Main segmentations of Ready-to-drink (often known as RTD) in China market include alcoholic RTD and non-alcoholic RTD. Alcoholic RTD, mainly alcopops, refers to certain flavored alcoholic beverages with relatively low alcohol content. Non-alcoholic RTD comprises many different types such as RTD coffee, RTD tea, soft drink, juice, energy drinks and dairy-based drinks.

According to the National Bureau of Statistics of China, the turnover of RTD market in China was 107.3 billion RMB in 2016, with 89% of which was wholesale and 11% of which was retail. Along with economic growth and consumption concept development, China RTD market has turned into the market with various segments such as RTD tea and energy drinks vigorously growing, from the market with soft drink being the absolute dominant segment.

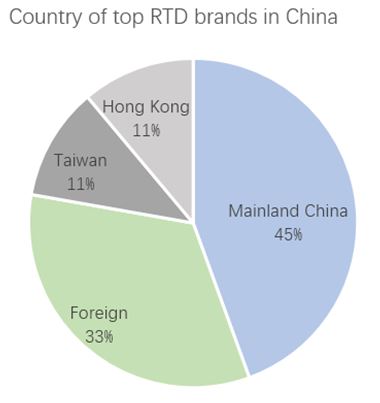

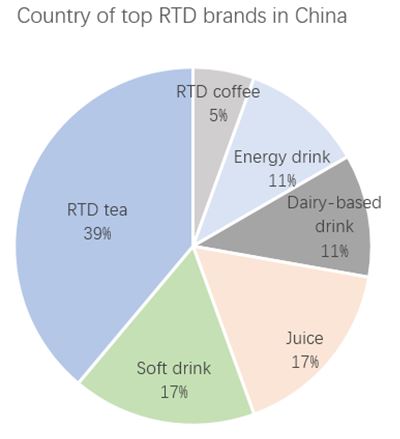

Among the top 18 popular RTD brands in China, near half of them are from mainland China and others from Taiwan, Hong Kong, the USA, Japan, France, Switzerland and Thailand. RTD tea, soft drink and juice are the top 3 leading RTD products of these brands.

Besides traditional offline distribution channels such as supermarket, convenience store and vending machine, online channels are getting an increasing share of sales volume thanks to the booming E-commerce in China. Main RTD brands either have opened official stores on Tmall, JD, YHD etc., either have their products sold by the third-party sellers on those platforms. As the result, almost all RTD products could be found on various E-commerce platforms.

Due to the popularity of social media such as Weibo and WeChat account, most of the top RTD brands have opened Weibo and WeChat accounts to conduct marketing campaigns. They use Weibo and WeChat account to gain traffic to official stores, release new products, publish cooperation information with celebrities and lottery activities.

As RTD market in China has become both broad and mature, the early players have occupied a strong position. Thus, sorts of development strategies have been applied to the battle over market share. From importing new types such as energy drink and alcopop to setting up premium brands in order to avoid a price war, and of course the emerging of local brands, with a better understanding of traditional culture. Those strategies have somehow changed the RTD landscape in China, which we would discuss in the following parts.

Historical VS New Players

The typical historical RTD segment is soft drinks. Coca Cola entered China in the 1920s and several domestic soft drink brands grew fast in 1980s. Energy drink and alcopop are two RTD segments that have developed in China relatively late, after the 1990s and 2000 respectively.

In recent years, the carbonated beverages market has been suffering the decline, the production of carbonated beverages has dropped by 3.71% even though the overall production has risen by 1.9%. Data show that only 7% of total consumers prefer buying carbonated beverages with the improvement of people’s awareness of health. For retailing channels, offline retailing channels including supermarket, convenience store and vending machines still accounts for most market share, though online retailing has been growing fast.

According to the data of China Industry Information Website, 4 of the top 10 carbonated beverage brands belong to Coca-Cola and 3 of them belong to Pepsi. Coca-cola, as the first foreign RTD brand which entered China in the 1920s, went back to the mainland market at the end of 1970s. Pepsi, the main competitor against Coca-Cola, followed its step into China in the 1980s. The two RTD magnate corporations adopt vigorous measures such as expand marketing channels, product and promotion innovation to face the new challenges.

The target consumer of both brands covers teenagers, young people and middle-aged people. As a low-calorie diet and healthy lifestyle become more and more popular, both brands put more efforts on sugar-free products such as Coca-Cola Zero and Pepsi Zero Sugar.

