As the largest automotive market in the world, China leads globally in both automotive sales and production. With the domestic market becoming increasingly saturated, China is increasingly focusing on exporting automotive products overseas. According to the Nikkei Asian Review, China’s automotive industry abroad have ranked first globally for two consecutive years. The automotive export industry in China has not only gained a significant share of the international market through its diverse product range and advanced technology, but it has also had a profound impact on the international automotive industry, particularly in areas such as the supply chain, battery dominance, and standard-setting capabilities. However, behind these remarkable achievements, the future of China’s automotive industry abroad has become somewhat clouded by uncertainty.

Achievements of China’s automotive exports in 2024

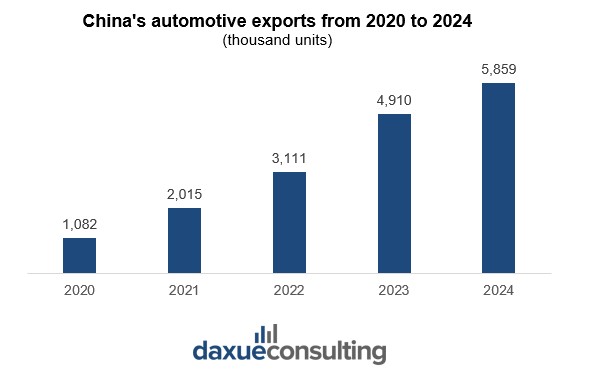

According to data released by the China Association of Automobile Manufacturers, in 2024, China exported 5.859 million vehicles, a year-on-year increase of 19.3%. Of these, 4.574 million were traditional fuel vehicles, representing a 23.5% year-on-year increase, while 1.284 million were new energy vehicles, marking a 6.7% year-on-year growth. This marks the second consecutive year since 2023 that China’s automotive exports have surpassed Japan, maintaining its position as the world’s largest automotive exporter. As competition in the domestic automotive market intensifies, an increasing number of Chinese automotive brands are starting to expand into overseas markets.

In late 2024, NIO announced that it would launch its high-end electric compact car brand “Firefly” in 16 countries by 2025. Additionally, NIO plans to introduce its first right-hand drive vehicle for export to Southeast Asia and Europe. Xiaomi, a new electric vehicle manufacturer that has just launched two new energy vehicles, also plans to expand into overseas markets starting in 2027, with plans to establish an electric vehicle R&D base in Germany. GAC Group also introduced a pickup concept car designed for overseas markets at the Shanghai Auto Show, with production expected to begin around 2027, targeting markets in Mexico, Australia, Saudi Arabia, and Chile.

What leads to the success of China’s automotive industry abroad?

Supply chain and technological advantages are driving product strength

Compared to other countries, one of the key advantages of China’s automotive industry abroad lies in its mastery of critical resources and technologies. Its vast domestic market also brought a scale effect and strengthened its ecosystem. Taking electric vehicles (EVs) as an example, China produces and processes most of the world’s lithium, cobalt, graphite, and rare earth elements—key materials for EV battery production. Thanks to this, two Chinese companies, CATL and BYD, together account for 55.1% of the global electric vehicle battery market. The massive domestic market, in turn, has driven scale effects, reducing the unit costs of research, development, and production. This helps Chinese automotive companies gain both price and technological advantages on the international stage.

For instance, BYD announced in early 2025 that it would offer its “God’s Eye” driver assistance package for free. In contrast, Tesla’s equivalent technology is priced at USD 9,000. This is not an isolated case. Today, mid-range cars produced in China are equipped with advanced autonomous driving systems, voice control systems, and high-end digital interfaces, paired with competitive pricing. These features are increasingly appealing to international markets, particularly in developing countries.

