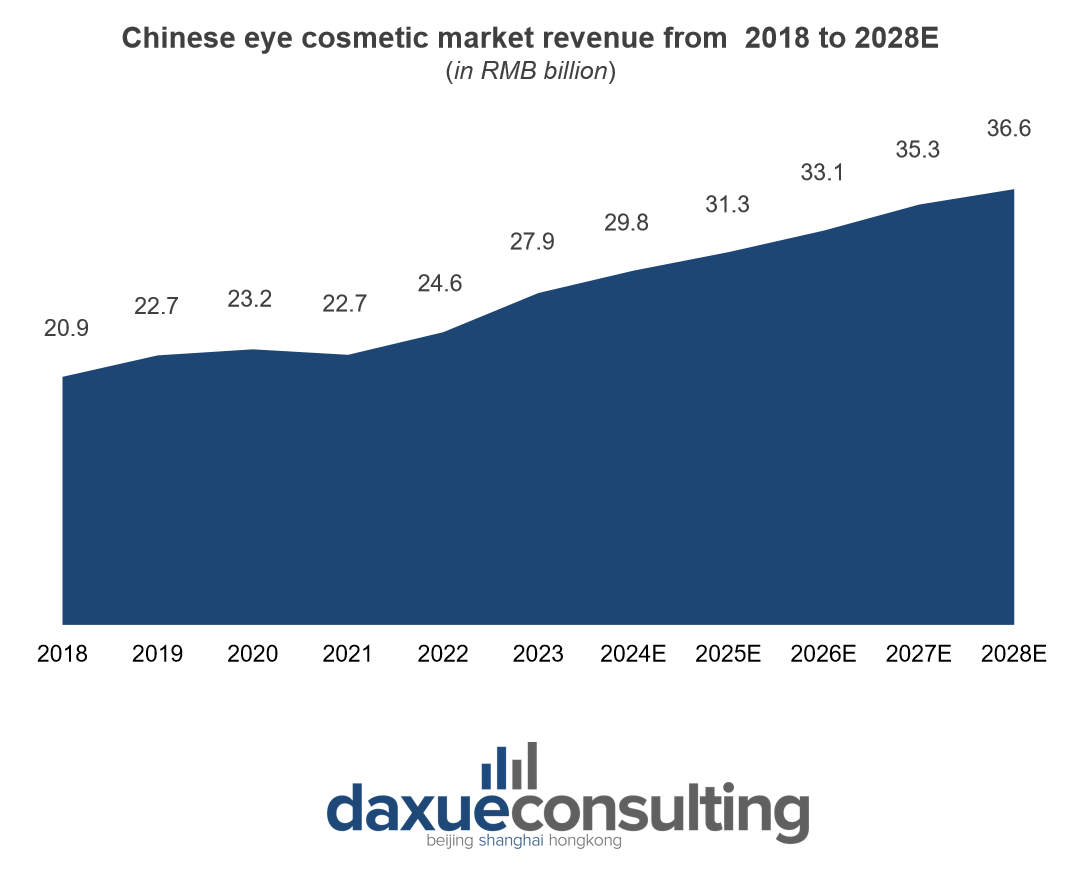

Chinese beauty standards are constantly evolving, driving shifts in makeup trends that resonate with evolving tastes. Women are increasingly embracing and showcasing their unique beauty, propelling the continuous expansion of the beauty market. Forecasts suggest that the market size of China’s cosmetics industry in 2022 stood at approximately RMB 393.6 billion, with an anticipated growth of RMB 555.9 billion by 2027. As an essential part of beauty, eye makeup is also starting to receive more attention in the beauty market and has become the fastest-growing cosmetic category. In fact, China’s eye makeup market is expected to grow at an average annual rate of nearly 8% in the coming years.

Download our China luxury market report

What’s driving the Chinese eye makeup trend?

