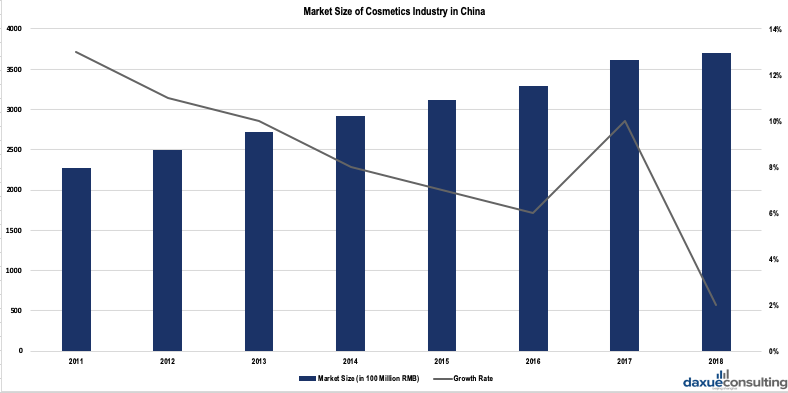

Since 2011, the cosmetics market in China has seen sustainable growth. In 2018, the market size of cosmetics industry in China reached 3.69 billion RMB. From 2010 to 2018, the average growth rate of the market size had maintained at 7.87%. It is expected that the average growth rate will maintain at 5.4% in the following years. For those selling makeup in China, the market growth has slowed but there is no shortage of opportunity.

Regarding the import trading pattern of the cosmetics market in China, since 2013, the volume and dollar value of import have both been rising. In 2018, China imported more than 200,000 tons of cosmetics products with the value of 92 million USD, which was approximately 160,000 tons more than 2013. Such a figure indicates that foreign cosmetics firms have a large business opportunity if they want to enter China’s cosmetics market.

Cosmetics market in China: Distribution channel analysis

Finding the right distribution channel is important for selling makeup in China. Supermarkets and hypermarkets are the main winners in the battle for distribution share of beauty and personal care goods in China.

The increase in sales of beauty and personal care products through supermarkets and hypermarkets comes mostly at the expense of small independent stores, which dominate sales in rural areas. As the population shifts into the cities, they are losing distribution share.

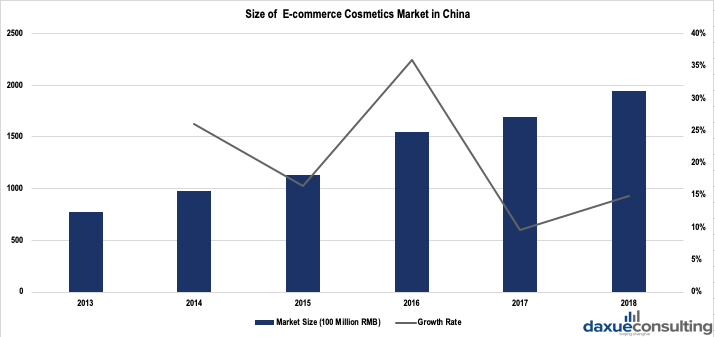

The share of direct sellers diminished since 2008 because of the regulation affecting multi-level direct selling. Internet sales have doubled from 0.4% of all beauty and personal care sales in 2011 as penetration of computers is on the rise in China.

With the development of Internet, online sales have become the major distribution channel in China’s beauty market. From 2012 to 2017, the market size of online shopping had a significant increase. The sales volume of online shopping accounted for more than 50% of the total sales volume. In 2012, the market size of online shopping was 62.2 trillion RMB. In 4 years, it had surged to 154.4 trillion RMB. It is expected that the market size of online shopping will grow continuously.