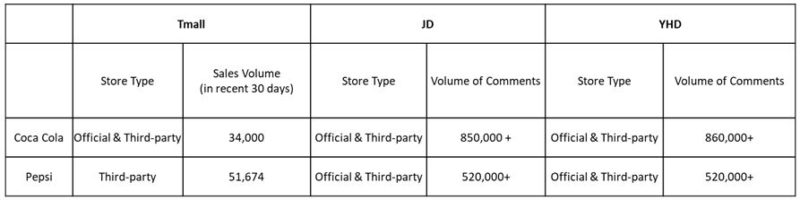

For online retailing, both of them have official stores in JD and YHD. While sales data are not available on JD.com, Coca-Cola has by far more product reviews than Pepsi. Product reviews are usually in line with sales volume since we estimate the review-per-sales ratio at 10 to 20% depending on the products. Coca-Cola is ranked 2nd and Coca-Cola Zero is ranked 19th on JD Best-selling RTD list, in which Pepsi does not enter.

However, neither of them focuses on Tmall platform. Pepsi does not have an official Tmall store, and Coca-Cola only sells small quantities of special edition products related to sports events or celebrity endorsement on its Tmall official store. It might because that Tmall has its own centralized store called Tmall Supermarket, which covers both brands’ products with favorable discount and cheap shipment.

As for advertising, both have a presence on overall channels, though there might be a different emphasis. Coca-cola focuses on localization marketing, since the beginning of 2018, it launched a series of specially designed packaging called “Slim Bottle City Design”, which contains the landmark building of 16 different cities and a single word to show the city features. Pepsi chose to build serial advertising combining celebrity endorsement and daily life scenes like cooking and holding parties, to establish a youthful and viable brand image.

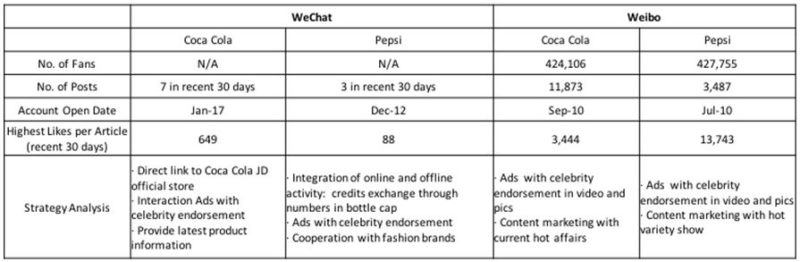

On social media platforms, Coca-Cola provides more functions on WeChat public account, where they offer a direct link to Coca-Cola JD official store, an advertisement with celebrity endorsement and latest products information. The main function of Pepsi public account is membership service, including point redemption and purchase of joint fashion clothing. Pepsi also pushes advertisement video of celebrity endorsement.

Both of them opened their accounts on Weibo in 2010, and they have similar amounts of fans. Coca-Cola seems to follow current affairs such as the World Cup, Asia’s Lights Out Day and Chinese Dragon Boat Festival with a corresponding poster or video advertisement. Pepsi’s posts are more about sponsored variety show and relevant celebrities. With huge star power, Pepsi’s post attracted more likes than Coca-Cola on Weibo.

17% of total RTD consumer have a preference towards energy drinks, which means a broad prospect for energy drink market in China. The market size in 2016 reached 43.9 billion RMB, the second largest market in the world, right after the USA. The energy drink market in China is an oligopoly market: RedBull accounted for 63% of the total market share in 2016, and still accounted for 59% in 2017.

RedBull entered into China in 1995, it is the pathfinder for energy drink segment, thus for a long time RedBull was synonymous with ‘energy drink’. However, since 2014 there has been a dispute over licensing of registered trademark between China RedBull products and imported Austrian RedBull since they share the same brand name in both Chinese and English. This dispute gave opportunities to its competitors, such as Eastroc Super Drink, which accounted for 9% of market share in 2017.

Under the market pressure of RedBull, Eastroc chose to focus on working class and students as their target consumers. The retail price of Eastroc is 3.5 RMB, while RedBull is 6 RMB, and imported Austrian RedBull even reaches 17 RMB. With pricing differentiation strategy, Eastroc has been growing fast during recent years.

