Athleisure is a fusion of fashion and athletic apparel, fit for a wide variety of occasions, such as at work, school, socializing, and of course, a variety of workouts. People dressing in athleisure clothes often present an active healthy lifestyle, 35.1% of individuals opted for regular exercise as their means of maintaining health in 2022.

Download our China luxury market report

According to Statista, China’s sportswear market value reached RMB 313.8 billion in 2023, and there are no signs of slowing down. The estimated year-on-year growth of the Chinese sportswear market is 4.3% for 2024 and 5.4% for 2025. With a growing passion for fitness, the sportswear market is booming.

This article aims to present the reasons for the growing popularity of athleisure wear among Chinese netizens, examples of marketing campaigns of both domestic and foreign sports brands in China, as well as tips on how brands can promote their athleisure apparel to the Chinese audience.

Reasons for the rapid growth of the athleisure market in China

The Chinese government encourages a healthier society

In recent years, China has faced many health challenges from an aging population, environmental pollution, and a developing healthcare system. To solve these problems, the Chinese government has had to step in to support the expansion of the health sector, and the State Council put forward the “Healthy China 2030” initiative in 2018.

According to the plan, the Chinese government hopes to engage 700 million people in physical activities at least once a week. According to Nielsen Sports, the government plans to build a CNY 5 trillion investment in the sports industry by 2025, a strategy covering improved China’s fitness to encouraging foreign investment, grassroots sport to elite performance.

Together with the increasing attention and participation in sports and fitness activities, the breakout of China’s fitness industry, and the encouragement from the government, all of these led to a dramatic growth of demand for fashion and sports apparel in China.

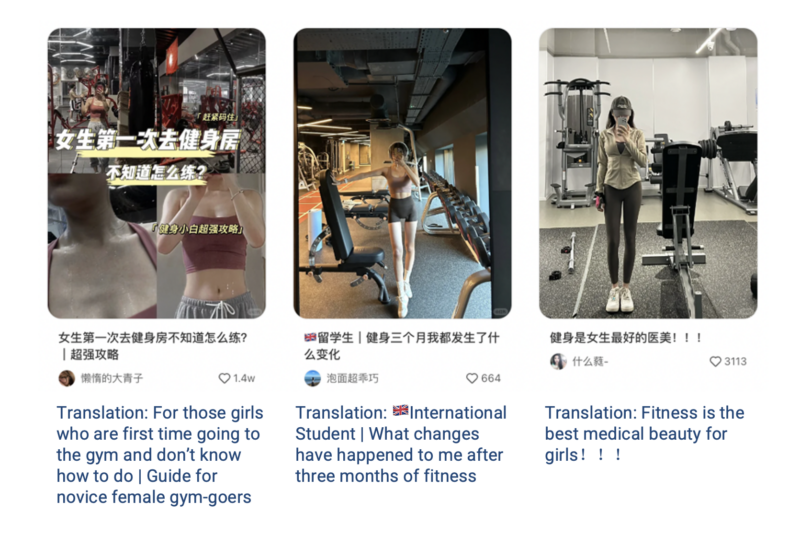

Fitness has become particularly popular among Chinese millennials

Chinese millennials are shifting beauty preferences from skinny to strong. Hence, going to the gym has become increasingly popular among young Chinese women. In 2001, there were only around 500 gyms all over China, however over the past two decades, this figure has surged to 85,149, comprising 39,620 fitness clubs and 45,529 fitness studios as of 2022. More and more young women are demonstrating a growing emphasis on health and fitness, with an increasing number adopting exercise routines and showing a stronger willingness to pay for fitness activities and healthy lifestyles.

Additionally, the lightweight sportswear sector appears to exhibit robust growth sustainability and development resilience, and there is a need to enhance the market penetration of domestic lightweight sportswear further. Statistics indicate that by 2023, women’s lightweight sportswear is projected to constitute only 51% of the market, while women’s footwear will represent 62%, suggesting ample opportunity for increased penetration. There is more and more diversity in fitness offerings, so it becomes more popular to workout, as everyone can find something for themselves.

