According to China’s General Administration of Quality Supervision and Standardization Administration, energy drinks are classified as “drinks with other special functions” as they contain caffeine, taurine, and sugar, together with other ingredients such as guarana, yerba mate, and B vitamins. Energy drinks that contain taurine are not traditional Chinese drinks, but they are gaining popularity among youngsters and workers.

Download our China F&B White Paper

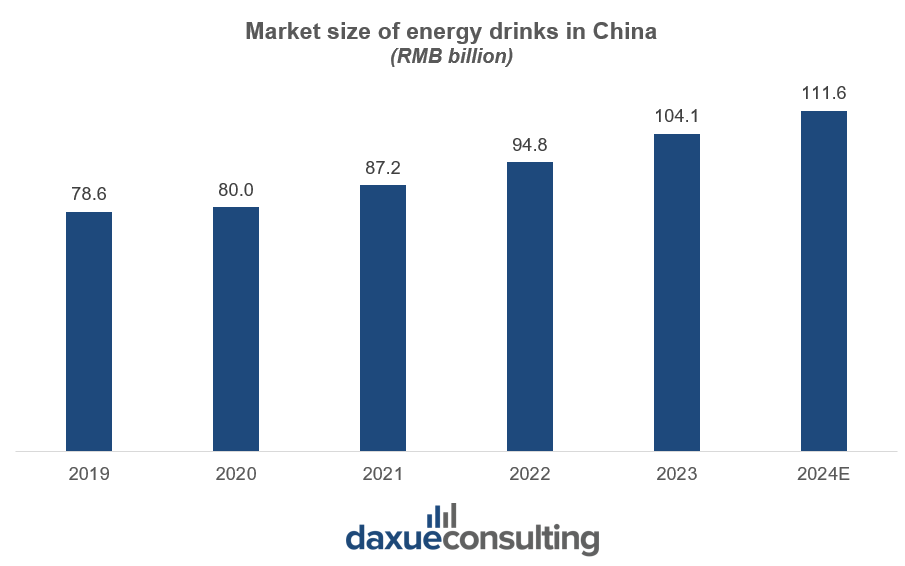

Since 2019, the variety of imported energy drinks to China has been increasing, with brands like Red Bull, Monster Energy, and Carabao gaining acceptance. Moreover, the functional properties of energy drinks that help to combat fatigue and mild addictive quality have led to higher repurchase rates and consumer loyalty. According to Euromonitor, energy drinks experienced a compound annual growth rate (CAGR) of 11.8% from 2013 to 2023. This outpaces the overall soft drink industry growth rate of 4.1%, positioning energy drinks as one of the fastest-growing segments within the soft drink market.

Energy drinks market in China: Red Bull leads, domestic brands rise

Canned and bottled energy drinks have been enjoying a surge in popularity nationwide among their primary consumers, such as gym-goers, sports people, the working class, and school students who prefer a boosting beverage to recover their energy and stay awake.

In 2023, the top three players in China’s energy drinks market are Red Bull, Dongpeng Beverage (东鹏), and Hi-Tiger (乐虎). Red Bull leads in terms of market share based on its online sales, although its share has declined since the 2016 trademark lawsuit. It maintained its high-end status by sponsoring extreme sports events and building a strong presence in nightclubs, high-end dining, gyms, and spas. The powerful brand and premium positioning help the brand to create a loyal customer base.

Dongpeng Beverage emerged as the strongest domestic competitor. It adopted a price differential strategy by focusing on prefecture-level and lower-tier cities. It primarily relies on offline channels such as internet cafes, grocery stores, and supermarkets in factories and military bases.

Hi-Tiger adopted a combined strategy of sponsoring major local sports events like the Chinese Basketball Association (CBA) and optimizing its regional distributor model. Its parent company, Dali Foods, has a strong track record of brand incubation and a vast distribution network. Dali Foods’ extensive resources and experience in the food and beverage industry provide Hi-Tiger with a competitive edge in scaling nationwide.

Consumption occasions of energy drinks in China

These drinks are consumed mostly by young adults, particularly students, blue-collar workers, and fitness enthusiasts in China. For work-related consumption occasions, workers in the delivery, manufacturing, and construction industries often consume energy drinks to maintain stamina and endurance during physically demanding tasks. It is also popular among students who are preparing for exams and white-collar professionals who are in mental labor-heavy sectors such as research, finance, and tech sectors. These consumers leverage energy drinks to enhance focus and cognitive performance during long hours of mental exertion.

Additionally, energy drinks are popular in social settings and recreational activities. For instance, entertainment settings such as KTVs and bars or leisure activities such as video gaming and music festivals. Travelers, especially those who are practicing “special forces tourism,” often consume energy drinks to stay alert and energized during travel and work.

