This article on Chinese digital marketing ecosystem in 2021 was published in the 2021 spring edition of the German Chamber Ticker, download the Ticker Magazine here!

The events of 2020 did not change the trajectory of Chinese e-commerce, but rather accelerated the country’s consumption to a digital future that was, sooner or later, inevitable. As we continue to shape the digital future, we see four prominent trends that will take center stage in 2021: virtual influencers will add a new dimension to KOL marketing; private traffic and KOCs will provide a solution to reach new tribes of consumers; mini-programs unlock deeper consumer engagement; and group buying will boost rural e-commerce consumption.

Virtual Idols Will Fundamentally Change Influencer Marketing

2020 was a hot year for livestreaming. iiMedia, a Chinese data-mining organization, reported China’s livestreaming market size to be 961 billion RMB. The total market size in 2019 was 444 billion RMB, meaning that China more than doubled its livestreaming market size in only one year. However, this might not be an anomaly for the industry, considering the market was less than 20 billion yuan in size as late as 2017.

But the livestreaming market is not just growing in size. 2021 may be the year it fundamentally changes.

Just like the human-to-robot transformation of many industries before, after human labor sets the fundamentals, technology replaces humans to scale industries. Like the first assembly lines at Ford, livestreamers may also soon face their technological replacements, in this case, virtual influencers. While this may sound like a dystopian prophecy, it is, in fact, already happening in China.

On 11 November 2020, the brands Philips, L’Oreal, Unilever, and L’Occitane used virtual hosts to promote their products online. AI-powered virtual hosts are a feasible way to step up a brand’s influence on livestreaming. In an interview with China Daily, Xiang Jing, Philips’ head of Tmall marketing said that every day featuring a virtual host saw record traffic.

The character from Philips’ livestream was created by Alibaba’s Damo Academy, and can adjust its facial expressions and gestures to mimic people. While many believe virtual characters are still not as convincing as real people, the technology is improving rapidly.

Virtual influencers are not just used for livestreaming, but also to moderate private traffic. Chinese beauty brand Perfect Diary created their very own virtual KOC named Xiaowanzi. Xiaowanzi was programmed to be the perfect digital make-up consultant: she is positive and lively, sporting numerous hobbies. She moderates private traffic groups, shares 2-4 beauty-related posts a day on WeChat, provides beauty advice to anyone who asks, gives real-time customer service, and interacts with users.

In the new era of influencers, the questions brands will need to ask themselves is not if, but what kind: should they create their own avatar, like Perfect Diary, or collaborate with an existing one, such as Hong-Kong’s virtual character Ruby Gloom? We’re witnessing the rise of a whole new virtual influencer market, where characters can be ‘hired’, ‘rented,’ bought and sold as IP, creating newfound opportunities for animators and character designers.

Virtual influencers are convenient for brands, as they do not sleep, eat, or take breaks, and they can even be in multiple places at once. However, as the lines between ‘character building’ and ‘falsification’ remain blurry, their presence raises ethical questions: Where do you draw the line between reality and fiction? What artificial personalities or characteristics could be harmful or receive backlash? Creators of US virtual influencer Lil Miquela faced such backlash after their presenter ‘recounted’ a clearly made-up story of sexual assault on YouTube.

KOCs and Private Traffic Reach Niche Groups Feel the Void of Blanket Marketing Strategies

KOCs, or Key Opinion Consumers, are the micro-influencers of China. Although they typically have only a few hundred to a few thousand fans on social media and seldom compared to KOL numbers, they are seen as more authentic, trustworthy and drivers of conversion.

Chinese consumers’ increasing sophistication drives the demand for KOCs. Online shoppers can tell when influencers have been paid by brands, and they are aware of the myriad of fake influencers with fake traffic. KOCs, which are primarily consumers themselves, are not career-influencers and therefore handpick products they wish to promote. As a result, once KOCs find a brand they align with, they are more likely to remain loyal to that company. This is where private traffic can come into play.

Private traffic is a marketing strategy that has been trending in China since 2019. Brands essentially funnel traffic from public platforms that offer little control of customer behavior and data to a private group, usually on WeChat. A KOC usually plays one of three roles: shopping assistant, topic expert, or private partner. They manage these private traffic groups and form relationships with customers. In these private traffic groups, consumers get direct contact with brands, which in turn enhances their loyalty to the brand.

The importance of these trends lies not in the existence of KOC marketing or private traffic, but in the fact that Chinese consumers seek intimate and authentic connections with brands.

China’s population is the most fragmented of Asia, not only in terms of geography and the urban-rural discrepancies: with a booming economy that supports the ability of individuals to pursue many hobbies and interests, consumers are increasingly breaking down into tribes and niche groups. As a result, a one-size-fits-all brand message is increasingly losing its appeal among Chinese consumers. KOCs and private traffic can tap into niche consumer factions that KOLs and large e-commerce platforms simply cannot, providing a sense of authenticity and community.

The Rise of Gamification

WeChat is increasingly becoming the ‘operating system’ of Chinese smartphone users. Hidden within the little green square is a user’s list of contacts, favorite memories, digital wallet, and with the introduction of mini-programs in 2016, their gaming center, e-commerce center, and gateway to favorite brands. WeChat doesn’t necessarily render other apps obsolete, but rather invites them to compete in the fruitful arena of 1.1 billion monthly active users. According to Tencent’s data, WeChat Mini Programs facilitated USD 250 billion transactions in 2020 – double that of 2019.

The mini-apps- light-sized applications that fit perfectly into WeChat’s closed ecosystem – have the benefit of running fast and smooth with relatively low development costs. A myriad of entry points keeps them omnipresent – as long as WeChat remains users’ focal point.

