China’s retail industry looked promising in the first quarter; the retail sales of consumer goods excluding automobiles was 3,155.4 billion yuan (USD 492.2 billion) in March, a 34.2% increase from last year. This gives a positive outlook for consumer-packaged goods (CPG) companies as consumption rebounds in China. However, the rising competition intensity and changing consumer behavior signify challenges for CPG companies. Something as specific as product packaging size can make a huge difference in term of sales and capturing market share. Find out how to determine the best product packaging size that fits the Chinese market.

The importance of getting the size of your product right

Product packaging size is one thing not to overlook when adapting products to a new market. In fact, it is an important element in packaging design, a business way of attracting consumers through tangible mediums. When shopping, consumers interact with the packaging in a matter of seconds before deciding which products to bring home. Apart from shape, labeling, and color of a product, shoppers will also make a buying decision based on package size.

What works internationally does not necessarily work in China. The country has many products in different sizes compared to other countries, and there is a reason behind this. Milk products in China, for example, are rarely in bulk or gallon like in most countries. Instead, they are sold in much smaller portion sizes. This is primarily because a large population of Chinese adults have some level of lactose intolerance and so the amount of milk consumed in one sitting is lower. In this case, selling too large portions of cow milk in China can put a limit on your potential revenue and growth.

Understand the package sizes for different products and the key factors that drive the differences

Product package sizing: social and cultural influences

Rice and flour are food staples in China as Chinese people have been consuming rice and flour since ancient times. People in the south eat rice in almost every meal, while people in the north eat more wheat or flour. You can see rice almost always in large quantity in China, ranging between 5 to 10kg per bag. Flour has a package of 1 to 2.5kg bags. In Europe and the US, rice is commonly sold in smaller bags of less than 2kg mainly because it is not eaten with every single meal. Rice consumption levels are much smaller in Europe and the US, with 5kg and 10.8kg per capita respectively compared to 126kg per capita in China.

Cooking oil and soy sauce are the main ingredients in Chinese cuisine. People use them in the cooking and flavoring of several Chinese dishes. Cooking oil and soy sauce come in various portion sizes to serve the varying consumption levels of households and restaurants. Whereas people in the West tend to use less oil in cooking on a daily basis and use soy sauce only for Asian dishes. Tea is another example of food products with significance in Chinese culture. Tea beverages come in all sizes from 250ml bottles to 5-litre gallons as Chinese people love to drink tea.

Western products packaging

Western products such as cereals, peanut butter, jam, and salad dressing have smaller packages in China. Though having long been accepted by the market, especially among younger generations who embrace Western tastes and eating habits, the demand for these products is still far from mature.

Asides from consumption level, smaller package can also be associated with portability. In China, people have to carry tissues with them whenever they go out. It is not guaranteed that there will be tissues in public places, especially restroom and restaurants. In contrast, people in the US and Europe mostly buy tissues for their home because tissues are typically available in public places. For this reason, we can see packs of small tissue packages sold in stores and supermarkets all around China.

The “single” population and smaller households: major influences in consumption and packaging portion size

China has the largest “single” population in the world, and the number is expected to keep increasing in the coming years. According to the Ministry of Civil Affairs, over 240 million people or 17% of the population are single; 92 million of which live entirely by themselves. The rising number of single people in China means a change in consumption which will generate opportunities for CPG companies that understand them.

The lifestyle of single people in China is characterized by freedom and the pursue of high-quality life. As singles do not have to raise children or take care of their family members, they can spend more money on things that would improve their life quality or happiness. Because single people tend to live alone, they also do not have to share things with others. Moreover, singles usually have busy schedules, so they would consider convenience when buying products. For these reasons, single portion packages have become very prevalent in China.