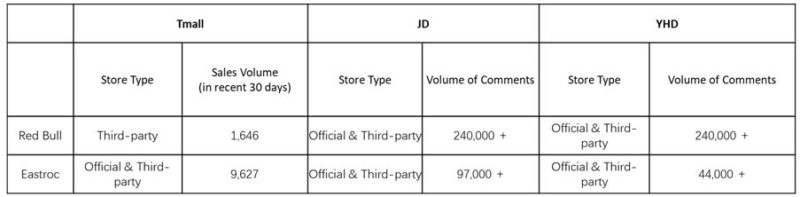

Both RedBull and Eastroc have official stores on JD and YHD. Eastroc also has Tmall store and Weidian (store in WeChat) while RedBull does not. The sales volume of RedBull is generally much higher than Eastroc.

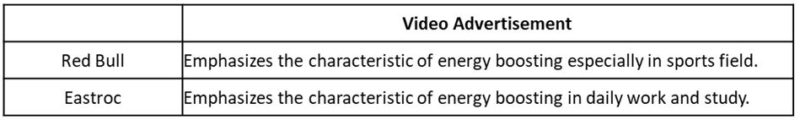

For video advertising, China RedBull emphasizes the feature of energy boosting, while Austrian RedBull always focuses on extreme sports sponsored by them in order to show the spirit of adventure and guide consumers to link RedBull to energy that is needed by extreme sports. Eastroc, as Chinese local brand, puts more efforts on the daily life picking-up of its target consumer, e.g. it shows the function of keeping people awake and helping people to focus on their study or work by a scene of students reviewing for an exam in the video ad.

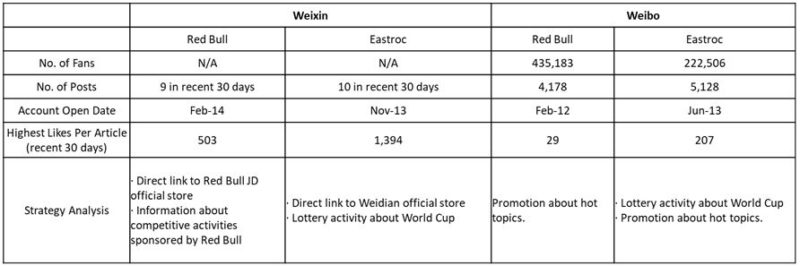

Both of them have official accounts on social media, WeChat and Weibo. On WeChat, both provide the direct purchase link on the dashboard, RedBull also introduces the sports events sponsored by them, while Eastroc offers lottery activities for free drinks. On Weibo, RedBull only post promotion information while Eastroc provides similar information and lottery activity with WeChat, therefore though RedBull has more followers, Eastroc attracts more likes (as they have lotteries).

Chinese alcopop market was born in 2000, with the appearance of Breezer and Rio is the first local alcopop brand which started in 2003. From 2000 to 2012, the alcopop market remained tepid, since consumers preferred foreign distilled spirit. After the anti-corruption campaign broke out in 2012, both spirits and wine market suffered the decline. Taking advantage of this opportunity, the alcopop industry walked into the public eye from 2012 due to the intense competition between Rio and Breezer through embedded advertisement in the hot variety shows and TV series. Attracted by the low market access and high-profit margin, many traditional white spirit manufacturers like Maotai and Wuliangye entered the market with homogeneous products and similar pricing strategy since 2015.

With large investment in marketing and relatively small investment in improving product quality and innovation, consumers attracted by the advertisement would be disappointed and would lose the trust of brand, thus the primary brands such as Breezer and Rio has been experiencing a severe sales winter and most of the following new entrants have been eliminated by the market.

The target consumers of both brands are the same since they have similar marketing and pricing strategy. The low alcohol content, rich colors, soft-drink-type taste, and stylish packaging, all those elements are tailored to younger consumers, especially for the home party scene and entertainment venues like KTV and club.

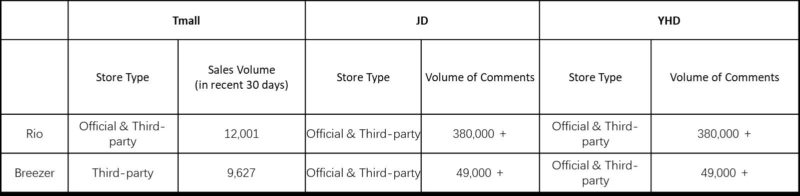

Both of Rio and Breezer have official stores on JD and YHD platforms, while Rio also has a presence on Tmall. Rio has obviously higher sales volume (indicated by the number of reviews), almost 8 times than Breezer’s. In the case of offline channels, Rio is the only brand which could still be found in the supermarket and convenience store. In fact, the manufacturer of Rio has realized profitable again in 2017, after two years of being in the red. The main reason for its profitability might not be product innovation, but the elimination of its main competitors from distribution channels, reducing advertisement and culling staff.