Embracing versatility and comfort in women’s activewear

The country’s apparel market for sportswear, primarily targeted at women, is showing a distinct trend toward consumption, emphasizing versatility, aesthetic appeal, and comfort. Encouraged by the National Fitness Plan, awareness of national fitness has steadily risen, leading to a growing popularity of light exercise.

Light exercise encompasses activities primarily aimed at leisure and relaxation, characterized by easy accessibility, low intensity, and minimal specialization. Looking at light exercise, consumers prioritize the appearance and aesthetics of their attire. They demand lightweight sportswear that is simple in design, comfortable in material, and well-tailored, capable of meeting their light exercise needs while showcasing their fashion taste.

In contrast, for activities like badminton, skiing, and hiking, consumers prioritize the functional attributes of sportswear. Additionally, there’s a significant increase in consumer demand for sportswear that can transition across different scenarios, with sportswear integrated into daily outfits becoming a trend, necessitating lightweight sportswear to be more fashion-forward.

The influence of female KOLs and celebrities on fitness culture and social media in China

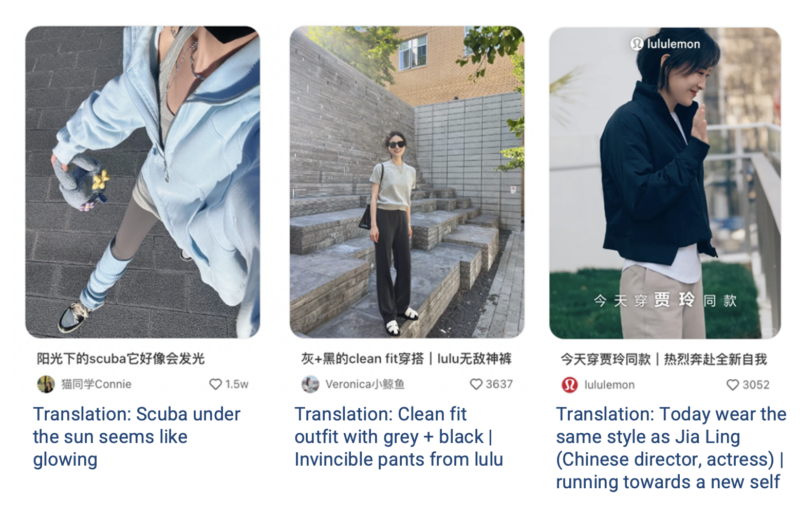

Moreover, influenced and encouraged by female key opinion leaders (KOLs) and celebrities on Chinese social media platforms, young Chinese women tend to share body progress photos and their fitness experiences on social media platforms.

Canadian athletic apparel company Lululemon, builds strong brand awareness within its target customers, using a strong KOLs team which includes local yoga coaches and internet influencers. Lululemon got mentions from 8 celebrities and 18 Top KOLs on Xiaohongshu in 2022. Additionally, Lululemon is known as “the Hermès of Yoga” in China. The elevated brand positioning and a strong sense of community make Chinese customers eager to share reviews on social media.

Different from Gen X in China, who take fitness as a method of relieving stress and preventing diseases, millennials regard fitness as a social activity. They would like to make friends in the gym or online communities, making socializing a key aspect of fitness culture in China. This is something many Chinese fitness brands have leveraged.

On social media platforms, users frequently share their workout routines, experiences with different activewear brands, and self-improvement tips. This dynamic engagement fosters a sense of camaraderie among fitness enthusiasts, driving the conversation around exercise apparel and personal growth. Because of this, emerging brands in the sportswear market in China need to recognize the significance of social interaction within the fitness community.

