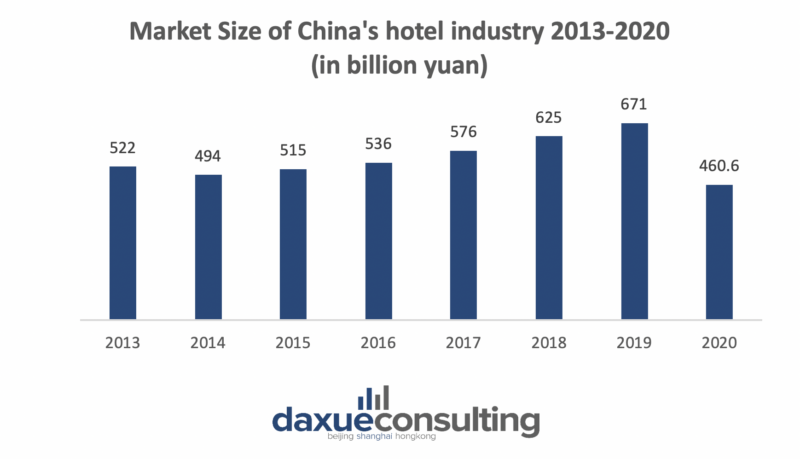

With increasing domestic tourism, business travel, and loosening Covid-19 restrictions, China’s hotel market remains far from its saturation point and is still primed for growth. Despite setbacks from the pandemic, China’s hotel market has experienced meteoric growth in recent years – its hotel construction pipeline has just hit record highs, with 3,711 new projects (8% increase y-o-y) and 704,101 additional rooms (7% increase y-o-y) in Q1 of 2022.

Looking at the steady growth of China’s hotel industry and despite the impacts of the pandemic in 2020, China’s hotel industry is predicted to bring USD 64.82 billion of revenue in 2022. It’s also worth noting that the industry market concentration is still relatively high, with Jinjiang Group, Huazhu Group Limited, and Guangdong (International) Hotel Management Holdings Limited being some of the top domestic hotel management brands in China. Currently, high-end hotels are dominated by foreign groups such as InterContinental Hotels Group (IHG) and Shangri-la Hotels and Resorts.

Staycation Splurge

Despite the lack of both foreign and interprovincial tourism, Chinese consumers have remained strong contributors to the hotel industry. During Lunar New Year 2022, China’s major cities saw an influx of hotel guests as people went on “staycations.” Hotel bookings made on travel search engine Qunar.com were triple the amount made last year in 2021. In fact, the more expensive the room was, the faster it was booked out. The growing spending power and consumption of Chinese consumers allowed them to splurge and celebrate the new year in a new way.

As residents of big cities couldn’t spend on travel and return to their hometowns for family reunions like usual, they have shifted their purchasing power from traveling home to booking nearby hotels to celebrate. For example, Pan Lei, a Beijing resident, usually spends the new year traveling to Guangzhou to visit his in-laws. He instead booked a boutique hotel room for nearly 5,000 yuan, despite the normal cost of the room is only 2,000 yuan.

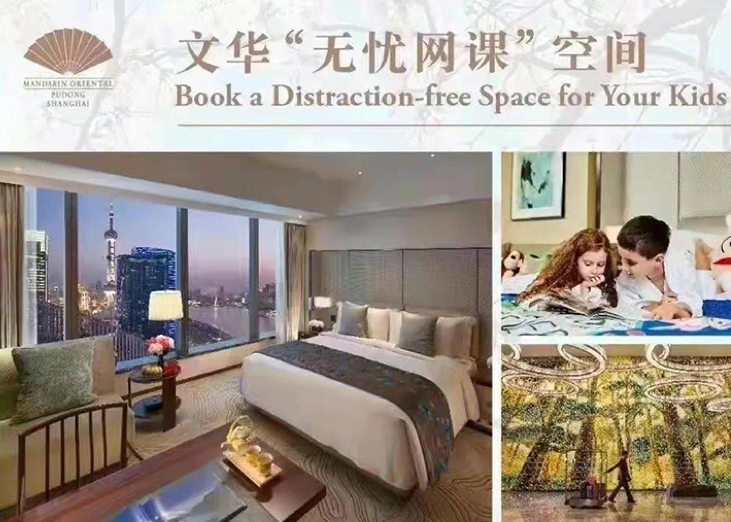

In addition to staycations, some hotels have launched a new concept of “studycations” for young students to keep afloat during the Omicron surge. The Mandarin Oriental Pudong’s “studycation” package in March 2022 included in-room online schooling, daily meals, as well as daily supervision by the hotel butler.