China cosmetics market case study: Sephora in China

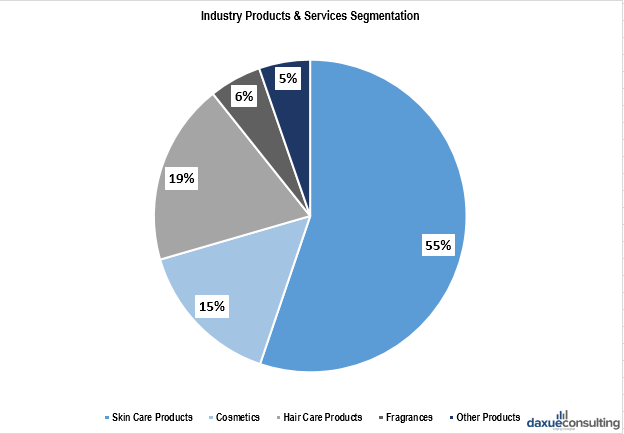

While many foreign personal care manufacturers have not done as well as expected when entering the Chinese market, premium French beauty retailer Sephora has enjoyed a great degree of success selling makeup in China. After initial success in big cities such as Beijing and Shanghai, Sephora in China is speeding up growth and is now focusing on second-tier cities. The French beauty retailer pulled out of the Japanese market in 2000s. Its crucial mistake there was too much emphasis on stocking fragrances, a category of minor importance in Japan compared to skin care. Sephora in China has learned from this and is focusing its product range more on skin care and color cosmetics. This makes far more sense given that these categories are currently far bigger than the fragrances sector in China.

Analysis of cosmetics market in China

Cosmetics products segmentation is influenced by culture and focused on skin care According to research by IBISWorld, skincare products are the largest segment among cosmetic products in China, accounting for 55.2% of industry revenue in 2018. Skincare products are used to clean and protect the skin, and keep skin healthy. Most women use skincare products, underpinning skincare’s dominance of the industry.

Hair care products are ranked second with a proportion of 18.8% in China’s cosmetics market. Moreover, in the skin care and hair care segments, male grooming products have been growing in popularity.

Cosmetics include makeup for the skin, eye makeup, lipsticks and nail care products. In 2018, less than 20% of Chinese people use cosmetics, while over 95% of Western women use them daily. However, the number of cosmetics users is expected to increase remarkably in the following five years.

Fragrances include perfumes, colognes and floral water. This segment has experienced steady growth in recent years as more Chinese women have started using perfumes. Relatively few Chinese people use fragrances, as market research shows they do not prefer strong smells. Nevertheless, this segment is anticipated to grow in the future with the influence of globalization and cultural integration, and would grow further with the development of lighter scented perfume products that fit Chinese consumer preferences.

Other products include deodorants, depilatory (hair removal) products, and pilatory (hair growth) products, accounting for an estimated 5.3% of industry revenue in 2018.

[Data source: IBISWorld, ‘Products of the personal care market in China’]

Key players in China’s beauty market: Foreign brands are successful in the cosmetics market in China

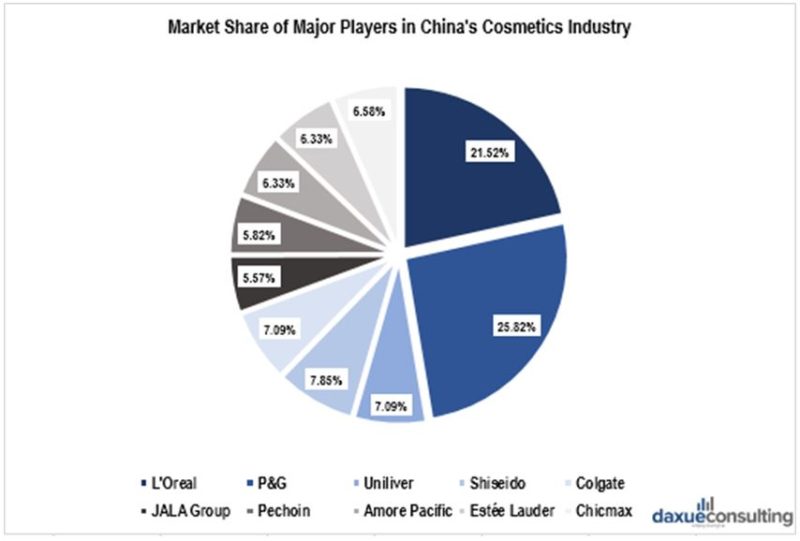

Foreign brands dominate the cosmetics market in China while domestic brands are catching up quickly. The competition of brands selling makeup in China is tightening as more domestic brands gain market share.