Chinese households are getting smaller

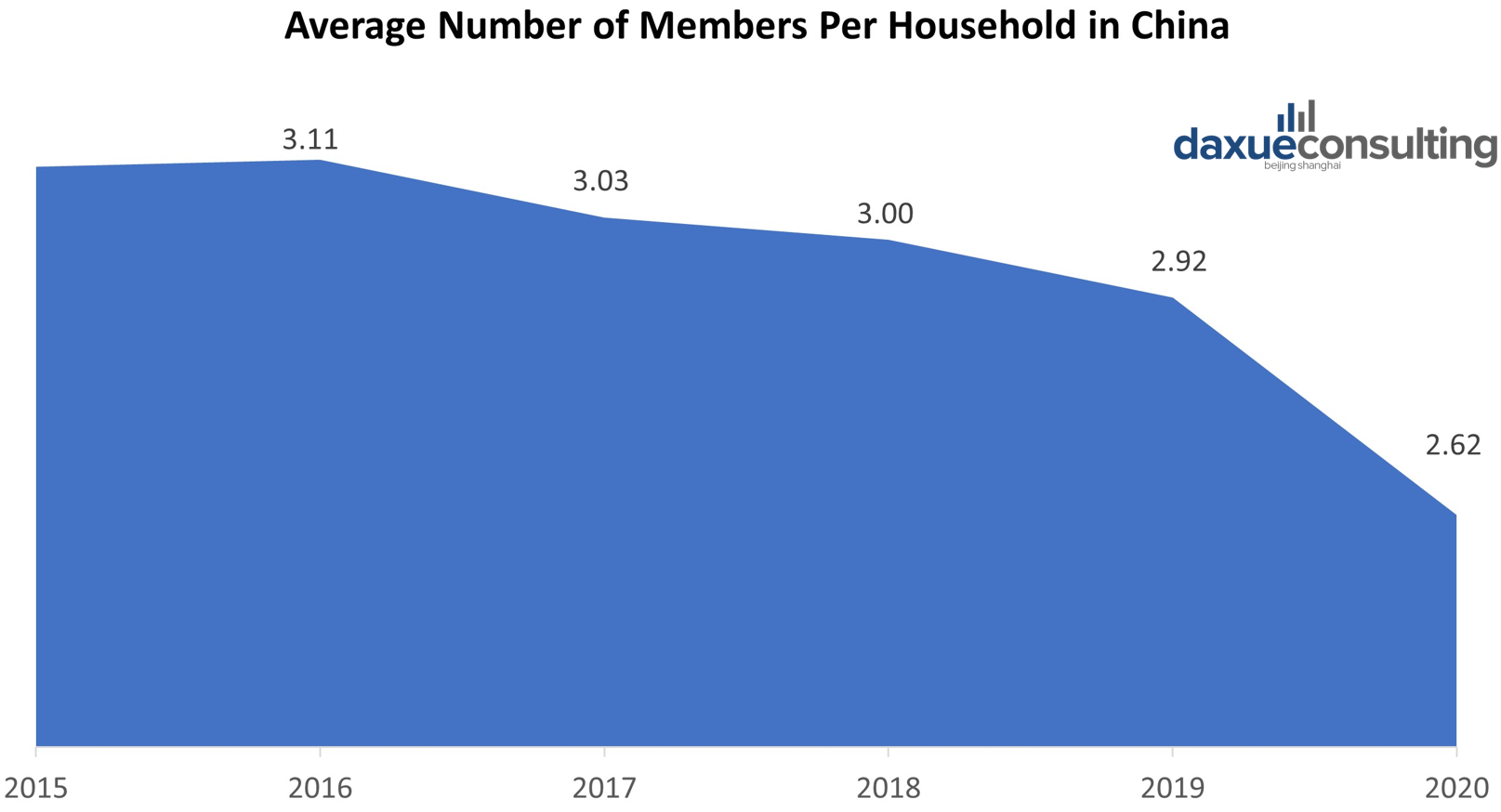

According to the recent census released by the government, the household size in China has declined over the past 5 years. The average number of people per family is down to 2.62 in 2020 from 3.1 in 2015. In the past, it was common for three generations to live together in the same household, but a typical family today only consists of parents and a child, or even no child at all. Small households in China usually buy less per time and make more frequent trips to grocery stores. On the other hand, large households tend to buy bulk and make less frequent trips to save money and time.

Short shelf-life products such as dairy products, bread, and processed meats are commonly sold in single portions or smaller packages. As these products can expire within days, it is a better choice for singles and smaller households to buy smaller quantity. Products such as pasteurized milk, juice box, packaged cakes, biscuits, and meat snacks can be kept for a long time. However, their shelf life can get significantly shortened after opening. Thereby, they are typically sold either individually or in a pack of multiple single portion packages for the shelf life and convenience.