Athleisure market in China: domestic vs. foreign brands’ approach

Competition from China’s domestic brands

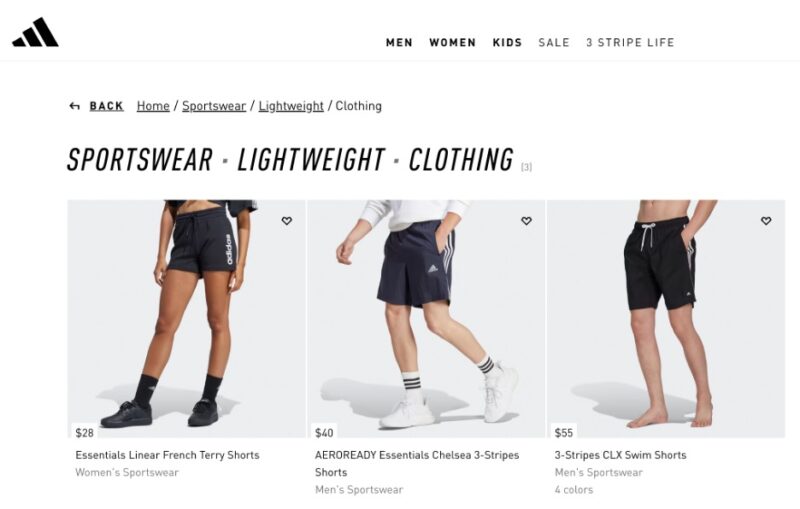

China’s sportswear market is the second-largest in the world, only behind the U.S., but is dominated by big international sports brands like Nike and Adidas. Even if the fashion trend of the athleisure market in China, in terms of design creativity or technology innovation, is controlled by those big sports companies, the local brands, like Anta and Li Ning, have grown their market share quickly in recent years as a result of products upgrading of Chinese domestic brands. Furthermore, China has emerged as the world’s foremost technology hub for sports footwear, with its share of patent applications in this sector comprising 40.44% of the global total.

As the footwear and apparel brands in the Chinese market appear on the stage of international fashion weeks and the popularity of Guochao trend culture, the sports footwear and clothing sector has experienced a surge in demand, especially among young Chinese consumers. As a result, there’s been a growing fervor for homegrown brands.

Projections suggest that by 2025, China’s sports footwear and apparel market is poised to reach an impressive RMB 598.9 billion. To be more specific, following Li Ning’s attention-grabbing debut at Paris Fashion Week in 2018, which stunned Chinese consumers with its prominent Chinese characters “中国李宁”(Li Ning China) emblazoned on its apparel, the brand made a triumphant return to the fashion capital to showcase its Spring/Summer 2024 collection at the prestigious Centre Pompidou.

Assessing the present market dynamics reveals a notable disparity in the average selling prices between domestic and international sports shoe brands. While foreign brands maintain their emphasis on premium pricing for high-end products, domestic counterparts excel in enhancing product capabilities while capitalizing on their cost-effective advantages. This strategic focus, combined with the burgeoning trend of national consumerism in recent years, has propelled the rapid growth of domestic brands, resulting in a marked increase in both sales volume and unit price. Consequently, the gap between domestic and international brands is notably narrowing.

Competition from fashion brands

The line between sports and fashion apparel is becoming blurred in the Chinese sportswear market. Most consumers – mass-market consumers – do not particularly seek the functionality of sportswear, but they are increasingly interested in fashion elements of sportswear.

In response to this trend, some fast-fashion brands extend their new product lines for customers who are looking for sports as well as fashion. H&M, for example, introduced the H&M Sports series; Uniqlo has also shown more athletic advertising as well as athlete models to better stand out its sports products line.

International sportswear giants like Nike and Adidas have led China’s athleisure market for a long time, but with the entry of fast-fashion companies, they are forced to make changes. However, fashion sportswear does not mean that consumers just want to look stylish rather than work out. The brand image of Nike and Adidas, professional activewear and performance-quality products, make consumers accustomed to buying brands that rank first in their mind, which is a core competitive power of an athleisure brand when a traditional sports brand wants to become fashionable.