In 2018, foreign brands such as Procter & Gamble and L’Oréal accounted for approximately 50% of the market share in cosmetics industry in China. Although domestic firms in China Chicmax, Pechoin and JALA Group) occupied 17.97% of market share, with the development of quality and innovation of products made nationally, it is expected that the market share of domestic cosmetics-manufacturing firms will increase steadily in the future. Previously, their performances have proven that this statement is real. From 2014 to 2017, the market share of Pechoin increased from 1.4% to 2.3% while Chando increase from 1.3% to 1.7% and ranked at the fifth place in the China’s cosmetics industry.

Consumer analysis of China’s cosmetics market

Consumer profile: Female-dominated, concentrated in eastern and southern China.

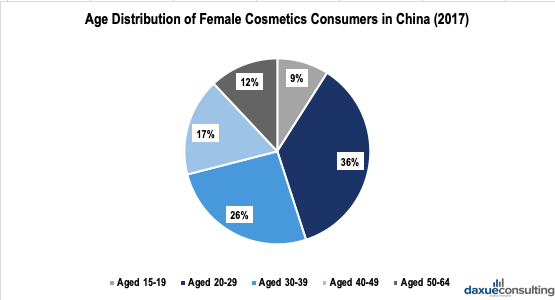

To some extent, consumers of cosmetics and personal care market in China are distinct from others. In terms of genders, Chinese female consumers have contributed most of the sales volume of the cosmetics market in China. According to Institute of Sina WRD Big Data, 64.35% of the users that follow the topic of cosmetics and personal care are female. More specifically, females aged 20-29 accounted for most of the sales transactions with the proportion of 36%, followed by the segment of females aged 30-39 with the proportion of 26%. As the segment of females aged 20-29 consumed the most in China’s cosmetics market, this can be explained by the fact of the rising anxiety of beauty and aging among them and their increasing affordability. In 2028, it is expected that the contribution of females aged 30-39 will outweigh that of females aged 20-29 and the sum of their contributions will be more than 50%.

On the other hand, with the influence of K-Pop and J-pop, Chinese males are becoming aware of their appearance, which lead to rising consumption on male personal care products. From 2019 onwards, in the following 3 years, the sales growth rate of cosmetics products regarding male segment in China will reach 13.5% in comparison with 5.8% of the global rate.

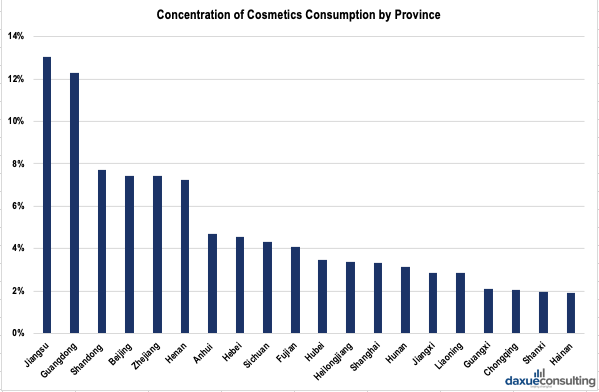

In terms of geographic locations, the sales volume of the cosmetics and personal care market in China is mainly concentrated in the area of Pearl River Delta (Guangdong) and Yangtze River Delta (Jiangsu, Zhejiang, Shanghai). According to Institute of Sina WRD Big Data, users from these areas are most likely to follow and post relevant information regarding cosmetics and personal care on social media platform. Moreover, it is found that the cosmetics market in provinces that are in northern east (i.e. Heilongjiang and Liaoning) and middle (i.e. Sichuan and Anhui) China has a potential business opportunity.

[Data source: Institute of Sina WRD Big Data ‘Concentration of cosmetics consumption by province’]

Consumer preferences: Craving for different functions of products, natural ingredients and top-grade brands

As consumers of cosmetics market in China become more familiar with the variety of products available, the consumer demand grows stronger for more specific items. Take skincare as an example, whitening, freckle removal, moisture and antioxidant are segments becoming more prevalent in Chinese consumers’ mind. When selling makeup in China, foreign brands often need to alter their product to match the unique beauty needs of Chinese consumers.