Growing health awareness among Chinese consumers and how it is related to product packaging size

According to BCG, China’s health and wellness market reached USD 70 billion in 2020. Even before the pandemic, Chinese consumers are becoming more aware of their health, as reflected by growing organic food sales and increased spending on wellness products online in recent years. This ongoing trend of health awareness in China has led consumers to change their eating habits and adopt a healthier lifestyle. As consumption for healthy products rise, healthy brands can offer more package sizes, especially larger ones to meet the different needs. Though, brands should pay attention to consumer perception of healthy food; what is healthy in other countries may not seem as healthy in China.

Snacks packaging

When it comes to snacking in China, the popular options are fruits, nuts, and granola bars. Dried fruits and nuts have various packaging sizes because they are perceived to be healthy. However, granola bars are mostly in the stores individually or in a pack of 5-10 individual packets as they seem not that healthy due to being more processed and containing added sugar. Meanwhile, you can easily find a pack of 20-40 granola bars in some countries like the US.

Oil packaging

Olive oil has been gaining popularity in China, especially in urban areas, thanks to the growing health awareness and disposable incomes. Olive oil seems as a healthier choice to the regular vegetable oils. Despite the higher price, olive oil has medium (250ml) and large bottles (as large as 5 liters), the latter is uncommon in the US due to the differences in cooking habits. Additionally, Chinese people like to buy olive oil products as gifts because they seem premium and healthy.

Health-conscious people in China also consume unhealthy snacks but do so in a limited amount. Products such as cookies and sweets have small packages or packs of single portions. However, there is an exception for confectionary products that customers buy as a gift. These products can come in large and premium packaging. Potato chips and crispy snacks have relatively smaller packages (40-80g) in China, compared to the US where you can see many “family or party size” bags (300-400g) on retail shelves.

What to consider for modifying product packaging size in China

Factors that impact package sizes in China

Consumption level

Consumption level of a product depends on the local culture and consumer preferences. Products with high consumption level are typically something many consumers have already acquired a taste for, or that the products have well penetrated into the market and culture. Products with low consumption level appeal to niche markets. Widely-consumed products should come in various sizes, especially large, and products with lower consumption level should better have smaller package.

Need for product portability and convenience

Smaller and more compact products are more portable and generally more convenience. For products which consumers need to carry around and regularly access, they should come in smaller package sizes. In addition, if your product appeals to single people, then smaller package size may be more suitable and attractive.

Health perceptions

Health awareness is growing in China but not every healthy product should come in larger package sizes. There are healthy products that people still perceive to be unhealthy. Perceived healthy products should offer various sizes to fit the varying consumer demands, while perceived unhealthy products should come in smaller packages or controlled portions.

Frequency of shopping trips

Small households tend to shop more often and buy less each trip. On the other hand, big households tend to shop less often and buy more each trip. Car ownership also influences how frequently consumers do grocery. Households without a car usually purchase less quantity per trip. Car ownership rate per capita is much lower in China than in the US and European countries.

Shelve life

Average household size in China is shrinking and the single population is growing. Short shelf-life products should also come in small packages to fit the consumption of smaller households and singles. Long shelf-life products can come in large packages or in packs of multiple single portions.

Price sensitivity

Consumers can be very sensitive to the change in price especially for expensive or high-end product categories. Product packaging size and pricing are inter-related; smaller portion size usually equals lower price, more affordable to consumers. In this case, brands should be precise about package size, taking into account their main consumer segment and price sensitivity.

Product experimenting

In the beauty industry or other industries where brand loyalty is not strong, people like to purchase products with smaller package size because it allows them to experiment with different brands before settling with the ones they prefer, or that consumers like to own different brands or styles of products at one time.

What steps should brands take to choose the right packaging size in China?

- Understand the Chinese market

Whether you are planning to enter the market or already an existing player, understanding the competitors, the trends, and the market landscape will help you make well-founded business plans, improve your competitiveness, and increase your chance of success. We provide data-driven market research for your specific need.

- Analyze target consumer segments

It is crucial to Identify who are or potentially will be the main buyers. Understanding the target consumer segment will allow you to tailor your product packaging to consumer needs. We provide consumer analysis and segmentation through methods like survey, focus groups, consumer panel, and qualitative interviews to give you a deep understanding and insights of Chinese consumers.

- Modify product package size based on key factors and findings

To ensure that your product will fit the market and meet the needs, we can benchmark products, assess product performance, and even get direct feedback from target consumers to help you determine the best packaging size for your product.