International dynamics boosting China’s automotive industry abroad

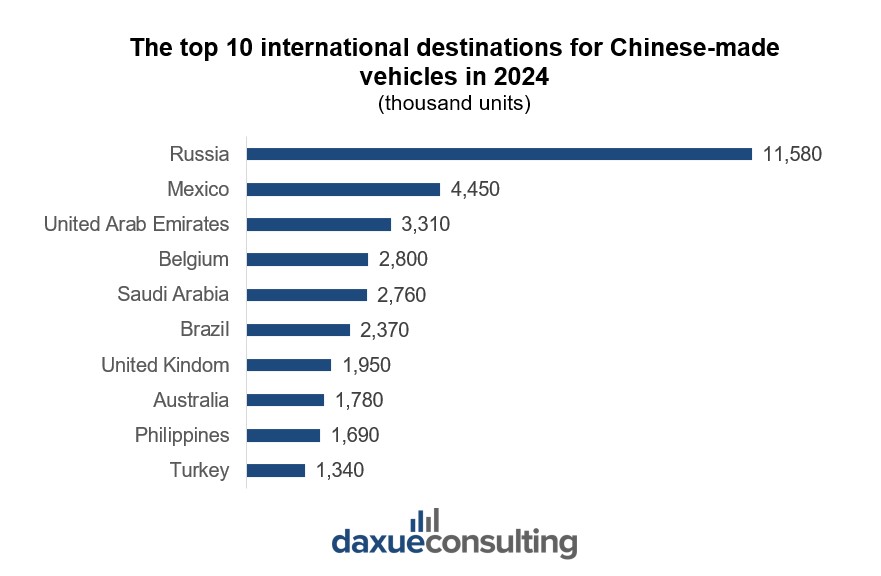

As noted by Xu Haidong, the Deputy Chief Engineer of the China Association of Automobile Manufacturers, one of the key reasons behind the rapid growth of China’s automotive industry abroad in 2024 is the increase in orders from developing countries, especially Russia. In 2024, Chinese automotive exports to Russia reached 1.158 million units, a year-on-year increase of more than 300,000 units. This surge is primarily due to the withdrawal of foreign brands, including those from Europe and the U.S., from the Russian market as a result of the Russia-Ukraine conflict. Since 2022, Chinese brands have significantly increased their market share in Russia, and by 2023, Russia had already become China’s largest automotive export market.

Uncertain road ahead: Barriers to China’s automotive industry growth abroad

However, the growth momentum of China’s automotive industry abroad failed to continue into 2025. According to data from the China Association of Automobile Manufacturers (CAAM), in March 2025, China exported 507,000 vehicles, a month-on-month increase of 14.9% and a year-on-year growth of 1%. The association further predicts that the total export volume for 2025 will reach 6.2 million units, a 6% increase compared to the previous year, significantly lower than the growth rates seen prior to 2024. The main reason for this slowdown is that global markets can no longer keep up with China’s automotive production capacity. According to Goldman Sachs, China’s EV production capacity already exceeded global demand by 1.2 times in 2023. Additionally, many countries have begun to actively impose restrictions on the import of Chinese cars.

Russia: Market saturation and increasing policy uncertainty

The fact that Chinese automotive exports now account for a significant share of the Russian market has caught the attention of the local government. Traditionally, China exports vehicles to Russia through two main channels: some manufacturers set up local plants in Russia and sell their vehicles via authorized overseas dealers, while others engage in parallel export, selling new cars as used ones in overseas markets. However, starting from April 1, 2024, Russia imposed additional taxes on vehicles transported from China through Central Asian countries, including customs duties, VAT, and excise taxes. Furthermore, Russia announced that, beginning October 1, 2024, the vehicle disposal tax on imported cars will increase by 70%-85%, with annual hikes of 10%-20% until 2030. This has effectively curtailed the channel for Chinese companies to export vehicles to Russia through parallel export.

Russia’s protectionist shift: Higher cost and lower demand reshape auto trade

In addition, Russian customs has announced that, starting January 1, 2025, the import tariff coefficient on vehicles will be adjusted to 20-38%, and the clearance fees for importing vehicles from China will rise from RUB 1,067 to as much as RUB 30,000 (USD 13.61 to USD 382.55). As pointed out by the First Financial News, the Russian government is keen to develop its own automotive industry and, through taxes and other administrative measures, is encouraging Chinese automakers to build local factories.

To make matters worse, the Russian market has reached saturation levels faster than expected, and it may no longer be able to accommodate more Chinese automotive exports. Alexey Kalitsev, Chairman of the Russian Automobile Manufacturers Committee, publicly stated that due to benchmark interest rates, car recycling fees, sanctions pressure, and fluctuations in foreign exchange rates, the Russian automotive market is expected to decline by about 15% in 2025 compared to 2024, with sales predicted to fall to 1.4 million units (including parallel imports). This news will undoubtedly cause Chinese automotive companies, who were preparing to expand their exports to Russia, to reconsider their actions.

Europe and North America: Tariffs hampering China’s electric vehicle exports

Compared to Russia, the European Union and North America have introduced stricter tariff measures on China’s automotive industry abroad, particularly on electric vehicles. In 2024, China exported 980,000 vehicles to the EU, with a year-on-year growth rate of only 4%. Among these, 570,000 were electric vehicles, accounting for nearly half of China’s total EV exports, representing a 10% decrease. The reasons behind this decline are clear: after conducting anti-subsidy investigations into China’s electric vehicle exports, the EU announced the imposition of temporary tariffs in early July 2024 and formal five-year tariffs in early November, with barriers reaching as high as 35.3%.

