A fragmented, fresh-focused niche

In China’s pet food market, a new trend is catering to pet owners who treat their companions like family: subscription-based, freshly cooked meals. This niche segment, though fragmented, is growing rapidly, driven by humanization, food safety fears, and social media. Subscription-based pet food business, or fresh pet meal plans, has developed into a small yet rapidly growing niche market in China. Unlike the mainstream pet food market, dominated by dry kibble and canned food, this segment focuses on regularly delivering freshly cooked meals to pet owners.

Download our report on China’s Pet Economy

Currently, the market remains highly fragmented, with no national leader yet emerging to dominate it. By 2024, China’s pet food market reached a scale of RMB 159.5 billion. For the subscription-based fresh pet food business in China, the industry currently lacks precise figures. However, based on consumption preferences among dog and cat owners, fresh pet food consumption accounts for approximately 16.5%-20% of the total market. This indicates a potential market size of RMB 26.3 to 31.9 billion for this segment. Focusing solely on the chilled fresh food portion delivered via cold chain logistics, the Chinese market for subscription-based pet food is estimated at approximately RMB 505 million (USD 72.2 million), projected to grow at a CAGR of 23% through 2030, demonstrating that the industry remains in a very early development stage yet possesses substantial growth potential.

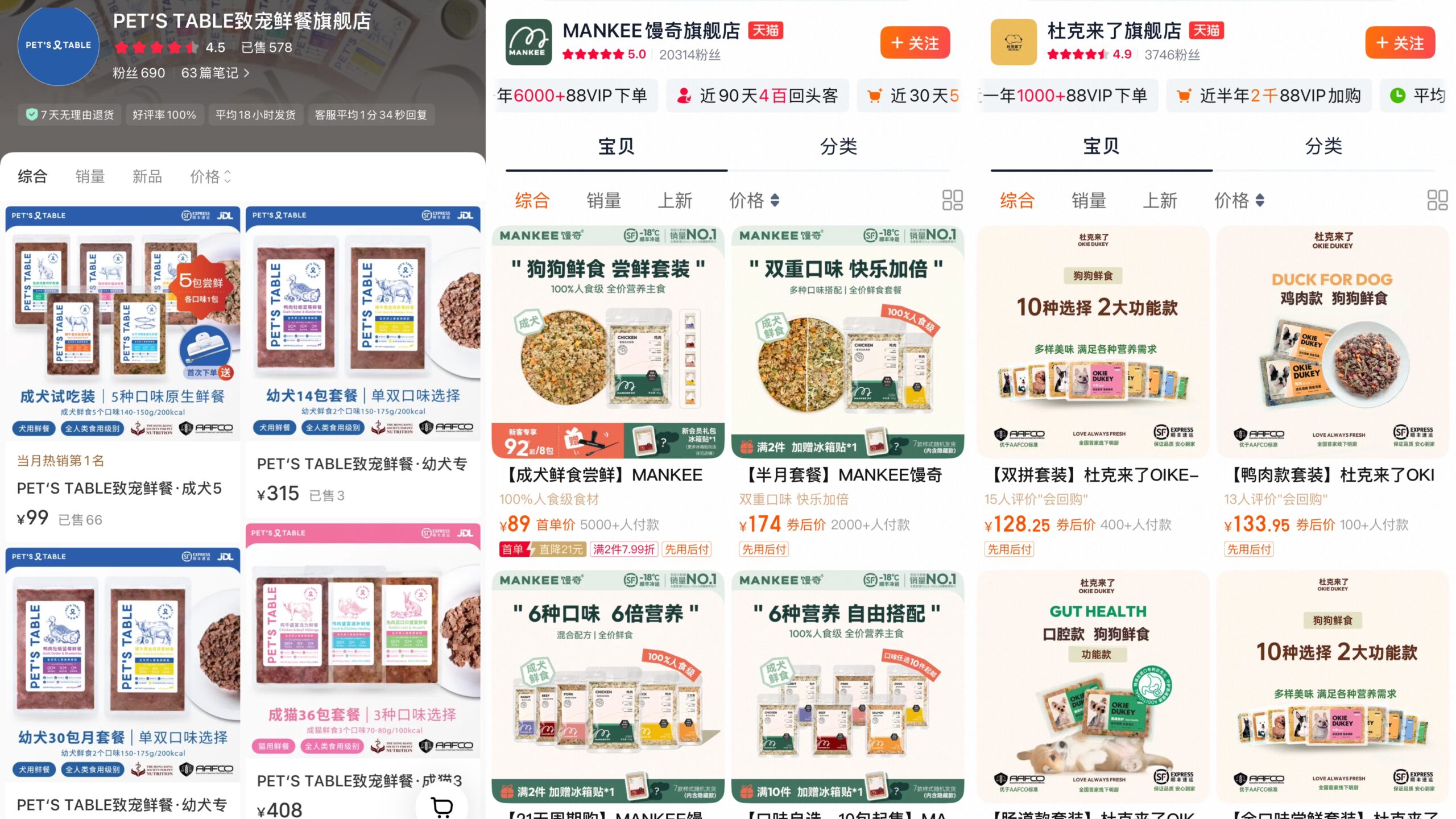

Mostly operating through online platforms

Most brands operate through WeChat mini-programs (the sub-applications function without downloading) or official accounts, selling directly to consumers via cold-chain logistics that deliver refrigerated meal packs. Shanghai-based Pet’s Table, one of the earliest fresh pet food providers (founded in 2019), operates entirely online, offering customized fresh meals without any physical stores. Overall, the subscription-based pet food business in China remains a “niche preference” within China’s pet economy, catering to owners in major cities who seek high-quality diets for their “children.”

Treating pets like family

Chinese pet owners, especially the younger generation, increasingly view their pets as family members and are willing to “feed their pets better than themselves.” Many embrace the “no matter how hard life gets, don’t let the kids suffer” philosophy, no longer content with merely filling their pets’ bellies but committed to providing healthier, higher-quality food. Social media has also fueled growing interest in high-quality pet snacks. Posts and videos on platforms like Xiaohongshu and Douyin showcase “Michelin-level” meals meticulously prepared by pet owners themselves, sparking envy among those who only purchase mass-produced pet food. On Xiaohongshu, homemade dog food (#自制狗饭) and cat food (#自制猫饭) recipes have garnered 780 million and 400 million views, respectively, demonstrating pet owners’ enthusiasm for preparing fresh homemade meals.

