In the 60s, Chinese people consumed on average 5kg of meat a year. After the launching of Deng Xiaoping’s reforms, those numbers grew fourfold, hitting 20kg per person. By 2015, the per-capita meat consumption reached 48kg. According to the Insight on Plant-Based Meat Industry White Paper, China’s per capita consumption of meat equals now that of Japan, following the US, Argentina, Brazil, the EU, Russia and Mexico. The amount of imported meat has gradually increased between 2014 and 2019, but Dongxing Securities estimates that it is going to decline starting from 2022, after reaching a peak in 2021. Meanwhile, the demand of plant-based meat in China is bound to experience a 200% rise in the next five years and Euromonitor foresees that China’s alternative meat market is going to be worth 13 billion US dollars by 2023, accounting for almost half of the global market.

Young people aged between 18 and 39 years old are the main group composing alternative meat consumer base, with women showing a much greater propensity to buy and eat plant-based meat than men. Health, sustainability and taste are the main elements encouraging people to consume alternative meat. However, according to Social Touch analysis of Weibo users’ opinion about plant-based food, Chinese netizens tend to have a neutral attitude towards alternative meat, which means that even though there is still a long way ahead, foreign sustainable food startups in China still enjoy great room to capture Chinese consumers.

The path for foreign sustainable food startups in China

Beyond international food giants, such as Unilever and Nestlé, both domestic and foreign startups are attempting to get their share of China’s alternative meat market. Nonetheless, Chinese legal framework for vegan meat is still at its infancy and plant-based meat in China has been in a grey zone until recently. Indeed, it was only in December 2020 that the first Group Standard For Plant-based Meat Products was released, providing a clear definition of plant-based meat, as well as outlining packaging and labelling guidelines.

The Government would be a real game changer in raising awareness towards the alternative meat industry and shaking Chinese audience from their neutral attitude. China’s plan to cut national meat consumption by half by 2030 as a means to curb CO2 emissions is likely to favor the development of sustainable food companies. In the light of these developments, the following foreign sustainable food startups would better to enter China as soon as possible and take their share of the pie.

Ÿnsect

As fish, soil and water resources shrink, French insect farming startup Ynsect dreams of a new agri-food industry, where insects return to be at the base of the food chain. The French start up produces insect-based food for animals and humans, as well as natural plant fertilizers. In particular, Ynsect breeds two species of mealworms, the Tenebrio molitor and the Alphitobius diaperinus, since mealworm proteins are particularly suitable for animal feeding and plant manuring due to their high nutritional value. Moreover, by substituting casein with Ÿnsect products, it is possible to reduce the amount of cholesterol concentration in the liver and plasma, both in human beings and animals. The sustainable food startup earned about 70 US dollars in 2019 and it raised 125 million US dollars in Series C funding in order to scale up its production and open a new factory in North America.

How can Ÿnsect enter China?

The Asia-Pacific region already holds the lion share in revenues of edible insects market for animal feed and China is one of the countries boasting the major number of consumers in this region. Beyond the B2B market, Ynsect may enter China’s booming pet economy, attempting to capture Chinese pet-owners with their innovative and high-quality products by relying on Chinese KOCs for their promotion strategy in order to gain popularity online and leveraging Chinese audience’s interest in cute pets. Furthermore, the growing health awareness among Chinese consumers represents a fertile ground for meat replacements and may help Ynsect catching the attention of fitness-lovers and gymgoers.

Daring Foods

Founded in Los Angeles in 2018, Daring is a US startup company that produces plant-based chicken providing a sustainable option to those who love consuming poultry meat. The great success of Impossible Foods and Beyond Meat in the red meat segment induced Daring’s co-founders, Ross Mackay and Eliott Kessas, to jump into plant-based chicken market since they considered that vegan poultry products lacked in taste, texture and proteins. The company is still tiny, but it is growing fast: in May 2021, it raised about 40 million US dollars in a Series B funding round and it plans increasing its staff. Currently, it is possible purchasing their products on their company website, through Rastelli’s grocery delivery, in crafted meals through Sun Basket and in Whole Foods Market’s stores in New York, Miami and Chicago. Daring offers plant-based chicken meat in 4 different flavors: Original, Lemon & Herb, Cajun and Breaded Original.

Is there room for Daring Foods in China’s alternative meat market?

With 2 million tons of imported poultry in 2019, China represents a tempting market for the Los Angeles-based startup. The strength of such promising startup undoubtedly resides in the great attention paid to their products’ taste and color. According to the Insight on Plant-Based Meat Industry White Paper, what makes China’s alternative meat brands stand out compared to their foreign counterpart is precisely their greater R&D efforts to improve color and flavor. Thus, Daring vegan products show having the right cards to enter China. In addition, their 227-grams package is especially suitable for growing high-income single consumers living in China’s Tier-1 cities, a group vaunting a significant marginal propensity to consume.