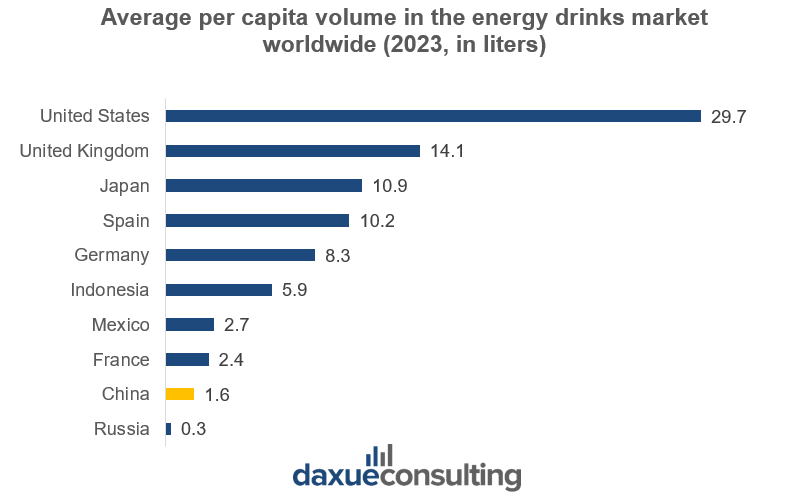

Per capita consumption of energy drinks is still quite low in China

The energy drinks market in China started expanding quite late, in the mid-1990s. The per capita consumption level of energy beverages is still significantly low, with broad room for growth. In 2023, Chinese consumption of energy drinks is ranked 9th globally, with 1.6 liters per year. This is significantly lower than other countries and shows a huge gap as compared to the United States at 29.7 liters. The lower consumption per capita might be due to cultural preference to rely on strong tea or herbal tonic for an afternoon pick-me-up rather than energy drinks.

Moreover, energy drinks are often seen as premium products. This makes energy drinks perceived as less accessible to budget-conscious consumers. As such, its consumption is concentrated in urban areas, where consumers have higher disposable income.

Spotting an opportunity, local brands are introducing budget-friendly options into the energy drinks market in China. For instance, Hi-Tiger (乐虎) offers a product line that targets young adults and blue-collar workers. The brand is commonly found in lower-tier cities and sold at RMB 3 to 4 for a 250 ml can. This represents a 50% price discount as compared to international brands such as Red Bull and Monster Energy, which are usually sold at RMB 6 to 8 per 250 ml can.

Whilst energy drinks are gaining traction, there are posts on Xiaohongshu (known as RedNote in the West) where consumers are actively seeking to educate themselves about the different variants of Red Bull available in the market. Netizens discussed their confusion due to the presence of multiple formulations under the “Red Bull” name. Each product has distinct ingredients and regulatory classifications thus consumers self-educate on social media to make informed purchasing decisions.

Adapting to Chinese consumers: Low-cal and e-sports

The changing consumer preferences in China, such as growing awareness about health and fitness benefits and the willingness to pay more for a quality difference, indicate the energy drinks market will have to adapt. Concerns regarding high sugar content require upgrading products. In particular, the young population at the age of 25-35 years is the target customer for energy and sports drinks. Brands match consumers’ expectations, which include not only low-calorie, high-nutrition, functional features but also natural and fashionable drink products. For instance, Red Bull offers a sugar-free variant to cater to health-conscious consumers.

Monster Energy has strategically partnered with Tencent’s Honor of Kings (known internationally as Arena of Valor). It is one of the most popular mobile games in China that will help the brand to tap into the booming e-sports and gaming market. The brand sponsors major Honor of Kings tournaments, including the King Pro League (KPL). These tournaments attract millions of viewers both online (via platforms like DouYu, Huya, and Bilibili) and offline. This in turn provided Monster Energy with massive brand exposure among Chinese gamers.

Over the past decades, China’s industrialization and urbanization have been in the process of converting a large population to urban dwellers. This led to increased regulations, economic growth has continued to soar and develop into a market-based economy. The rising income and disposable income levels and a constant improvement of living standards of Chinese people have resulted in modernized, busier lifestyles, which is one of the primary drivers of the increase in demand for energy drinks.

The battleground of the energy drinks market in China:

- Red Bull leads, but domestic brands like Dongpeng Beverage and Hi-Tiger are rising, targeting lower-tier cities with affordable pricing (RMB 3-4 per can).

- Students, blue-collar workers, and professionals consume energy drinks for work, study, fitness, and social occasions like gaming and travel.

- Brands are adapting with low-calorie, sugar-free, and functional options (e.g., Red Bull Sugar-Free) to meet health-conscious demands.

- Partnerships with e-sports (e.g., Monster Energy x Honor of Kings) drive demand among younger urban consumers.