WeChat’s mini-programs also provide a world of opportunities for brands looking to engage consumers with gamification. There are over 2,000 games on WeChat which, unlike the e-sports gaming community, are being used by gamers of all ages. Brands can tap into this consumer base with simple yet addictive games, driving brand awareness in an interactive way.

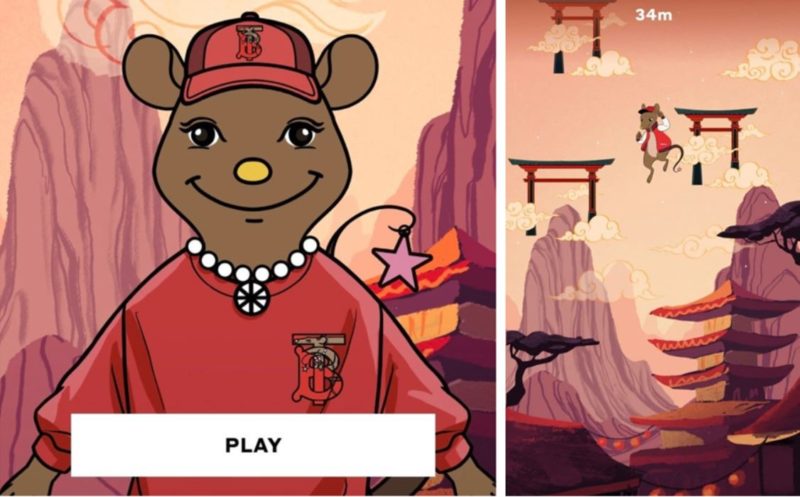

A good example is of Gamification is Burberry’s Ratberry game, launched for Lunar New Year 2020. Players bounced a cute mouse up different platforms, collecting coins and lanterns that could convert to prizes from the British luxury brand. The game’s hashtag, ‘Ratberry has arrived, drew 120 million views and generated 179 thousand discussions on Weibo.

Nevertheless, gamification is not necessarily the end goal for brands – it is the deeper level of brand engagement that may come in different forms. Brands will continue to find new ways to engage consumers as entertainment, social media, and shopping continue to evolve.

Group Buying and the Booming Rural Chinese Consumption

According to the World Data Bank, just under 40% of China’s population lived in rural areas in 2019. While the proportion of rural inhabitants is on the decline, these 540 million rural residents’ salaries and monthly expenditures are both growing faster than that of urban residents.

Improving the rural economy has been a national focus for the Chinese government. The country’s 14th five-year plan includes improving income distribution in the rural area and farming sectors and urban-rural integration by assisting farmers moving into modern facilities. This means brands should be preparing for an uptick in rural consumer confidence.

However, reaching rural consumers requires a different strategy than attracting urban dwellers. Rural residents are more concerned with price and have relatively more free time than their urban counterparts. Hence, they can treat shopping as a leisure and social event. These factors are behind the meteoric rise of group buying in lower-tier cities.

Group buying is a form of social e-commerce shopping in which a community of consumers unites to increase their bargaining power. Merchants sacrifice profits for more frequent turnover by offering discounts for group purchases and simplifying the delivery process to one central location in the consumer community.

The group buying market reached RMB 72 billion in 2020 – up 112% from 2019. It is forecasted to reach RMB 100 billion by 2022. According to QuestMobile data, 60% of group buying consumers reside in tier-3 cities or below.

The great success of Pinduoduo

The platform most famous for group purchases is Pinduoduo. According to company filings, 61% of Pinduoduo users are over 30 years old, 70% are female, and 58% live in tier-3 or lower cities. From its launch, Pinduoduo focused on this consumer group, which is largely ignored by China’s e-commerce industry. As a result, Pinduouo has the lowest cost of new customer acquisition among the top e-commerce platforms, at RMB 102.7 per new user in 2019 (compared to Alibaba’s 530.4 RMB), according to iResearch. As a result of Pinduoduo’s success, its stock price quintupled in one year, from USD 36.5 on 27 January 2020 to USD 180.42 on 22 January 2021.

But Pinduoduo is far from the only group-buying platform to watch out for in 2021. For one, Alibaba’s Nice Tuan received USD 450 million in funding last year. Nice Tuan’s unique business model treats the community as a unit, training ‘community leaders’ – mainly housewives and local family shop owners – to help distribute goods. These traders get a 10% commission for transactions – a sum that has the potential to make a big impact in low-tier city households. Then there is JD-backed Xinsheng Preference, the first ‘unicorn’ company in Hunan Province with a valuation of more than USD 1 billion. In 2020, Xinsheng had an average of 10.4 million orders a day.

How to do internet marketing in China

If we were to summarize the future of China in one word, it would be ‘digital.’ Influencers, traditionally the human faces of marketing, are slowly becoming virtual, opening a new market that could go in many directions. Seemingly the opposite of non-human influencers is the authentic, very human KOCs, which, along with private traffic, represent a genuine need of consumers to connect authentically with brands.

At the same time, brands are finding new ways to engage consumers, using games and other forms of entertainment to attract their attention. While mini-programs provide opportunities for engagement, group shopping unites millions of rural and low-tier consumers, bringing them into an e-commerce game of which they were largely excluded.

The technology in consumer’s pockets is their gateway to the world. This new decade will blur the lines between digital and reality, between branding and entertainment, and between shopping and socializing. We can speculate which trends will emerge next, but China marketers’ time would be better spent working on how to adapt to the digital world. As the saying goes: the only constant in life is change.

Learn something new? Stay updated on Chinese Digital Marketing Ecosystem by following our WeChat, scan the QR code below, or subscribe to our newsletter

Learn more about how to do internet marketing in China, see our report on WeChat mini-programs

Listen to over 100 China entrepreneur stories on China Paradigms, the China business podcast

Listen to China Paradigm on Apple Podcast