Pet food safety anxiety in China

Food safety and quality concerns have further fueled this trend. Scandals involving counterfeit and substandard pet food have eroded some pet owners’ trust in mainstream brands. The founders of fresh pet food startups like Pet’s Table (致宠鲜餐) and Pawsome (爱宠优粮) themselves serve as vivid examples. The founders of Pawsome’s own dog nearly died from consuming toxic pet food, prompting them to launch Pawsome in 2016. The founder of Pet’s Table established the brand in 2019 after her dog passed away from gastric adenocarcinoma.

Local subscription brands and strategies

China’s subscription-based fresh pet food brands utilize both online sales and subscription models. This offers customers the option of one-time purchases or regular meal deliveries. Leading fresh pet food brands typically operate central kitchens with standardized production lines. After pre-processing, meals are packaged in small batches (150g per pack) and delivered via express cold-chain logistics, usually every two weeks or monthly. This ensures pets consume meals within their shelf life. Under this operational model, pre-order and subscription sales are key to aligning demand with production and minimizing spoilage of fresh pet food.

Key players of subscription-based pet food in China

- Pet’s Table (致宠鲜餐)

- Mankee (馒奇)

- Duke Comes (杜克来了)

- Pawsome (现更中文名拍窝森)

- Petiboxy (宠物鲜粮)

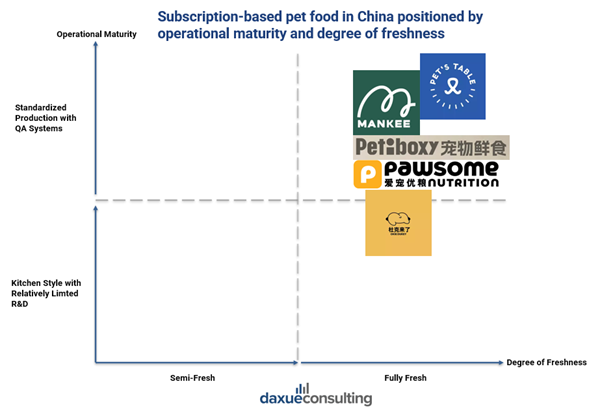

Standardization and scientific credibility are differentiators

Among the leading fresh pet food brands currently on the market, larger-scale, more mature operations like Mankee and Pet’s Table often establish their own factories or central kitchens to ensure standardized production. Their R&D teams hire professional pet nutritionists and formulators to design recipes, delivering products that exceed AAFCO nutritional standards. Regarding ingredient sourcing, larger brands rigorously select trusted suppliers to guarantee quality. They also regularly submit samples to third-party authoritative testing agencies for inspection reports, thereby earning consumer trust.

Why is there a niche market of subscription-based pet food in China?

- Subscription-based fresh pet food has emerged as a small but rapidly growing niche within China’s RMB 159.5 billion pet food market.

- The category is driven primarily by pet humanization, with younger urban consumers increasingly treating pets as family members.

- Social media platforms, especially Xiaohongshu and Douyin, have accelerated interest in fresh pet food by normalizing homemade and high-quality pet meals.

- Food safety concerns and declining trust in mass-market pet food brands have pushed some owners toward fresh, veterinarian-formulated alternatives.

- The market remains highly fragmented, with early players differentiated mainly by operational maturity and scientific credibility rather than scale.