Apart from the function, consumers in China’s cosmetics market desire for cosmetics made from natural ingredients. Due to the frequent safety issue of items in China, consumers are more aware of safety of cosmetics. Products made from natural or herbal ingredients become popular with consumers in China. This has been proven by the rising performance of companies that focus on producing cosmetics with herbal ingredients. In 2018, the sales volume in this segment was 5.3 times than that of 5 years ago while the consumer base was 4.2 times than that of previous years. In the future, cosmetics with natural ingredients are projected to occupy more market share.

Lastly, influenced by the rising purchasing power, consumers of cosmetics market in China are switching to top-grade brands. This has been proven by the increasing market share of top-grade brands in China’s market.

[Data source: qianzhan & Research Institute of Orient Securities, ‘Example: market share of Lancôme and YSL in China’s cosmetics industry’]

Choosing the right E-commerce Platforms for selling makeup in China

Dominating e-commerce platforms: Tmall and JD

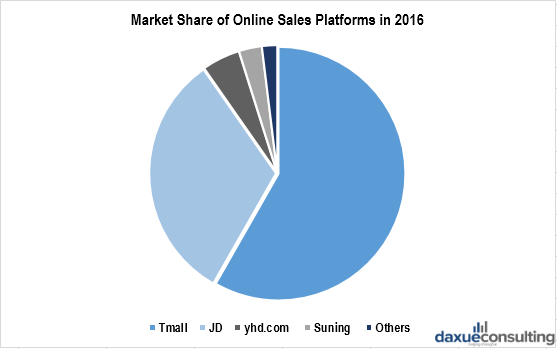

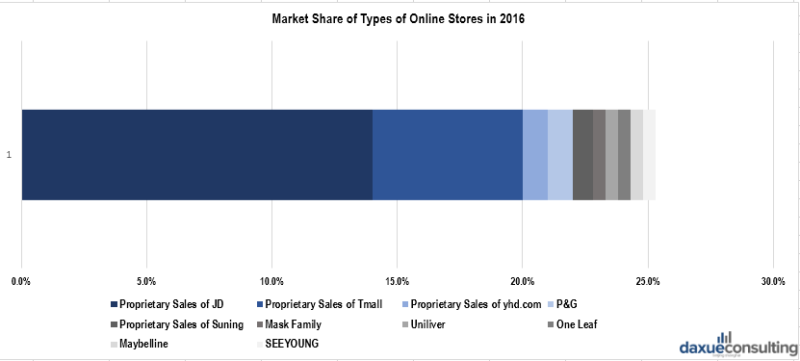

In 2016, Tmall and JD were the dominating channels with the market share of 60% and 33% respectively. Although other channels such as Suning and yhd.com had occupied certain market share, they were still pale in comparison with those of the main channels. Moreover, as for the types of online stores that were most popular with customers, online flagship stores listed on the platforms like Tmall and JD accounted for the largest market share with 45.4% of market share while proprietary sales of these platforms ranked at the second with 23.9% of market share. This reveals Chinese consumers preference for online shopping. That is, they are likely to shop at stores that are directly operated by cosmetics brands.

Promotion platforms: TikTok and Xiaohongshu

With the development of online shopping channels, social media platforms have significant impact on the promotion channels and consumer behaviour. Xiaohongshu and TikTok become novel platforms for cosmetic firms to promote their products. For example, Proya, a domestic skincare firm released short videos on TikTok and invited influencers of Xiaohongshu to post their reviews after using the products. Posting related information on such platforms can reach target customers since most of the users are millennials. It turned out to be successful. The new product, Black Sea Salt Deep Purifying Bubble Spa Mask, has a remarkable performance with more than 1-million sale volumes every month.

[Photo source: jumeili, ‘Promotions of cosmetics on Xiaohongshu in China: Selling makeup in China’]

Promotions of China’s cosmetics products

Common marketing strategies: celebrity endorsements, crossover marketing and KOL marketing

Celebrity endorsement is a common strategy that beauty and personal care brands in China would utilize to promote their products. Companies in this sector are likely to hire KOLs or celebrities from China, especially males to endorse their products. In 2019, 24 cosmetics companies established collaboration with famous stars and hired them to be the brand ambassadors. There is couple of reasons to explain this trend. Firstly, the majority of fans are females and they are likely to make consumption on the products which are related to their idols. Secondly, male endorsement is able to create sensations, which can draw people’s attention.

