported brands. With seamless shopping features on platforms like WeChat, Tmall, Douyin, and RedNote, and instant payment options via Alipay and WeChat Pay, consumers can complete transactions online without the need for physical cards.

Based on a 2023 Rakuten Insight survey of 7,108 respondents in China, early-career adults (aged 25 to 34) display increased digital engagement, with approximately 23% buying alcohol via social media platforms. This demographic frequently explores premium options, particularly for social and gifting occasions. Middle-aged adults (ages 35 to 44) make up the largest share (34%) of social media alcohol buyers. They balance traditional consumption of Baijiu for formal events with growing interest in premium imported whiskies and cocktails for casual after-work occasions.

From work to whisky: The rise of ‘Reward Drinking’ in China

Rising trends on social media highlight popular hashtags such as #下班喝一杯 (after-work drink), describing drinks as rewards after long workdays. often paired with cosy decorations, soft and dim lighting, and even plush toys to make consumers feel truly relaxed at home. Premium bars have become increasingly popular among young and middle-aged professionals in urban areas. These spaces are designed for after-work relaxation, intimate gatherings, and social media-worthy experiences, with drink prices ranging from RMB 80 to 200 (approximately USD 11 to 28) per glass, appealing to consumers seeking quality, creativity, and ambience.

Older adults, particularly those aged 45 to 54, have lower online alcohol purchase rates (11%), adhering more to traditional purchasing methods and classic consumption patterns. However, affluent segments within this group demonstrate substantial spending on premium baijiu and international brands for celebratory occasions. Placing more Maotai (茅台), a renowned baijiu brand, on the dining table represents more than just drinking. Rather, it symbolizes social status and affluence. Meanwhile, elderly consumers aged 55 and above are turning to e-commerce for price comparisons and product discovery, as this generation tends to be mostly price-sensitive. Their online activity has moderately increased in proportion to the rise in leisure time following retirement, with 18% reporting alcohol purchases via social media.

How women are reshaping China’s alcohol market

Gender dynamics within the alcohol market are undergoing notable changes. Historically dominated by male consumers favoring higher alcohol-by-volume (ABV) beverages, the market now sees significant shifts toward female consumption. Female consumers primarily favor lighter drinks and mixed beverages, with RIO—currently the leading brand in the RTD (ready-to-drink) market—holding the top sales position. However, female alcohol purchasing behavior is evolving rapidly. According to recent data from Taotian Group (淘天集团), per capita spending on Baijiu by female consumers on Taobao surpassed that of males in 2023. Additionally, spending by women on low-ABV beverages through Taobao has shown a steady increase, highlighting the rising influence and purchasing power of female consumers aged 25 to 39 living in Tier 2 cities within the alcohol sector.

Latest trends in the Chinese alcoholic beverage market

- Baijiu remains dominant, but the market is diversifying significantly with increased popularity of craft beer, imported wines, and ready-to-drink (RTD) beverages among younger demographics and residents in major urban areas.

- Gen Z and Millennials make up a significant portion of alcohol consumers, showing strong preferences for low-alcohol, flavorful beverages like craft beers, ciders, RTDs, and cocktails, driven by health-conscious choices regarding calorie and sugar intake.

- Social media trends such as “微醺” (tipsy culture) and “after-work drinks” influence young consumers, emphasizing self-expression, aesthetics, and lifestyle-oriented drinking experiences.

- Young adults and retired elderly increasingly purchase alcohol online through platforms like Tmall, JD.com, Douyin (TikTok China), and RedNote, facilitated by easy online payments via WeChat Pay and Alipay.

- Greater flexibility in leisure time and a tendency towards individual consumption enable these groups to compare prices online, highlighting their budget-conscious buying behavior compared to late-career professionals.