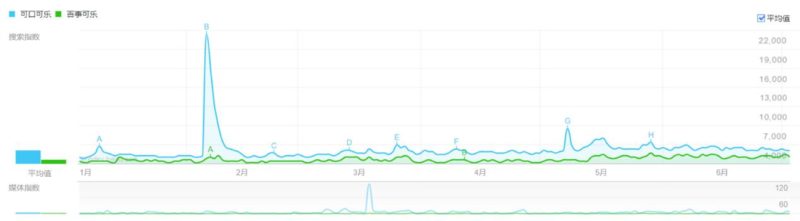

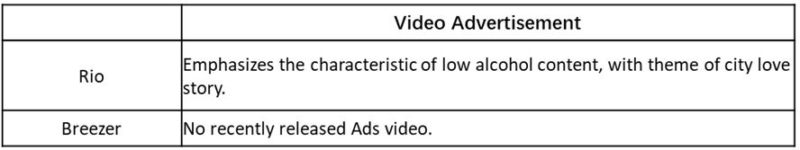

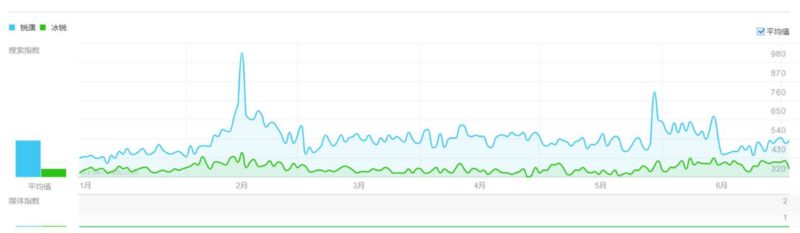

Video advertising is always the core marketing method of Rio. From embedded Ads in hot TV programs to the short films with the theme of city life of younger people, Rio tries to emphasize the characteristic of its low alcohol content and its suitability for parties. Breezer has ceased to push new marketing activity in recent years, thus the Baidu Index of Rio is higher than Breezer.

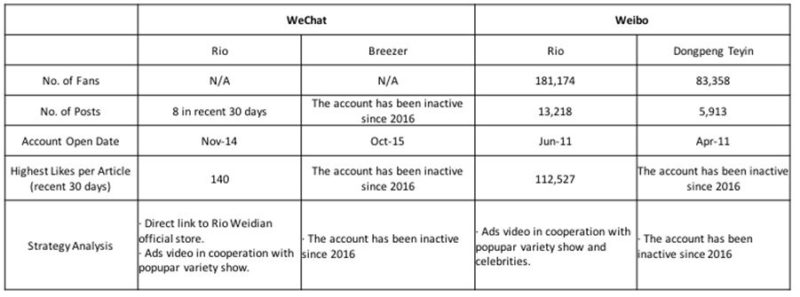

For social media, both brands have official accounts, but Breezer has no longer updated any content since 2016. Rio puts more effort on Weibo than WeChat, it might because the network community character of Weibo makes it more suitable for watching and reposting video ads, especially short films. The number of likes of its top post is 112,527, even much higher than Pepsi, although the number of fans of Pepsi is more than double Rio’s.

Premium RTD Products

The total sales volume of the coffee industry in China has reached 70 Billion RMB in 2015 and is expected to reach 300 Billion RMB in 2020. Even though the instant coffee still dominates the whole coffee market (71.8% in 2016), both global giants like Coca-Cola, Suntory and Local brands like Wahaha and Uni-President have participated into the battle of RTD coffee. As the disposable income per capita in China rises every year, the consumption upgrade of coffee is expected to happen in the future.

Among main RTD coffee products, the common price is from 4 to 7 RMB, which is cheaper than freshly brewed coffee offered by a convenience store (usually 10~15 RMB per cup) and a little more expensive than instant coffee (usually 1~3 RMB per package).