Crossover marketing is a novel strategy in the beauty industry in China. Promoting multiple products from different industries is able to draw consumers’ attention and increase brand exposure among existing and potential consumers. Nowadays, since people are bombarded by novelties, it is necessary for a cosmetic firm to come up with sensational meanwhile effective promoting content in order to target consumers successfully, which will potentially lead to increase in revenues and profit. Quite a few cases have proven that this strategy is feasible. For example, in December 2018, the marketing campaign of “The Forbidden City & Cosmetics” was launched. It suddenly went viral among consumers. According to Weibo, the topic of “The Forbidden City & Cosmetics” reached 4,500,000 reads and discussed more than 4000 times.

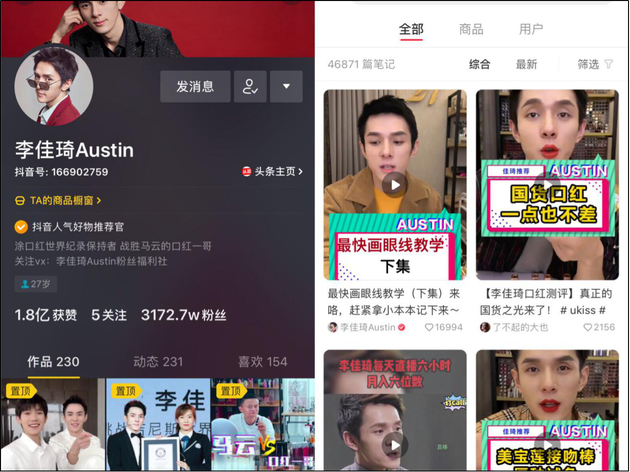

KOL marketing is also widely used by cosmetics and skincare brands in China. For example, Austin Li, a famous makeup influencer who is famous as “Brother Lipstick” on social media has successfully promoted multiple products. He has over 31 million followers on Tik Tok and has earned 100-million likes. On Xiaohongshu, there are 40-thousand articles related to him. Lots of cosmetics consumers refer to his comments on products as guideline prior to their shopping on cosmetics. Austin has proven to be an impressive KOL for brands selling makeup in China.

Regulations China’s beauty: Tax & hygiene supervision

For foreign cosmetics brands that want to enter China’s market, it is necessary to apply for safety certifications. Furthermore, taxes on imported goods are continuously adjusted and it is important for them to know the information of taxation as this can affect costs and revenue significantly.

In terms of import tax, according to the policy updated in 2018, for imported cosmetics, the Chinese government has decreased the taxation rate from 8.4% to 2.9% for the purpose of boosting international trade and satisfying domestic customers’ needs.

In terms of Chinese cosmetics industry’s safety standards, the regulations that strengthen hygiene supervision over cosmetics to safeguard consumers’ health are continuously updated. For example, according to IBISWorld, in 2012, the State Food and Drug Administration issued the Guideline for Rapid Detection Method of Health Food and Cosmetics to establish and complete the rapid detection method of health food and cosmetics. The security of cosmetics will be of increasing importance in the future. In July 2015, new regulations on technical specifications for safety of cosmetics were published, which are expected to reduce the occurrence of cosmetic safety incidents.

Case study: L’Oreal in China

L’Oreal is an MNC based in France, that entered China’s cosmetics market in 1996. After 2 decades, the firm has become the major player with the largest market share in China’s cosmetics industry. Since 2016, their business in China has become the second largest income stream for the company. Owing to the dynamic strategy of L’Oreal which fits China’s market accordingly, it wins the heart of Chinese consumers.