Social media: tracking trends, targeting audiences

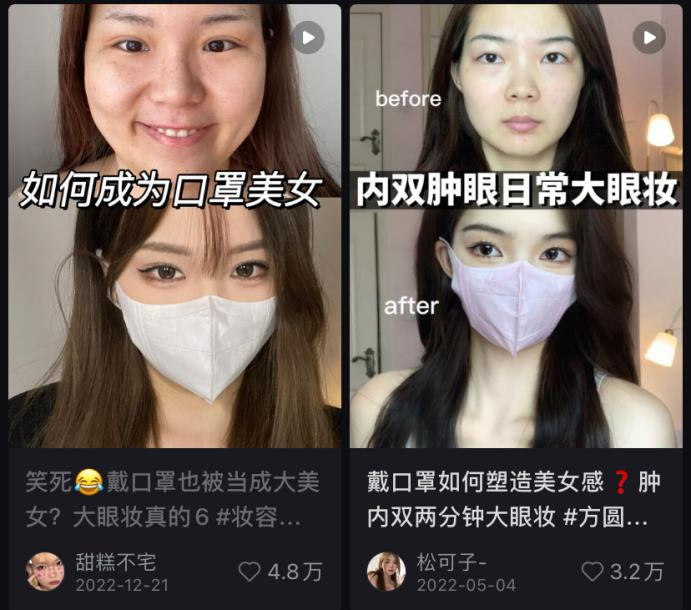

Social media platforms like Xiaohongshu have become instrumental in driving the popularity of eye makeup trends. Chinese female consumers, who are at the forefront of these trends, often turn to platforms like Xiaohongshu for user-generated product reviews and to stay updated on the latest fashion and beauty trends. Amid the pandemic, there was a noticeable increase in attention toward eye makeup as a way to counteract the impact of masks on overall makeup looks. After the pandemic, consumers reverted to full-fledged makeup routines and eye makeup has emerged as a key avenue for enhancing overall makeup aesthetics.

Moreover, an increasing number of young people have begun to pay attention to the impact of facial makeup on overall appearance. Makeup styles such as Euro-American styles (欧美妆) and Y2K, which emphasize eye makeup, have become popular new trends on social media. In addition to the emergence of new styles, Chinese youth are using makeup to express their attitudes towards life and to please themselves. As eye makeup is an indispensable part of overall makeup, it naturally becomes the focus of attention for everyone.

E-commerce platforms: reliable and convenient

Beyond just following trends, robust and convenient e-commerce platforms stand as a cornerstone in the evolution of China’s eye makeup market. Taobao and Tmall, as the nation’s leading e-commerce platforms, host a myriad of official brand stores, both domestic and international, making them the go-to destinations for consumers.

Moreover, the rise of live-streaming e-commerce has propelled the expansion of China’s beauty market. During the 2023 Double 11 Festival, the comprehensive e-commerce platform recorded a staggering GMV (Gross Merchandise Volume) of RMB 923.5 billion, with Tmall claiming the top spot. Undoubtedly, Taobao and Tmall remain unrivaled as the largest channels for beauty e-commerce.

Douyin speeds up the realization of traffic

Douyin, a short-video social commerce app, is not just a trendsetter but also a rising force in e-commerce. With robust growth, Douyin achieved a GMV of RMB 21.5 billion during the 2023 Double 11 Festival, a 38.9% increase. Key Opinion Leaders (KOLs), beauty bloggers, and live streamers on Douyin hold considerable sway over young makeup consumers. Through live-streaming, hosts offer personalized advice and product recommendations tailored to different skin types, resonating well with Chinese consumers and prompting them to purchase goods directly from the anchor’s official live-streaming channel. This seamless transition from browsing to buying enhances brand awareness and boosts sales effectively.

Convergence of domestic and foreign brands in China’s eye makeup market

Foreign brands flock to enter China’s market

During the pandemic, China’s eye makeup market faced challenges, with sales dropping from RMB 10.15 billion in 2021 to RMB 8.36 billion in 2020. However, by 2027, sales are expected to rebound to RMB 10.89 billion. This vast and lucrative market has caught the attention of numerous overseas eye makeup brands, drawing them to China in increasing numbers.

As a giant in the beauty industry, LVMH Group’s total sales in 2022 reached RMB 584.9 billion, with sales of the cosmetics business alone reaching RMB 56.8 billion. With China’s eye makeup market thriving, LVMH has accelerated the introduction of its brands’ eye makeup products into the Chinese market to secure a larger market share. Dior, a standout in this field, offers not only a classic five-color eyeshadow palette, but also eye makeup products such as eyeliner, mascara, and eyebrow pencil. Fenty Beauty, founded by Rihanna, has launched a time-saving eyeshadow stick, adding innovation to eye makeup products and bringing more exposure to the brand.

Charlotte Tilbury expands market presence through localization

Apart from leading brands in cosmetics, numerous eye makeup brands have also entered the Chinese market. Renowned for its expertise in eye makeup, Charlotte Tilbury (CT) cast her sights on the lucrative Chinese market as early as 2019. With a keen understanding of the market, CT promptly established a flagship store on Tmall in 2021, officially venturing into the Chinese mainland and gaining a loyal fanbase through Tmall International. Beyond traditional e-commerce platforms, CT has expanded its presence on multiple content platforms like Douyin and Xiaohongshu, generating significant economic value.