What China’s hotel structure may look like once fully matured

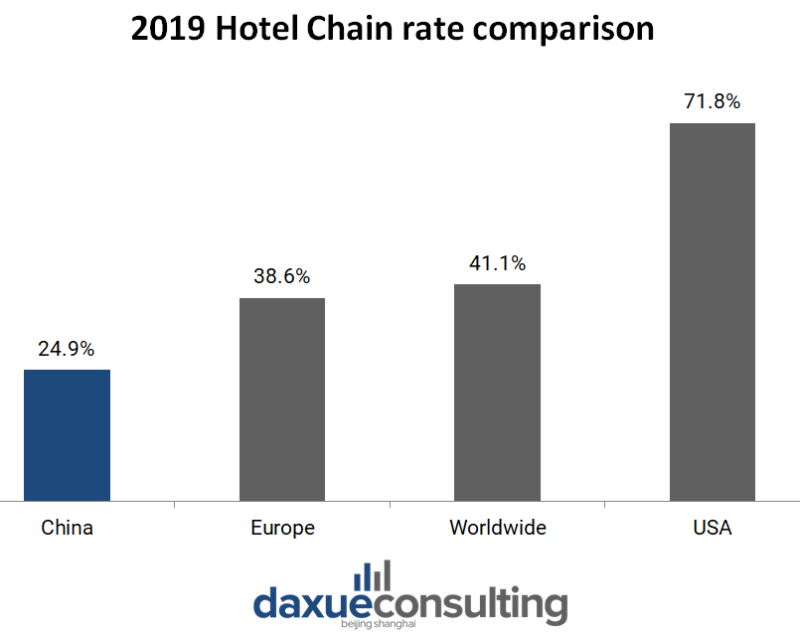

As the purchasing power and consumption levels of the Chinese population steadily increase, so do demands for tourism and leisure activities. The number of tourists in China and the scale of the hotel industry also continue to expand. Although the industry is expanding, the chain rate of the hotel industry in China is relatively low at only 26% in 2019. In 2020, the number of hotel enterprises in China grew by approximately 1,500, with Jinjiang International having the most guest memberships. However, in Tier-1 cities, such as Shanghai, 69% of hotels belong to a hotel chain. At the same time, in terms of region, scale and grade, and product structure, the distribution is not yet balanced, and there is still much room for improvement in management, service, brand building, and chain development.

As shown by hotel industries in developed countries, there should be a positive correlation between a country’s income structure and hotel scale structure. According to Dongxing securities, China’s income structure proportion of high, middle, and low-income classes is 1:4.5:4.5. The current hotel scale structure has a proportion of luxury, mid-upper scale, and budget hotels in China at 1:3:6. This shows that the hotel scale structure and the income structure of China are not aligned as it should be. Using the Western hotel markets as a reference, the structure of China’s hotel industry is predicted to transition from 1:3:6 (hotel proportions) to 1:4:5 (class proportions).

The proportion of mid-to-high-end hotels will continue to expand and stabilize at around 44%. And under this market expansion, the mid-to-high-end market will have at least 3-8 years of high-speed growth, with guest rooms reaching 881 – 1,101 million, which will reach 76% to 120% of potential growth. Overall, there is a stronger demand for mid to high-level hotels to develop in China.

The potential behind China’s ‘sinking market’ for the hotel industry

China’s hotel industry has a hotel chain rate of only 24.9%. The country has 338,000 hotel facilities, but there are only 1,975 domestic chain hotel brands (with 4.5 million rooms). This ratio is relatively small compared to the number of non-chain hotel rooms (13.1 million).

With over 60% of hotel brands in developed countries, the hotel market in China has massive room for hotel chain branding. Many Chinese hotels are referred as Zhaodaisuo (招待所), which are lower-end accommodation options that are not listed in the worldwide accounts.

Although most hotels in China are located in third and fourth-tier cities, there are only 1.9 million chain rooms compared to 9.1 million non-chain rooms (chain rate of 17%). Thus, the sinking market in China has enormous development potential.

The sinking market in China was also impacted less by the pandemic when compared to Tier 1 and 2 cities; 70% occupancy rate was reached in third, fourth, and fifth-tier cities, as well as in county towns and prefecture-level cities.