At the level of individual EU member states, France removed the eligibility for subsidies on Chinese-exported electric vehicles at the end of 2023, with Italy and other countries planning to follow suit. The situation in North America is similar to that of Europe. On September 27, 2024, the Biden administration announced a 100% tariff on Chinese electric vehicles, with Canada following suit shortly after. As a result of these policies, China’s electric vehicle exports to the United States in 2024 decreased by 29% year-on-year. On January 14, 2025, the outgoing Biden administration also announced new regulations banning Chinese-made intelligent vehicle software and hardware from entering the U.S. market. Although the Trump administration is in talks with the Chinese government, the uncertainty of these policies continues to trouble Chinese automakers.

Thailand: NEV market decline amid tightened infrastructure and credit policies

In 2024, Thailand, another important destination for China’s new energy vehicle (NEV) exports, experienced a significant setback in its automotive market. Due to stricter loan approval processes by Thai banks and high household debt, consumer demand for vehicles has dwindled, causing domestic car sales to fall to their lowest point since 2015. This has inevitably impacted China’s automotive industry abroad. In 2024, China exported 116,000 NEVs to Thailand, a year-on-year decline of more than 25%.

Additionally, the country’s infrastructure issues have hindered the growth of the NEV market. According to the China Council for the Promotion of International Trade, to meet the NEV target for 2025, Thailand would need to build at least 19,000 charging stations, which is a challenging task. Due to the lack of charging infrastructure, consumers are more likely to opt for non-pure electric vehicles, a trend that is common not only in Thailand but across Southeast Asia.

Facing challenges, China’s automotive industry actively strikes back

However, China’s automotive industry has not stood idly by. In Europe and the U.S., where exports face tariff restrictions, many Chinese automotive companies have found alternative approaches. Since the EU tariffs apply only to pure electric vehicles (EVs), Chinese automakers are expanding their supply of plug-in hybrid electric vehicles (PHEVs) and hybrid electric vehicles (HEVs) to increase their market share in Europe. Additionally, Chinese companies are establishing electric vehicle factories in locations like Mexico to bypass these tariffs and enter the U.S. market. Nevertheless, the market losses remain significant.

Thailand as a hub: How China’s auto industry is scaling in ASEAN and beyond

In Thailand, China has started investing in local charging infrastructure. In July 2024, the Thailand Charging Alliance was officially established, organized by the Thai Electric Vehicle Association and joined by 18 charging station operators. Among the first automotive companies to join the Thailand Charging Alliance, GAC Aion signed a memorandum of understanding and plans to build a network of 200 supercharging stations with 1,000 charging points in 100 cities across Thailand by 2028.

Furthermore, investments in Thailand will extend across Southeast Asia. As China and the ten ASEAN countries completed negotiations for the ASEAN Free Trade Area 3.0 on May 20, 2025, China has begun to actively promote upgrades to customs procedures and trade facilitation rules with ASEAN, prioritizing cooperation in standards for new energy vehicles, electronics, and electrical appliances. This will help China’s automotive industry, centered in Thailand, to export to other nearby markets. For example, vehicles produced at Changan’s factory in Thailand will be exported to other Southeast Asian countries and are expected to enter the global right-hand drive market. Great Wall Motors has announced plans to expand the capacity of its Thai factory in the second quarter of this year, with plans to export the new Ora Good Cat produced in Thailand to Brazil, Australia, and New Zealand.

New trade policies, new opportunities for China’s automotive industry’s global expansion

More importantly, by integrating industry resources and moving away from the current “solo efforts” model, there seems to be room for growth in China’s automotive industry abroad. This topic has already been raised at the 2025 “Two Sessions” in China. For example, as pointed out by Zhu Huarong, Chairman of Changan Automobile, at the 2025 14th National People’s Congress, it is necessary to promote the establishment of a common basic database for overseas automotive markets. Additionally, Hu Jianjiang, Vice Chairman of the Supervisory Committee of the Hong Kong Economic and Livelihood Alliance, highlighted the importance of building an industry association system for China’s automotive industry abroad. With the introduction of relevant policies, China’s automotive industry abroad may see new growth opportunities.

China’s automotive industry abroad: Opportunities or challenges?

- In 2024, China exported 5.85 million vehicles, surpassing Japan once again to maintain its position as the world’s largest automotive exporter.

- Thanks to its vast domestic market and a complete supply chain, Chinese-produced vehicles have advantages in terms of cost-effectiveness and technological innovation.

- However, with the domestic market becoming saturated, many Chinese brands have begun to expand into overseas markets.

- Despite these efforts, China’s automotive industry abroad has encountered obstacles: policies in countries such as Russia, Europe, North America, and Thailand have placed restrictions on imports of Chinese cars, particularly pure electric vehicles. As a result, Chinese automotive companies are shifting to export plug-in hybrid electric vehicles (PHEVs) and hybrid electric vehicles (HEVs).