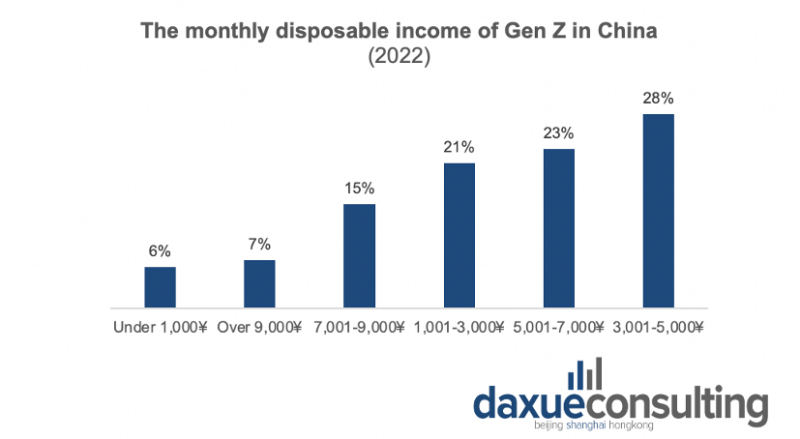

China’s Gen Z consumers are still largely dependent on parents, yet they are some of the highest spenders in the country. At the same time, brands often underestimate the consumption ability of Chinese Generation Z because of their young age.

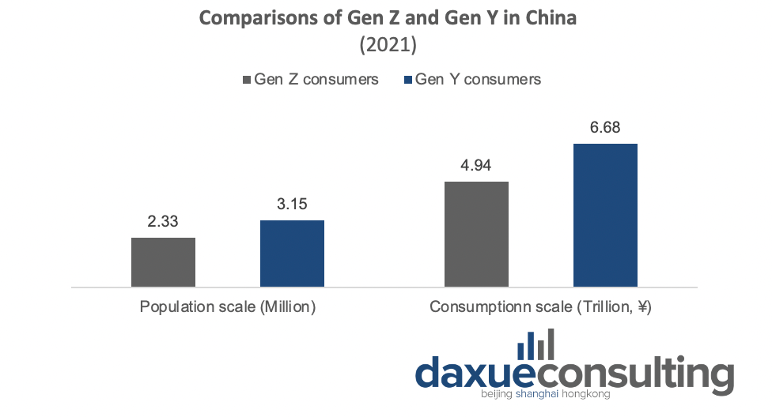

According to the Chinese National Bureau of Statistics, the population size of Zoomers has reached 233 million, and the consumption scale reached 4.94 trillion Yuan, accounting for 11.2% of total consumption in China in 2021. In addition, Chinese Gen Z direct and indirect expenditure account for 13% of household expenditure which is much higher than the global average of 8%, reported by OC&C. Moreover, with the growth of low threshold credit and instalments such as Huabei, microparticle loan, and white strip (31% of Gen Z are using instalment plans), Gen Z accesses higher amounts of disposable cash flow.

The e-commerce giant JD, on the other hand, reports that Chinese consumers born after the 90s account for more than half of total consumers in health-related consumption, including fitness, nutrition supplements, and sleep improvement items. Gen Z is set to become the backbone of China’s next powerful consumption group. Gen Z’s consumption mode is gradually affecting and leading the consumption trend in China.

Unique features of Chinese Gen Z

Chinese Gen Z has unique beliefs and experiences affecting their consumption behaviour. They are not simply a continuation of the Chinese Millennials. Local Gen Z consumers have a strong sense of “Self-identity” and are willing to express themselves. Their social characteristics are apparent, and they are trendsetters. Coupled with growing purchasing power and increased disposable income, Gen Z’s consumption pattern presents the following features:

- Novelty and experience: Gen Z consumers are more willing to experience new products and services. The more inclusive and diverse modern education, as well as the explosion of the Internet and social media, have shaped Gen Z’s character. 54% of Gen Z say they wanted the latest experience, while 38% say they often switch to different options for the same product.

- Environmental concern: Gen Z consumers have much higher sensitivity and more profound recognition of sustainable consumption. 91% of Daxue Consulting’s Green Guilt Report respondents stated that environmental sustainability is crucial when purchasing beauty products. According to Vogue Business in China, 54% of Gen Z consumers believe they have a clear and comprehensive understanding of “sustainability”; and 42% of consumers said they supported the concept of sustainable consumption. Furthermore, most Gen Z consumers are strongly convinced that they have an obligation and responsibility to build a better world. In fact, the Gen Z has developed a strong social conscience and tends to shape its spending habits accordingly. For instance, 89% of Gen Z consumers claimed to have changed their shopping behaviours at least once over the last six months due to environmental concerns in 2021. Hence it is not surprising that 90% of Gen Z respondents are more drawn to sustainable and recyclable products and are willing to pay a premium.