As a result, leading hotel chain brands are targeting hotel development in lower-tier cities due to the competitiveness of the hotel market in first-tier cities. Residents in third and fourth-tier cities have been gradually looking for higher-end entertainment facilities, such as middle and upper-scale hotels, driving growth for hotel chains in lower-tier cities. As low-tier cities increase their economic output, the lower-tier market will become the main target for leading hotel brands in the future. High-quality mid-upper scale, budget, and soft brands (hotel brands that join a chain) will become the leading force in opening up the sinking market. Hence, this trend will gradually lead to a structural change in the distribution of the hotel market in China.

Fast… but not so fast post-Covid recovery

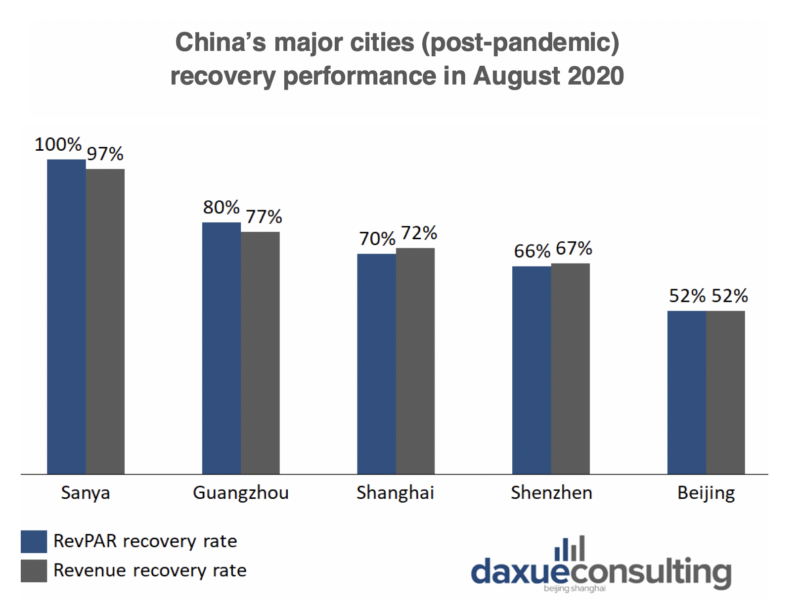

The pandemic hit hard in the hospitality industry worldwide, and China was no exception. Since 2020 Q2, the hotel market in China has shown signs of gradual recovery. As for Q3 of 2022, hotels’ revenue per available room (RevPAR) has reached 80% of the same period last year. However, in August 2021, the Delta variant undid much of the hotel market’s recovery progress, with average occupancy rates falling from 70 to just under 40%, (marking the revenue as half of what it was in 2019).

What’s interesting is that the demand for hotels in non-first-tier cities has recovered faster. Budget hotels mainly provide local services, which were utilized by people as they weren’t able to travel too far away from home due to post-Covid policies. Therefore, the overall recovery effect is best when combined with the rise of surrounding localized tours. Activities such as skiing, camping, or staycations have given hotels more resilience to the effects of the pandemic. Mid-upper range hotels benefit a considerable amount from the recovery of meeting, incentive, conference, and exhibition (MICE) services in China because they offer affordable prices and quality services.

Among the cities in China, Sanya has shown an incredible recovery sign in the hotel industry in China. The occupancy rate surpassed the same time last year since June of 2020. In 2020 August, the overall performance had fully recovered to 100% because Chinese tourists were urged to travel domestically. However, the pandemic resurgence did result in a decline during the first quarter of 2021, which is has now recovered from. Sanya is slowly evolving into a substitute as an international travel destination because of its beautiful tropical island landscape and tax-free policy for duty-free shopping.

Learn more about the trends of Chinese travel shoppers

The hotel industry in China has proven resilience and reflects its ability to recoup losses despite the pandemic. In addition, Sanya is notably the lead for both RevPAR and revenue recovery rate – showing its growing popularity and importance as a major Chinese tourist destination.

Key takeaways of China’s hotel industry:

- China’s hotel market has faced tremendous growth these years. The market potential is still far from the saturation limit, despite setbacks from the pandemic in 2021.

- Most hotels in China are independent hotels concentrated in lower-tier cities. Both domestic chain brands and international brands have plans to develop new hotels in Tier 2 and 3 cities.

- The upgrade in consumption taste has led to an increase in preference for Chinese consumers to stay in mid-upper scale hotels over budget hotels, which will gradually lead to a structural change in China’s hotel industry.

- The hotel industry in China has largely recovered from the Covid epidemic due to domestic still being available.

- Sanya in Hainan, a substitute destination for outbound tourists, has even shown greater performance than in 2019 because of Chinese inelastic consumption and travel demand.

Author: Tong Zhu, Revisions: Gloria Tsang