Starbucks has established its premium brand positioning since its entrance into China in 1999, it imported Frappuccino to start their first step in Chinese RTD coffee market. The retail price range of this glass-bottled coffee is from 15 to 22 RMB, which avoids direct competition with other RTD brands and targets the brand follower with high loyalty and strong spending power as their consumers.

In 2018 Starbucks launched a new series of canned RTD coffee with a lower retail price (about 12 RMB), and local RTD giant producer, Tingyi, will be responsible for production and share the distribution channels with Starbucks. This is considered an intermediate complement for its premium Frappuccino, also an attempt at expanding its target consumers.

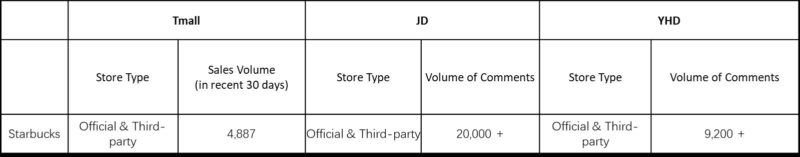

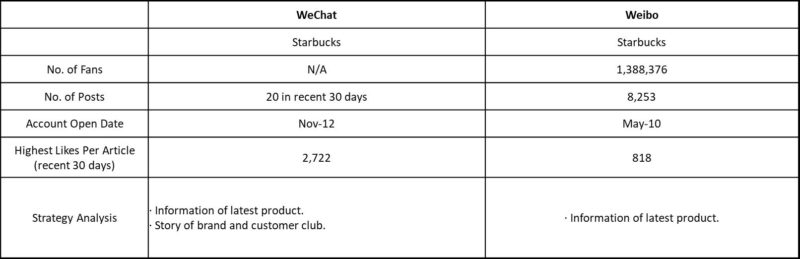

Starbucks has official stores on overall distribution channels. Just like Coca-Cola, the RTD products of Starbucks are not available in Tmall official store. They could be found on Tmall Supermarket, JD and YHD official store instead.

Starbucks has never made a video advertisement on TV or other channels, though it is active on social media platforms. On WeChat, it posts 20 messages in recent 30 days, which is a fairly high frequency compared with other brands’. It provides the latest product information, and customer club service on WeChat, while on Weibo it provides only the former information. It might sound incredible that Starbucks received so much positive feedback on social media without conducting some typical marketing activities which are common for other brands, but brand recognition truly determines its success.

Another premium RTD product which emerged in recent years along with citizens’ health awareness is NFC (Not From Concentrate) juice, though the current market share of NFC in total juice market is less than 1 %. Ingredients and the necessity of low-temperature delivery and storage determine that NFC juice would be positioned as a high-end product and the main distribution channel is offline convenience stores. However, the limited distribution of convenience store in first- and second-tier cities hinders the expansion of NFC juice.

Zero Fruit Square is considered the largest player in NFC juice area, founded in 2012, its monthly sales volume has broken 1 million bottles in 2014, and it has entered the distribution channel in Starbucks since 2017.

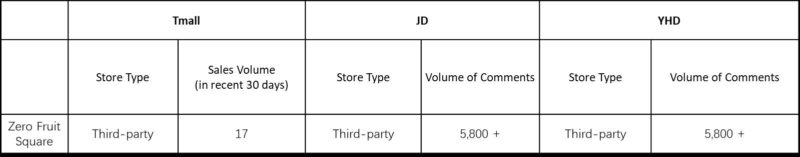

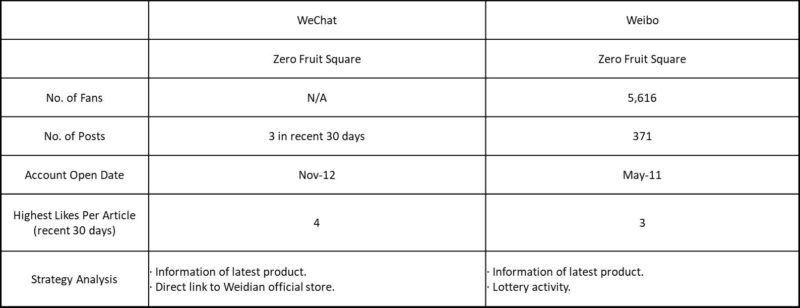

Due to its focus on offline distribution and high-end positioning, Zero Fruit Square has no official stores on main online marketplaces except Weidian (on WeChat). On Tmall, JD and YHD consumers could purchase it on third-party store and juice would be delivered through cold chain delivery.