Cultural confidence or passing fad: Gen Z’s rising support for homegrown brands

In 2017, the Chinese State Council declared May 10 as China Brand Day, and the Chinese government introduced tax incentives to encourage local small and start-up entrepreneurship in 2015. Doubled by the rapid growth of domestic consumption and needs, numerous homegrown brands were urged to show up on the stage. Meanwhile, a growing sense of national pride is emerging among Chinese consumers; this trend is known as Guochao (国潮), meaning ‘national tide. According to a 2020 China Youth Daily survey of 998 college students across the country, 79.8% of respondents were willing to support domestic products.

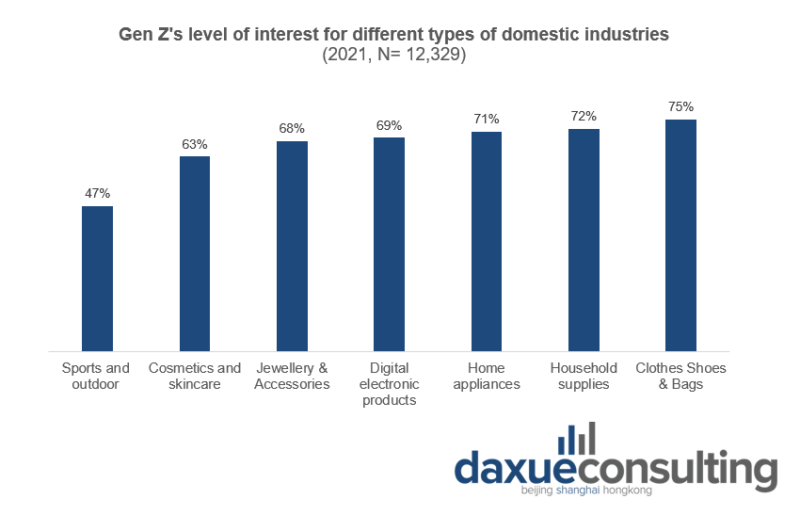

Chinese Gen Z consumers have demonstrated significant attention to local fashion brands, household supplies, and home appliances.

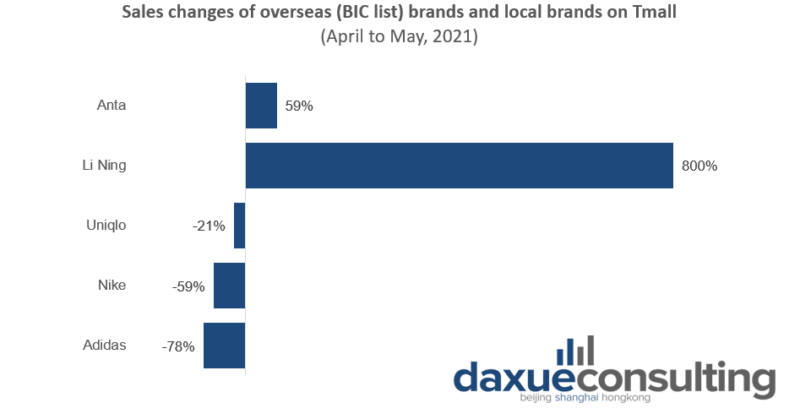

Supporting local enterprises (48.7%) and the affinity with Chinese culture (50.8%) are mentioned as main drivers for purchasing domestic brands by Chinese Gen Z consumers. Therefore, the changes in consumer preference have boosted homegrown brands and induced local players to upgrade their products. In addition, especially after the “Xinjiang Cotton” incident, many Chinese Gen Z consumers decided to support local brands out of a sense of patriotism.

In the long term, the rise of local brands’ competitiveness is inevitable, especially as Gen Z impose itself as the main consumer group in China. Products “made in China” nowadays are no longer labelled as low quality. Hence, Gen Z’s attention and preference for domestic products have allowed local brands to thrive.

Gen Z consumers prefer spending money on cosmetics and skincare products

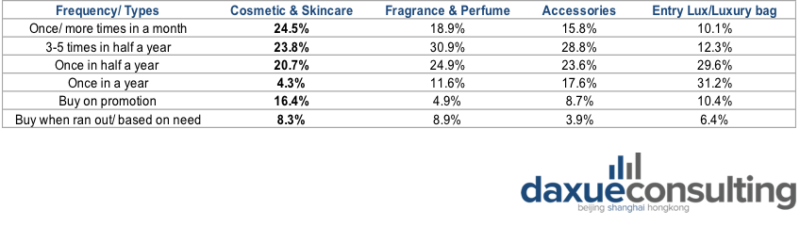

According to iResearch, cosmetics and skincare are the most frequent category in Gen Z’s shopping cart: about 24.5% of Gen Z consumers purchase these products more than once each month.

