China Market Reports

Browse our China market research reports

While market research and consulting for clients is the core of our business, daxue consulting’s media team is constantly creating reports which can be downloaded for free. We will continue to publish more reports, to stay updated on our China market reports and insights articles, subscribe to our newsletter.

- All

- beauty

- children & maternity

- consumer electronics

- e-commerce

- fashion & luxury

- fitness & wellness

- food and beverages

- green & sustainability

- healthcare

- merger & acquisition

- new retail

- pharmaceuticals

- social medias

- tech

- travel

2025 China’s pet economy report

2025 China’s winter sports market recap report

China’s summer sports market recap report

China’s samples economy report

Consumer pain points in China’s beauty market

China’s food & beverage industry white paper

China’s luxury market in 2024: VICs, omnichannel & CRM strategies

A brand’s guide to Chinese gifting habits

She economy rising: Decoding the shopping secrets of Chinese women

The future of sustainable fashion in China

How young Chinese consumers are finding themselves

Vietnam x China business relations

Thailand x China business relations

The Philippines x China business relations

Malaysia x China business relations

Indonesia x China business relations

ASEAN x China business relations

10 mistakes Chinese brands make when going overseas

China’s Singles’ Day: 11.11 2022 Guide

China’s metaverse: The next frontier in retail

The Zero-COVID lockdown’s long-term impact on Chinese consumption

Green Guilt: The present and future of sustainable consumption in China

China Chic: The Emergence of Chinese luxury brands

Turning “tiger moms” into soccer moms: How to tap into China’s youth sports market

China travel retail market report

Everything you need to know about crowdfunding in China

Maia Active: An Asian women-oriented active-wear brand

Yin jewelry, redefining the gold jewelry market in China

2021 JD 618 DATA REPORT

Rising Chinese fashion brands’ secrets to success report

China Guochao Marketing Report

Chinese F&B brands’ secrets to success report

C-beauty brands’ secrets to success report

M&A market in China 2021 report

Keys to nostalgia marketing in China: Qualitative research on what makes Chinese millennials and gen Z nostalgic

The growing popularity of Russian products in China: Ice cream, beer, agriculture and more

The era of WeChat mini-games has come: How to monetize and advertise on mini-games

Mobility in China: Opportunities and challenges of when ride-hailing meets delivery

The mattress market in China is springing up with new demand

The impact of the Covid-19 pandemic on the organization and HR of foreign companies in China

50 measures China uses to suppress the spread of COVID-19

COVID-19 impact on China’s beauty sector

The rise of the Stay-at-home Economy in China | How COVID-19 boosted indoor consumption

COVID-19 impact on Chinese consumption

Chinese duty-free consumption: China as the World’s Largest Outbound Travel Market

The AI in China 2020 White Paper

Coronavirus China Economic Impact Report

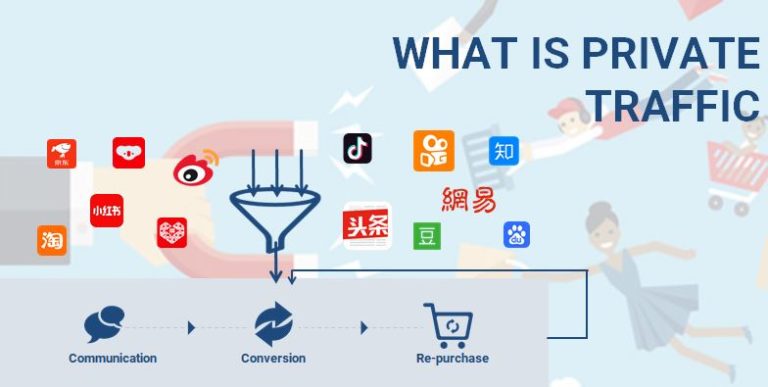

Private Traffic in China: Own your customer traffic

The adult toys market in China: untapped economic potential