A variety of products with different positioning

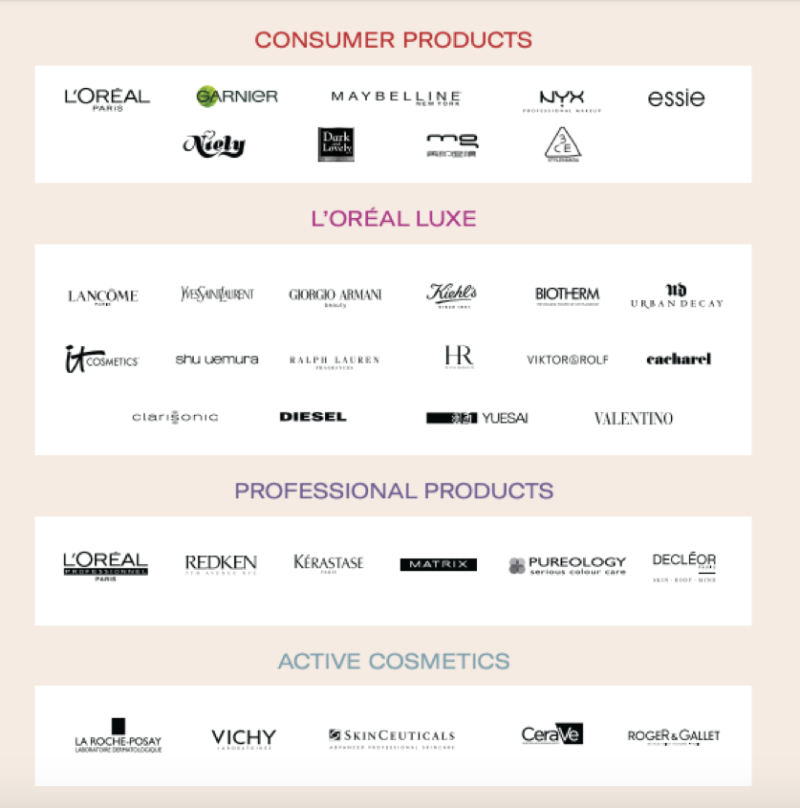

By acquiring brands specialized in different cosmetics areas, L’Oreal is able to diversify its business and gain profit from different streams. Meanwhile, L’Oreal is also able to position each of its brands in order to suit Chinese consumers’ needs. For example, shu uemura in China is positioned as luxury while 3CE and mg are positioned as mainstream consumer products. It is noticeable that shu uemura, 3CE and mg are brands based in East Asia and have already gained reputation among consumers in China prior to the acquisition. Many Chinese customers perceive that these brands are suitable for them as they tailor to Asian skin. Furthermore, after the acquisition, L’Oreal dedicates to amplify their advantages in order to maintain and expand its customer base. In addition to Asian brands, luxurious brands such as Lancôme, YSL and GIORGIO ARMANI have remarkable performances in China as the positioning and quality of products are in line with the expectation of customers in China. At the same time, by taking advantage of the current consumer’s preference in China, rising trend of purchasing with top-grade brands, it may enable L’Oreal to gain more profit.

Apart from the acquired brands, the home brand such as L’Oreal Paris has altered in order to tailor to China’s market. The company has established R&D centers in China and hired Chinese talents for the purpose of creating products which meet Chinese consumers’ needs.

[Photo source: L’Oreal, ‘Product segmentation of L’Oreal’]

Keep pace with the up-to-date sales channel and promotion strategy

E-commerce and KOL marketing are necessary promotion methods when selling makeup in China. L’Oreal, as a market leader, has always updated its distribution channel and promotions of cosmetics to keep up with the fast-changing Chinese beauty market. For example, in 2016, the company officially set up its E-commerce department in China and standardized its online sales channel. This had proven to be effective. In 2017, the total sales volume of online selling achieved 2.1 billion Euros with the growth rate of 33.6%.

As for promotions, L’Oreal is notable for its Beauty Advisers (BA). Since the company has leveraged KOL marketing in China, in 2016, it launched the program which enabled BA to be influencers on social media platforms. The company collaborated with Tmall and trained 200 BAs to be influencers. Austin Li, who is mentioned in the previous section, is one of the trained BAs of L’Oreal. He has broadcasted 80 live shows on social media platforms for L’Oreal and potentially increased the revenues by 10 million RMB. What is more, L’Oreal is the pioneer of KOL marketing in the cosmetics and market in China.