Skincare and makeup are essential to most of Gen Z’s daily routine. Only 0.6% of Chinese Gen Z say they don’t have any daily skincare routine. According to Guoyuan Securities, 60% of Gen Z female consumers wear makeup on working days, and 38.3% wear makeup every day, even during the pandemic. Furthermore, over 70% of Gen Z spend over 300 Yuan monthly on skincare and cosmetic products.

Consumption frequency of Gen Z consumers in China

With the growing number of online shopping festivals (Double Eleven Shopping Festival, Double Twelve Shopping Festival and 618 Celebration), Chinese consumers’ consumption frequency has reduced. Consumers usually prefer doing shopping during online promotional events when they can benefit from lower prices and more gifts.

However, Chinese Gen Z doesn’t follow this general trend as strictly. The decreasing proportion of fashion retail items purchased during shopping events indicates that Gen Z is more inclined to buy whenever and wherever they want rather than hoarding goods at a low price.

Top 4 most frequently purchased categories by Gen Z

Chinese Gen Z social media habits

Recommendations from social media’s Key Opinion leaders (KOLs) (77.55%), word of mouth (52.30%), and WeChat group chat/shopping guide (33.19%) have become the most critical ways for Gen Z to know a brand. In addition, more than 62.76% of Gen Z would recommend or share a brand they like with their friends on social media. The high use of social media has significantly impacted Gen Z’s spending habits. Consequently, Gen Z’s shopping habits are deeply bound to their social life.

Influencer marketing on Chinese social media has developed fast. In the second quarter of 2020, people spent more time using social media apps or platforms as countries entered a new wave of lockdowns. The outbreak of Covid-19 and consequent lockdowns have changed Gen Z’s use habits and boosted KOL marketing.

Gen Z consumers account for the largest user group on Douyin and the earliest to migrate from traditional platforms to Douyin. As e-commerce has become ubiquitous in Chinese people’s life, Douyin has turned into one of the biggest consumption platforms for Gen Z. Diversifying marketing channels played a crucial role in boosting Gen Z’s consumption on Douyin. Examples include e-commerce promotions, IP collaborations, advertisements from celebrities and influencers, and live streams by brands or influencers. Meanwhile e-commerce on Douyin experienced an unexpected rise in user viscosity as more and more Chinese gen Zs have shifted their online social presence towards the short-video platform.

What makes Chinese Gen Z different from other consumers

- Due to the increase in disposable income of Gen Z consumers, the consumption scale in China reached 4.94 trillion Yuan in 2021, accounting for 11.2% of total consumption in China.

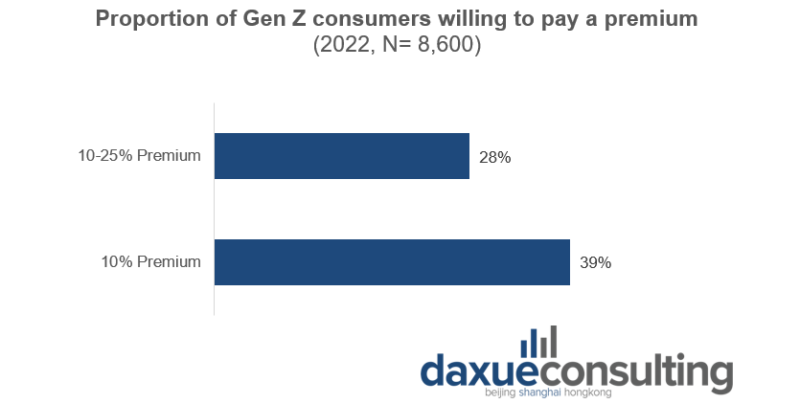

- 90% of Gen Z consumers are more drawn to “Sustainable” and “Recyclable” products, and 39% are willing to pay a 10% premium on these items.

- In 2021, due to the impacts of the “Xinjiang Cotton” incident, more Gen Z consumers chose to support Guochao and local brands. After April 2021, Li Ning and Anta’s sales witnessed an explosive growth of 800% and 59%, respectively.

- Gen Z consumers are shifting their preference to beauty and skincare products; 24.5% of Gen Z purchase skincare products once or more per month.

- Chinese Gen Z doesn’t follow the trend of stocking up products during promotional events; they are more inclined to shop whenever and wherever they want.

- Gen Z’s consumption habits heavily rely on social media and e-commerce. Douyin has become one of the biggest e-commerce platforms for Gen Z consumers.