Zero Fruit Square has no video advertising, neither active operation on social media. The WeChat and Weibo official accounts have post only few information about products. The official Weidian store is integrated into WeChat account.

Chinese RTD Products

Among all RTD segments in China market, RTD tea is the segment that has many specific “Chinese” products which are local brands or adapted to Chinese taste and even culture. RTD tea in China market has entered maturity stage in which the brand concentration trend is getting more and more obvious. The top 10 RTD tea brands in China (ranking by sales volume) take more than 96% of the RTD tea market share. Uni Present, Masterkong, WLJ etc. 6 brands take about 90% market share and Uni Present, Masterkong each take 40%. The turnover of China RTD market is expected to reach 70 billion RMB by 2020.

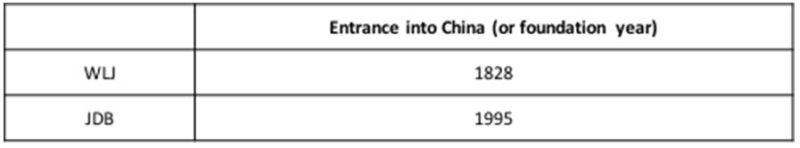

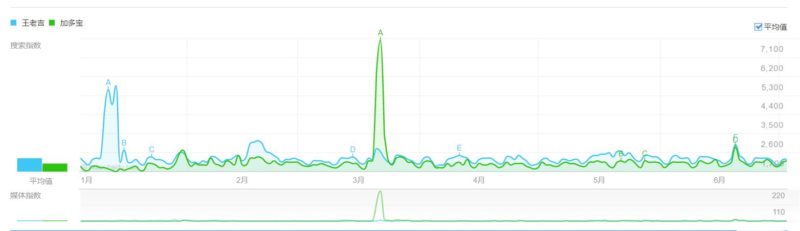

Herbal tea, a traditional Chinese drink, has two dominant brands, WLJ and JDB. WLJ is a historical herbal tea brand derived from Guangdong Province since 1828 and JDB was founded in 1995. Their competition history is a long story due to complicated trademark and red packaging fight. As the result of famous lawsuits between them, they have similar popularity in China, which could also be indicated by Baidu Index where their brand names have similar search times.

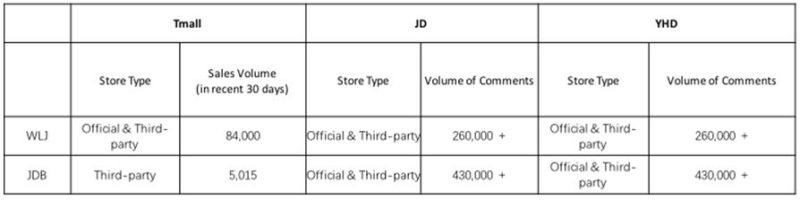

The revenue of China herbal tea market was 56.1 billion RMB in 2016 and JDB took 52.6% market share in it and 70.7% in RTD herbal tea market. However, recent data from Tmall sales volume shows that though JDB has more accumulated sales volume than WLJ, WLJ’s sales volume in the recent 30 days is 16 times JDB’s. Facing fierce competition, WLJ launched new products, sugar-free herbal tea and low sugar herbal tea, to adapt to modern Chinese’s healthier lifestyle and it opened its Tmall official store, while JDB does neither launched new products nor opened a Tmall official store.

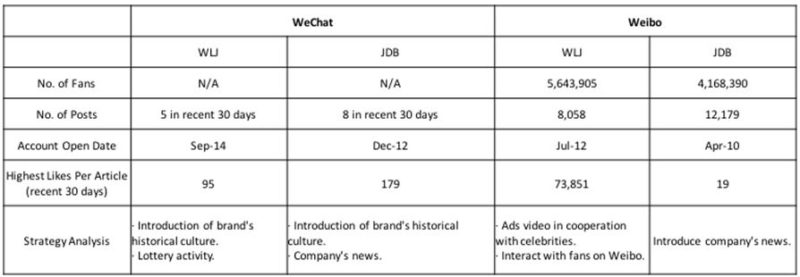

Ads of both WLJ and JDB the function of herbal tea, clearing intern heat and they even have similar wording in their ads. For other marketing activities, both of them operate WeChat official account and Weibo account. Unlike their ads, their strategies on social media are different and therefore get different effects. On WeChat, besides the introduction of company history and culture, WLJ also push articles about current affair and lottery activities while JDB pushes mainly company news. On Weibo, WLJ post cooperation with hot stars with hashtag of this cooperation and @ these stars to attract more likes and retweets, besides, it also posts company awards such as “Top 50 enterprise in China food industry” and current affairs such as world cup with hashtags of this award or affair and its slogan. On the contrary, JDB post mainly company news and culture, rarely current affairs compared with WLJ. In terms of content diversity, WLJ performs better than JDB.