Recognizing the importance of offline beauty experiences for local customers, CT has also established boutique stores in Tier-1 and new-tier-1 cities such as Beijing, Shanghai, Hangzhou, and Shenzhen. This initiative provides avid beauty lovers with even more opportunities to immerse themselves in the brand’s offerings. Leveraging the influence of local recommendations and eye makeup bloggers, CT has capitalized on this momentum by appointing Angela Baby as the brand’s latest global makeup spokesperson, further solidifying its position in the Chinese market.

Chinese eye makeup brands strive to introduce products with national identity

The overall competitive landscape of eye makeup is witnessing a continuous surge in the popularity of domestic brands. This is attributed to the enhancements in the production process, design concept, and a shifted consumer perception towards Made-in-China products. In particular, the spread of Guochao has induced more consumers to choose products with Chinese culture and national characteristics. In the Top 20 eye makeup brands across all networks in 2023, domestic brands held 11 positions. Besides the top few brands, other national brands are also leveraging their unique strengths to gain a foothold in the market.

Maogeping leverages Guochao to entrench itself

The beauty brand Maogeping (毛戈平), founded by the renowned Chinese makeup artist Maogeping, offers makeup products tailored for women with diverse facial features. As a cosmetic brand deeply rooted in Chinese culture, Maogeping has successfully collaborated with the Palace Museum (Forbidden City) to launch the Qi Yun Dong Fang collection, featuring meticulously designed eyeshadow palettes that embrace the essence of Chinese classical patterns and court paintings, perfectly in line with the Guochao trend. Leveraging its expertise and the charm of traditional Chinese culture, the brand has achieved revenue of RMB 1.6 billion in 2022, firmly establishing its position in the Chinese eye makeup market.

Judydoll taps into affordable prices to target young markets

In the realm of eye makeup, eyeshadow singles hold a pivotal position, while other products like eyeliner, eyebrow pencils, and mascara are also highly popular. Since its establishment in 2016, the Shanghai-based makeup brand Judydoll has emerged as a beacon of domestic products, renowned for its cost-effective and affordable options. Judydoll primarily offers eye makeup products, embodying play makeup as a brand ethos. Notably, Judydoll’s seven-color eyeshadow tray boasts the convenience of completing an entire face of makeup with just one palette, ideal for makeup beginners, providing them with an opportunity to experiment and explore. Furthermore, the average price of Judydoll’s eyeliner, eyebrow pencil, and mascara is approximately RMB 30, making it accessible to students and opening up a new market segment at an economical price point.

The false eyelashes market is gaining significant momentum

As an integral part of eye makeup, false eyelashes have become increasingly popular in recent years. As the most prominent finishing touch, thick and warped eyelashes have become synonymous with natural and wild feelings, such as “sunflower eyelashes” and “fairy eyelashes” and other styles are also very hot. Apart from the widely used full-strip false eyelashes and individual or double clusters, magnetic false eyelashes, which offer greater convenience and time efficiency, have also made their way into the market. The Chinese false eyelashes market has shifted its preference from overseas brands to domestic brands, indicating the growth of China’s eyelashes industry.

In 2022, the false eyelashes sales market on Alibaba and Jindong totaled about RMB 975 million. A clear trend in this market is that more and more consumers are starting to choose domestic brands. Domestic false eyelashes have a competitive edge over overseas options, largely due to their consumer-friendly pricing. As a disposable consumable, for ordinary consumers, foreign false eyelashes priced at tens of yuan per pair are perceived as too expensive. Especially now that domestic enjoy greater recognition, an increasing number of consumers are beginning to choose cheap and easy-to-use domestic false eyelash brands on Pinduoduo or other platforms.

China’s eye makeup market: overseas brands localize, local brands capitalize on strengths

- China’s cosmetics market is expected to reach RMB 555.9 billion by 2027

,with the eye makeup segment growing at an average annual rate of nearly 8%. - Social media platforms like Xiaohongshu drove the eye makeup trend, while Taobao and Douyin facilitated consumer product purchases.

- International eye makeup brands have entered the Chinese market, leveraging social media, establishing physical stores, and collaborating with local celebrities for endorsements to drive their presence and popularity.

- Chinese brands integrate Chinese elements to attract local consumers and exploit the market with low-price strategies.

- China’s false eyelash industry chain has matured, providing Chinese consumers with the advantage of accessing affordable and high-quality products.