More opportunities for sportswear brands: differentiation

With the rise of income, expanding middle class, growing level of sports specialization, and diversity of fitness in China’s urban cities, the differentiation of sportswear brands has become more important. In the past years, popular fitness in China was limited to running, basketball, and ping-pong; now, more and more Chinese are beginning to participate in tennis, fencing, golf, fitness classes, and yoga. It provides more space for sports brands to find their position in the Chinese sports market, such as Lululemon (yoga), DESCENTE (skiing), and BIEM.L.FDLKK (golf).

How can brands succeed in China’s sportswear market

Build the brand as a professional fitness brand

Athleisure brands in China should develop their brand image as professional fitness brands. Among sports brands like Nike and Lululemon, the top choices that consumers are familiar with when they think about buying new sportswear. Besides, when brands focus on their professional image, it is easier to collaborate with athletes and KOLs who care more about the function of a product.

The target customers are changing

Lululemon is an example of a brand with very distinct consumer groups, their customers are generally 20-40-year-old, urban white-collar females who are interested in yoga, running, and wellness. However, China’s fitness trends are changing fast. When more females became interested in basketball and more males were looking for comfortable trousers for both work and workouts, Nike launched more professional women’s shoes, and Lululemon designed joggers which easily stay dry and comfortable for their expanding male consumer base.

New opportunities in China’s lower-tier market

China’s sportswear market is booming in urban, first and second-tier cities, but the fitness culture in China’s lower-tier cities is just beginning. The domestic market for lightweight sports apparel has a low penetration rate, with the prominent brand Lululemon holding a mere 1.1% share of the overall sports market.

Currently, most brands position themselves in the mid-to-high range, targeting primarily first-tier cities, leaving a gap in the market for mature brands in lower-tier cities with larger populations. However, as fitness habits become more prevalent, the trend for lightweight sportswear is gradually expanding into lower-tier cities. With more and more Chinese taking fitness as a daily activity and the trend of live-streaming all over China, getting in touch with those consumers earlier would build awareness and drive revenue.

Navigating the dynamic athleisure market in China

- Athleisure, blending fashion and athletic wear, is versatile for various occasions and represents an active lifestyle, resonating with 35.1% of individuals opting for regular exercise in 2022.

- The “Healthy China 2030” initiative, aiming to engage 700 million people in weekly physical activities, signals government support and China’s sportswear market value soared to RMB 313.8 billion in 2023, with a projected year-on-year growth of 4.3% for 2024.

- Chinese millennials are embracing fitness as a social activity, leading to a surge in gym memberships and increased spending on fitness-related activities.

- The athleisure market is evolving in response to shifting beauty preferences, with a growing emphasis on strength over skinniness among young Chinese women, driving demand for fashionable and functional sportswear.

- Understanding emerging requirements, harnessing innovative technologies, enhancing cost-effectiveness without compromising product functionality and quality, and forging competitive edges via distinctive strategies will take center stage for lightweight sportswear brands.

We Offer Tailored Strategies for an Emerging Lifestyle Market

At Daxue Consulting, we harness our deep understanding of the Chinese sportswear market to offer comprehensive branding, market research, and consulting services tailored to the unique demands of China’s athleisure sector.

Our approach is data-driven and customer-centric, ensuring that every strategy is grounded in a thorough understanding of the Chinese consumer’s preferences and behaviors. From granular analysis of market trends to actionable insights for brand positioning and customer engagement, our expertise covers all facets necessary for a brand’s success.

Our suite of services extends to management consulting, where we streamline your operations and align them with the nuanced complexities of the Chinese market. Whether you’re establishing a new athleisure line or optimizing an existing brand, Daxue Consulting is your partner in navigating this dynamic industry landscape, ensuring that your brand not only enters the market but thrives in it. Contact us to learn more.