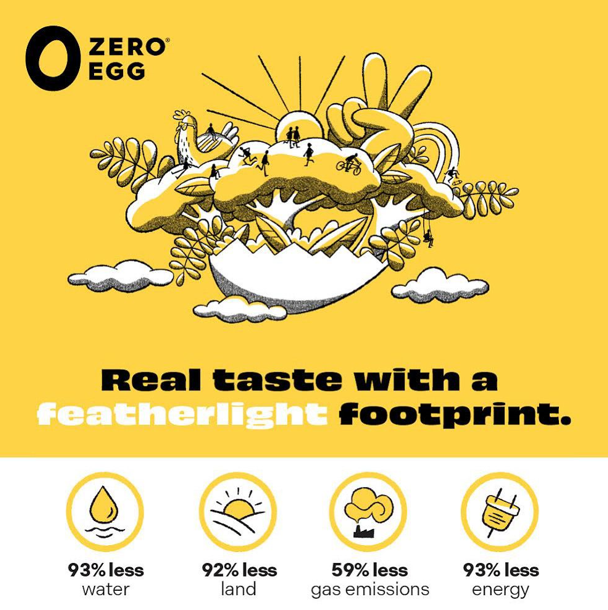

Zero Egg

According to Faostat, in 2019 Chinese people consumed on average 19.74kg of eggs per capita, more than the people in the US (16.21kg per capita) and Germany (13.21kg per capita), but slightly less than Japanese people (19.84kg per capita), accounting for about 40% of the global total. Producing one ton of eggs requires on average 3.147 m3 of water, 99.88% of which is due to feeding.

Based in Israel, Zero Egg is a startup founded in 2018 producing plant-based eggs. Their mission is obtaining eggs good for people, hen-friendly, and easy on the planet. The company is currently focusing its business on the B2B market in Israel, Europe and in the US. Nevertheless, it plans selling directly to consumers in the future. Their plant-based egg is available in two forms: liquid or powder, and they can be used for many purposes, such as scrambles, omelets, quiches and egg replacement for baking.

How can Zero Egg enter China’s alternative egg market?

As the demand for premium and healthier bakery ingredients gradually grows in China, diving into the Chinese Foodservice and Food manufacturing industry would be a big move for the Tel Aviv-based sustainable food startup. Especially now that Chinese consumers pay greater attention to food safety, food quality and health, and restaurant chains focusing on healthy and natural foods are mushrooming across the country. Zero Egg versatile plant-based egg solution boasts an impressive potential and China is likely to be the perfect market where expanding their business.

Just Salad

According to a study published on the academic journal Science in 2018, the food supply chain accounts for 26% of greenhouse gas emissions. This data induced the US fast casual restaurant chain Just Salad to look for a more eco-friendly alternative to the mainstream food system capable of providing customers with sustainable and healthy food. Currently, Just Salad counts more than 40 restaurants throughout the US, operating in New York, New Jersey, Florida, Illinois, Pennsylvania, and North Carolina, as well as 4 locations in Dubai. Despite the name, they offer a great variety of dishes, from classic salads to wraps, avocado toasts and warm bowls. Moreover, on their website it is possible filtering according to one’s own needs helping to select the best dishes for those following climatarian, keto, paleo, vegan or gluten-free diets.

How Just Salad can enter China’s eco-friendly meal market

Attention to food safety and growing health awareness is turning sustainable and organic food restaurant chains into powerful magnets for Chinese consumers, sick of the numerous food scandals. Following the footsteps of the healthy food restaurant chain Element Fresh, Just Salad could easily enter the Olympus of successful foreign sustainable food startups in China. Ensuring food safety by taking under control suppliers’ production and storing activities should be of primary importance in order to improve customers’ trust and food quality. Moreover, having trained staff and eco-friendly venues are other essential elements fostering the promotion of those values underpinning Just Salad business and strengthening the brand image in the eyes of Chinese consumers. Lastly, opening their restaurants close to gyms and sport clubs in Tier-1 and Tier-2 cities would enhance their popularity among athletes and fitness-lovers and build a hard core of regulars.

Market strategies for promising foreign sustainable food startups in China

- The demand of plant-based meat in China is bound to double in the next five years. However, Chinese netizens’ opinion towards alternative meat is neither positive nor negative, indicating that although foreign sustainable food startups in China still enjoy great room to capture Chinese consumers, they still have a long way ahead to build a hard core of regular customers.

- French insect farming startup Ynsect would benefit from entering China’s B2C market, since by embracing the right marketing strategy it could surf Chinese growing health awareness and booming pet economy, giving a powerful boost to both its human and pet insect-based food.

- With 2 million tons of imported poultry in 2019, China represents an appealing market for the Los Angeles-based startup Daring. Their great attention to taste and color would make their plant-based chicken stand out from competitors.

- As the demand for premium and healthier bakery ingredients gradually grows in China, along with a greater attention to food safety, food quality and health, Zero Egg versatile plant-based solution has all it needs to conquer the B2B market and thrive.

- Just Salad aims at offering a more eco-friendly alternative to today’s food supply chain so as to provide customers with sustainable and healthy food. Emulating Element Fresh, the US fast casual restaurant chain could expand its business in China by giving great emphasis to food safety and quality, as well as targeting fitness-addicted and gym-lovers living in Tier-1 and Tier-2 cities.