The RTD milk tea market in China has entered multi-brands steadily developing stage. Well-known RTD brands, such as Uni Present, Masterkong, Nongfuspring, Suntory, Wahaha and Kirin all launched RTD milk tea. Urban consumers of milk tea are a quarter billion, and 71% are 15 – 25-year-old females.

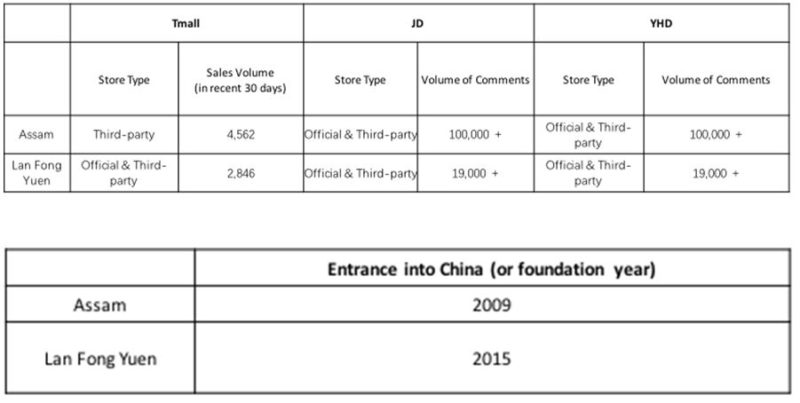

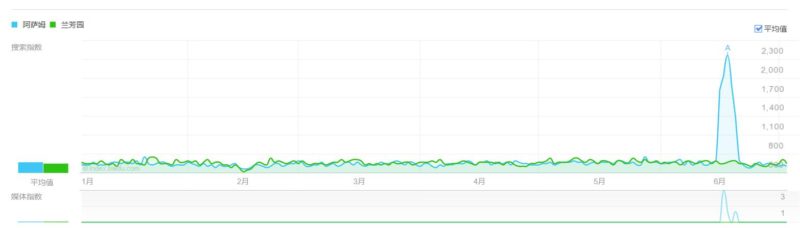

Assam RTD milk tea (Uni Present) and Lan Fong Yuen RTD milk tea are top products perform well according to sales volume on Tmall supermarket. Uni Present took 70% of RTD milk tea market share in 2016 and Assam is its leading product. Lan Fong Yuen is relatively new, but its popularity is comparable to Assam according to Baidu Index. No matter accumulated or monthly sales volume on big E-commerce platforms, Assam performs much better than Lan Fong Yuen. (However, the fact that Assam’s accumulated sales volume is better than Lan Fong Yuen’s, has limited reference value due to Assam was launched in 2009 but Lan Fong Yuan was 2015.)

For marketing, both of them have opened WeChat official account and Weibo account. On WeChat, Assam is more active than Lan Fong Yuen and its highest likes in recent 30 days are about 150 times of Lan Fong Yuens. Assam pushes the link to its official JD store and posts video ads with celebrities in them. Lan Fong Yuen holds lottery activities and posts release of new product. On Weibo, Assam has 6 times Lan Fong Yuen’s fans and 2 times of Lan Fong Yuen’s posts. As the result, Assam’s highest likes are near 2 times of Lan Fong Yuen’s. Though Assam does not put emphasis on lottery activities on WeChat, on its Weibo, it does. Assam differentiates WeChat and Weibo marketing by focusing on different contents, which is WeChat for direct traffic to an online store while Weibo for interaction with fans (consumers) by lottery activities. However, Lan Fong Yuen operates its Weibo the same way as its WeChat, mainly lottery and product release.

Daxue Consulting can help strategize your China market entry:

Daxue Consulting assists overseas clients by designing comprehensive and data-driven strategic action portfolios, business models as well as business projections.

If you want to know more about the RTD industry in China, or about market strategy do not hesitate to contact us at dx@daxueconsulting.com